Bitcoin (BTC) began to drop significantly around 11 pm on the 13th, hitting a low of $62,050, but quickly rebounded to above $63,000, and then fluctuated around $62,500.

Then this morning at 11 am, it suddenly surged from $62,600, reaching a high of $64,500, a new high for the month, and before the deadline it climbed further to $64,867.

On the other hand, Ethereum (ETH) also surged rapidly this morning at 11 am, rising from $2,450 to a high of $2,548, a new high since October 1, and then pulled back slightly, closing at $2,522 before the deadline, up 2.4% in the last 24 hours.

Breaching $65,000 will trigger large-scale liquidations

SOFA.org Insight Manager Augustine Fan analyzed that the Chinese stock market rebounded during the day on Monday, shaking off the disappointment of the past weekend, indicating that the risk sentiment is still in "buy everything" mode, driving the rise of Bitcoin. The strong inflows into Bitcoin last Friday may also be a positive signal, but with the US presidential election scheduled for November 5, the wait-and-see sentiment remains, and Bitcoin may still need patience to set a new high.

CoinDesk market analyst Omkar Godbole previously predicted that Bitcoin needs to break through the key resistance level of $69,000 to be considered a bullish signal and further towards the $100,000 target.

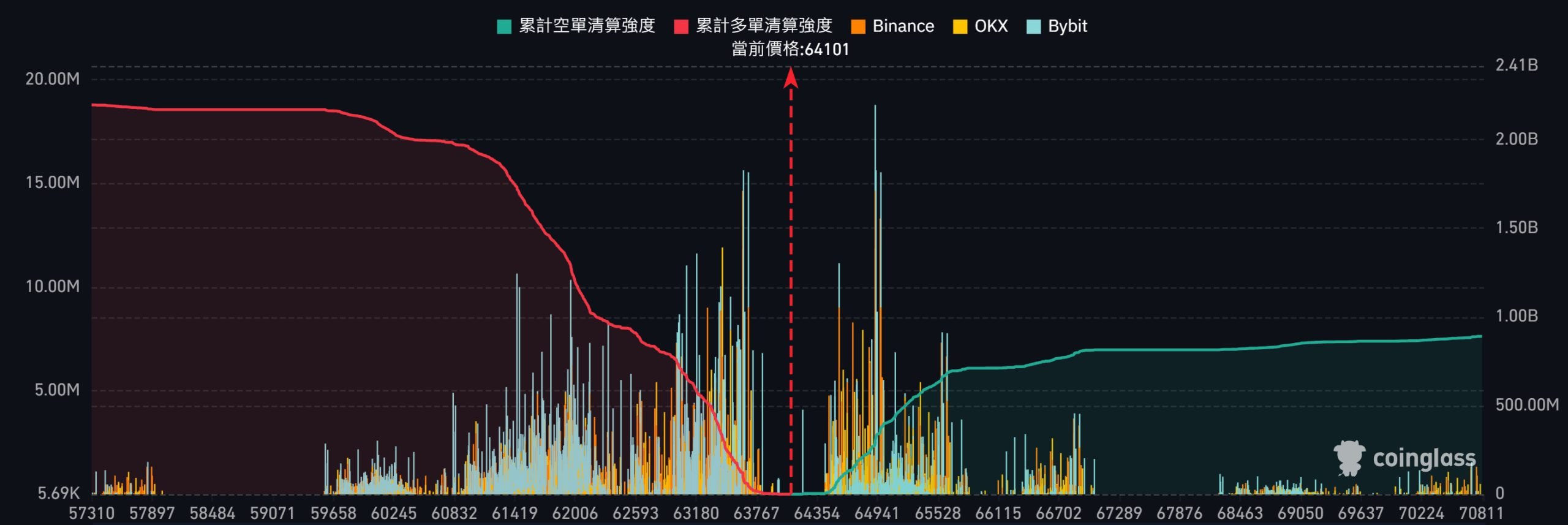

It is worth noting that Coinglass data shows that if Bitcoin breaks through $65,000, the cumulative liquidation strength of short positions on mainstream centralized exchanges will reach $396 million, and if Bitcoin falls below $63,000, the cumulative liquidation strength of long positions on mainstream centralized exchanges will reach $749 million, so the subsequent trend will be worth watching.

Coinglass points out that the liquidation map provides a visualization chart of the liquidation of futures crypto market traders, and the map predicts the upcoming liquidation based on previous price trends. When a small cluster of positions is liquidated, the impact on the market is relatively small, but if thousands of position clusters are liquidated at similar prices, the simultaneous liquidation of these orders will have a huge impact on the market price.

Coinglass points out that the liquidation map provides a visualization chart of the liquidation of futures crypto market traders, and the map predicts the upcoming liquidation based on previous price trends. When a small cluster of positions is liquidated, the impact on the market is relatively small, but if thousands of position clusters are liquidated at similar prices, the simultaneous liquidation of these orders will have a huge impact on the market price.

Coinglass reminds that the liquidation map does not display the exact number of contracts to be liquidated or the exact value of the contracts to be liquidated, the cylinders on the liquidation map show the relative importance of each liquidation cluster to the nearby liquidation clusters, i.e. the strength.

Therefore, the liquidation map shows to what extent the target price will be affected when it reaches a certain price level, and the higher the liquidation cylinder, the more intense the reaction will be due to the liquidity wave after the price reaches that point.

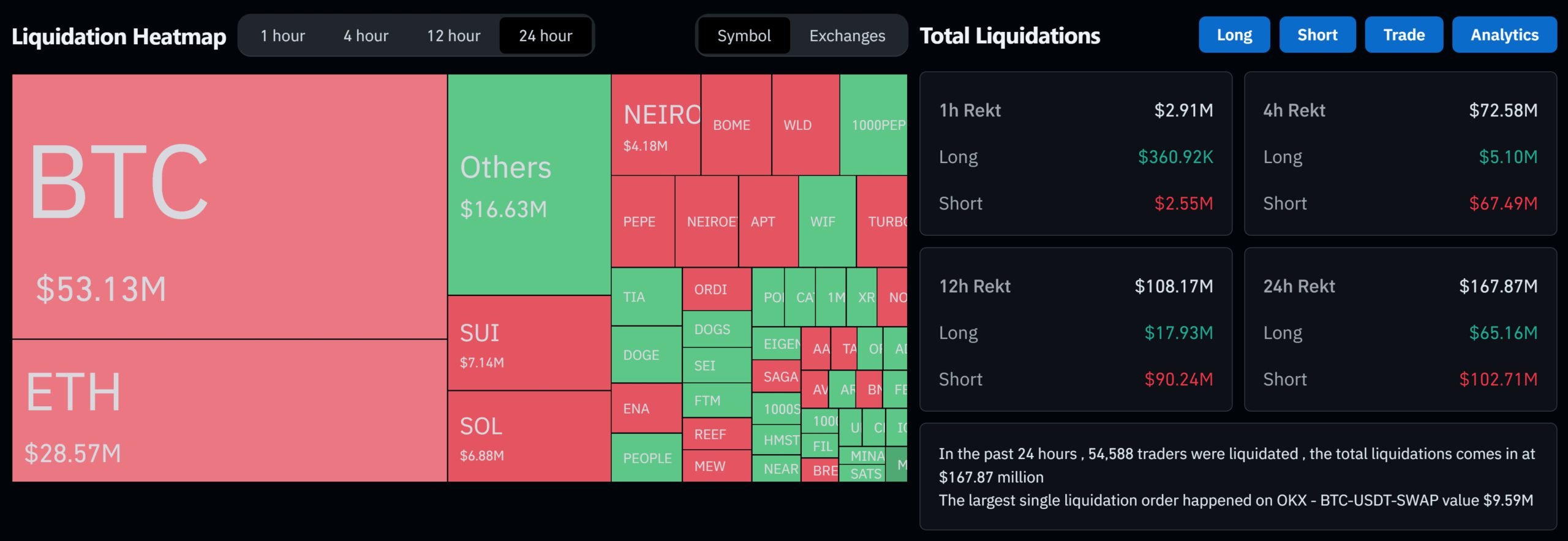

Over $100 million in total network liquidations in the past 24 hours

Amid the significant volatility in Bitcoin, according to Coinglass data, in the past 24 hours, the total network liquidation amount of cryptocurrencies exceeded $167 million, of which long positions accounted for $65.16 million and short positions accounted for $102 million, with over 54,500 people being liquidated, but overall the liquidation data is not too large, so there is still the possibility of greater volatility.