Written by: Chainalysis

Compiled by: Aiying Aiying Team

As Web3 and cryptocurrency technology develop rapidly, the global economic landscape is constantly changing, and Latin America has shown significant growth potential and unique challenges in this process. It is against the backdrop of this wave of globalization and decentralization that Aiying hopes to provide industry insights through this Chainalysis report, inspiring practitioners to think deeply and explore the Latin American market. Of course, a similar report has been done before: 【Research Report】Detailed Analysis of the Latin American Cryptocurrency Market in 2024: From the Legalization in El Salvador and Brazil to the Regional Innovation.

I. Overview of the Latin American Cryptocurrency Market

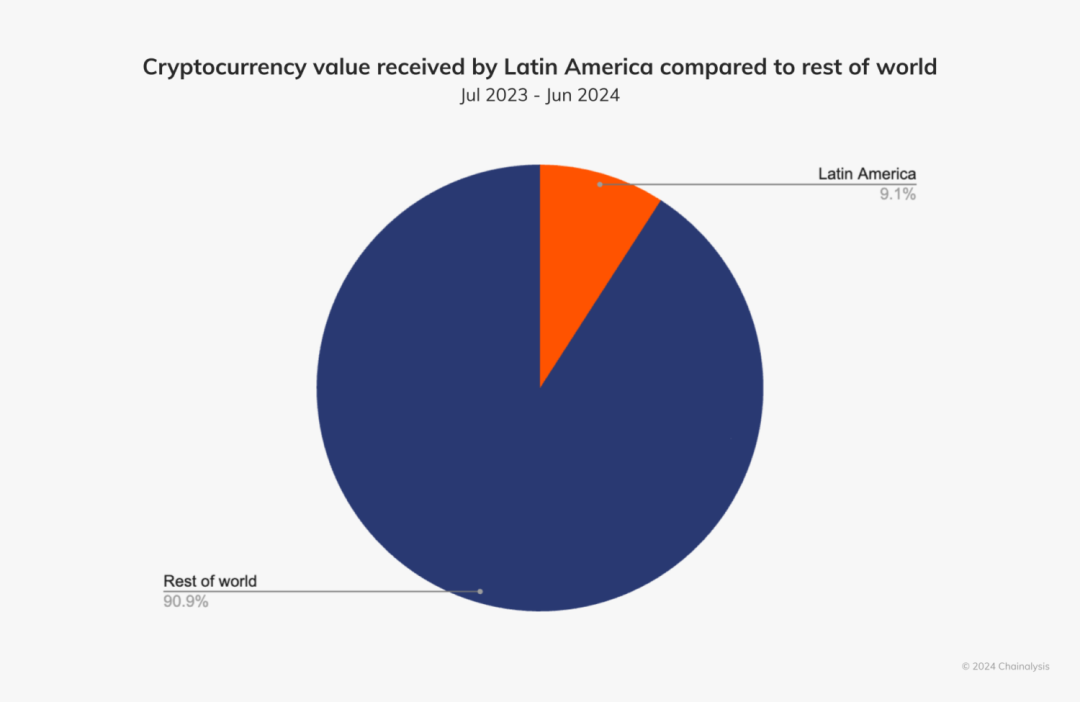

According to the report, Latin America accounted for 9.1% of the global cryptocurrency received volume from July 2023 to June 2024.

During this period, the region received approximately $415 billion in cryptocurrency, slightly higher than East Asia.

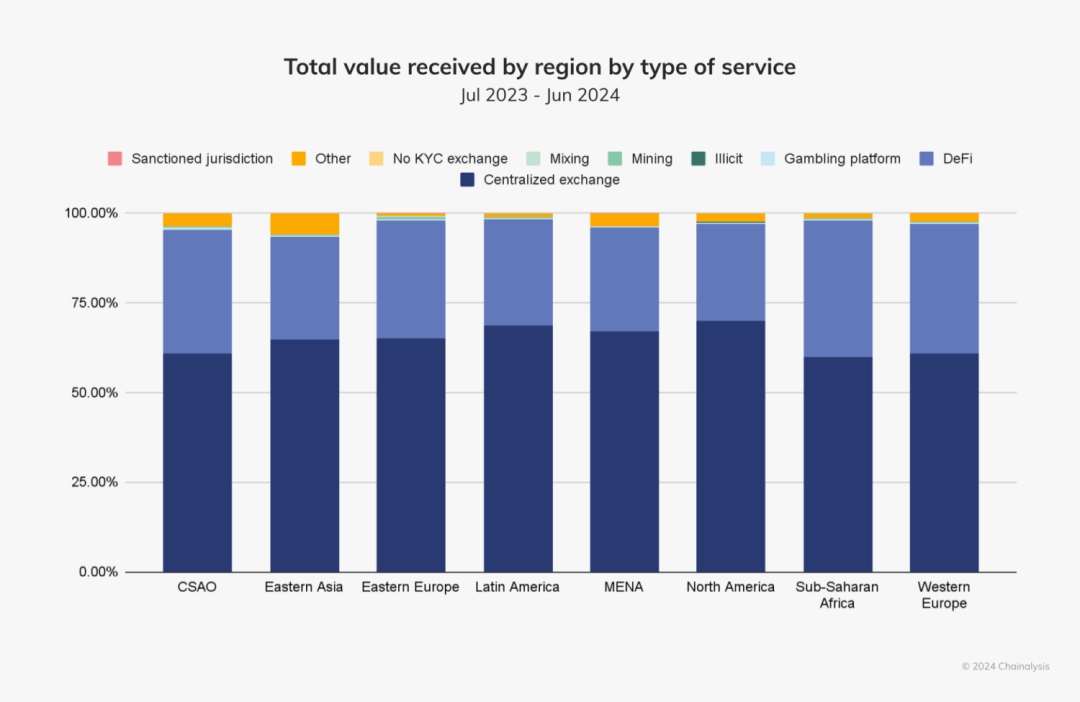

In Latin America, centralized exchanges (CEXs) are the most popular cryptocurrency services, with 68.7% of transactions conducted through these platforms, slightly lower than the centralized exchange usage rate in North America.

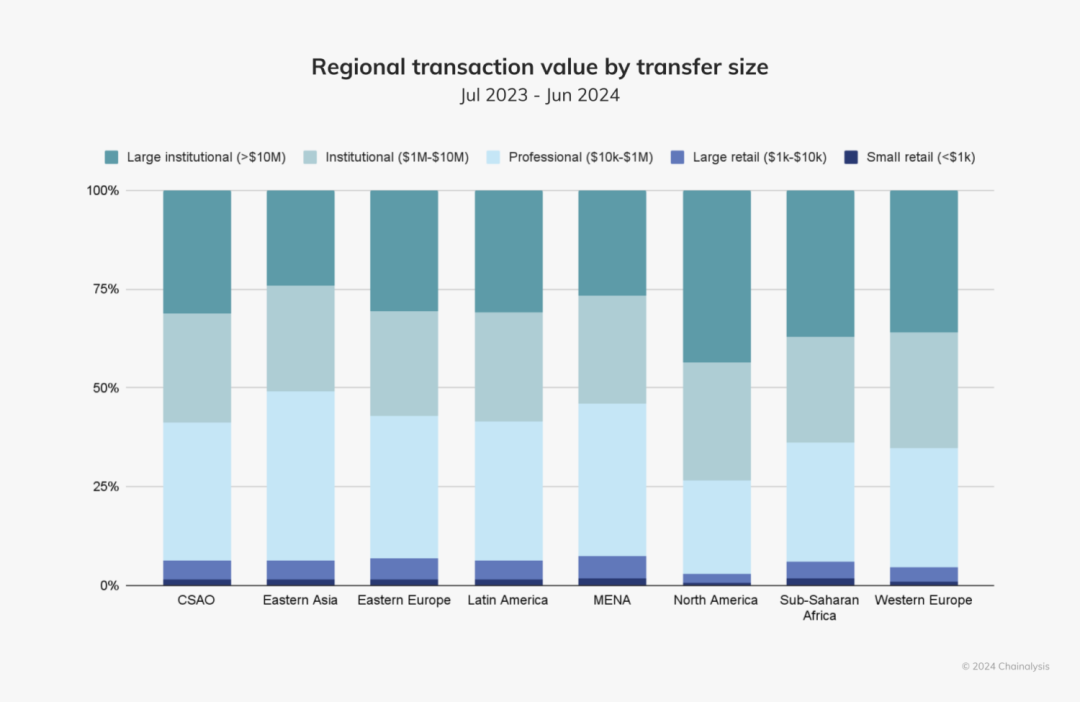

In terms of trading volume, cryptocurrency transactions in the Latin American region are mainly driven by institutions and professional investors (i.e., entities with transaction amounts exceeding $10,000).

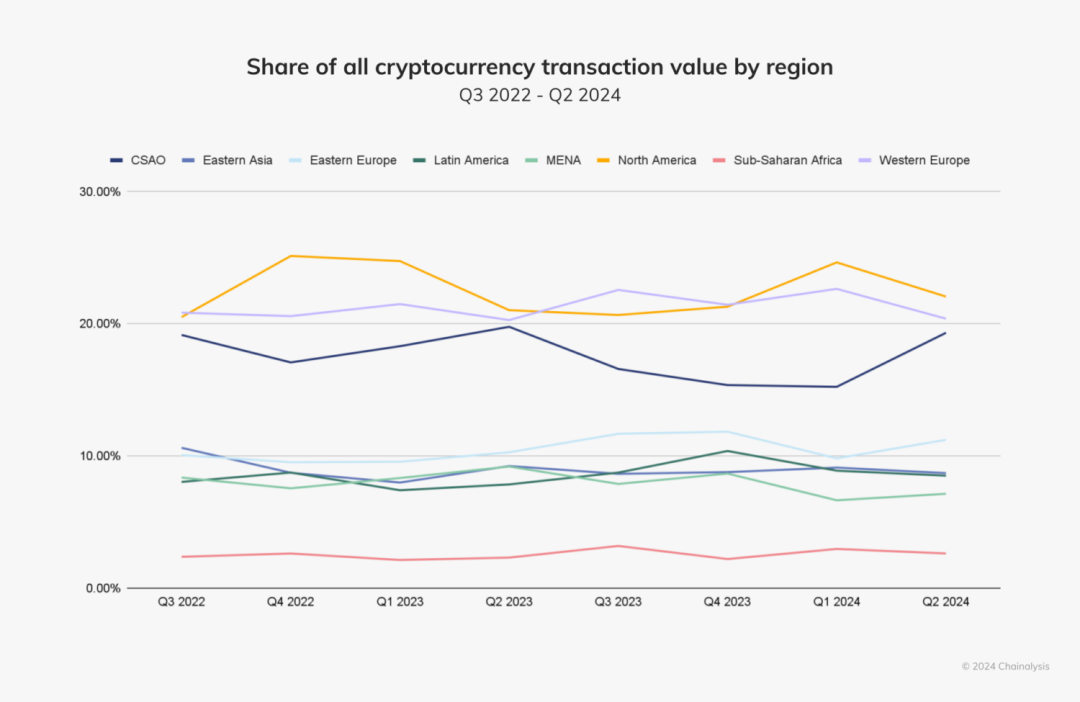

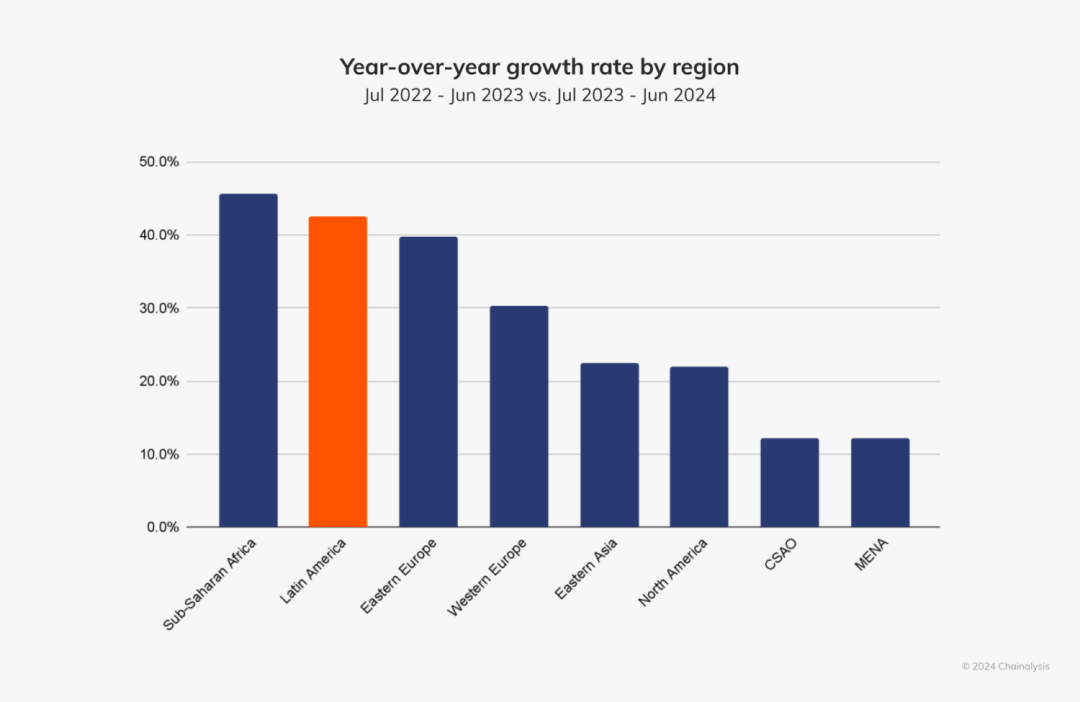

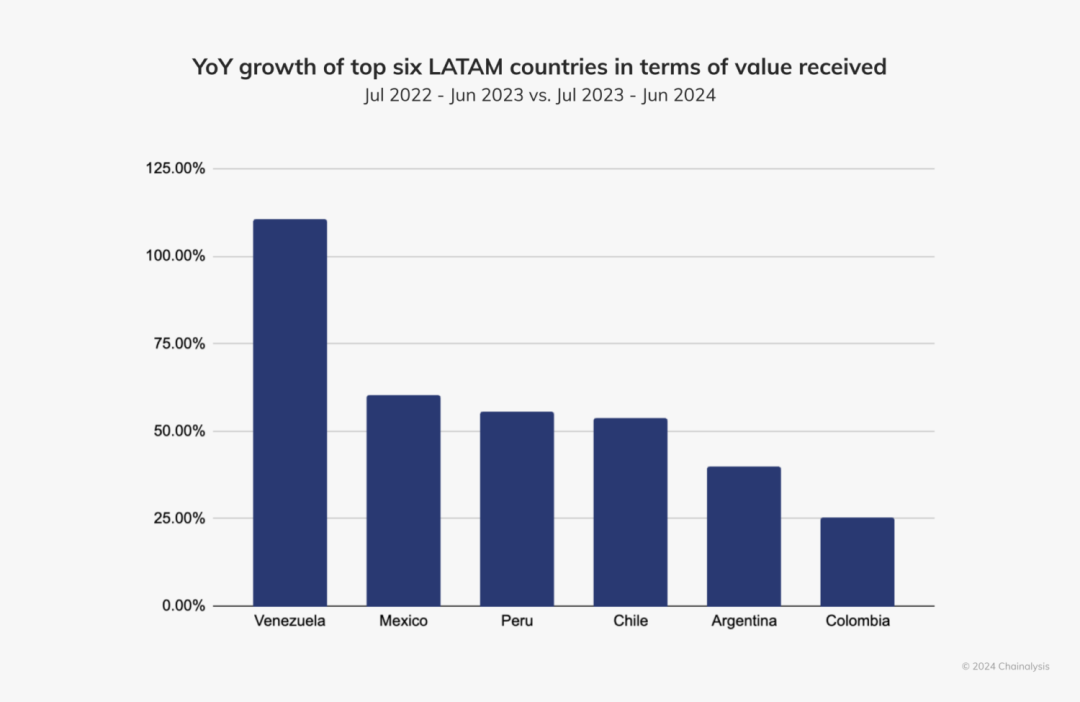

This year, Latin America is the second-fastest growing region in the reported study, with a year-over-year growth rate of approximately 42.5%.

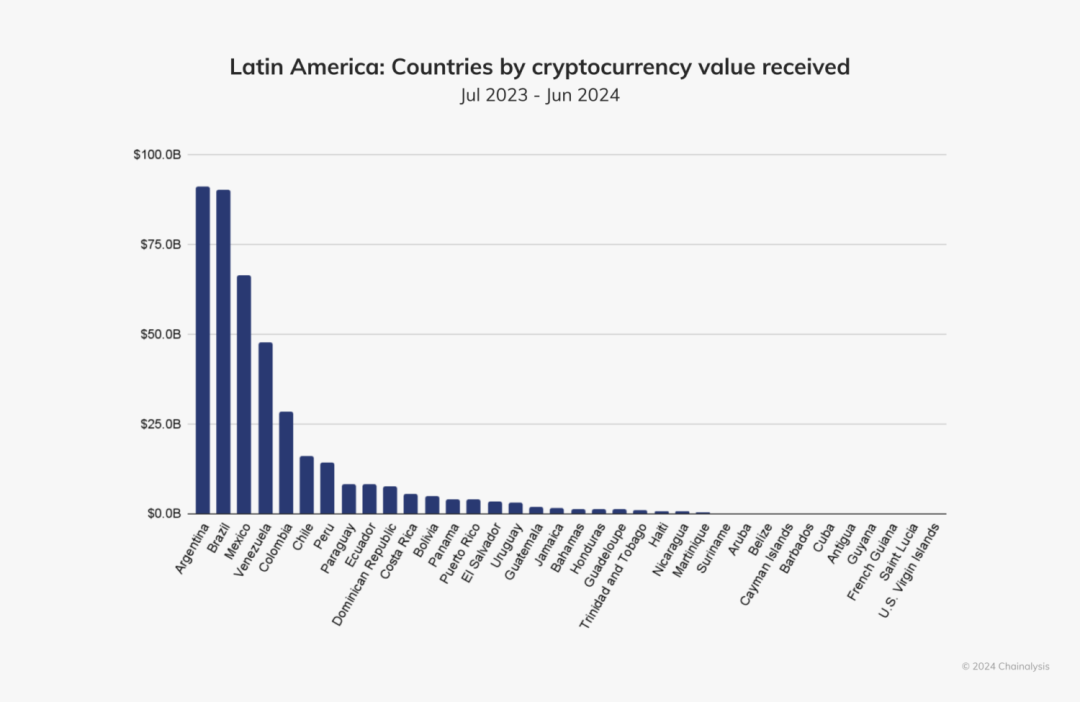

This growth is primarily driven by the strong but distinctive cryptocurrency markets in countries such as Venezuela, Argentina, and Brazil. Argentina is the region's highest recipient of cryptocurrency value, at around $91.1 billion, slightly higher than Brazil's $90.3 billion.

In Chainalysis' global Crypto Adoption Index, four Latin American countries are among the top 20: Brazil (9th), Mexico (13th), Venezuela (14th), and Argentina (15th). This will be discussed in more detail in the following content, as stablecoin-based remittance services are gradually gaining widespread attention and application in these countries and across Latin America.

II. Brazil's Institutional Crypto Activity Rebounds, Financial Giants Return to the Crypto Market

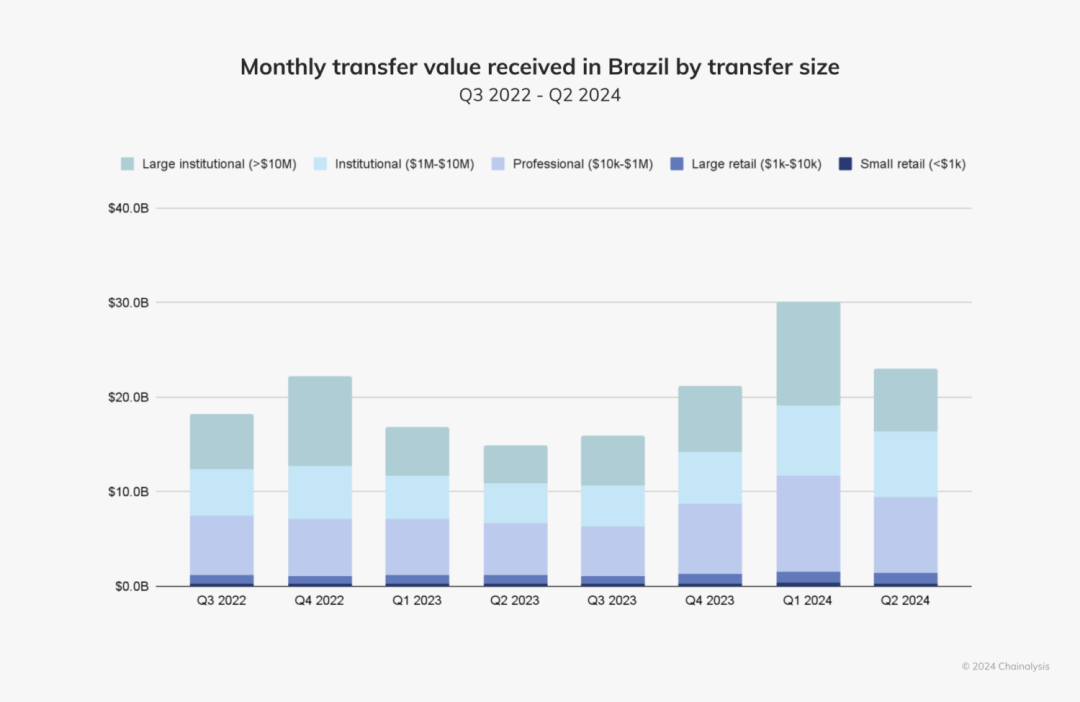

According to the report, the Brazilian crypto market has experienced significant volatility over the past year, from a sluggish start in early 2023 to a strong rebound by mid-year, indicating a resurgence of interest from institutional investors. The report notes that the global cryptocurrency bear market in early 2023 led to a significant decline in institutional trading volume in Brazil; however, as market sentiment shifted, this trend was reversed in the middle of the year, with a rapid increase in institutional trading activity. The data shows that large institutional transactions over $1 million grew by 29.2% between the last two quarters of 2023, and this growth rate further expanded to 48.4% between the fourth quarter of 2023 and the first quarter of 2024.

According to the report, one of the reasons driving this rebound is the diversification of investment portfolios. André Portilho, head of digital assets at investment bank BTG Pactual, analyzed that "in the context of a maturing market, investors are increasingly incorporating digital assets into their asset allocation, seeing them as an alternative investment option that can provide high returns. Bitcoin and other cryptocurrencies are gradually being recognized as mature investment tools, which is crucial for attracting new capital inflows. Furthermore, the recovery of the Brazilian crypto market has also been driven by improvements in the regulatory environment and the entry of US institutions, particularly the launch of Bitcoin and Ethereum ETFs, which have greatly boosted investor confidence."

Aaron Stanley, the founder of the Brazil Crypto Report, observed from the overall industry development perspective: "Over the past year, the Brazilian crypto ecosystem has become increasingly mature. Many traditional financial institutions, including Brazil's largest bank Itaú, have launched cryptocurrency brokerage services, and other major banks are also actively developing similar products. At the same time, major global crypto exchanges like OKX and Coinbase have also expanded significantly in Brazil, establishing local teams and providing customized services for the Brazilian market. Additionally, the pilot project of the Brazilian Central Bank's hybrid central bank digital currency (CBDC) and the smart contract platform Drex have further encouraged traditional financial institutions to take a more proactive strategy in the digital asset space. All of this has undoubtedly driven the adoption of cryptocurrencies among both institutional and retail investors."

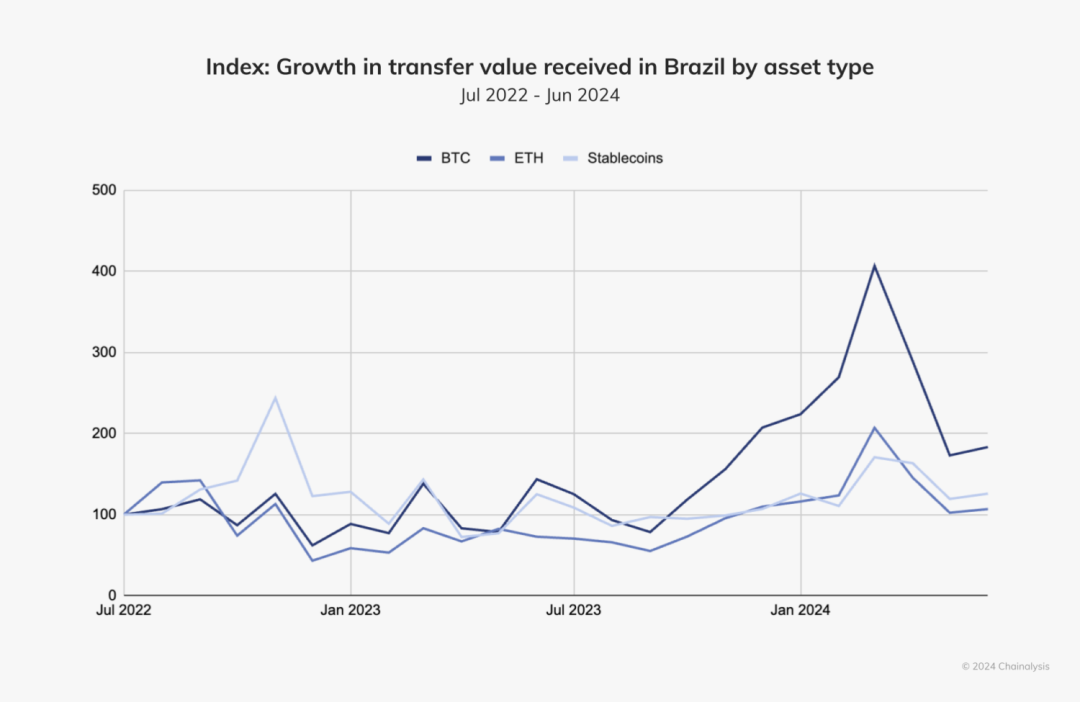

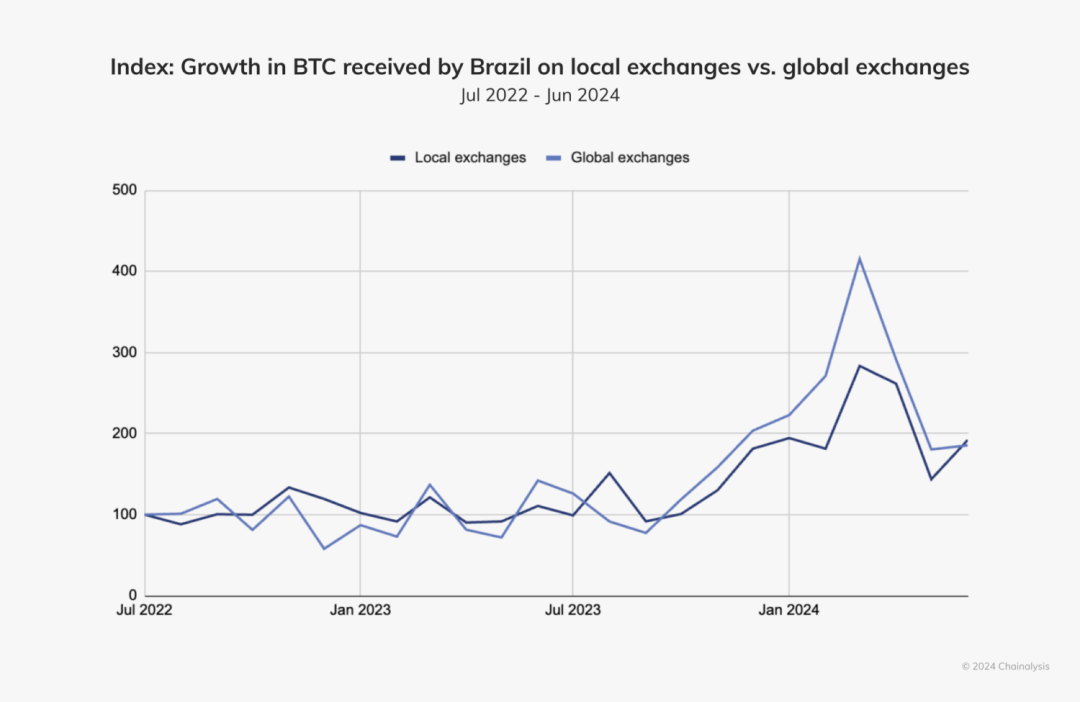

Against this backdrop, Brazilian cryptocurrency investors have shown particular interest in certain assets. The report data shows that Bitcoin trading volume surged from September 2023 to March 2024, which may be directly related to the US Securities and Exchange Commission's (SEC) approval of a Bitcoin spot ETF in January 2024. During this period, Bitcoin prices nearly doubled, which also significantly drove the increase in trading volume.

Furthermore, the report also shows that Brazilian investors' Bitcoin trading volume on global exchanges is much higher than on local exchanges.

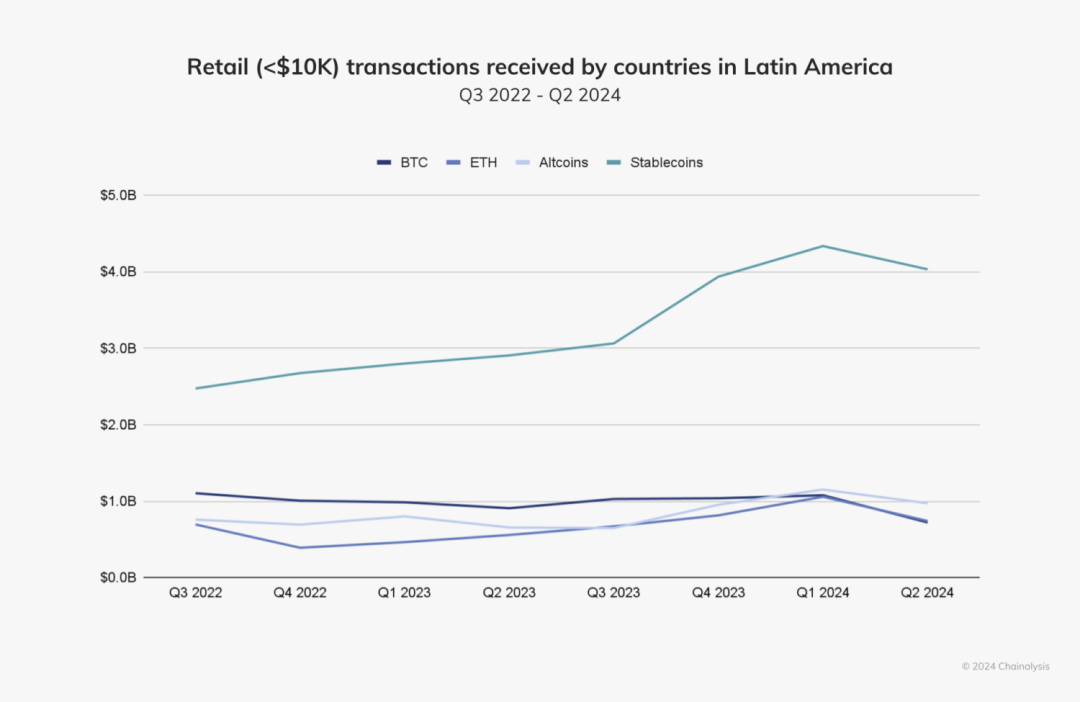

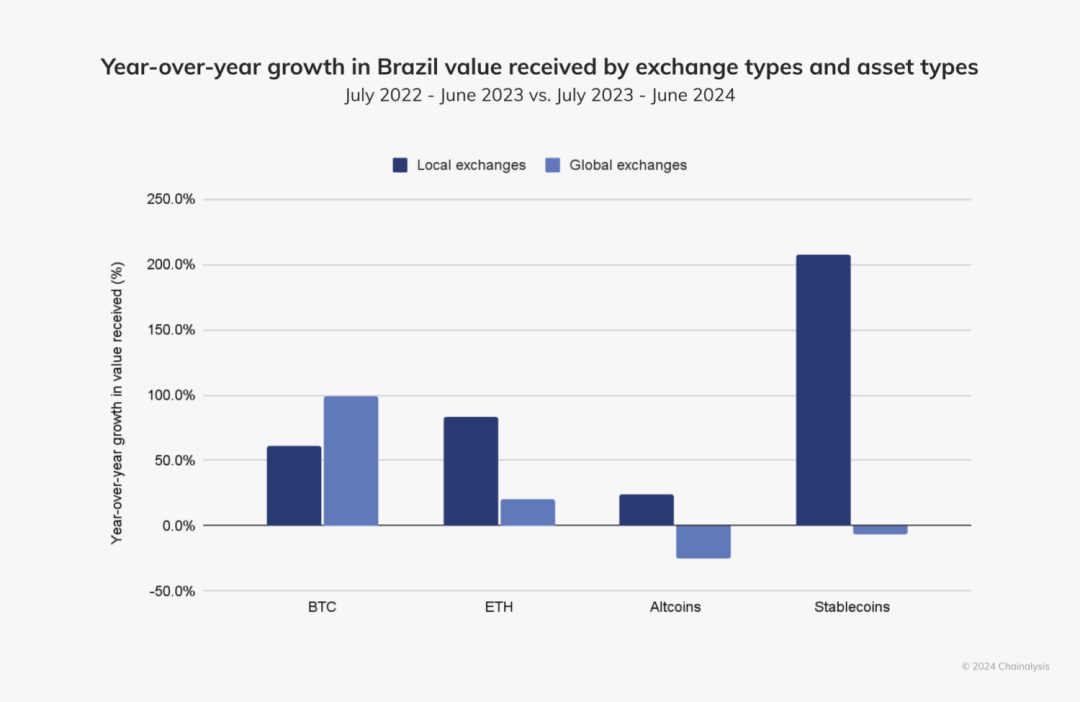

However, on local exchanges, there is a noticeable difference in asset types. Data shows that stablecoin trading volume grew by 207.7% year-over-year, far outpacing Bitcoin, Ethereum, and Altcoins. Regarding this, Stanley explained: "Many local exchanges and fintech companies offer stablecoins pegged to the US dollar to their clients as a store of value. This strategy has indeed attracted a significant number of customers, but for now, the main use of stablecoins seems to be concentrated in the B2B cross-border payment area."

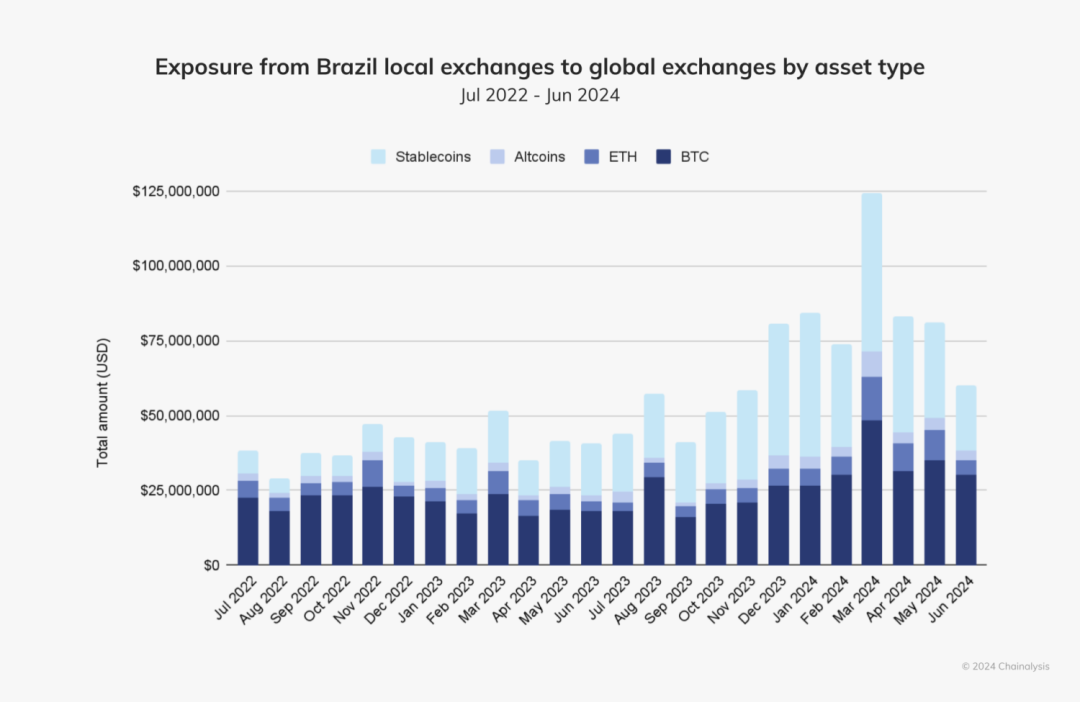

Stablecoins now account for about 70% of the indirect flow from Brazilian local exchanges to global exchanges. The report points out that Brazil's high interest in stablecoins and other digital assets, as well as its widespread acceptance of digital services, have also caught the attention of major crypto companies, including Circle. Circle announced its official entry into the Brazilian market in May 2024. A Circle spokesperson said: "We chose this moment to enter Brazil because the regulatory environment is becoming increasingly clear. The government has implemented policies to support innovation, and there may be more business-friendly regulations in the future. We are collaborating with leading local companies to launch digital asset products and provide 24/7, low-cost USDC services for Brazilian users, while also strengthening our local business coverage. Due to this strategic commitment, the number of USDC users has already grown rapidly."

However, Brazil's Altcoin market still faces many challenges in its future development. The report mentions that Aaron Stanley points out that the macroeconomic environment is currently one of the biggest obstacles: "Slow economic growth, a sharp depreciation of the Brazilian real (BRL) against the US dollar, concerns about increased tax burdens, and heavy debt burdens for middle-class households. Overall, the disposable income of Brazilian consumers is far lower than market expectations." Nevertheless, the regulatory authorities have an open attitude towards Altcoins, which lays the foundation for future growth. "Regulators view Altcoin technology as a tool that can be effectively utilized, rather than a threat that must be suppressed. As long as a regulatory framework that is widely recognized by the market can be established, Brazil's Altcoin economy will have the opportunity for stable growth in the coming years," Stanley summarized.

III. Stablecoins Provide a Stabilizing Path for Argentina's Long-Term Economic Turmoil

According to the report, Argentina's struggle with inflation and the depreciation of the Argentine peso (ARS) has lasted for decades, causing many citizens to constantly seek alternative ways to protect their savings and ensure a more stable economic future. The report points out that Argentina's economic situation was particularly turbulent in 2023. By the second half of 2023, the inflation rate reached around 143%, the value of the Argentine peso plummeted, and 40% of Argentines lived below the poverty line. In December 2023, the newly elected President Javier Milei announced that the peso would be devalued by 50%, calling it a "shock therapy", while the government would cut energy and transportation subsidies.

To cope with the economic crisis, some Argentines have started to turn to the black market to buy foreign currencies, the most common being the US dollar (USD). This so-called "blue dollar" is the US dollar obtained through informal parallel exchange rate transactions, usually through the "cuevas" underground exchange points scattered across the country. Furthermore, more and more Argentines are choosing stablecoins pegged to the US dollar to protect their financial situation.

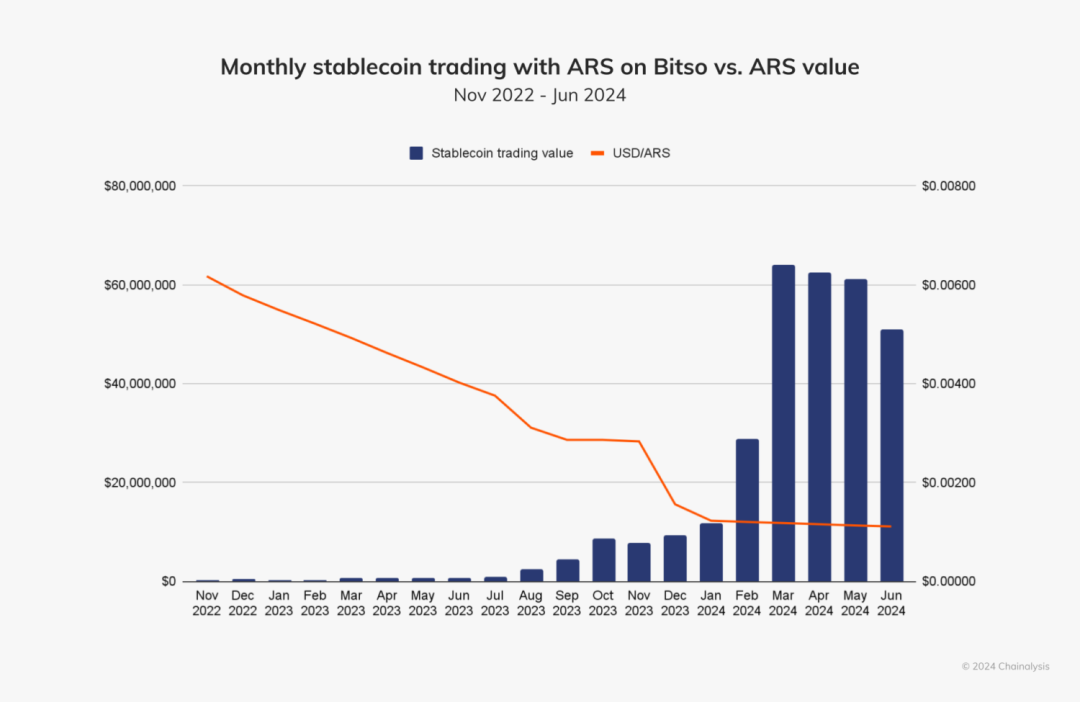

According to the report, we looked at the monthly stablecoin trading volume in ARS on the leading Latin American exchange Bitso, and found that the constant depreciation of the peso has always triggered an increase in stablecoin trading volume. For example, when the peso fell below $0.004 in July 2023, the stablecoin trading volume surged to over $1 million the following month. Similarly, when the peso fell below $0.002 in December 2023 - the month Milei announced the policy - the stablecoin trading volume exceeded $10 million the following month.

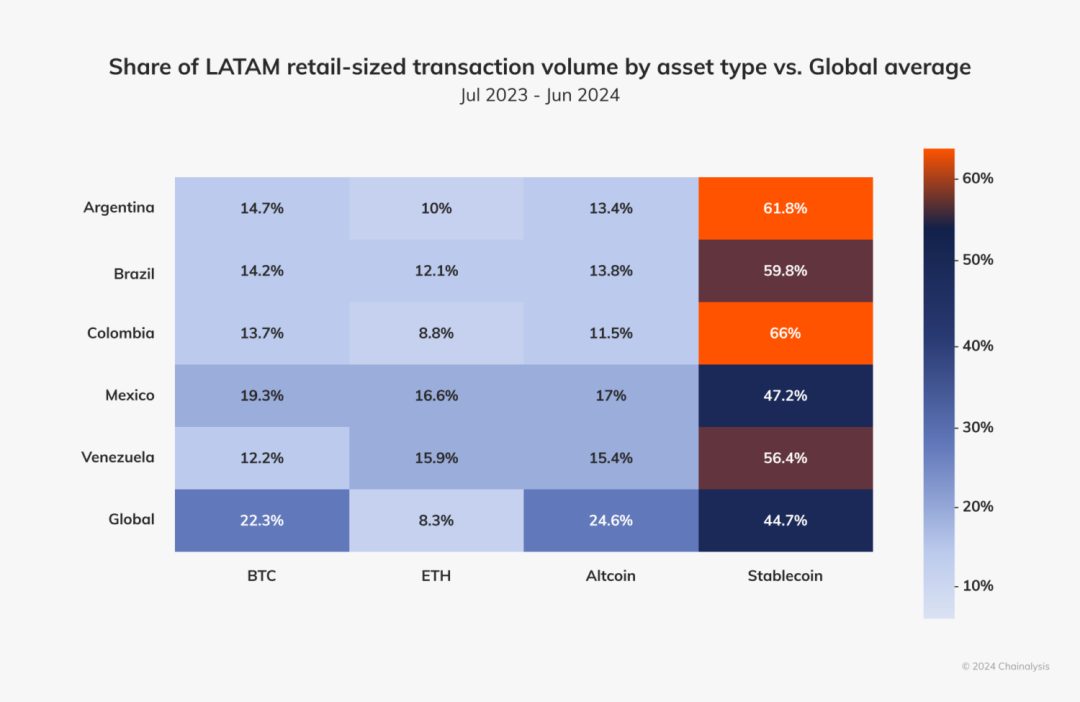

The report further points out that Argentina's stablecoin market is a leader in the Latin American region. Argentina's stablecoin trading volume accounts for 61.8%, slightly higher than Brazil's 59.8%, and far higher than the global average of 44.7%.

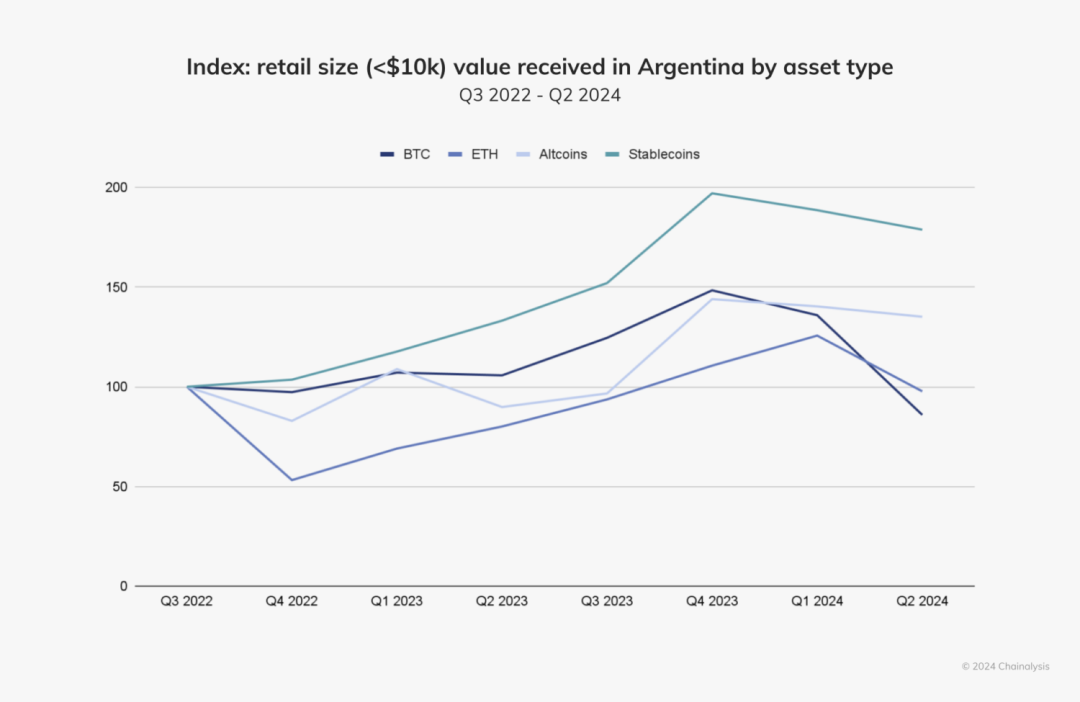

In addition, the report shows that the growth rate of retail-level stablecoin transactions (i.e., transactions under $10,000) in Argentina is faster than any other asset type, further indicating that Argentines view stablecoins as a means to mitigate the impact of inflation and currency depreciation. Their interest in stablecoins highlights the role of Altcoins in unstable markets, and how citizens can better control their financial future by embracing Altcoins, regardless of official monetary policy.

IV. Strong Growth of Altcoins in Venezuela Despite Uncertainty Under the Maduro Regime

According to the report, despite the turmoil caused by the Maduro regime, Venezuela's Altcoin adoption rate remains strong. Venezuela's relationship with Altcoins has been tumultuous, from the launch of the state-backed Petro (PTR) - a stablecoin intended to be backed by Venezuela's oil and mineral resources - in 2018 to its sudden termination in 2024, to the crackdown on Bit mining and the blocking of access to mainstream Altcoin exchanges, all of which reflect the complexity of the country's Altcoin journey. At the same time, the Maduro regime has tried to circumvent economic sanctions through Altcoins, and its illegal oil trade has also been entangled with Altcoin transactions, ultimately leading to high-profile prosecutions by the US Department of Justice. These Altcoin-related events reveal a broader shift, where the Maduro regime is using Altcoins for corruption, while ordinary citizens view them as a means to secure financial independence.

Despite the turbulent situation, the Maduro regime has recently shown renewed interest in Altcoins, although no specific plans have been provided yet. Regardless of how these political developments ultimately unfold, Venezuela remains one of the fastest-growing Altcoin markets in Latin America. The report shows that Venezuela's annual growth rate reaches 110%, far exceeding any other country in the region.

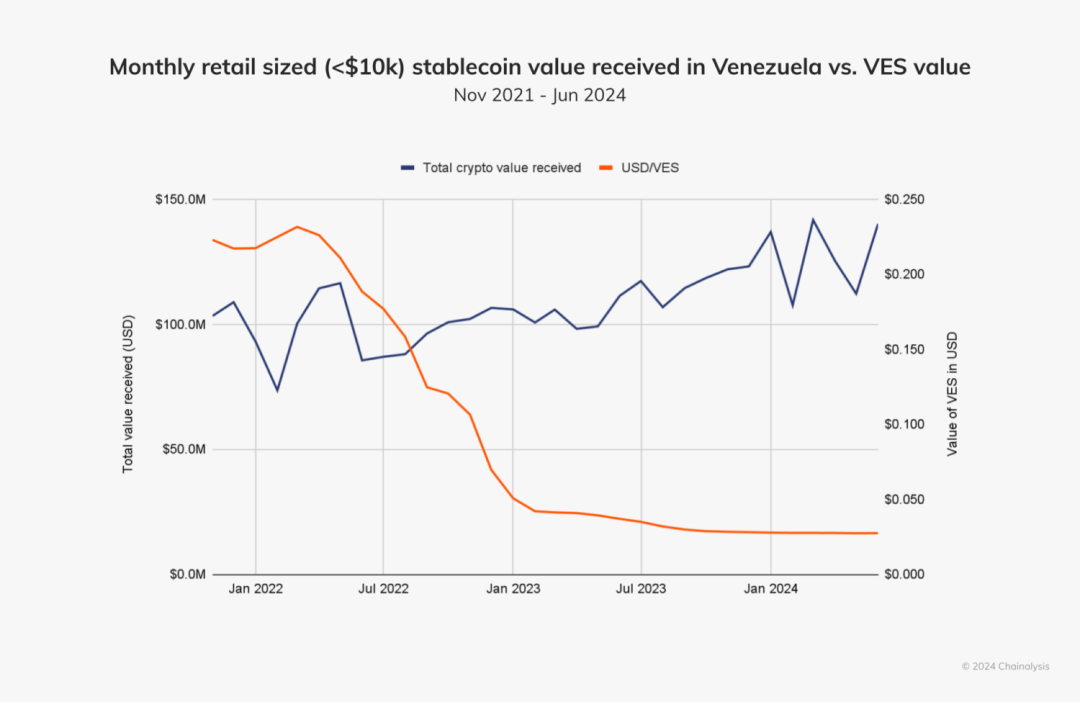

What is driving this growth? First, the report points out that Venezuelans are attracted to Altcoins to address the plummeting value of the bolivar (VES). Data shows a clear inverse relationship between the VES-USD exchange rate and the monthly value of Altcoins received. Multiple media reports also confirm that ordinary Venezuelans continue to seek stable stores of value to hedge against the impact of the national economic crisis.

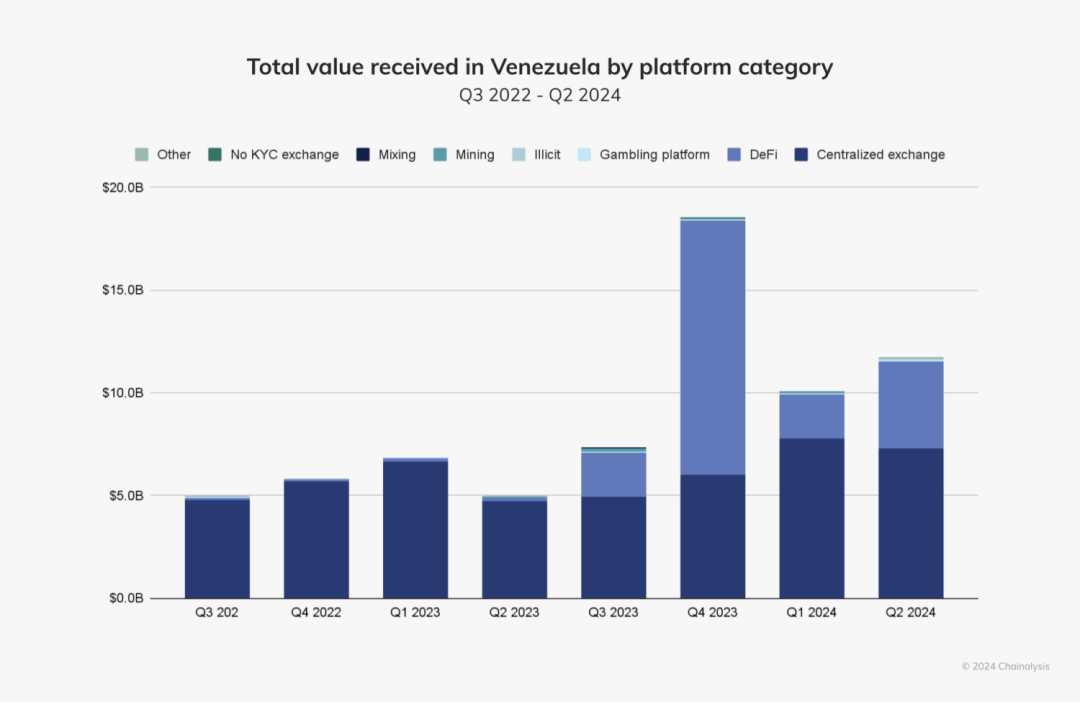

The report further notes that DeFi (Decentralized Finance) is another aspect of Altcoin growth in Venezuela. Since 2022, centralized services have accounted for the majority of Altcoin value received in the country. However, interest in DeFi is gradually increasing, particularly notable towards the end of 2023. While centralized services remain the most popular, the growth of the DeFi market share is an area to watch for the future, especially if the Maduro regime explicitly supports Altcoin innovation, which could further accelerate DeFi's growth.

V. Accelerating Altcoin Activity in the Caribbean Region, Despite Lingering Uncertainty After the FTX Collapse

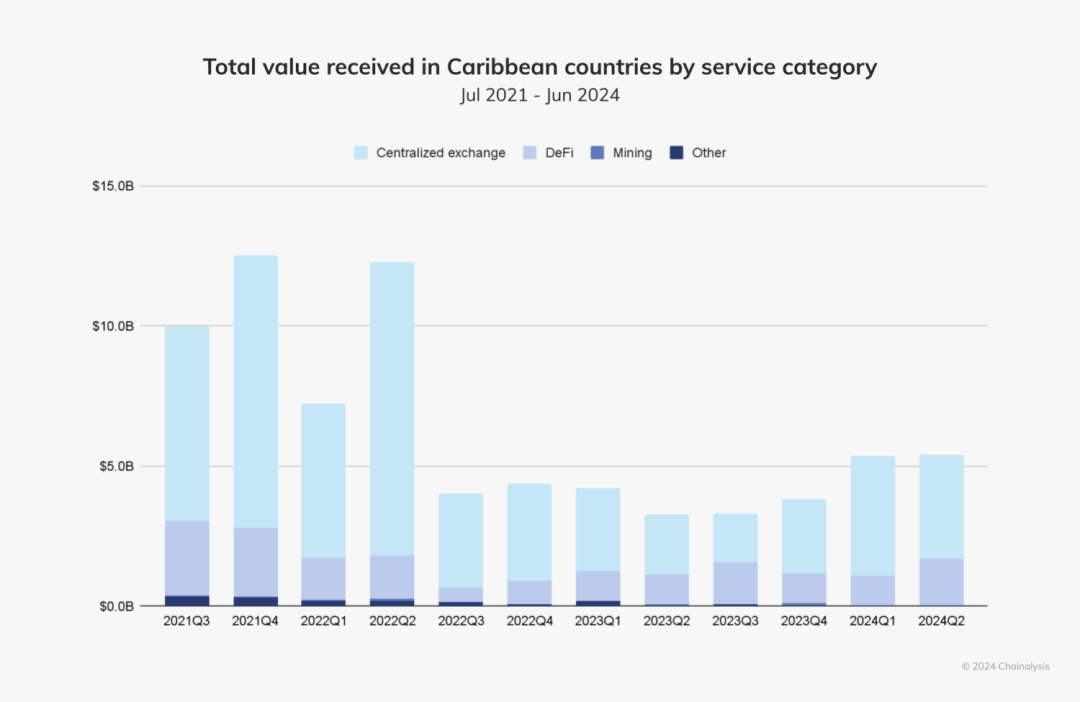

According to the report, since the FTX collapse, the Altcoin ecosystem in the Caribbean region has experienced a period of uncertainty and reduced activity, with users' trust in Altcoin platforms gradually diminishing. However, starting from the end of 2023, Altcoin activity in the Caribbean region has seen a resurgence. Data shows that users seem to be turning back to mainstream centralized crypto exchanges (CEX), such as Coinbase and Binance.

Through an interview with David Templeman, a professional financial investigator from the Cayman Islands Monetary Authority, we can better understand the changes in Altcoin activity in the Caribbean region. Templeman points out that particularly in the Cayman Islands, the number of overseas clients seeking to establish Web3 and blockchain-related legal entities has clearly increased over the past year, a trend that was not as evident in previous years. These projects typically involve Layer 1 or Layer 2, and have a wide range of applications, from artificial intelligence, cross-chain infrastructure, gaming, to data and cloud storage.

Templeman summarized: "A series of collapse events (FTX, TerraUSD/Luna, Celsius Network, and Three Arrows Capital) have put pressure on the entire industry, forcing it to learn from mistakes and establish better oversight and protection measures. In the Cayman Islands, blockchain and Web3 companies physically and legally established here have formed a strong community." Clearly, activities in the Caribbean region are thriving again, consolidating the region's position as an important hub for adoption in the coming years.