Source: CoinGecko, Translated by Shan Ouba, Jinse Finance

In the third quarter of 2024, the cryptocurrency market closed with a market capitalization of $2.3 trillion, remaining stable, but still experiencing significant volatility during the period. Geopolitical and economic events had a significant impact on the crypto market. The US Federal Reserve decided to keep interest rates unchanged in July and cut them by 50 basis points in September, changing the market's trajectory for the quarter. The unexpected rate hike by the Bank of Japan in July caused unexpected market volatility, while China's new stimulus measures suggested the possibility of more structural liquidity.

Our "2024 Q3 Crypto Industry Report" comprehensively covers the landscape of the crypto market, delving into in-depth analyses of Bitcoin and Ethereum, exploring the Decentralized Finance (DeFi) and Non-Fungible Token (NFT) ecosystems, and reviewing the performance of Centralized Exchanges (CEX) and Decentralized Exchanges (DEX).

7 highlights of the CoinGecko 2024 Q3 Crypto Industry Report:

The total cryptocurrency market capitalization decreased by 1.0% in Q3 2024, ending the quarter at $2.33 trillion.

Bitcoin's dominance increased, now accounting for 53.6% of the total crypto market capitalization.

Major asset classes outperformed Bitcoin, with gold rising 13.8%.

Prediction markets grew 565.4% in Q3 2024, with Polymarket capturing 99% of the market share.

Ethereum Layer 2 transaction volume increased by 17.2% in Q3 2024, with Base leading the performance.

Centralized exchange spot trading volume declined to $3.05 trillion, a 14.8% decrease quarter-over-quarter.

Ethereum remains the dominant chain for decentralized trading, but is rapidly losing market share to Solana and Base.

1. Cryptocurrency Total Market Cap Declined -1.0% in Q3 2024, Ending the Quarter at $2.33 Trillion

At the end of Q3 2024, the total cryptocurrency market capitalization declined by -1.0% ($95.8 billion) to $2.33 trillion. On July 22nd, the market briefly reached $2.61 trillion, but due to global economic weakness, it experienced a significant drop on August 6th. The Federal Reserve maintained interest rates, while the Bank of Japan raised rates.

Subsequently, the global cryptocurrency market value fluctuated between $2.00 trillion and $2.20 trillion, before slightly rebounding to the current $2.33 trillion level, driven by the US's significant 50-basis-point rate cut and China's announcement of stimulus measures.

Additionally, the average trading volume for Q3 2024 was $88 billion, a slight decrease of -3.6% from the previous quarter.

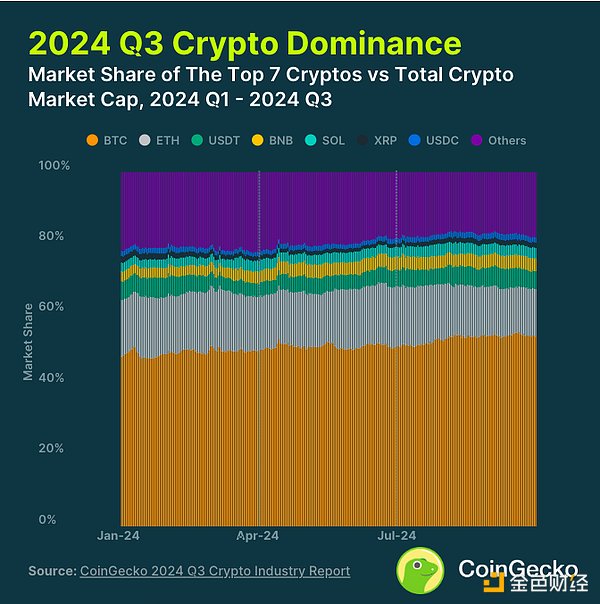

2. Bitcoin's Market Dominance Further Strengthened, Now Accounting for 53.6% of the Total Crypto Market

Despite a slight decline in the global cryptocurrency market capitalization in Q3 2024, Bitcoin (BTC) successfully increased its dominance to 53.6%, a 2.7% increase quarter-over-quarter. It recorded a modest 0.8% gain, while Altcoins such as Ethereum (ETH) and BNB saw larger declines this quarter, leading to a decrease in their market share. BTC last achieved such a dominant position in April 2021.

Meanwhile, Ethereum's dominance among the top 7 cryptocurrencies declined the most, decreasing by 3.6% in the third quarter, with a market share of 13.4% at the end of the quarter. Although an Ethereum ETF was launched in July, this decline may be attributed to decreased interest in the Ethereum ecosystem.

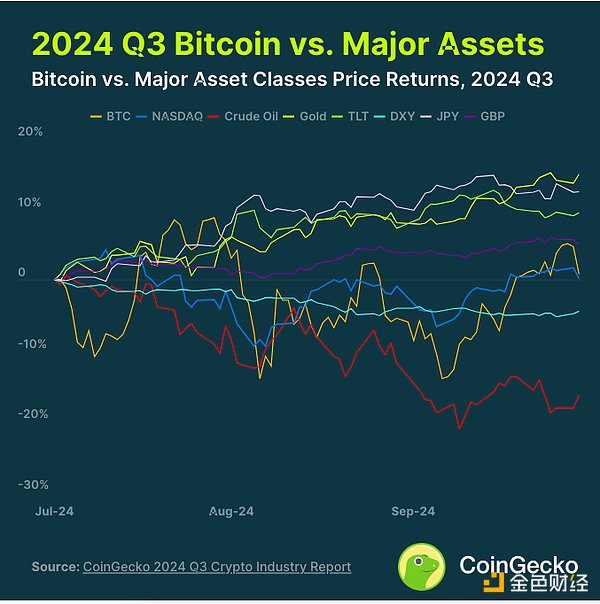

3. Major Asset Classes Outperformed Bitcoin, with Gold Leading the Gains at 13.8%

In Q3 2024, Bitcoin (BTC) price increased by a modest 0.8%, easily outperforming most other major asset classes. Gold had the largest gain, rising 13.8% in the quarter. This occurred amidst concerns about a slowdown in the US economy and escalating tensions in the Middle East.

The Japanese yen also performed well in the quarter, appreciating 12.0% after the Bank of Japan (BOJ) unexpectedly raised rates in August and the Federal Reserve subsequently cut rates. Crude oil and the US Dollar Index (DXY) were the only major asset classes that outperformed BTC, as the market was concerned about weakening demand and rate cuts. All major fiat currencies appreciated against the US dollar.

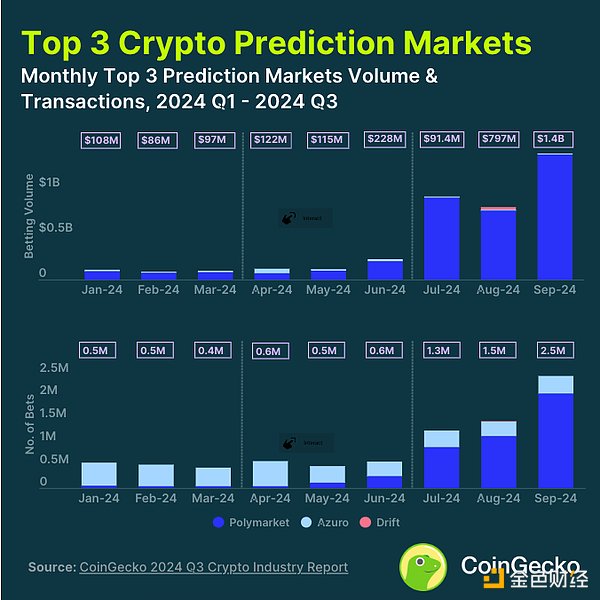

4. Prediction Markets Grew 565.4% in Q3 2024, with Polymarket Dominating at 99% Market Share

In Q3 2024, the prediction markets saw strong momentum, growing 565.4%, as experts placed bets on the upcoming US elections. This caused the trading volume of the top 3 prediction markets to increase from $466.3 million in the second quarter to $3.1 billion in the third quarter.

However, the majority of the trading volume came from Polymarket, which had a 99% market share in September. Its betting volume grew 713.2%, and its trading volume increased by 848.5% during the period. Since the beginning of 2024, the betting amount for the "Winner of the US Presidential Election" has reached $1.7 billion, accounting for about 46% of Polymarket's annual trading volume.

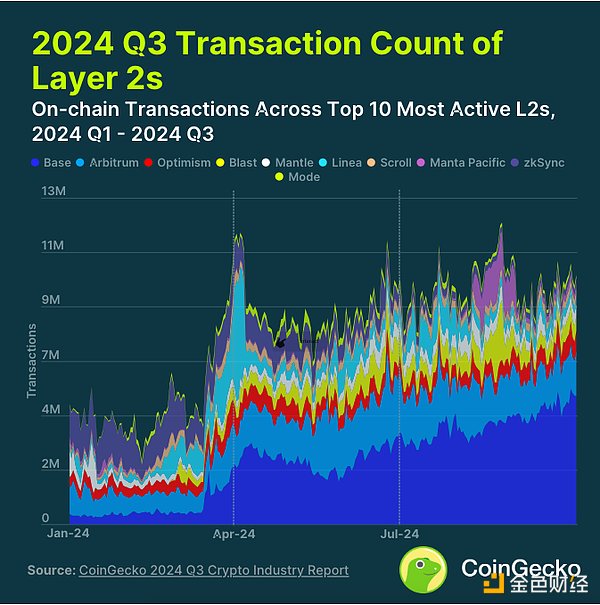

5. Ethereum Layer 2 Transaction Volume Grew 17.2% in Q3 2024, with Base Leading the Performance

In Q3 2024, the total transaction volume of the top 10 Ethereum Layer 2 (L2) solutions steadily increased, reaching nearly 10 million transactions per day by the end of September, compared to around 1 million transactions per day on the Ethereum mainnet.

Since the beginning of the year, network activity on Base has significantly increased, making it the most active L2 to date, accounting for 42.5% of all transactions in the third quarter. Arbitrum was second, accounting for 18.9% of transactions, followed by Blast at 8.1%. Manta Pacific saw a surge in transaction volume in August, with most of the activity attributed to a fully on-chain Telegram mini-program called Taman. However, once the initial launch activity subsided, network activity gradually declined.

6. Centralized Exchange Spot Trading Volume Fell to $3.05 Trillion in Q3 2024, a 14.8% Decrease Quarter-over-Quarter

In Q3 2024, the spot trading volume of the top 10 Centralized Exchanges (CEXs) was $3.05 trillion, a 14.8% decrease quarter-over-quarter.

Binance remains the largest CEX, with a 38% market share as of September 2024. However, this is the first time Binance's market share has fallen below 40% since January 2022. Meanwhile, Crypto.com has risen to become the second-largest CEX, jumping from the ninth position in the previous quarter. It is also the fastest-growing CEX among the top 10, with a 160.8% increase quarter-over-quarter. Its market share in September was 14.4%.

OKX and gate.io both saw trading volume declines of over 30% in the third quarter. Coinbase's trading volume also decreased by -23.8%, falling from the sixth position to the tenth position in the quarter.

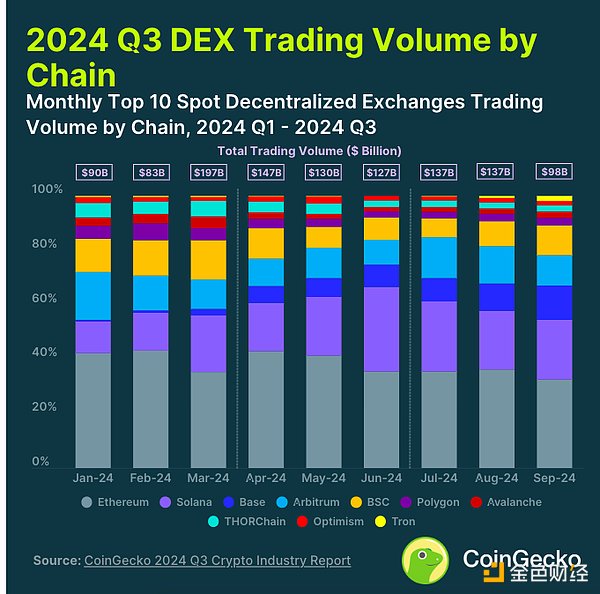

7. Ethereum Was Once the Dominant Chain for DEX Trading, but Its Market Share Is Rapidly Being Taken by Solana and Base

In the third quarter of 2024, Ethereum was the dominant chain for DEX trading, although its market share has always been below 40%. From July to September 2024, Ethereum's trading volume showed a downward trend, with a cumulative trading volume decrease of 19.6% to $130.5 billion.

Driven by numerous meme coins, DEX trading activity on Solana continued to thrive. As of the end of September, its market share was 22%, with a trading volume of $21.5 billion. Meanwhile, despite the crypto market's slow development in the third quarter, Base's market share continued to grow. Base's trading volume grew by 31.4%, allowing it to surpass Arbitrum in September with a 13% market dominance and $12.3 billion in trading volume.

TRON is the new entrant in the top ten, replacing Blast, whose trading volume declined significantly after its TGE. With the launch of the meme coin generator SunPump on the TRON network, its trading volume surged. In September, the network successfully captured a 2% market share with a trading volume of $1.7 billion.