Source: cryptoslate

Compiled by: Blockchain Knight

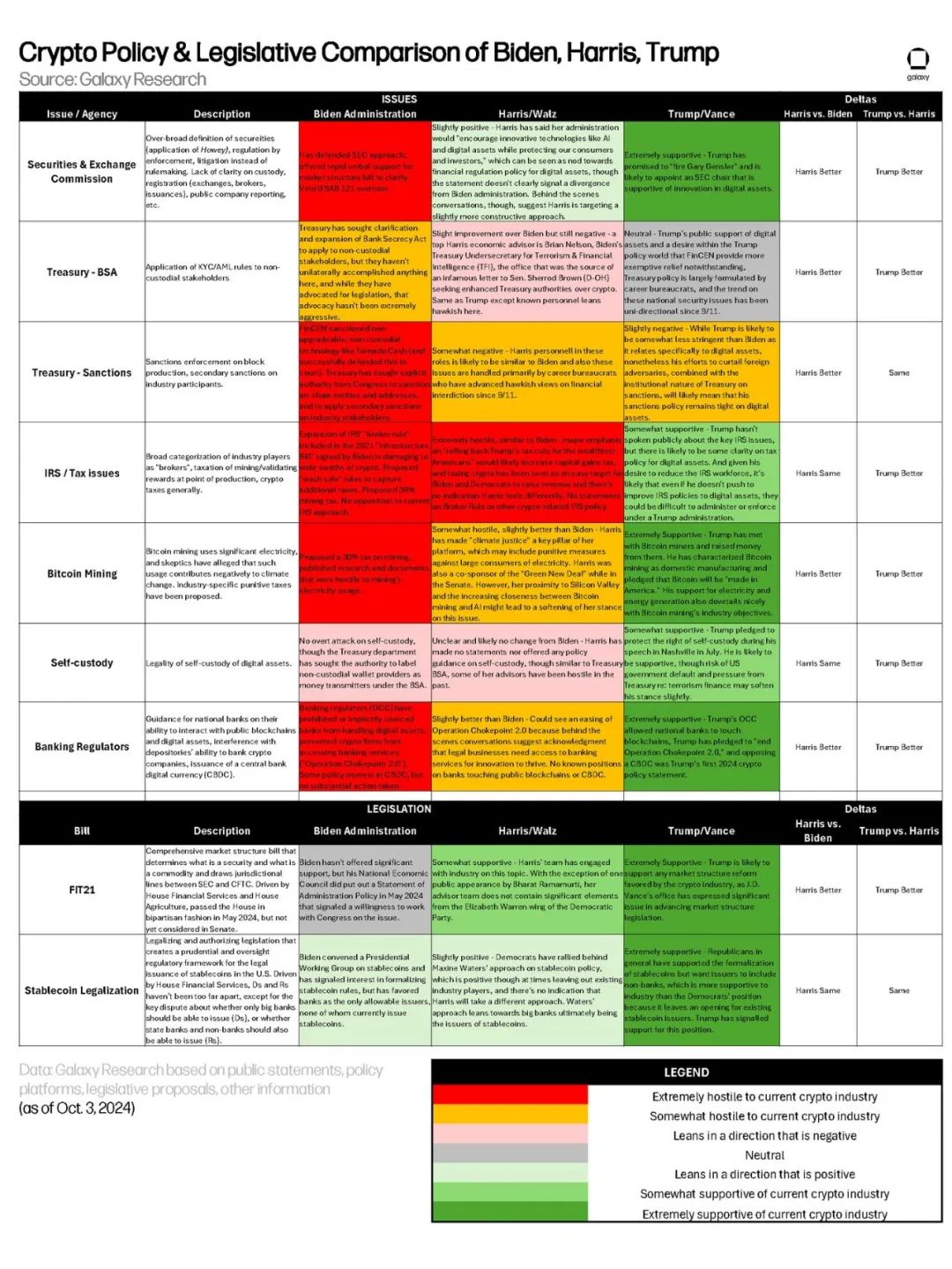

According to the policy positions of US presidential candidates on the Crypto asset industry, Alex Thorn, head of research at Galaxy Digital, has shared a "policy scorecard".

The image shows that a victory for Vice President Kamala Harris would pose a relatively "limited risk" to the Crypto industry, which would be more favorable than the current Biden administration.

However, former US President and current candidate Donald Trump has the most favorable attitude towards Crypto assets.

Galaxy Research analysts are "optimistic" that Harris's tenure may be more friendly to the industry than that of US President Biden, based on actions taken so far.

The main differences between Harris and Trump on Crypto assets are reflected in four areas: taxation, BTC mining, self-regulation, and banking regulation.

On the issue of taxation, Galaxy's analysts described Harris's campaign as "extremely hostile", citing her public pledge to repeal Trump's tax cuts for "the wealthiest Americans".

In contrast, Trump is expected to make the digital asset tax policy more clear.

BTC mining policy also shows a similar contrast. Biden has proposed a 30% tax on mining, while Harris's campaign rhetoric has been much more lenient.

The scorecard rates her position as "slightly better" than Biden's, but still somewhat hostile.

Meanwhile, Trump is seen as very supportive of BTC mining, as he has accepted donations from miners.

Previously, Trump had publicly stated that he believes mining is part of "domestic manufacturing".

Harris and Trump also differ greatly on banking policy.

Behind-the-scenes discussions suggest that Harris may loosen Biden's "Operation Choke Point 2.0" and acknowledge the Crypto industry's need for banking services.

Trump, on the other hand, is seen as "highly supportive", promising to completely end "Operation Choke Point 2.0" and allow national banks to participate in blockchain. Trump has also expressed strong opposition to central bank digital currencies (CBDCs).

In terms of self-regulation, Harris and Trump's policies are relatively similar.

Harris has not made any direct statements on this issue, but some of her campaign advisors have previously taken a hostile stance. Trump, on the other hand, is "somewhat supportive", having vowed to protect self-custody rights at the Nashville BTC conference.

Galaxy's analysis is based on public statements and reports from sources close to the two parties' campaigns.

BTC is clearly absent from most of the regulatory discussions on the scorecard, indicating that it will not be significantly impacted regardless of whether Harris or Trump wins the upcoming election.

However, the prospects for alternative assets are more divided.

A Trump victory could provide the regulatory clarity needed for alternative assets to outperform BTC, while a Harris administration may pose risks to these assets.

If Trump brings the long-awaited regulatory reform for the US Crypto asset industry, tokens like Uniswap's UNI will benefit.

While a Trump presidency could unleash "explosive upside" potential for Crypto assets, Galaxy's research head believes the downside risk of a Harris victory is "limited", and notes that her overall stance on Crypto assets is better than Biden's.