According to the world's largest exchange Binance, the global regulatory framework for stablecoins will see an important step forward with the upcoming regulatory framework of the European Union.

The EU's Regulation on Markets in Crypto-Assets (MiCA) is the first comprehensive regulatory framework for cryptocurrencies, which could legalize the industry for lawmakers globally.

MiCA will be a "key factor" for the development of a comprehensive global stablecoin regulation. According to a Binance spokesperson:

"By establishing clear rules on issuance, reserve management and redemption, MiCA enhances market stability and protects users, while also fostering innovation through legal certainty".

The Binance representative further stated that MiCA's holistic approach will serve as a "global standard" that other legal jurisdictions may seek to align their own frameworks with for "greater cross-border interoperability".

The MiCA framework impacts crypto service providers and will be fully effective on 30/12. Some major European financial institutions are already preparing to offer their digital assets.

While MiCA carves out fully decentralized digital assets from its scope, some DeFi protocols that include centralized intermediaries may fall under this framework in certain cases.

However, a Binance report on global stablecoin regulations suggests that strict implementation could further burden stablecoin providers.

"Strict interpretation of this law could force DeFi protocols to comply with licensing and KYC requirements like traditional financial service companies. This could impose a significant burden that many DeFi protocols find difficult or unwilling to undertake".

In an effort to create more stability, the EU's MiCA implementation will ban the issuance of Algorithmic Stablecoins to avoid another collapse like the Terra USD (UST) in May 2022.

While MiCA is seen as a positive move for the crypto industry, it also raises consolidation concerns for smaller companies.

According to Anastasija Plotnikova - CEO and co-founder of blockchain infrastructure and management company Fideum, this framework is making the Web3 industry more akin to traditional finance (TradFi), as it will make it harder for companies with limited capital to scale.

"Crypto is becoming more like TradFi. The more money you have, the more assets you manage, the easier it is to scale".

She added that this could put more pressure on smaller companies with limited capital:

"It will be much more predatory, even VC activities or larger crypto companies will just be looking for talent".

Some of the largest banks are now preparing to offer digital assets to implement MiCA.

Societe Generale, the 19th largest banking group in the world by assets, is collaborating with Bitpanda to launch a MiCA-compliant stablecoin called EUR CoinVertible (EURCV) pegged to the euro.

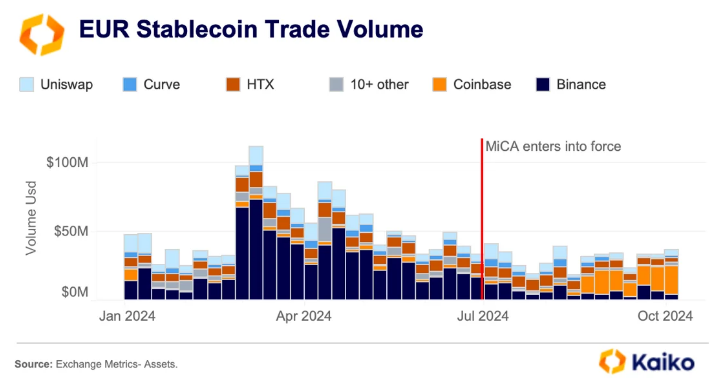

According to the latest Kaiko report, MiCA has had a notable impact on the euro stablecoin landscape. The research indicates that the implementation of MiCA has led to some delistings and adjustments on major exchanges.

Three months after MiCA's enforcement, the euro stablecoin market has seen significant changes. Kaiko data shows that MiCA-compliant euro stablecoins, such as Circle's EURC and Societe Generale's EURCV, now account for 67% market share.

This growth has been attributed to platforms like Coinbase, which have surpassed Binance to become the leading market for euro stablecoins in August, partly due to the removal of non-compliant tokens. However, Kaiko notes that exchanges like Binance continue to promote non-compliant stablecoins, targeting users outside of Europe.

Source: Kaiko

The report also mentions an increase in the market share of MiCA-compliant USD stablecoins, particularly USDC from Circle. According to Kaiko, USDC's market share has increased slightly from 10% to 12%, with more gradual changes compared to euro stablecoins.

Despite these changes, the trading volume of euro stablecoins remains stable at around $30 million per week, significantly lower than the $100 million level before the introduction of MiCA in March.

Going forward, Kaiko researchers predict potential changes in the USD stablecoin market, particularly with Coinbase's upcoming plan to delist USDT for European users by the end of the year.

USDT is non-compliant with MiCA but is widely accepted globally, and its removal from the European market could open the door for more regulated USD stablecoins. However, Kaiko's data shows that USDT maintains a strong presence in other regions, despite these regulatory barriers.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Dinh Dinh

According to Bitcoin Magazine