Important Events of the Week (10/13-10/19)

- Escalation of Middle East Tensions: Israel continues military operations against Hezbollah in Lebanon, bombing the Nabatieh municipal headquarters, and there are reports of planned retaliation against Iran before the US presidential election.

- Stablecoin Cross-Border Payments and Remittances Realized: Siam Commercial Bank launches new services related to stablecoins, stating that they will provide 24-hour trading under regulatory compliance.

- Base Chain TVL Exceeds $2.4 Billion: It has successfully become the "strongest Ethereum L2" at the moment, with much higher trading activity than Arbitrum.

- World Chain Mainnet Launched: The official seems to be hinting that the new iris scanner Orb will land in Taiwan.

- Vitalik Announced the Goal of "The Surge": Ethereum TPS to break 100,000, strengthen interoperability between L2s, and further support Rollups...

- US Election: Trump's chance of winning the US presidential election has risen to 62%, the first time it has exceeded 60% since late July, but there are suspicions of manipulation by whales.

- Chinese A-Shares: Rescue efforts ineffective, with a slowdown in September exports triggering a significant market correction, with the three major A-share indices all declining.

- China's Real Estate Market: The Chinese government has introduced a "4+4+2" policy package to rescue the market, but the market response has been lukewarm.

- CZ's Dynamics: Binance founder CZ will attend the 2024 Binance Blockchain Week to be held in Dubai at the end of October.

Changes in the Trading Market Data This Week

Sentiment and Sectors

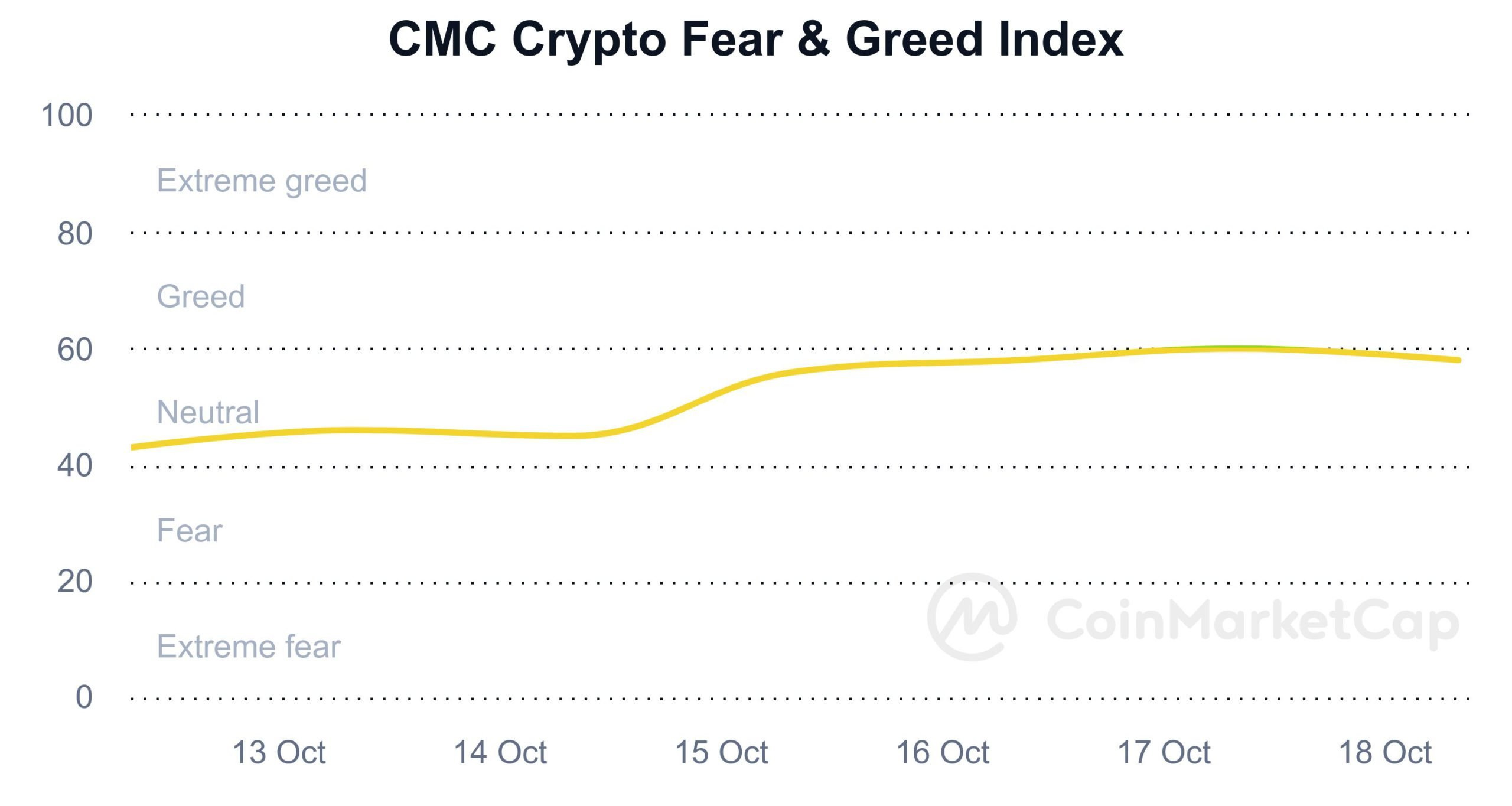

1. Fear and Greed Index

The market sentiment indicator rose from 43 (neutral) to 58 (neutral) this week, briefly reaching 60 (greedy).

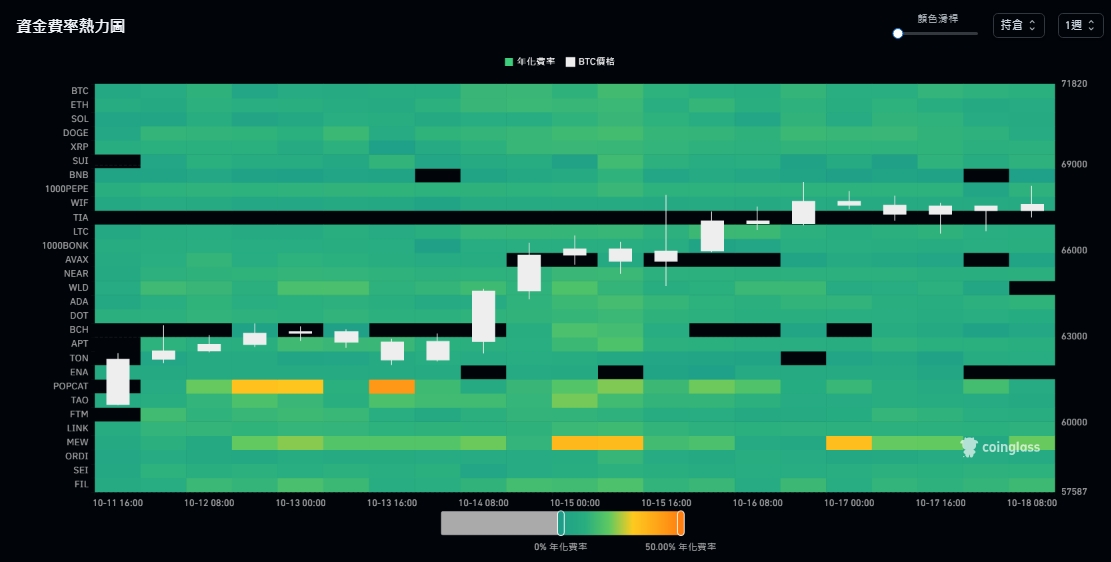

2. Funding Rate Heat Map

The highest Bitcoin funding rate this week reached 14.88%, and the lowest was 4.16%, indicating a strong bullish sentiment.

The funding rate heat map shows the trend of funding rate changes for different cryptocurrencies, with colors ranging from the zero-rate green to the 50% positive rate yellow, and black representing negative rates; the white candlestick chart also displays Bitcoin price fluctuations, contrasting with the funding rate.

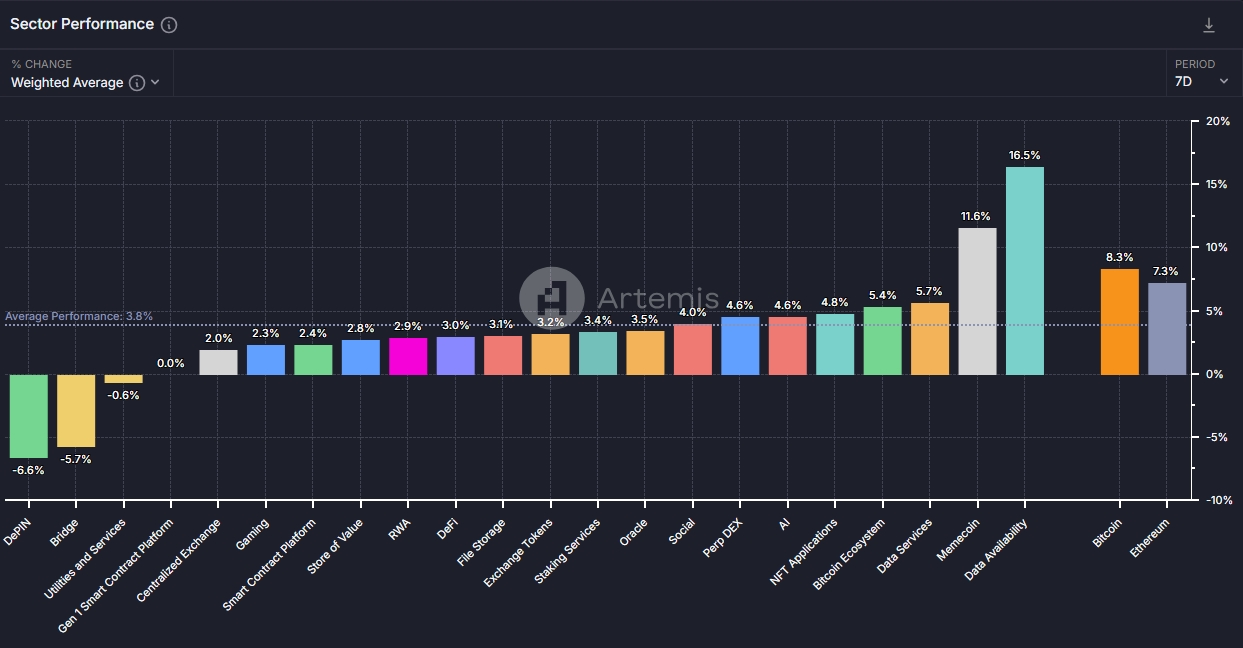

3. Sector Performance

According to Artemis data showing, the average gain of blockchain-related sectors this week was (3.8%), with data availability, MEME, and data services taking the top three spots at (16.5%, 11.6%, 5.7%) respectively.

This week, Bitcoin and Ethereum gained (8.3%, 7.2%).

The three worst-performing sectors were: DePIN (-6.6%), cross-chain bridges (-5.7%), and utilities (-0.6%).

Market Liquidity

1. Total Cryptocurrency Market Cap and Stablecoin Supply

This week, the data shows that the total cryptocurrency market cap increased from $2.12 trillion to $2.32 trillion, an increase of $200 billion, or about 9.43%.

The total supply of stablecoins, an important indicator of market health and liquidity, decreased from $159.4 billion to $159.2 billion, a decrease of $200 million, or about 0.13%.

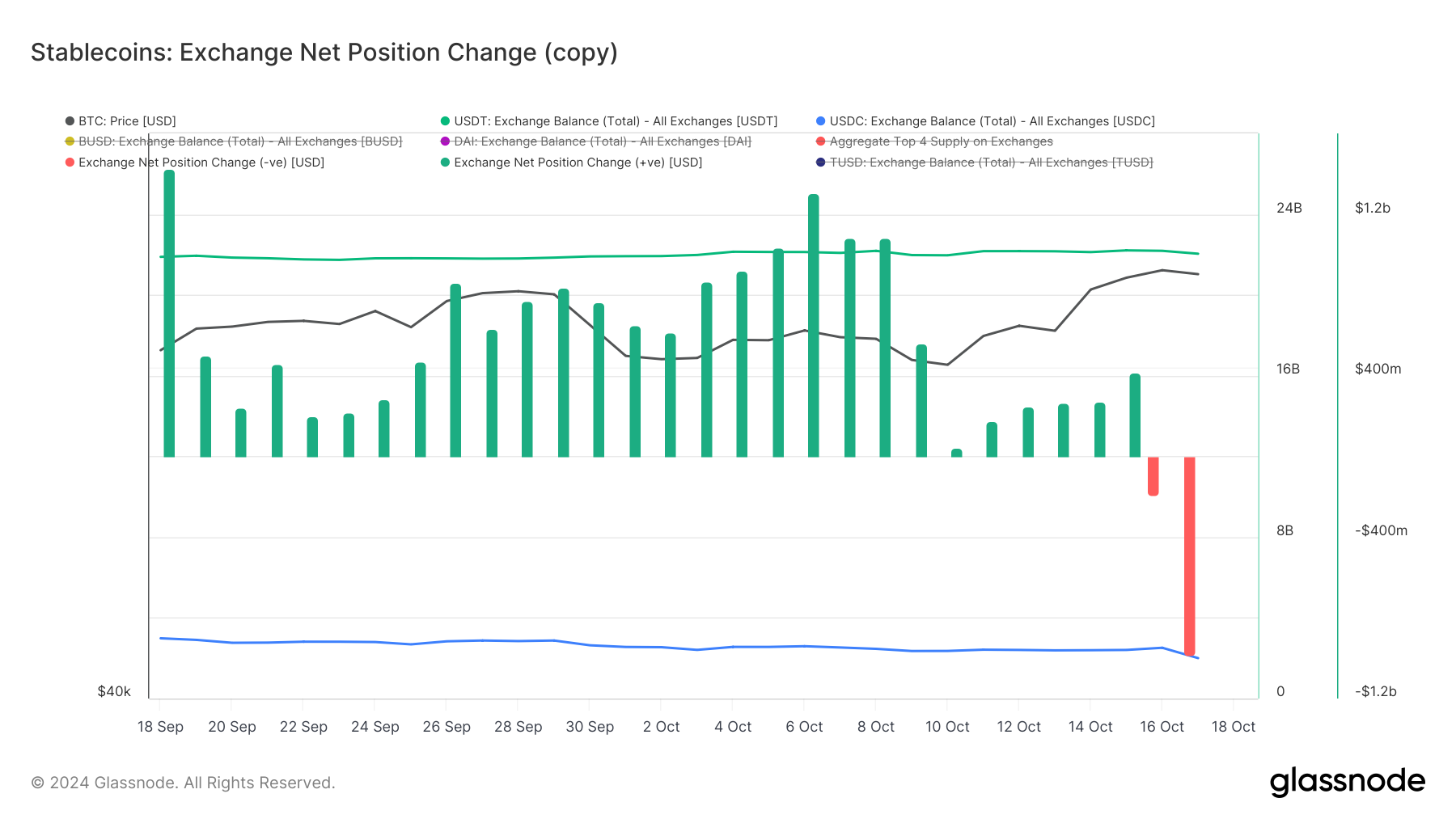

2. Potential Buying Power on Exchanges

The data shows that the overall net position of exchanges was initially in net inflow, but later turned to net outflow.

Bitcoin Technical Indicators

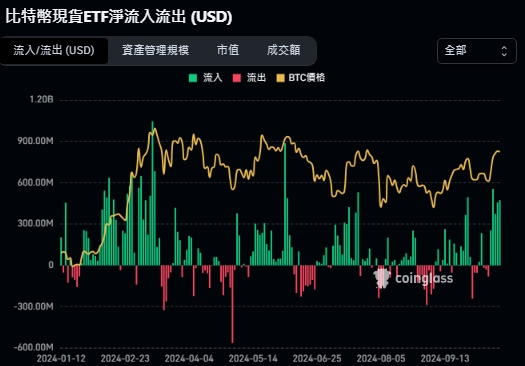

1. Massive Net Inflow of Bitcoin ETF Funds

This week, Bitcoin ETF funds saw a net inflow of $2.113 billion.

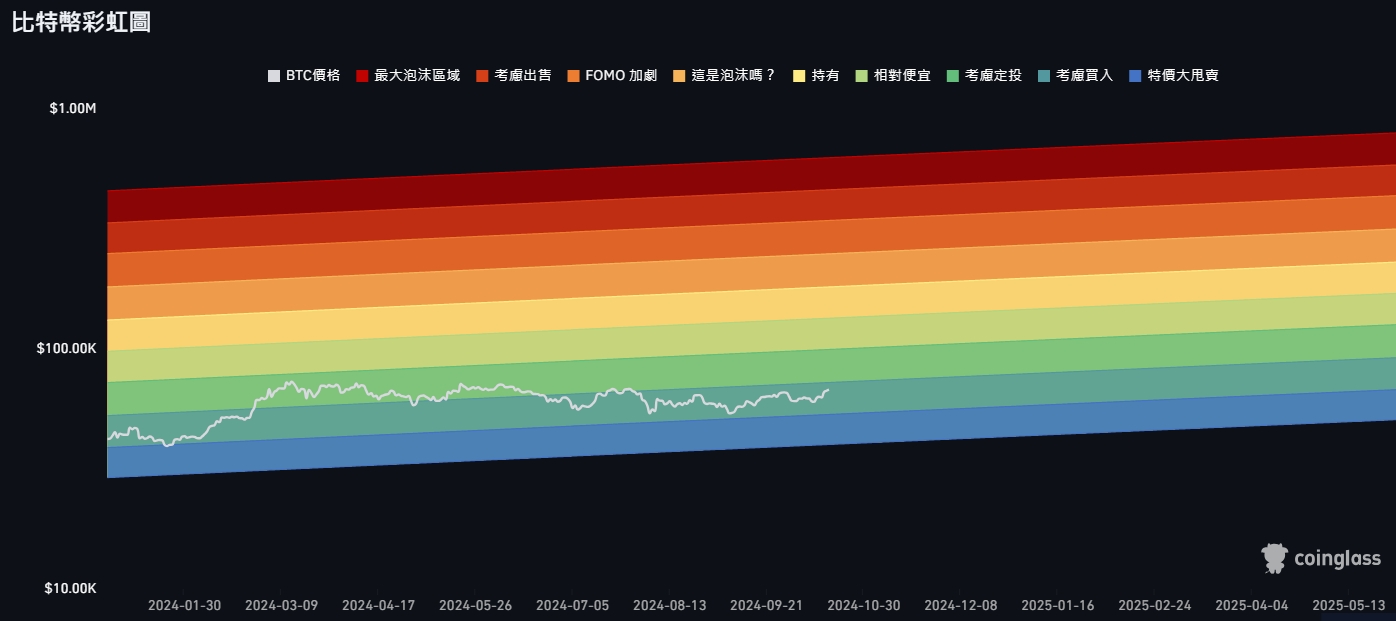

2. Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart shows that the current Bitcoin price is in the "Consider Buying" zone ($66,700), between the "Consider DCA" stage ($70,000) and the "Bubble Territory" stage ($52,000).

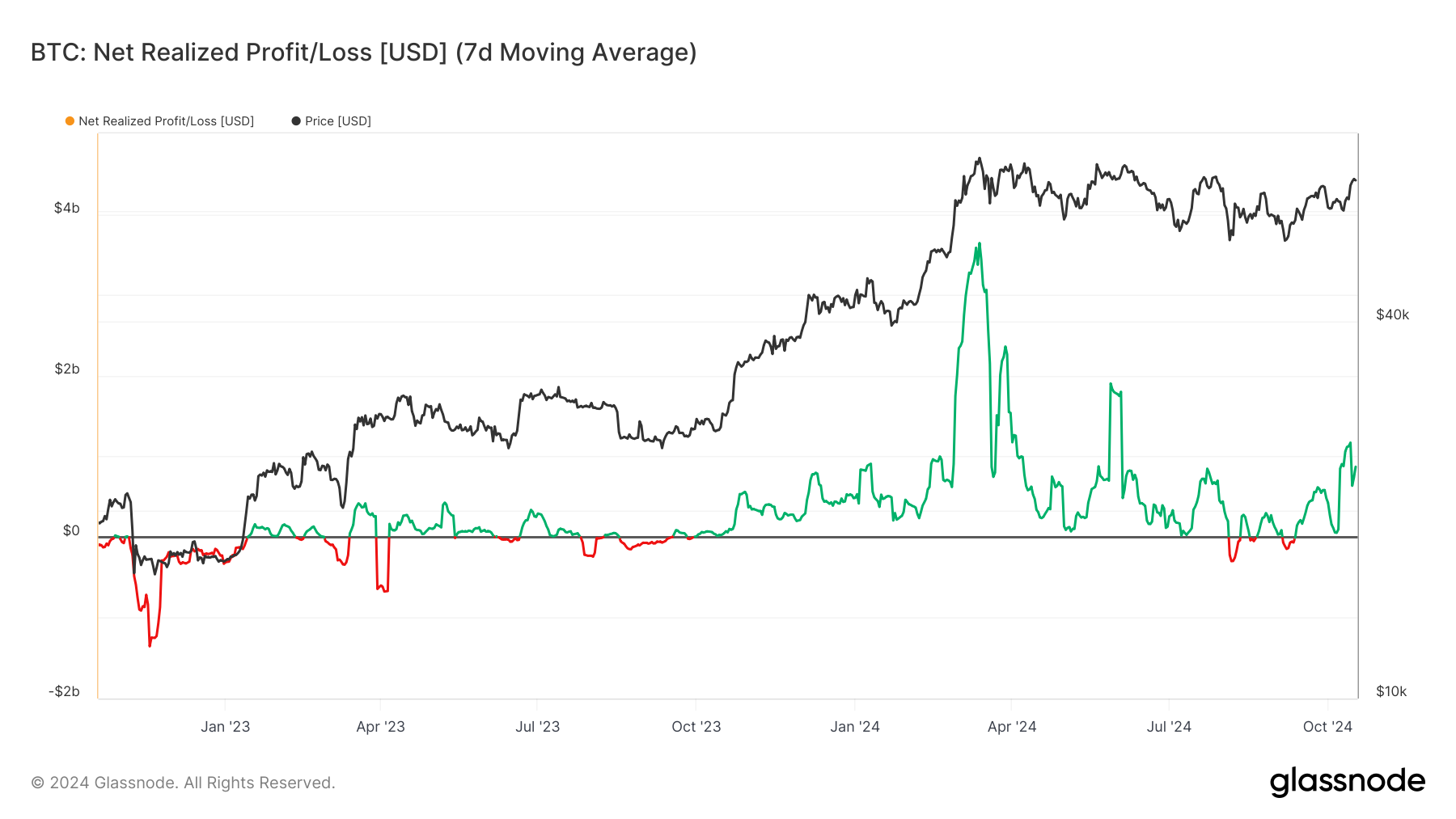

3. Bitcoin Net Realized Profit/Loss

The indicator of Bitcoin's realized net profit/loss shows that the current market sentiment is improving, with the ratio of profits and losses being similar to January this year.

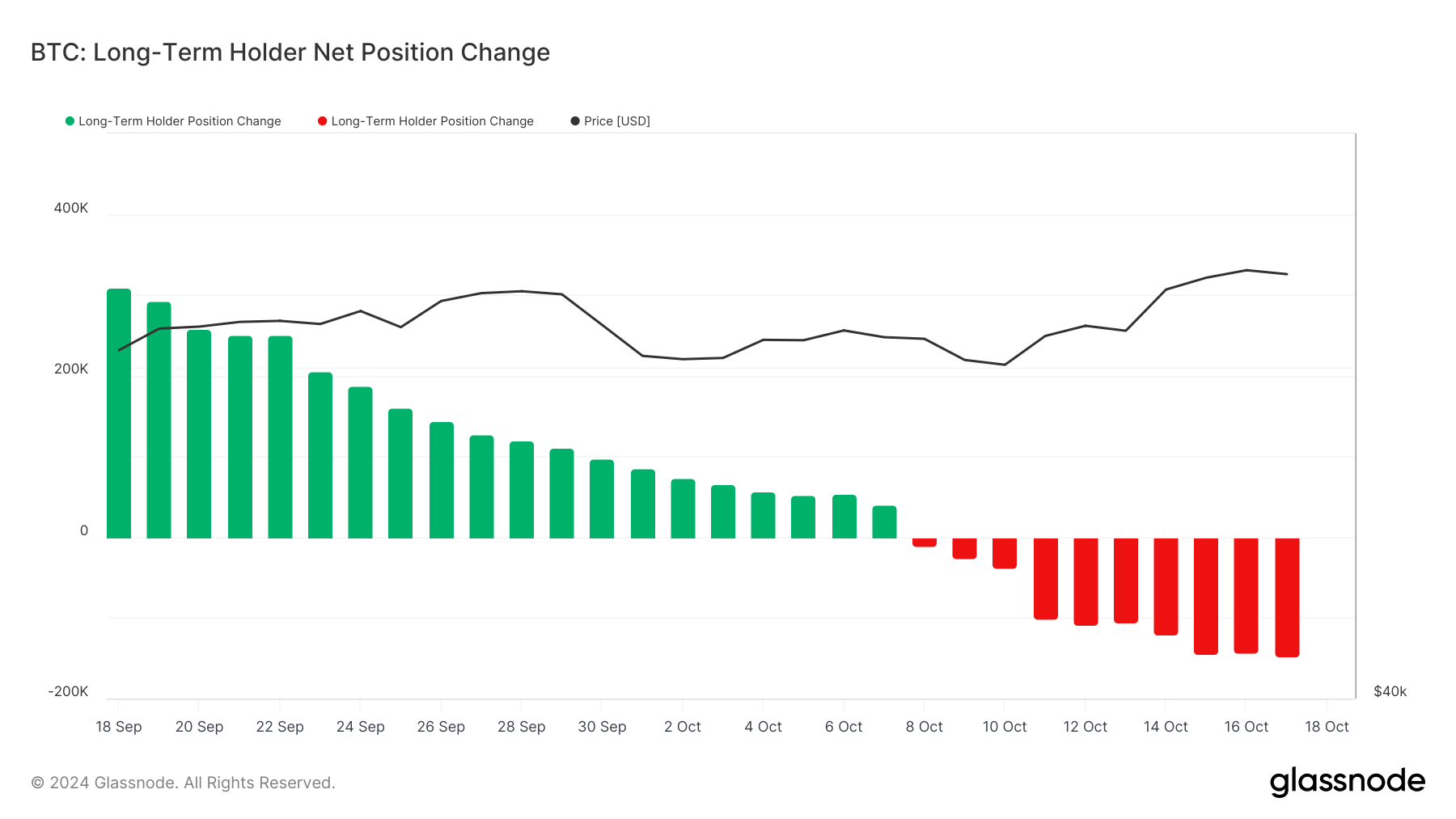

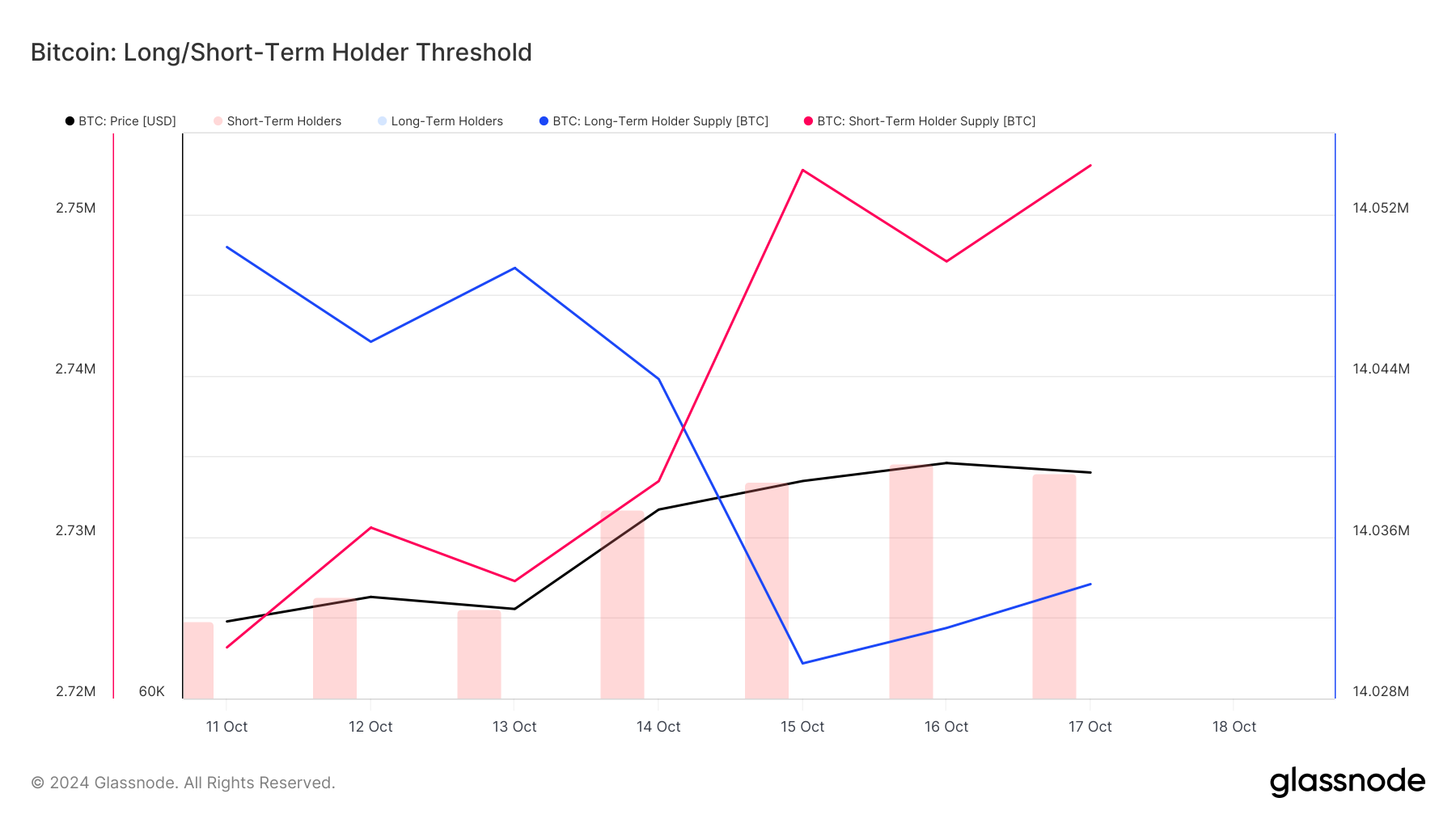

4. Long-Term Bitcoin Holders Reducing Positions

According to on-chain data, the behavior of long-term holders has changed this week, shifting from accumulation to partial reduction of positions. This behavior may reflect their cautious attitude towards the short-term market outlook. However, the relatively stable Bitcoin price suggests that market demand is still sufficient to absorb these selling pressures, or it may indicate an impending market shift.

It is necessary to continue monitoring the dynamics of long-term holders, as their behavior often serves as a leading indicator of market trends.

5. Bitcoin On-Chain Long-Term Buying Power Selling

According to on-chain data, the activity of short-term Bitcoin holders increased this week, while long-term holders reduced their positions. This suggests that more Bitcoin is being held by short-term holders, possibly due to an increase in new investors or short-term traders participating in the market.

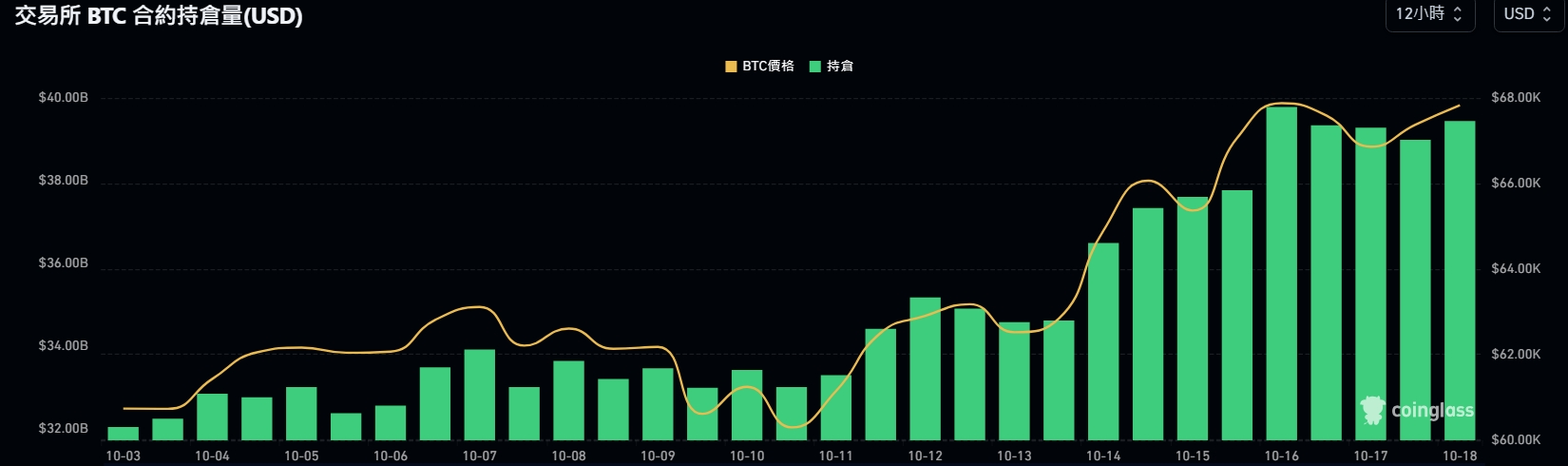

6. Bitcoin Futures Open Interest Reaches New High

6. Bitcoin Futures Open Interest Reaches New High

According to data, the Bitcoin futures open interest on exchanges has been steadily increasing this week, rising from $34.42 billion to $39.43 billion, successfully breaking through the key level of $39 billion at the end of March. This growth in open interest indicates that leveraged trading activity is active in the market, and investor risk appetite has clearly increased.

Important Ethereum Technical Indicators

1. Net Inflow of Ethereum Spot ETF Funds

This week, Ethereum ETF funds saw a net inflow of about $298,000.

2. Bitcoin Correlation

This week's data shows that the correlation between BTC and ETH, and BTC and SOL, is 0.93 and 0.71 respectively. This week, the overall market trend has been more consistent, and the correlation of BNB with other cryptocurrencies has also rebounded, indicating that the market performance of this coin has begun to re-link with the broader market. The negative correlation between USDT and other cryptocurrencies has expanded, indicating that the performance of stablecoins is becoming more independent from the risk assets in the market.

3. DeFi Total Value Locked (TVL)

This week's data shows that the total value locked in the DeFi market decreased from $87.4 billion.

Weekly Market Analysis News

1. Bitcoin Holds $66,600, Where is the Resistance? TSMC ADR Soars 10%, Semiconductor Stocks Celebrate

Bitcoin fell to as low as $66,670 yesterday in a volatile decline, but has since rebounded to above $67,000. The subsequent bullish or bearish trend remains to be seen. US stocks were boosted by Taiwan Semiconductor's impressive earnings report, with chip stocks leading the gains. (Continue reading)

2.CoinList CEO: Bitcoin is the king of memes, Memecoins will continue to surge...How are the former ICO giants doing now?

Raghav Gulati, the CEO of the veteran public offering platform CoinList, said today that he "likes memecoins" and shared his views on meme coins and future market trends. (Continue reading)

3.Assumption》If North and South Korea go to war, will Bitcoin become a safe haven for capital?

North Korea suddenly blew up the inter-Korean railway line this morning, further escalating tensions between the two Koreas. If a war unfortunately breaks out, will South Korea, known for "crazy coin trading", affect the price of Bitcoin and other cryptocurrencies. (Continue reading)

4.Rescue efforts ineffective! Chinese and Hong Kong stocks, the yuan "plummet simultaneously", September exports slow significantly, stock investors desperate with losses

The Chinese and Hong Kong stock markets and the yuan fell collectively on the 15th, with the three major A-share indices falling by an average of more than 2.5%, the Hang Seng Index falling below 21,000 points, and the yuan depreciating to below 7.1. Although the Chinese government implemented multiple stimulus policies at the end of September to boost the stock market, foreign and main capital continued to sell during the rally, and the subsequent fiscal stimulus expectations failed to materialize and September exports slowed, triggering a major market correction. (Continue reading)

5.Gold prices have soared 30% this year! Is it a harbinger of a stock market crash?

Robert Kiyosaki, the best-selling author of "Rich Dad, Poor Dad", recently warned that the repeated historical highs in gold this year may not be a good sign for the stock market, and a stock market crash may be imminent. Is there a direct correlation between the trends of gold and US stocks? (Continue reading)

6.Taiwan stock ETF "00887" plunged 79% in ten days, the Financial Supervisory Commission: a perfect mini-storm! Artificial speculation not ruled out

The Yuanta China Technology 50 ETF (00887) in the Taiwan stock market has been widely concerned recently due to the plunge in its stock price, default delivery, and significant premium issues. Yesterday, Chen Yan-liang, the deputy chairman of the Financial Supervisory Commission, also stated in a legislative session that this was a "perfect mini-storm". (Continue reading)

Cryptocurrency Regulatory Landscape in Different Countries

1.Cold wallet confiscated when leaving China! Customs expands inspection of electronic devices, asset protection guide

A netizen recently had his cold wallet confiscated by customs when leaving China. This has warned him: "If you want to enter and exit China, to ensure the safety of your assets, never carry a cold wallet with you." (Continue reading)

2.US regulators made $19 billion in crypto settlements in 2024, up nearly 80% from last year

US regulatory agencies have strengthened their oversight of the cryptocurrency industry over the past two years. According to the latest CoinGecko report, US regulators have obtained over $19 billion in litigation settlements from cryptocurrency companies so far in 2024, up 78% from 2023. (Continue reading)

3.People holding large amounts of USDT "may be defrauded", why do the police say so?

Virtual currency fraud in Taiwan has been gradually increasing, with 9,625 cases of virtual currency fraud in the first half of this year, up 25% year-on-year. In this regard, Deputy Captain Hung Cheng-chi of the 7th Investigation Brigade's 1st Squadron stated in an interview with The Epoch Times that there are three major types of virtual currency fraud in Taiwan: fake investment, wallet authorization, and secondary fraud, and he reminded people holding large amounts of USDT to be aware of the risk of fraud. (Continue reading)

The Ministry of Digital Development, Innovation and Aerospace Industry of Kazakhstan announced on October 14 that the instant messaging giant Telegram has agreed to appoint a local representative and open an office in Kazakhstan to comply with local regulations. (Continue reading)

The Legislative Yuan of Taiwan held a plenary session on October 15, where Premier Chen Chien-jen was invited to attend and respond to questions from legislators Ke Jie-jun, along with Central Bank Governor Yang Chin-long and Financial Supervisory Commission Chairman Peng Chin-long, on the current development status and policy promotion of the virtual asset industry in Taiwan. (Continue reading)

Market Highlights Next Week

10/18 (Fri)

- China: Q3 GDP YoY, previous 4.7%

- China: Sep Industrial Production YoY, previous 4.5%

- Hong Kong: Sep Unemployment Rate, previous 3.0%

10/22 (Tue)

- Hong Kong: Sep CPI YoY, previous 2.50%

10/23 (Wed)

- Canada: Oct Interest Rate Decision, previous 4.25%

- US: Sep Existing Home Sales, previous 3.86M

10/24 (Thu)

- US: Initial Jobless Claims

- US: Oct Manufacturing PMI, previous 47.3

- US: Oct Services PMI, previous 55.2

- US: Sep New Home Sales, previous 716K

Recommended Interview Videos

1.Interview with Citi's Digital Assets Head Mark Attard on the "Citi Token" innovation in global fund flow

Top 5 Most Popular Articles This Week

1.A man in the UK is suing the government for £647 million after losing 8,000 BTC in a landfill

British IT engineer James Howells accidentally threw away a hard drive containing 8,000 bitcoins 11 years ago, and has recently sued the Newport City Council, claiming £495 million (about $647 million), in an indirect attempt to obtain permission to excavate a landfill site under the jurisdiction of the Newport City Council. (Continue reading)

2.V神 dumps multiple meme coins, cashes out 907.97 ETH! $2.23 million in proceeds to be fully donated to charity

Ethereum co-founder Vitalik Buterin sold a large amount of meme coins on the 12th and 13th, converting them into 907.97 ETH, worth $2.23 million. He had previously stated that any tokens sent to him without his permission would be sold and donated to charity, and it is expected that this will be the case this time as well. (Continue reading)

3.The CHIIKAWA meme coin, themed on the popular Japanese manga and Ikaawa, surges 12-fold, suspected to be driven by Japanese and Taiwanese "Chiika fans" buying up the coin

The CHIIKAWA meme token, themed on the popular Japanese manga and Ikaawa, suddenly surged over tenfold today, with the surprising increase leading the community to speculate that Japanese and Taiwanese "Chiika fans" may be buying up the coin. (Continue reading)

4.People holding large amounts of USDT may be at risk of fraud, why does the police say so?

Virtual currency fraud in Taiwan is gradually increasing, with a total of 9,625 virtual currency fraud cases in the first half of this year, an increase of 25% year-on-year. In this regard, Deputy Captain Hung Cheng-chi of the 7th Investigation Brigade's 1st Squadron stated in an interview with The Epoch Times that there are three main types of virtual currency fraud in Taiwan: fake investment, wallet authorization, and secondary fraud, and he reminded people holding large amounts of USDT to be aware of the risk of fraud. (Continue reading)

The fraud group may first give small profits to the public to establish a relationship of trust, and then, when the public invests a large amount of funds and buys virtual currency, the fraud group will transfer all the virtual currency in the public's wallet. He said that if the public wants to withdraw money midway, they will also be refused for various reasons.

5.Who is Coinbase's boss's wife Angela Meng? Immigrated to the US at 11, worked as a journalist, model...

The recent news of Angela Meng's marriage to Coinbase CEO Brian Armstrong has attracted a lot of attention. This article will delve into Angela's growth journey and her status in the crypto world, including a review of her childhood, immigration experience, and how she overcame bullying in American middle school to find her own direction amid the difficulties. (Continue reading)