For most of last year, there were many predictions that the price of Ethereum (ETH) would reach five digits. However, as Bitcoin (BTC) surged in 2024, causing ETH to lag behind, market analysts have reevaluated their forecasts.

As ETH has struggled to maintain momentum, the $6,000 price outlook has now been adjusted, and the indicators suggest it's time to lower expectations for this cycle.

Investors Prefer Bitcoin Over Ethereum

In August, Pi Cycle Top had indicated that Ethereum's price could exceed $6,000 before the end of this bull run. However, several factors have since changed, making the initial prediction harder to achieve.

Pi Cycle Top is a reliable indicator that represents the potential peak price a cryptocurrency can reach within a specific period, using the 111-day Simple Moving Average (SMA) and the 350-day SMA to predict this top.

Currently, Ethereum's price is $2,603, but the 350-day SMA (purple line), which represents the potential peak value, is at $5,699. This suggests that ETH may struggle to break above this price range in the short term, and further significant price appreciation may become more difficult.

Read more: How to Invest in an Ethereum ETF

The potential reduction in Ethereum's price upside may be due to a decrease in investor interest, especially when compared to Bitcoin.

For example, this week, a Bitcoin ETF saw $1 billion in inflows in just three days, indicating strong institutional interest. In contrast, an Ethereum ETF only raised $5 million on October 17, emphasizing that institutional investors are favoring Bitcoin over Ethereum.

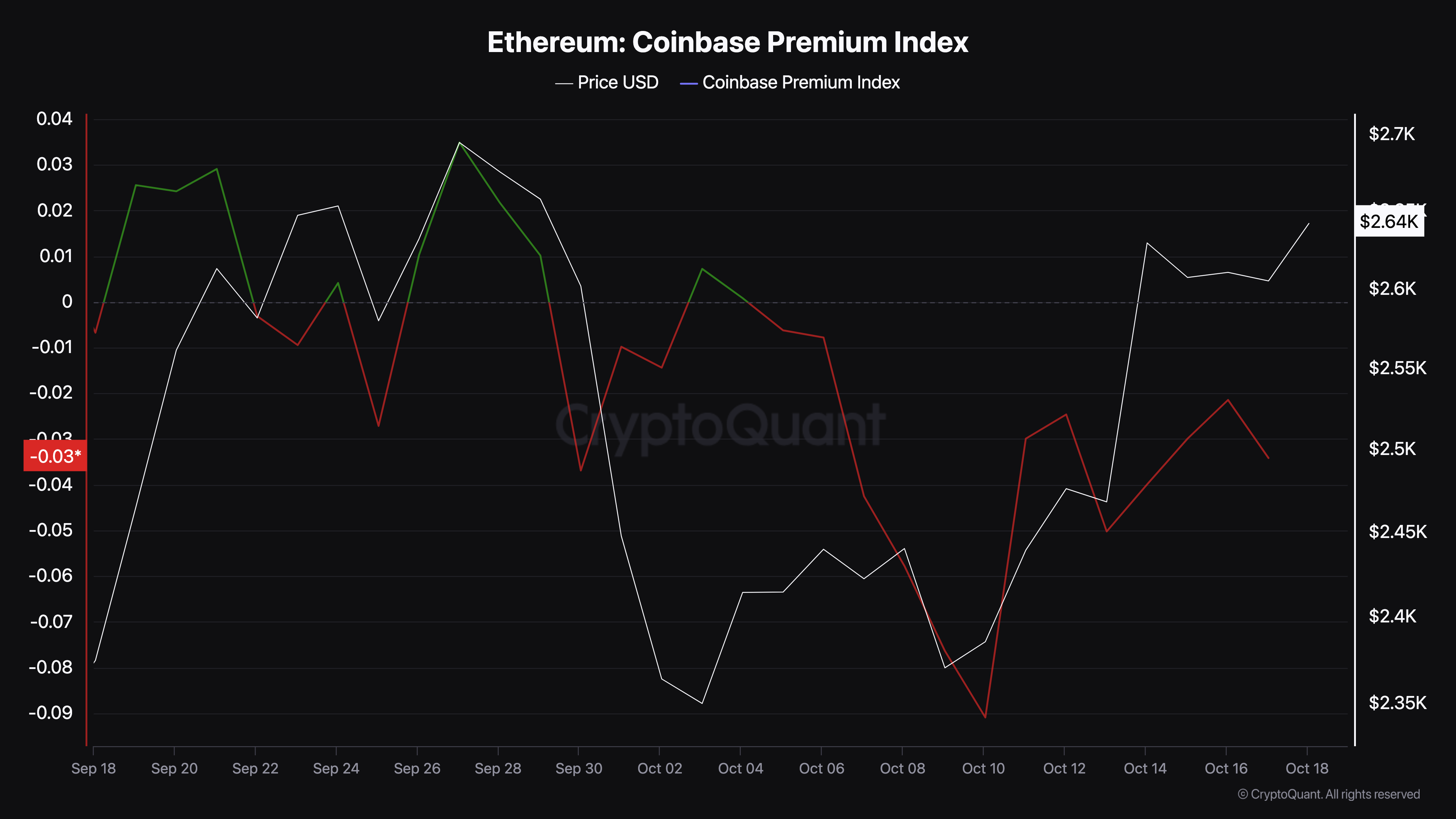

This sentiment also appears to have extended to retail investors in the US. According to on-chain platform CryptoQuant, the Coinbase Premium, which tracks buying and selling pressure, has recently fallen into negative territory. This shift suggests that more investors are selling ETH rather than buying it, reflecting a bearish outlook on this altcoin.

ETH Price Forecast: Downside Risk Remains

Ethereum is currently trading in a pattern similar to the price movements seen in May and November 2021. Whenever this situation occurs on the weekly chart, ETH's price has dropped by double digits. For instance, in the mentioned year's May, the altcoin plummeted by 52%.

With a similar technical setup, in November, it declined by 45%. Currently, ETH is relying on the $2,455 support level to avoid a repeat of this scenario. However, the low trading volume suggests the cryptocurrency may not be able to sustain the support for long.

Read more: How to Buy Ethereum (ETH) with a Credit Card: The Ultimate Guide

If this were to happen, ETH's price could drop to $2,186. On the other hand, if investor interest in Ethereum increases, this forecast may not materialize. Instead, ETH could potentially rise to $3,814 in the medium to long term.