Cryptocurrency investment inflows soared to $2.2 billion last week, reaching the highest level since July 2023. Experts analyze that this growth is attributable to heightened expectations of a Republican victory in the upcoming U.S. elections.

This change in political expectations has lifted both investor confidence and market prices.

Cryptocurrency Inflows Reach New Highs Amid U.S. Election News

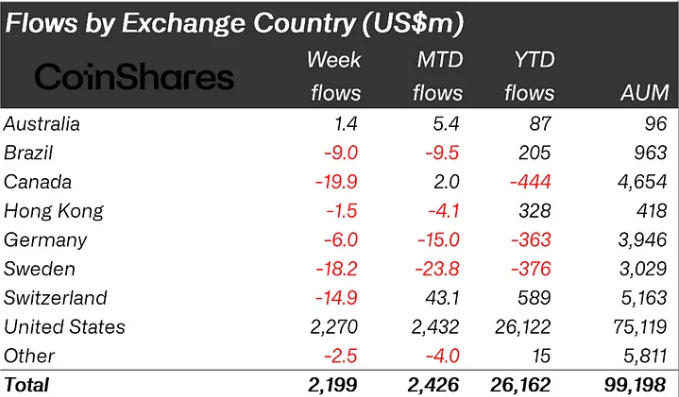

According to data from UK cryptocurrency asset manager CoinShares, global digital asset investment products saw positive inflows of $407 million in the second week of October. Last week saw an even greater increase, with $2.2 billion in net inflows, a fivefold growth from the previous week.

Examining the inflows by coin, Bit saw the largest inflow of $2.13 billion. Positive inflows into Ethereum amounted to $57.5 million. Meanwhile, multi-asset inflows, which had recorded 17 consecutive weeks of inflows, saw $5.3 million in outflows.

As in the previous week, CoinShares analysts noted that the U.S. was driving the $2.3 billion in inflows, indicating increased interest ahead of the U.S. elections.

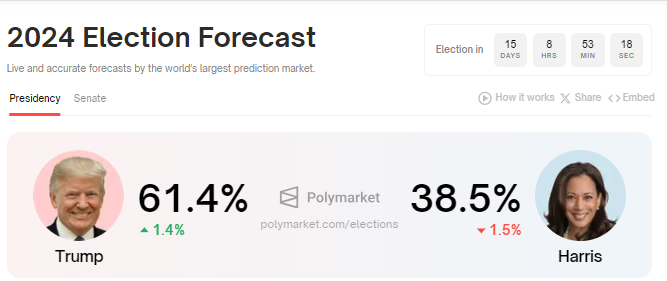

"This newfound optimism stems from growing expectations of a Republican victory, which is generally viewed as more favorable to digital assets. This has translated into positive price trends," the report stated.

Read more: How Can Blockchain Be Used for Voting in 2024?

According to CoinShares researchers, this indicates growing interest in cryptocurrency investment within the U.S. With just 15 days until the election, Donald Trump is leading Kamala Harris by 22.9 percentage points, according to Polymarket.

Given the perception that the Republican candidate is generally supportive of the cryptocurrency sector, the possibility of a Donald Trump victory could lead to crypto-friendly regulations.

As reported by BeInCrypto, the Republican presidential candidate plans to overhaul U.S. crypto rules, going beyond Gary Gensler, which could further fuel market growth as the party is believed to be adopting crypto-friendly policies.

As the countdown continues, investor interest in cryptocurrencies is also increasing. According to the report, trading volume for digital asset investment products increased by 30% last week. The rise in trading activity and rising asset prices have brought the digital assets' AUM close to $100 billion.

If the current trend continues, the market could soon surpass this milestone. This week could see even greater cryptocurrency investment inflows than last week.

"A positive regulatory environment could open the door to institutional investment. A change in leadership that supports crypto innovation in the U.S. could bring clear guidance for crypto firms, potential ETF approvals, and restore institutional trust, ushering in a new wave of capital to the crypto markets," an analyst wrote on X (formerly Twitter).

Read more: How to Buy Bit (BTC) and Everything You Need to Know

Meanwhile, according to BeInCrypto data, Bit is currently trading at $68,210 and eyeing the psychological level of $70,000.