The Scroll ecosystem has also recently seen remarkable progress, with SCR being the first to launch the pre-trading board on Binance, supporting users to trade SCR with pre-trading assets, and directly converting to spot trading after the SCR token TGE, bringing huge market attention and incremental users to Scroll. With the surge of the Scroll ecosystem, Pencils Protocol, as the leading protocol in the ecosystem, is also gaining increasing attention and continues to receive market focus.

In fact, since the launch of the Pencils Protocol Beta version in February this year, it has been widely recognized by the market and has been developing rapidly. As of now, with its innovative yield aggregation and reStaking platform advantages, Pencils Protocol's TVL has exceeded $400 million, ranking first in the Scroll ecosystem and serving as an important liquidity hub.

This protocol is not only the fastest growing single-chain protocol in terms of TVL growth, but also ranks third among all Farming projects in TVL, making it a well-deserved unicorn ecosystem. At the same time, Pencils Protocol has reached 750,000 active users, becoming the undisputed traffic portal of the Scroll ecosystem. The heat of the Scroll ecosystem is a boon for the development of Pencils Protocol.

After SCR, will DAPPs also be successively listed on top exchanges?

In fact, against the backdrop of the overall lack of narrative in the crypto market and the overall low market sentiment, CEXs are eager to seek new hot spots to continuously bring new traffic to the platform. For example, the explosion of TON mini-games and the new round of meme craze, top CEXs are rushing to list related concept tokens to seize the market. So CEXs have a high tolerance for projects or market sectors with heat.

In fact, with the upcoming TGE and listing of SCR on Binance, not only is the SCR token receiving market attention, but the Scroll ecosystem is also becoming a new market hot spot. From the Scroll ecosystem, as the liquidity hub and traffic portal of the Scroll ecosystem, Pencils Protocol has naturally become the sole focus of high attention in the Scroll ecosystem.

From the CEX's perspective, to fully capture the heat of the Scroll ecosystem, one is to list the SCR token immediately after the TGE, and the other is to further explore the Scroll ecosystem, and Pencils Protocol's DAPP is obviously the best choice. From the Pencils Protocol project itself, its $400 million TVL, 750,000 active users, and the fundamental support of being invested by well-known institutions including OKX Ventures, Animoca, gate.io Labs, Presto Labs, AQUARIUS, Agarwood, Taisu Ventures, DePIN X, Bing Ventures, and Black GM Capital, can all support Pencils Protocol's listing on major exchanges. So for the DAPP token, it is completely reasonable to continue to be listed on top-tier CEX trading platforms after already being listed on platforms including Gate and Bitget.

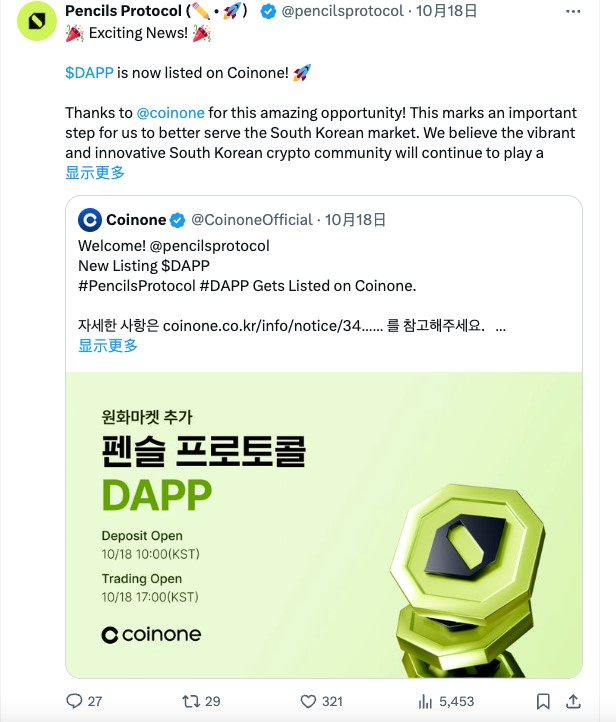

Currently, DAPP has already been the first to be listed on the top Korean trading platform CoinOne, and has used this to expand its ecosystem into the Korean market, which may be an important milestone for the continuous expansion of the Pencils Protocol ecosystem, and will also become an important starting point for DAPP to be listed on more top-tier CEXs, and will become a positive signal.

Of course, the positive news for the Pencils Protocol ecosystem does not stop there.

The expansion of Pencils Protocol's business, continuously enhancing the moat of the ecosystem

Pencils Protocol has planned the recent development of its business, continuously enhancing the moat of the ecosystem to build a more solid value foundation.

l BTC ecosystem asset access

Currently, we can see that Pencils Protocol's Farming section has actively expanded into the BTCFi ecosystem through cooperation with Babylon and Solv, in order to bring the BTC value system into the ecosystem.

In fact, with the launch of the Babylon Bitcoin staking mainnet Cap-2, the BTC LRT asset TVL integrated into Pencils Farming has reached $160 million, accounting for more than 40% of the total TVL. With the cooperation with Solv Protocol, Pencils Protocol is also expected to have a greater say in the LRT field of BTCFi.

Pencils Protocol is also expected to integrate more BTCFi ecosystem assets in the future, and further promote the secondary growth of Pencils' BTC ecosystem assets. The comprehensive expansion into the BTCFi ecosystem will also bring incremental users and capital to the Pencils Protocol ecosystem.

l The Pencils Auction product that may be launched soon

Pencils Auction is a business section in the product planning, and is a relatively novel Launchpad product. With the launch of the Vaults product, the Auction product is also expected to be launched to the market soon.

In fact, compared to traditional IDO platforms like Daomaker, Auction pays more attention to rewarding users who have contributed to Pencils, such as DAPP token holders, Vaults section LPs, and Pencils Point users, who can all obtain early equity in the Auction Launchpad section. As more and more Scroll native assets are released, Auction may soon be able to take the stage.

l Empowering Scroll ecosystem native assets

Currently, the Scroll ecosystem is still in the early stage of development. As the technology stack matures and the market progresses, the DeFi system of the Scroll ecosystem will achieve rapid development, and a large number of native assets and underlying assets will continue to be launched. We can see that Pencils, as the liquidity hub and traffic portal of the Scroll ecosystem, will also successively take on the underlying and native assets of Scroll, relying on the asset management and aggregation advantages of Pencils Farming and Vaults, to provide liquidity distribution and reuse, maximize returns and enhance ecosystem effectiveness.

With the in-depth expansion of the business, Pencils will also further expand the use cases and burning scenarios of DAPP, and provide in-depth empowerment for the value accumulation of DAPP tokens.

l More diversified value capture under the potential multi-chain trend

For DeFi protocols, multi-chain development is an important way to horizontally expand the ecosystem and capture more users. For Pencils Protocol, multi-chain development may also be the future development trend.

In the future, through integration with more mainstream public chain ecosystems, more ecosystem liquidity is expected to be incorporated into Pencils' asset sequence, and it is expected to further expand the compatibility and flexibility of the ecosystem. This will not only help attract a wider user base and partners, but also enrich the role DAPP tokens play in the DeFi market and provide a foundation for more value scenarios.

So overall, whether it is the current state of the business, the short-term business planning of the ecosystem, or the long-term ecosystem development expectations, they will all be able to further enrich the fundamentals of the Pencils Protocol ecosystem, and continuously bring positive news to ecosystem users. This will be a strong basis for DAPP to continue to be listed on major CEXs, so those who hold DAPP can wait for the takeoff before the series of positive news arrives.