1. Introduction

As we stand on the cusp of 2025, the cryptocurrency landscape is slowly taking shape as a blueprint for the future of finance, governance, and technology. With 617 million users now connected to decentralized systems and $845 billion flowing through on-chain economies, we are witnessing the birth of an entirely new global infrastructure. The transformation is inevitable; blockchains are processing transactions 50x faster than ever before, stablecoins are the backbone of 32% of crypto activity , and DeFi is reshaping cross-border capital flows. This article lays out the design of the future that will become a framework as crypto advances. Here, I present to you 14 predictions for 2025 from crypto developments. Co-written with collaborators at McKinsey Crypto. 🥳

Key Highlights

- Activate passive crypto users by simplifying access and reducing barriers.

- Bridging the gap between on-chain activity and ownership.

- Crypto platforms should prioritize user-friendly mobile solutions and stablecoin products in regions with high inflation.

- Political candidates should develop clear crypto policies to appeal to the growing number of voters who prioritize digital asset regulation.

- Leverage the growing adoption of stablecoins by ensuring a strong regulatory framework.

- Governments should expedite the implementation of clear encryption regulations to promote institutional adoption.

- Ethereum projects should take advantage of reduced fees to target cost-sensitive markets, especially developing regions.

- Developers should take advantage of the increased scalability to innovate new use cases, especially in high-demand areas.

- Leveraging ZK technology to build privacy-centric, scalable decentralized applications, focusing on industries such as finance and healthcare.

- Focused on integrating stablecoins into traditional systems to accelerate global cryptocurrency adoption, particularly in high inflation and developing markets.

- Leveraging blockchain to enhance AI applications and create new market opportunities in areas such as DeFi, supply chain management, and digital identity.

- Take advantage of the shift to DEXs by improving user experience, liquidity, and cross-chain trading.

- Prioritize developer-friendly tools and infrastructure to attract and retain builders.

- Get ready for the fifth wave of cryptocurrency adoption in 2025.

2. Current size and adoption of cryptocurrencies

In 2024, cryptocurrency growth and adoption have been remarkable, with key indicators indicating an increase in cryptocurrency ownership, active participation, and global trends. In particular, the industry has seen significant growth in developing countries, while improvements in infrastructure are laying the foundation for future mass adoption. This section dives deeper into the current size of the crypto ecosystem, focusing on global ownership, active users, and mobile wallet adoption.

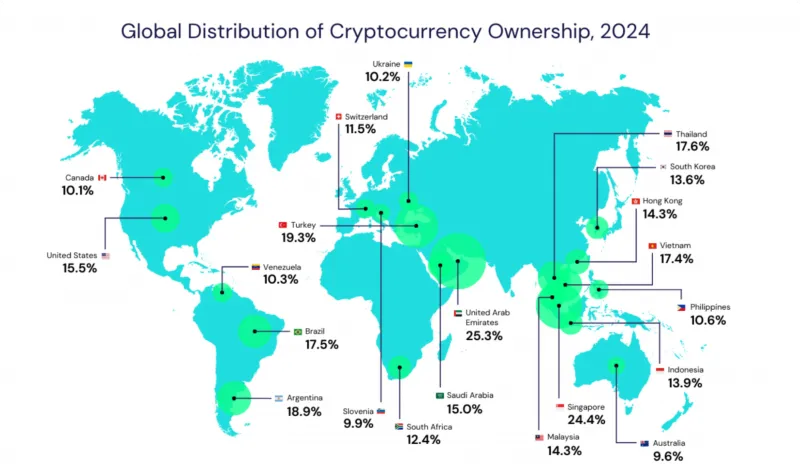

2.1 Activating Passive Crypto Users by Simplifying Access and Reducing Barriers Cryptocurrency ownership has increased significantly in recent years, with millions of users holding crypto assets across various platforms.

- Estimated number of cryptocurrency holders worldwide: By 2024, it is estimated that there will be approximately 617 million cryptocurrency holders worldwide. This number accounts for approximately 12% of the total number of Internet users in the world (approximately 5 billion people).

Although the crypto industry has covered a considerable portion of Internet users, it is still in the early stages of adoption. Most Internet users have not yet been exposed to cryptocurrencies, which provides opportunities for further development.

Although the crypto industry has covered a considerable portion of Internet users, it is still in the early stages of adoption. Most Internet users have not yet been exposed to cryptocurrencies, which provides opportunities for further development.

The data also shows that many cryptocurrency holders are passive owners, meaning they hold digital assets but do not actively interact with blockchain applications such as DeFi protocols or decentralized exchanges.

- Passive ownership vs. active use: Many individuals who hold cryptocurrencies have yet to fully embrace the blockchain ecosystem beyond purchasing and holding the asset. This represents an untapped potential market for developers and startups who aim to turn cryptocurrency holders into active participants by building applications that appeal to a wider audience.

Opportunities for Startups There is a huge opportunity for crypto projects to focus on onboarding these passive users into the active ecosystem by simplifying access to decentralized applications (dApps) and reducing barriers such as high fees, complex user interfaces, and technical knowledge requirements.

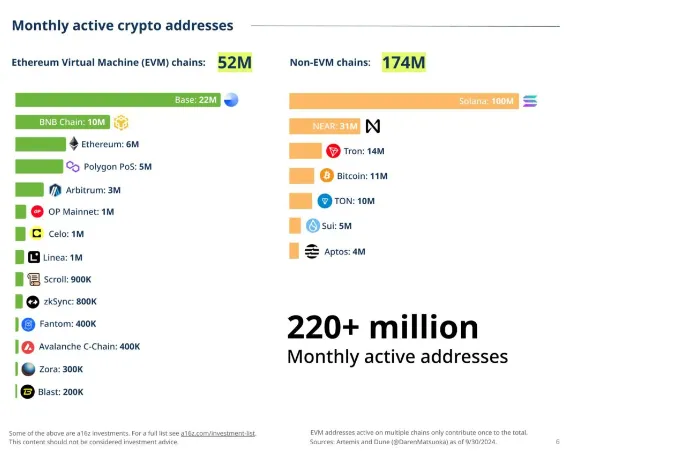

2.2 The gap between on-chain activity and ownership Monthly active cryptocurrency addresses

The number of monthly active addresses across blockchain networks has reached an all-time high of approximately 220 million. However, it is important to note that a single user may control multiple addresses, so this number does not directly correlate to the number of unique users.

After adjusting for users holding multiple addresses, an estimated 30-60 million unique active users interact with blockchain networks each month. While the number of active addresses is impressive, the discrepancy between the number of addresses and the number of unique users highlights that the crypto ecosystem is still relatively small compared to the total number of internet users. This gap suggests that the industry has yet to reach mainstream adoption. On-chain Activity vs. Ownership: Despite the large number of individuals holding cryptocurrencies, on-chain active participation is much lower. This can likely be attributed to the high transaction fees of some networks, the lack of user-friendly interfaces, and the limited real-world applications of cryptocurrencies outside of speculation.

2.3 Crypto platforms should prioritize user-friendly mobile solutions and stablecoin products in regions with high inflation Mobile wallets have become an important entry point for cryptocurrency users, especially in developing countries where traditional financial infrastructure is less convenient.

- Regions leading in mobile wallet adoption:

- Nigeria, India and Argentina have emerged as key regions for mobile wallet use, leading in terms of adoption and activity.

- US Mobile Wallet Share: US mobile wallet usage share has fallen below 15%, reflecting a shift in adoption patterns toward developing markets.

Implications The growing reliance on mobile wallets in regions such as Africa, Asia, and Latin America reflects the actual use of cryptocurrencies in these economies. In many of these regions, cryptocurrencies are used to hedge against inflation, transfer funds across borders, and access financial services that would otherwise be inaccessible.

- Stablecoins in high-inflation economies: The surge in mobile wallet usage in countries such as Argentina highlights the role of stablecoins as a hedge against local currency depreciation. With annual inflation rates as high as 80%, stablecoins pegged to the US dollar provide users in these regions with a more stable store of value.

3. Political landscape and regulatory environment

As cryptocurrency continues to grow, its impact on the political landscape is becoming increasingly evident, especially in the U.S. This section explores how cryptocurrency has become an important political issue, the role of stablecoins in maintaining the dominance of the U.S. dollar, and the latest regulatory developments shaping the industry.

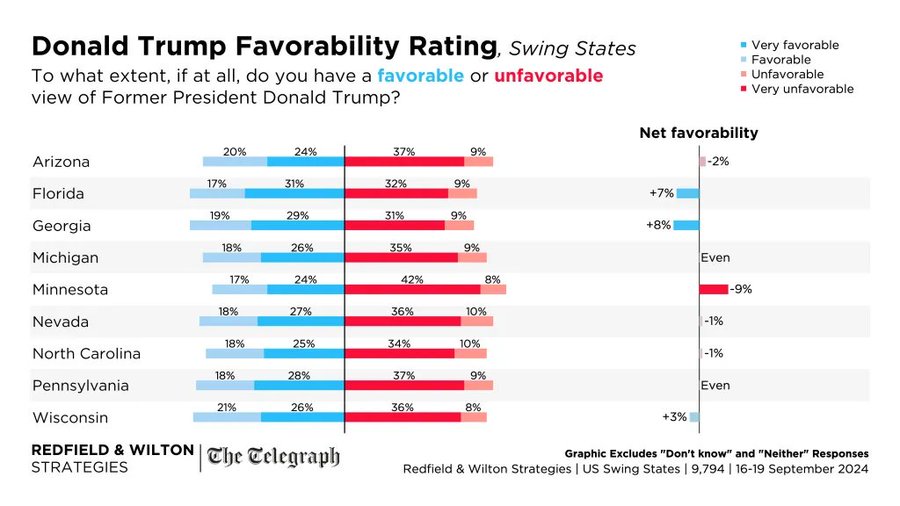

3.1 Political candidates should develop clear crypto policies to appeal to the growing number of voters who prioritize digital asset regulation

In the run-up to the 2024 U.S. presidential election, cryptocurrency has become a hot topic, especially in key swing states.

- Pennsylvania, Wisconsin, and Michigan saw the most significant growth in crypto-related search interest between 2020 and 2024, making them key battlegrounds where crypto policy could impact voter turnout and decisions

- Google Trends Data: Digging deeper into search trends shows that interest in cryptocurrency has risen sharply in these states, indicating that some voters consider cryptocurrency an important issue.

Growing interest in cryptocurrencies in politically critical states suggests that cryptocurrencies could influence the outcome of the 2024 election. With the rise of pro-crypto candidates and discussions surrounding the role of digital currencies in the U.S. economy, cryptocurrency could become a decisive issue in the election.

- Politicians’ stance: Both Democrats and Republicans have begun integrating cryptocurrencies into their platforms and engaging in discussions around innovation, regulatory clarity, and the economic benefits of embracing digital assets. The bipartisan interest in cryptocurrencies demonstrates the importance of cryptocurrencies as a mainstream issue that transcends traditional political divides.

3.2 Leverage the growing popularity of stablecoins by ensuring a strong regulatory framework The U.S. dollar’s status as the global reserve currency is strategically important to the United States, but its dominance is challenged by other currencies and emerging digital assets.

- Stablecoins as a tool for USD dominance:

- USD-denominated stablecoins: Over 99% of stablecoins are pegged to the U.S. dollar, making them an important tool in maintaining the dollar’s dominance in the global economy.

- Strengthening the dollar: As foreign central bank digital currencies (CBDCs) gain traction, stablecoins become the digital standard for cross-border transactions, providing the U.S. with a means to maintain its influence.

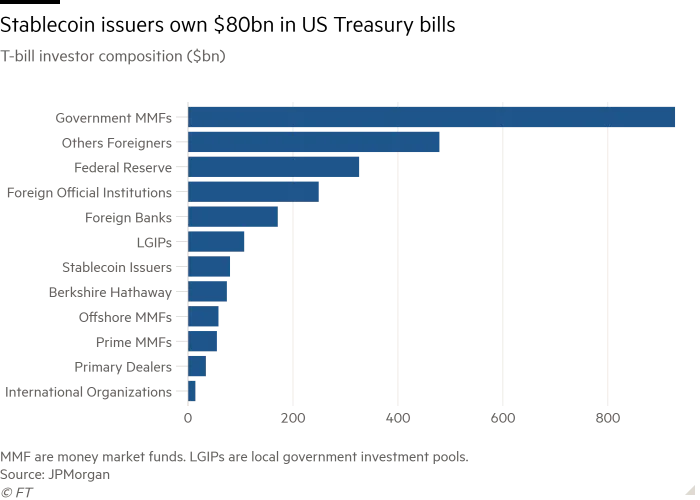

Key Metrics: Stablecoins Holding U.S. Debt

Stablecoins are currently the 20th largest holder of U.S. government debt, surpassing major economies such as Germany. As adoption increases, stablecoins are likely to continue to play a key role in backing U.S. government debt and have the potential to become one of the largest holders in the future. This shift highlights the growing influence of stablecoins in both the crypto and traditional financial ecosystems. As a digital extension of the dollar, the widespread use of stablecoins presents the United States with a unique opportunity to strengthen its economic influence around the world, even as other countries experiment with central bank digital currencies (CBDCs). By adopting stablecoins, the United States can strengthen the dollar's position in global trade and finance while providing a more flexible digital alternative to the traditional banking system.

- Future Challenges: While stablecoins have significant advantages, regulatory uncertainty and concerns about their systemic impact on traditional finance remain obstacles that need to be addressed. Ensuring that stablecoins are well-regulated and backed by appropriate reserves is critical to maintaining confidence in their use as digital dollars.

3.3 Governments should expedite the implementation of clear encryption regulations to promote institutional adoption.

The regulatory environment for cryptocurrencies in 2024 is marked by both progress and challenges, as governments around the world grapple with how to regulate this rapidly evolving industry. The United States has made great strides in developing a clearer regulatory framework for cryptocurrencies, but challenges remain.

- Bipartisan support for encryption legislation:

- FIT-21 Act: In a significant development, the U.S. House of Representatives passed FIT-21 with broad bipartisan support. The bill outlines a regulatory framework for cryptocurrencies that aims to clarify issues such as taxation, consumer protection, and regulation of decentralized finance (DeFi) platforms.

- Stablecoin Legislation: There is growing bipartisan interest in developing stablecoin legislation, with some lawmakers recognizing the importance of ensuring stablecoins are regulated and operate within a safe and sound financial system.

The passage of the FIT-21 bill and the growing focus on stablecoin regulation marks a positive step forward for the U.S. cryptocurrency industry. Regulatory clarity is critical to fostering innovation and ensuring consumers are protected. However, the speed at which new laws will be implemented, as well as the ultimate regulatory landscape, remains uncertain.

- Global regulatory trends:

- Europe and Asia: Several countries in Europe and Asia are also moving towards more comprehensive regulatory frameworks for cryptocurrencies. The EU’s Markets in Crypto-Assets (MiCA) regulation is a prime example of how regions are seeking to regulate the industry and create a stable regulatory environment that encourages growth.

- CBDC and cryptocurrency regulation: As more countries experiment with or launch central bank digital currencies (CBDCs), the interaction between national currencies and decentralized stablecoins will become an important regulatory focus. Governments need to find a balance between promoting innovation and maintaining control over the monetary system.

Greater regulatory clarity could increase institutional adoption of cryptocurrencies as businesses and financial institutions seek the security of operating in a clear regulatory environment. At the same time, regulatory clarity will help attract more users by providing safeguards against fraud and abuse.

4. Infrastructure Development

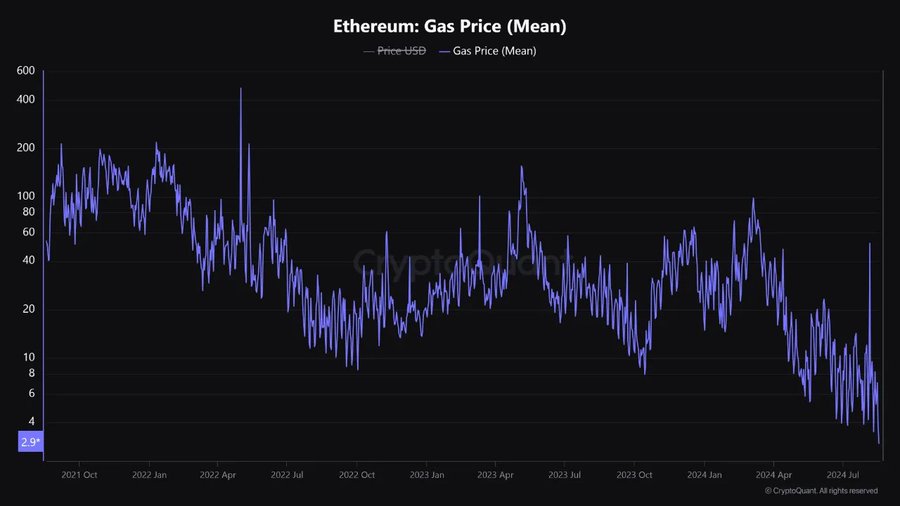

4.1 Ethereum projects should use reduced fees to target cost-sensitive markets, especially developing regions The Ethereum network underwent a major upgrade in 2024, one of the most impactful changes being EIP-4844 (Proto-Danksharding). This upgrade significantly reduced transaction fees for Layer 2 (L2) solutions and improved the overall scalability of the Ethereum ecosystem.

- EIP-4844 Implementation:

- Proto-Danksharding: This upgrade introduces a new data availability layer to Ethereum specifically designed to support the needs of rollups (a layer 2 scaling solution). By allowing rollups to store data more efficiently, EIP-4844 significantly reduces the cost of using Ethereum for developers and end users.

- Impact on Layer 2 Solutions:

- Reduce ETH transaction costs

Fees for using layer 2 networks like Arbitrum or Optimism have dropped significantly. For example, transferring stablecoins using a layer 2 solution now costs less than a penny, compared to $12 on the Ethereum mainnet in 2021. This is a game-changing move for users in developing countries, where high fees previously made many Ethereum-based services unusable. The success of EIP-4844 is a key milestone for Ethereum as it continues to address challenges with high fees and network congestion. By making transactions on layer 2 networks more affordable, Ethereum can better compete with newer layer 1 blockchains that offer faster and cheaper transactions. This infrastructure upgrade also opens the door to new types of decentralized applications (dApps) that require low transaction costs to function effectively.

Fees for using layer 2 networks like Arbitrum or Optimism have dropped significantly. For example, transferring stablecoins using a layer 2 solution now costs less than a penny, compared to $12 on the Ethereum mainnet in 2021. This is a game-changing move for users in developing countries, where high fees previously made many Ethereum-based services unusable. The success of EIP-4844 is a key milestone for Ethereum as it continues to address challenges with high fees and network congestion. By making transactions on layer 2 networks more affordable, Ethereum can better compete with newer layer 1 blockchains that offer faster and cheaper transactions. This infrastructure upgrade also opens the door to new types of decentralized applications (dApps) that require low transaction costs to function effectively.

4.2 Developers should leverage enhanced scalability to innovate new use cases, especially in high-demand areas

Blockchain scalability has been a major focus for the industry as networks need to handle increasing numbers of transactions without sacrificing speed or security. In 2024, significant progress has been made towards full scaling of blockchain networks.

- Transaction throughput growth:

- 50x Growth: Blockchain networks are now able to process 50x more transactions per second (TPS) than they were four years ago. This improvement is due to advances in Ethereum’s layer 2 scaling solutions and optimizations by alternative layer 1 blockchains such as Solana, Tron, and Avalanche.

- Contributors to scalability:

- Layer 2 Scaling: Ethereum’s layer 2 solutions, such as rollups, have played a key role in increasing the network’s transaction throughput without overloading the main chain. As more and more users turn to layer 2 networks, Ethereum’s ability to handle dApp activity grows exponentially.

- Solana and Other Layer 1s: Platforms like Solana are focused on increasing the speed and efficiency of base layer transactions. Solana’s Proof of History (PoH) mechanism enables the network to process thousands of transactions per second, making it a popular choice for high-frequency trading and gaming applications.

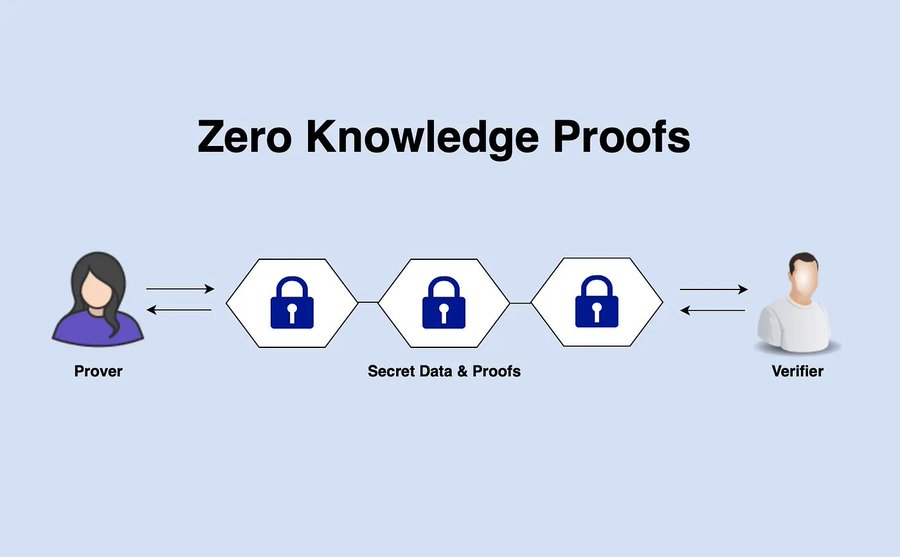

These scaling advances allow blockchain to support a wider range of applications, from DeFi to gaming, without experiencing the bottlenecks that plagued the industry during previous bull runs. As blockchain becomes more efficient and affordable, we are likely to see more experimentation with decentralized applications that were previously impossible due to high costs and slow transaction speeds. 4.3 Building privacy-focused, scalable decentralized applications with ZK technology, focusing on industries such as finance and healthcare Zero-knowledge proofs (ZKPs) represent a breakthrough in cryptography that provide solutions to some of blockchain’s most pressing challenges: scalability, privacy, and interoperability. What are zero-knowledge proofs?

- Zero-knowledge proofs allow one party to prove the validity of a statement to another party without revealing any other information. In the context of blockchain, ZKPs can be used to verify transactions without exposing sensitive data.

- Applications of ZKP:

- Privacy: ZKPs enable private transactions on public blockchains, protecting user confidentiality without compromising network transparency.

- Scalability: By allowing certain computations to be processed off-chain and verified on-chain, ZKP can significantly reduce the amount of data that needs to be stored on the blockchain, thereby improving efficiency.

- Interoperability: ZKP can facilitate cross-chain interactions by verifying data between different blockchains without exposing the underlying information.

- Technological advancements:

- ZK Virtual Machine (ZKVM): The development of ZKVM is an important milestone in making zero-knowledge technology more accessible. ZKVM allows developers to build decentralized applications that leverage ZKPs to enhance privacy and scalability.

- Performance metrics: ZKVM is still in the early stages of development, and performance is comparable to the early days of traditional computing. However, improvements are happening rapidly, and ZK technology is expected to play an important role in the next wave of blockchain innovation.

ZKPs are a key area of focus for the future of blockchain technology. Their ability to address privacy concerns while improving scalability makes them a key innovation for the next generation of decentralized applications. As ZK technology matures, we can expect wider adoption in industries ranging from finance to healthcare.

5. Emerging Applications and Trends

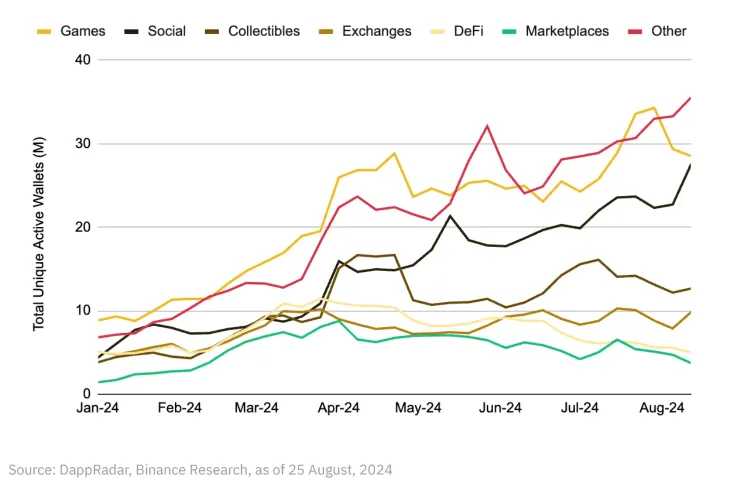

5.1 Focus on expanding the integration of stablecoins with traditional systems to accelerate the adoption of global cryptocurrencies, especially in high inflation and developing markets. Decentralized Finance (DeFi) and stablecoins will continue to dominate the cryptocurrency space in 2024. These two areas represent the majority of on-chain activities and have become key drivers of the entire cryptocurrency ecosystem.

- Usage details:

- DeFi: Accounting for 34% of on-chain activity, it is the most prominent use case of blockchain technology.

- Stablecoins: Stablecoins accounted for 32% of activity, primarily due to their use as a medium of value transfer, particularly in high-inflation economies and for cross-border remittances.

- Infrastructure services (bridges, oracles, smart contract wallets): These account for 14% of blockchain activity, highlighting the growing importance of infrastructure solutions for connecting different blockchain ecosystems and ensuring seamless functionality of dApps.

- Token Transfers: General token transfers account for 13% of usage, illustrating the continuous flow of value within blockchain networks.

- Other categories:

- Centralized Exchanges (CEX): Only 3% of blockchain activity is related to centralized exchanges, indicating that people are turning to decentralized alternatives.

- Gaming and NFTs: Together, these emerging sectors account for less than 3% of total activity but have huge growth potential in the coming years.

- Social Applications: Social dApps are still in their infancy and account for less than 1% of blockchain activity.

DeFi and stablecoins have proven to be the most powerful and widely used applications of blockchain technology. The success of DeFi lies in its ability to provide financial services without intermediaries, allowing users to easily borrow, lend and trade. On the other hand, stablecoins provide a reliable medium for transactions and hedge against volatile local currencies in high inflation markets. As infrastructure improves and more users join decentralized platforms, these two areas are expected to continue to drive cryptocurrency adoption in 2025.

- Growth Potential:

- DeFi: As the DeFi ecosystem matures, more complex financial products (such as derivatives, insurance, and cross-chain lending) are expected to emerge, attracting institutional investors.

- Stablecoins: The demand for stablecoins continues to grow, especially in developing countries and among institutional players, which may drive their further adoption. The integration of stablecoins into the traditional financial system, coupled with clearer regulation, may spur their further adoption.

5.2 Leverage blockchain to enhance AI applications and create new market opportunities in areas such as DeFi, supply chain management, and digital identity . The intersection of artificial intelligence (AI) and blockchain has become one of the most exciting frontiers in 2024, with a large overlap between user groups and emerging applications.

- User overlap:

- High Correlation: The data shows a high overlap between users of AI technologies like ChatGPT and active participants in the cryptocurrency space. This overlap suggests that cryptocurrency users are among the early adopters of AI and are likely to drive innovation at the intersection of the two technologies.

Applications and Synergies:

- Authenticity and Verification: One of the most promising use cases for blockchain in AI is verifying the authenticity of AI-generated content. As deepfakes and AI-generated media become more common, the need for trusted systems to verify the origin and accuracy of content will increase. Blockchain has cryptographic properties that can serve as a verification layer to ensure the legitimacy of AI output.

- Data ownership and control: Blockchain can also address concerns about data ownership in AI applications. Decentralized systems enable individuals to control their own personal data, which can then be used to train AI models without compromising privacy or sovereignty.

- Decentralized AI Agents: Blockchain can facilitate the creation of decentralized AI agents that are independent of any central authority. These agents can be used for a variety of applications, from automated trading to decentralized customer service, without the risk of censorship or tampering.

Many startups and established companies are beginning to explore how blockchain can improve the functionality and security of AI applications. The fusion of these two cutting-edge technologies could open up new markets and use cases that were previously impossible, particularly in areas such as decentralized finance, supply chain management, and digital identity verification.

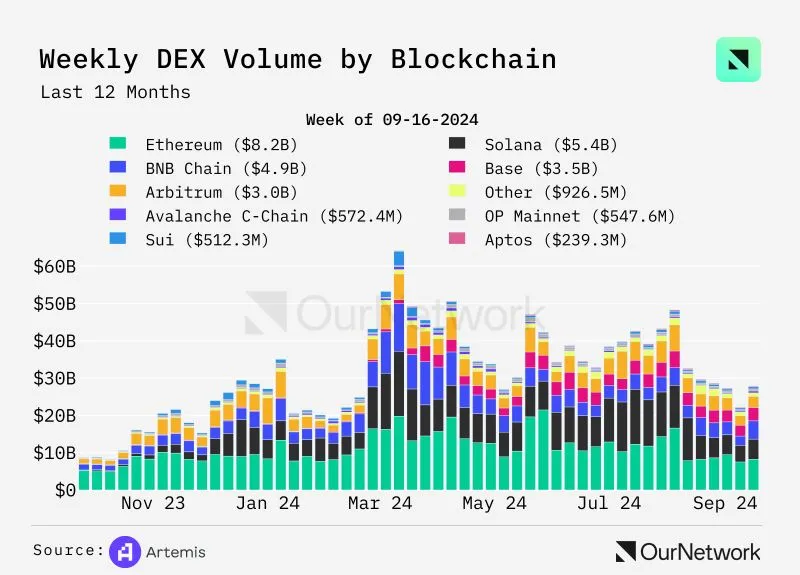

5.3 Leverage the shift to DEX by improving user experience and liquidity as well as cross-chain transactions . One of the most notable changes in 2024 is the increasing market share of decentralized exchanges (DEX) compared to centralized exchanges (CEX). This trend reflects the broader trend of the crypto ecosystem towards decentralization.

- Market share trends

- DEX: Decentralized exchanges accounted for 0% of cryptocurrency trading volume in 2020. By 2024, DEXs will account for more than 10% of total cryptocurrency trading volume, and some estimates suggest that this figure could rise to 30-40% in the coming years.

- Centralized Exchanges: While they still dominate the market, their share is gradually declining as more users seek decentralized alternatives for greater security, transparency, and control over their funds.

Advantages of DEX:

- Security: DEXs eliminate the need for users to entrust their funds to a central authority, reducing the risk of hacking or fraud that has plagued many centralized exchanges in recent years.

- Transparency: All transactions on a DEX are executed on-chain, which means they are publicly visible and verifiable, reducing the risk of market manipulation or opaque behavior.

- User Control: DEX allows users to keep custody of their own assets throughout the trading process, thereby reducing the risk of loss due to exchange bankruptcy or mismanagement.

Prediction: As DEXs continue to improve their user experience and liquidity, they are expected to capture a larger market share. The introduction of features such as automated market makers (AMMs) and cross-chain trading has already made DEXs more competitive, and further development of decentralized financial infrastructure is likely to accelerate this trend.

6. Prioritize developer-friendly tools and infrastructure to attract and retain builders

Developer interest in the crypto space is a key indicator of the industry’s long-term growth potential. In 2024, the number of builders focused on crypto projects will increase significantly as infrastructure advances and innovation potential increases.

- Builder Energy Dashboard: A16Z’s proprietary Builder Energy Dashboard tracks developer activity across blockchains, categories, and regions. The tool shows that the number of active builders in the crypto space has grown year over year, reflecting the growing maturity and expansion of the ecosystem.

- Platform Preference:

- Ethereum and Layer 2: Ethereum and its Layer 2 solutions continue to attract the majority of developer interest, with a focus on scaling and improving user experience. The success of EIP-4844 and rollup solutions like Optimism and Arbitrum have attracted developers looking to build on these efficient, scalable platforms.

- Base: Base is a breakout ecosystem for 2024, with developer interest growing rapidly due to its performance and innovation in Layer 2 scaling.

- Other Ecosystems: While Ethereum and its Layer 2 dominate, platforms like Bitcoin, Solana, and new entrants continue to gain traction, especially for applications that require high throughput and low transaction costs.

Growth in Builder Energy: Increasing developer interest indicates a healthy and growing ecosystem. As more projects launch and more tools are created for developers, the crypto space is becoming more accessible and innovative.

7. Trends in 2025

As the crypto industry continues to evolve, several key trends and predictions have emerged for 2025. These are expected to influence the next phase of growth and innovation in the space.

- Infrastructure Utilization : With scalability improvements in 2024, blockchain technology is ready for widespread adoption. As transaction fees decrease and network efficiency increases, more users and applications will enter the space.

- New use cases : Lower transaction fees will enable more decentralized applications to be developed in areas such as social media, gaming, and supply chain management. These areas are currently underrepresented in terms of on-chain activity, but they could see significant growth as the infrastructure becomes more robust.

- Regulatory Clarity : Regulatory developments in the U.S. and around the world will play a key role in determining the pace of adoption. Clearer regulations will attract more institutional investors and bring greater legitimacy to the industry, while protecting consumers and ensuring market stability.

- AI and blockchain convergence : The convergence of AI and blockchain is expected to accelerate in 2025, with more use cases emerging at the intersection of the two technologies. From AI-driven decentralized financial applications to blockchain-based AI model validation systems, the synergy between these technologies is likely to bring new opportunities for innovation.

- The fifth wave of adoption is expected to usher in the fifth wave of adoption in the cryptocurrency market, driven by the maturity of decentralized applications, increased institutional participation, and greater global regulatory clarity. If the industry continues its current momentum, 2025 could usher in the next major cycle of growth and innovation.

8. Conclusion

2024 marks a transformational period for the cryptocurrency industry, characterized by major infrastructure improvements, regulatory advancements, and the maturation of key applications. As blockchain technology continues to scale and become more affordable, the industry is expected to see wider adoption in a variety of fields, including finance, gaming, and more. While challenges remain—particularly in terms of regulatory clarity and user experience—the overall outlook for the industry is positive.