Source: Pantera Capital October Blockchain Letter; Translated by 0xjs@Jinse Finance

Crypto: A Tool for the AI Gold Rush

Author: Matt Stephenson, Research Partner at Pantera Capital; Ally Zach, Research Engineer at Pantera Capital

"AI is infinitely abundant, while Crypto is absolutely scarce."

This observation by Sam Altman in 2021 has become a mantra for enthusiasts of these two technologies. At first glance, abundance seems more impactful than enforced scarcity, suggesting that AI may be the more prudent investment. In fact, Nvidia's market cap is larger than the entire cryptocurrency market.

But Altman's remark evokes Adam Smith's "diamond-water paradox." Smith pointed out that while water is vital for survival, its abundant supply makes it nearly worthless.

Conversely, diamonds have little practical use, but their scarcity gives them substantial value. This paradox suggests that even if AI becomes as ubiquitous as water, its market value may still be limited. In contrast, the scarcity of cryptocurrencies may be more strategically important and valuable than it initially appears.

Large language models (LLMs) have achieved remarkable feats, including passing the Turing test and reportedly outperforming humans on standard IQ tests. But this raises a question: if humans cannot distinguish between humans and intelligent AI (in the Turing test), can they differentiate between intelligent AIs? If not, then future improvements in AI performance may yield diminishing returns in terms of perceptible benefits to consumers.

Just as the leap from 4K to 8K resolution on televisions is barely noticeable to the average viewer, the differences between highly capable AI models and slightly more advanced ones may also be imperceptible to most users. This could lead to the commoditization of much of the AI market, with the most advanced models reserved for research, industrial, or government applications, while more cost-effective "good enough" models become the standard for everyday use. The top-tier AI models may become "expensive luxury items that the mainstream consumer will never consider upgrading."

Therefore, even as we speculate on AI's potential growth, we should consider another possibility: the powerful capabilities of current AI are already known and will become increasingly commoditized. This is where the intersection of crypto and artificial intelligence ("Crypto x AI") truly comes into focus. The potential of crypto may not be a high-beta bet on the meme value of AI, but rather a mechanism for capturing the practical value of an AI-powered distributed future. Once everyone has a 4K TV in their home, its value lies in what we do with them.

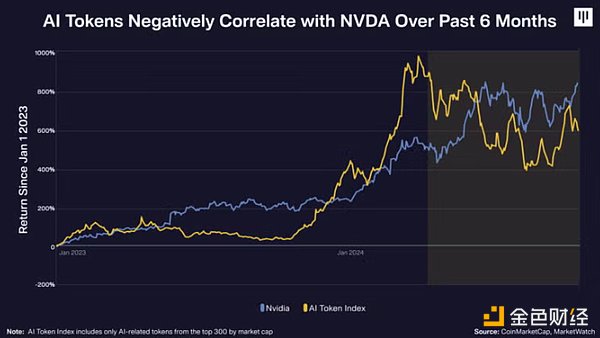

By serving as critical and reliable inputs for AI, as well as the rails for coordinating and transacting distributed AI, cryptocurrencies are closer to a conservative "pick and shovel" bet on AI. This may surprise investors who primarily view Crypto x AI as a volatile proxy for AI's potential growth. Interestingly, over the past six months, crypto has looked more like a hedge against AI growth sentiment, rather than a high-beta play, compared to viewing Nvidia as a proxy for AI growth sentiment.

We will first assess the bright prospects of "AI agents" and how crypto technology can play a role. Then, we will discuss the potential for crypto to support AI's current inputs: data, computation, and models.

AI Agents: Programs that Use Programmable Money

Author: Matt Stephenson, Research Partner at Pantera Capital

Last year, before most people were talking about AI agents on the blockchain, I co-authored a paper that was accepted by the top AI conference, NeurIPS. Since then, I've had the privilege of participating in and speaking at crypto and AI agent events at universities like Stanford, Columbia, Cornell, and Berkeley, as well as numerous technology and investment conferences. Next week, I'll be speaking about AI with a professor from the University of Oxford, the IEEE chair, and a member of the GBBC, all in an effort to better understand, explore, and communicate what the future of AI agents is and how it intersects with blockchain. Of course, I also have investments in this future, including in Sentient and other undisclosed positions in agent infrastructure.

The future is here. While OpenAI has stated that AI agents will not be ready until 2025, in the crypto space, we now have AI agents that are transacting and exploring on the blockchain. One AI agent that has promoted its own token (Note: Truth Terminal) currently has around $300,000, and by the time you read this article, it may become the first AI agent millionaire.

But what are these agents? How are they different from the "robots" we are more familiar with?

Agents are More than Just Robots

Defining "agent" is more nuanced than it appears. The AI field's definition of an agent is not very practical: "anything that perceives its environment through sensors and acts upon that environment through effectors." Economists have a view of agents that is closer to what we want: "an agent is someone who acts on your behalf in a particular decision domain."

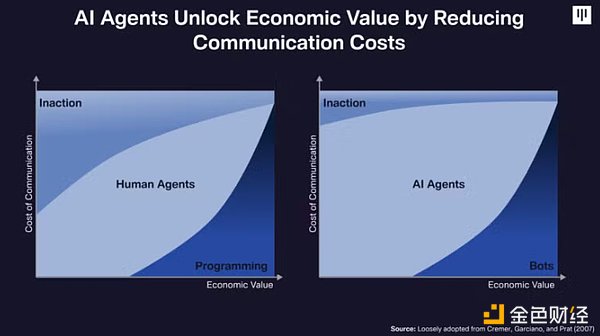

If an agent acts on your behalf, then a robot is essentially a difficult-to-communicate agent. First, you have to write code for the robot to execute, which means communicating in a language that most people don't understand (programming). And for those who do understand the language, they still have to write programs that specify what the robot should do under various conditions, which means pre-specifying those conditions. Both of these are communication costs.

For example, imagine you have a friend who is traveling abroad, and you ask them to buy you a souvenir. If your friend was like a robot, they would ask you to write a program specifying exactly what souvenir they should buy. If your friend was like an agent, what would that be like? You could simply express your request in language, and trust that your friend will buy you something you want. Using language, without needing to specify your preferences for gifts you might receive abroad, reduces the communication cost. Clearly, this is a better agent.

The need to pre-specify conditions (because you have to program them) limits the practical usefulness of robots as agents. Then, the fact that you have to program them means they are inaccessible to those who don't program. We will turn to AI agent modeling as a way to reduce these communication costs and unlock corresponding economic value.

While the communication costs of existing robots are high, the over $2 trillion in monthly cryptocurrency stablecoin transactions seem to be largely robot trading. As robots become better agents, perhaps able to trade USDC and USDT based on relative risk like you, we should expect this number to grow.

AI Agents Will Leverage Crypto Technology

One reason AI agents are beneficial for cryptocurrencies is that they can help alleviate the notorious user experience problems of cryptocurrencies. The complexity of blockchain interactions, wallet management, and decentralized finance protocols has long been a barrier to widespread adoption. AI agents can serve as intuitive interfaces, translating user intent into the precise technical operations required on the blockchain. They can guide users through complex transactions, explain risks, and even recommend optimal strategies based on market conditions and user preferences.

Another reason is that agents cannot have bank accounts, but can transact using wallets. This limitation of traditional financial systems aligns perfectly with the ethos of cryptocurrencies. In the crypto world, agents can operate directly with smart contracts and decentralized protocols, representing users and managing digital assets, without needing permission from a central authority. This opens up new possibilities for fully crypto-native automated wealth management, 24/7 trading, and personalized financial services.

Here is the English translation:Finally, a mature intelligent agent ecosystem means that intelligent agents need to trade and coordinate with each other. Modern smart contracts, as programmable, always-on international legal systems, are well-suited for this task. AI intelligent agents can leverage the crypto infrastructure to participate in complex multi-party transactions and protocols. They can negotiate terms, execute transactions, and even resolve disputes within the parameters set by their human principals. This creates a new paradigm of autonomous economic activity, where agents can form temporary alliances, pool resources, and collaborate on tasks that humans cannot or cannot directly manage.

We believe these activities will all add value to the crypto infrastructure. But there are also indirect impacts that make crypto itself better. For example, due to the attention constraints in crypto, decentralized autonomous organizations (DAOs) have remained largely inactive. DAOs actively managed by an AI agent network (where each agent represents the interests of DAO voters) will change the game. These agents can analyze proposals, allocate resources, and execute strategies at speeds and scales beyond human capabilities, while adhering to the core principles and objectives set by their human creators.

AI intelligent agents and cryptocurrencies are not just a perfect match, they are two mutually dependent technologies. Agents need programmable money to autonomously operate in the digital economy. Cryptocurrencies need AI to improve the user experience and deliver on their promise of a financial revolution for everyone. As this synergy develops, we may see core blockchain infrastructures like Solana, Ethereum, Near, and Arbitrum emerge as the primary beneficiaries of this new AI-driven economic paradigm. They are poised to facilitate intelligent agent transactions, host the decentralized applications that agents interact with, and provide the secure, transparent environment needed for agent coordination. With increased agent activity, these networks may see transaction volumes rise, demand for their native tokens increase, and network effects strengthen. This is not just about technical compatibility - it's about creating a new economic paradigm where AI and cryptocurrencies work together to make finance more efficient, accessible, and perhaps a bit futuristic.

Crypto Empowers Current AI

Author: Ally Zach, Research Engineer at Pantera Capital

Imagine you're on the verge of a major breakthrough, only to find the necessary tools are out of reach. Innovation often feels this way - a journey of breakthrough highs and challenge lows. Take the automotive industry, for example. The quest for more efficient engines once hit a dead end. Engineers craved breakthroughs, but the required materials did not yet exist. Progress stalled until new alloys and composites reignited the innovation engine. Similarly, new technologies like crypto may unlock potentials yet untapped in AI.

For years, AI development has followed an S-curve, slowly at first, then rapidly. In 2017, we saw a key inflection point, with the rise of Transformer-based architectures, as outlined in the influential paper 'Attention is All You Need'. These Transformers fundamentally changed the way models process sequential data, enabling efficient training on large datasets. This sparked the rapid development of powerful new LLMs and generative AI models.

While AI has made progress, major bottlenecks in data, compute, and model generation must be overcome to achieve the next leap forward. Combining AI with blockchain technology can help decentralize resources and democratize access, opening innovation to global contributors.

Data

Data is the lifeblood of AI, the fuel that drives its accuracy and reliability. High-quality, representative data is crucial for building effective models, but obtaining this data is challenging due to privacy concerns, restricted access, and inherent biases. Furthermore, users are increasingly unwilling to share personal information, making data collection resource-intensive and often hindered by trust issues.

Blockchain technology offers a promising solution by introducing decentralized, secure, and transparent data aggregation methods. Platforms like Sahara align with our long-term strategy of advancing decentralized AI infrastructure, enabling individuals to contribute data and monetize it while retaining control. Additionally, the token economy incentivizes high-quality contributions by rewarding users accordingly. This approach helps address privacy concerns by empowering users to own and control their data. It democratizes data access, allowing smaller entities that previously lacked resources to compete with large tech companies. By securely incentivizing data sharing, blockchain-based platforms turn data into a commodity, enriching the available data pool and potentially producing more robust and equitable AI models.

However, while innovative, blockchain-based data aggregation is not a standalone solution for AI development. Used in isolation, practical challenges such as scalability, data quality assurance, and integration complexity may limit its effectiveness. Large tech companies, with their vast datasets and mature infrastructure, still hold significant advantages that decentralized platforms struggle to match.

Therefore, solutions including blockchain-based approaches introduce new avenues for data collection and collaboration, complementing rather than replacing traditional methods. The synergy between decentralized efforts and mature technology leaders can foster partnerships that leverage the strengths of both, promoting innovation and inclusivity in AI development.

Compute

The rising costs and scarcity of GPUs pose a significant barrier for small-scale AI developers. Due to high demand and supply chain issues, GPU prices have been steadily increasing since the pandemic, with large enterprises increasingly monopolizing access to essential hardware. This limits innovation, as many startups and researchers require assistance to afford the tools for advanced model training. This reduces the diversity of AI research and slows the progress of smaller institutions.

However, Crypto has the potential to create a more equitable competitive landscape by commoditizing compute power. Platforms like Exo and io.net are democratizing GPU access through decentralized marketplaces, allowing anyone to access or lend out computing resources. Individuals with idle compute capacity can offer it on the network, earning rewards. The commodification of high-performance computing removes the barriers that once restricted access to advanced tools, enabling a broader range of innovators to participate in AI development.

In the future, as GPU supply increases, decentralized compute markets may directly compete with traditional cloud services. These platforms lower the access threshold and provide cost-effective alternatives, allowing more people to engage with the AI ecosystem. However, ensuring reliable compute for users remains a challenge. Verifying GPU standards and maintaining consistent, secure resources are crucial for building trust and preventing fraud. While decentralized solutions may not replace traditional services, they can provide competitive alternatives where flexibility and cost-effectiveness are more important than guaranteed performance.

Models

Currently, AI development is often concentrated within a small number of organizations, such as OpenAI, Google, and Facebook. This centralization limits the opportunities for global innovators and raises concerns about whether AI can reflect the diverse values of humanity. Centralized control may result in models that embody narrow perspectives, overlooking the needs and perspectives of a broader user base.

The decentralized platforms are transforming the distribution of power in AI development. Platforms like Sentient and Near align with our vision of AI increasingly running on crypto rails, democratizing development through open-source, community-driven ecosystems. Leveraging blockchain technology, they transparently manage contributions, ensuring developers are recognized and compensated through token rewards. This enables anyone to build, collaborate, own, and monetize AI products, ushering in a new era of AI entrepreneurship. Illia Polosukhin, co-author of the groundbreaking paper "Attention is All You Need" and co-founder of Near, is spearheading crowdsourced efforts to cultivate an open environment for developing Artificial General Intelligence (AGI). Such collaborative initiatives aim to align AI advancement with broad human values.

These platforms act as catalysts for change, fostering a competitive yet collaborative AI economy. By expanding participation, they encourage the flourishing of diverse ideas, leading to more innovative solutions and potentially reducing biases in AI models.

Crypto x AI presents unique opportunities for democratizing AI development, but also poses significant challenges. Balancing large-scale collaboration with high-quality, expert-driven work is crucial to ensuring robust and ethical models. Decentralized data access, compute power, and model development enabled by crypto break down traditional barriers, allowing talents from around the world to participate in AI's evolution. This influx of diverse perspectives promotes collaboration and builds a more inclusive ecosystem. Embracing this collaborative model can not only accelerate innovation but also ensure the global community shapes the future of AI.