Over the past few weeks, the Layer 1 (L1) blockchain Aptos (APT) has seen a noticeable increase in network activity. User activity on the Proof-of-Stake (PoS) network has reached its highest level in months, driving the value of its native token APT to new heights.

Analysis of the technical composition shows that APT is ready to expand on its current gains. If demand persists, this altcoin could rise to $193,737. This analysis explores that possibility in the medium term.

Crypto users are flocking to APT

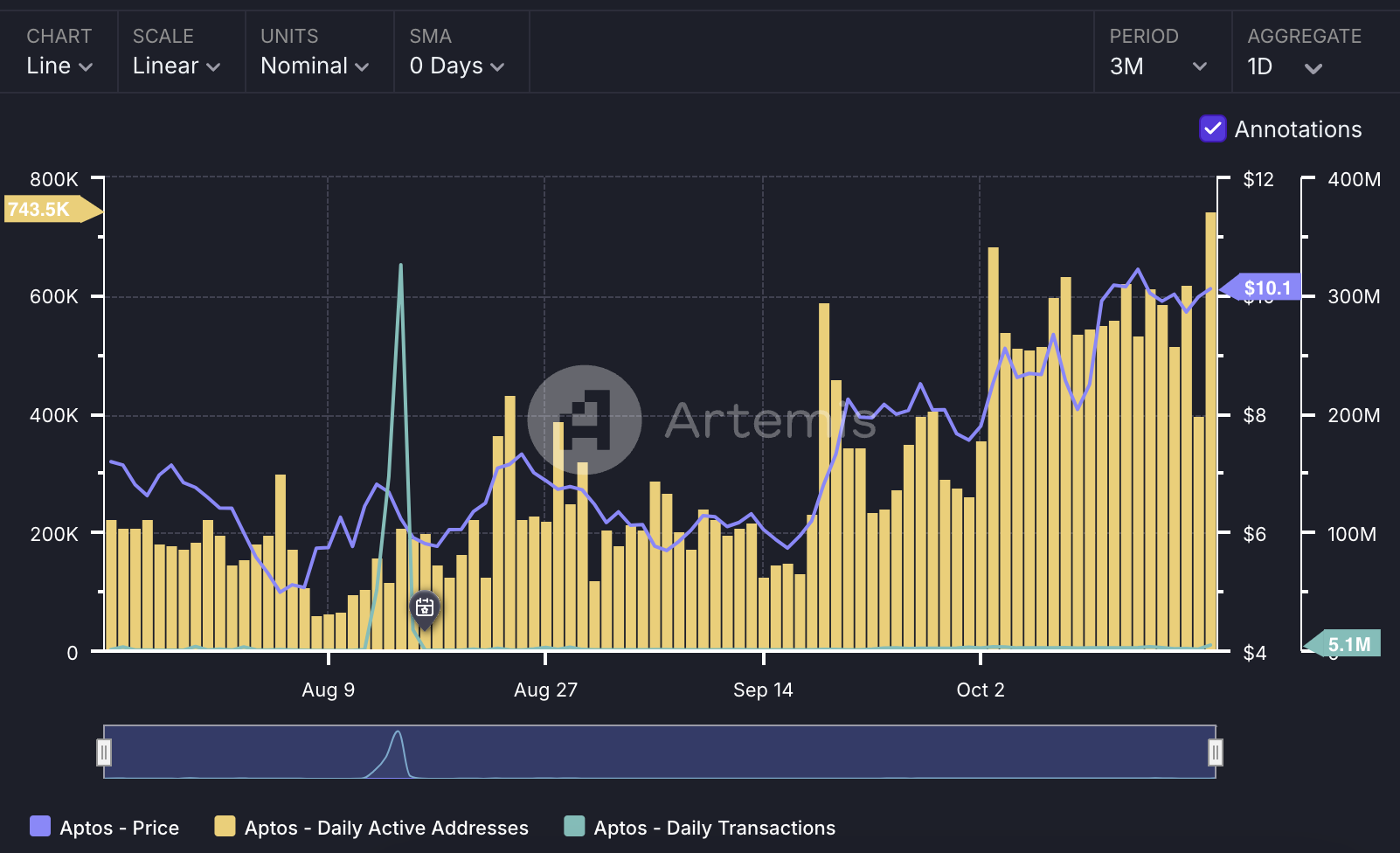

On-chain data shows that user activity on Aptos has increased significantly over the past month. According to blockchain data firm Artemis, the daily number of unique addresses that completed at least one transaction on the blockchain surged by 115% over the past 30 days. During the review period, Aptos had a total of 7,430,466 daily active addresses.

The increase in user activity on the Aptos network has led to a substantial increase in daily transaction volume. Over the past month, the network processed over 5 million transactions, a 373% increase in volume.

Read more: Top 5 Aptos (APT) Wallets in 2024

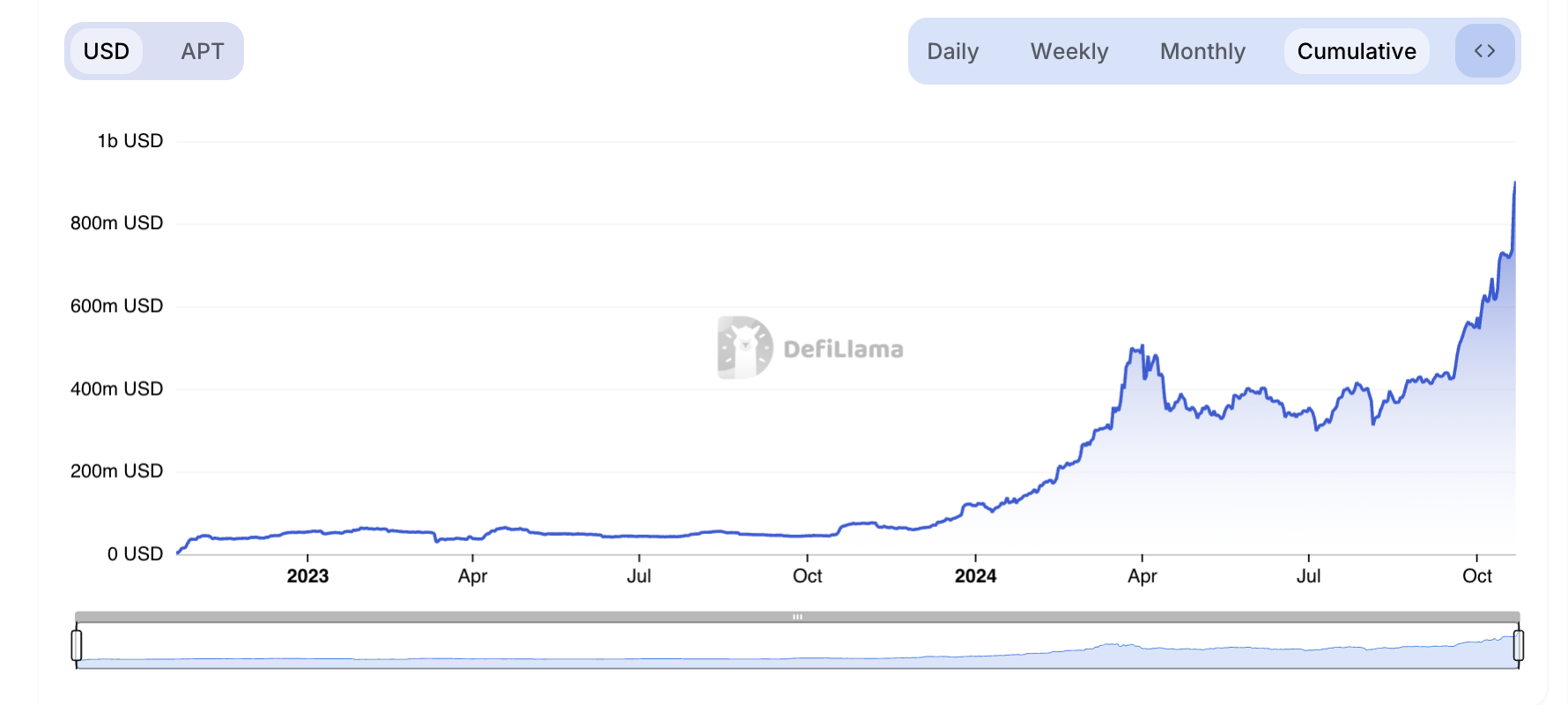

This growth is also evident in Aptos' thriving DeFi sector. Its DeFi Total Value Locked (TVL) surged by 67% over the past 30 days, reaching an all-time high of $909 billion.

According to the DeFi on-chain data site defillama, Aptos is currently the 11th largest blockchain by TVL, trailing just behind Sui with $10.1 billion in TVL.

APT Price Prediction: Aiming for Annual Highs

The increase in network activity has translated into an impressive price surge for APT. The altcoin is currently trading around $10.36, just above the $10.07 support level. After a 11% price increase on the 22nd, it has since declined 0.38% as of the 23rd.

BeInCrypto's key momentum indicator analysis suggests the rally is likely to continue. For example, APT's Chaikin Money Flow (CMF) has also been rising along with the price, currently sitting at 0.20 above the zero line.

CMF measures the flow of money into and out of an asset. When it rises with the price, as in the case of APT, it suggests the price increase is being supported by strong buying volume, and the trend is likely to continue. If the uptrend persists, Aptos' price could return to its annual high of $19.37 and surge towards the psychological resistance of $200 million.

Read more: Aptos Crypto (APT): What It Is and How It Works

However, this bullish outlook could be invalidated if profit-taking activity increases. If that happens, APT's price could drop to the August 5th low of $43.2 million.