However, BeInCrypto's assessment of XRP's technical setup indicates that this decline is only temporary, and the Altcoin is likely to rebound soon. The reasons are as follows.

Ripple's selling pressure is starting to weaken

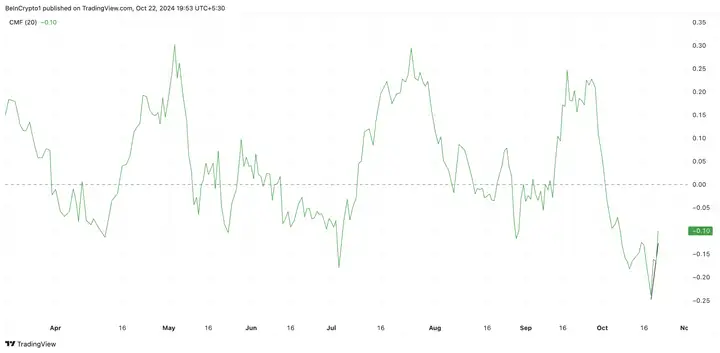

Despite the price decline, XRP's Chaikin Money Flow (CMF) has been on an upward trend over the past few days. This indicator measures the buying and selling pressure on an asset over a specific period. As of the time of writing, the indicator is at -0.10, attempting to break above the zero line.

Just like in the case of XRP, when its Chaikin Money Flow (CMF) is negative but trending upwards as the price declines, it indicates that the asset is still in a net distribution state, meaning that there is overall selling pressure. However, the decrease in the intensity of the selling indicates that the bears are weakening, and the bullish interest is starting to increase.

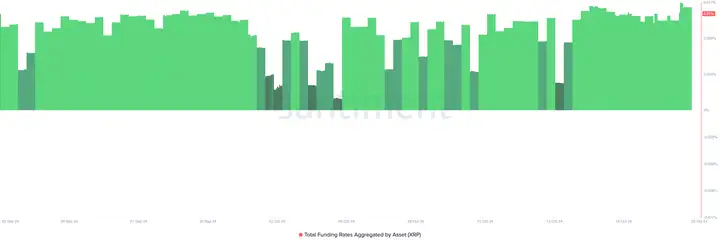

As of the time of writing, XRP's perpetual funding rate is 0.01%, reflecting that despite the Altcoin's value declining, it still enjoys a bullish bias.

The funding rate is a periodic fee used to keep the price of a perpetual futures contract in line with the spot price of the underlying asset. When the asset price declines, the funding rate remains positive, indicating that the majority of traders are still bullish, and they are still betting on the price to rebound, despite the continued decline.

Will XRP fall further?

XRP price is struggling to extend the uptrend above $0.5600, and it has started a downside correction, similar to Bitcoin and Ethereum. It has broken below the $0.5550 and $0.5500 levels.

The price even dropped below $0.5320 and tested $0.5290. The lowest price was $0.5277, and the price is currently consolidating the losses and trading below the 23.6% Fibonacci retracement level from the $0.5600 swing high to the $0.5292 low.

The price is currently below the $0.5450 and the 100-hour simple moving average. On the upside, the price may face resistance near $0.5365. A new lower highs connecting bearish trend line has also formed on the XRP/USD hourly chart, with resistance at $0.5365.

The first major resistance is near $0.5440, which is close to the 50% Fibonacci retracement level from the $0.5600 swing high to the $0.5200 low.

The next key resistance could be $0.5520. If there is a clear break above the $0.5520 resistance, the price could decline towards the $0.5500 resistance level. If the price rises further, it may test the $0.5600 resistance in the short term, or even $0.5650. The next major resistance could be $0.5800.

XRP Price Prediction: Seven-Month High Approaching

XRP is currently trading at $0.53, slightly above the crucial support at $0.52. The revival of bullish sentiment could drive a new wave of demand for the Altcoin, potentially triggering a rebound.

If this happens, XRP's price could attempt to break above the $0.65 resistance. If successful, the Token could further rise, aiming for the seven-month high of $0.74.

However, if the downtrend continues, the bulls may be unable to defend the $0.52 support, and XRP's price could drop to $0.38, invalidating the aforementioned bullish forecast.

In summary

XRP has dropped to $0.52, a weekly low, but technical indicators suggest a potential rebound is on the horizon.

Despite the decline in XRP, its Chaikin Money Flow has been on an upward trend, indicating that the selling pressure is weakening.

If demand picks up, XRP could rise to $0.65, but if it fails to defend the $0.52 support, it could drop to $0.38.