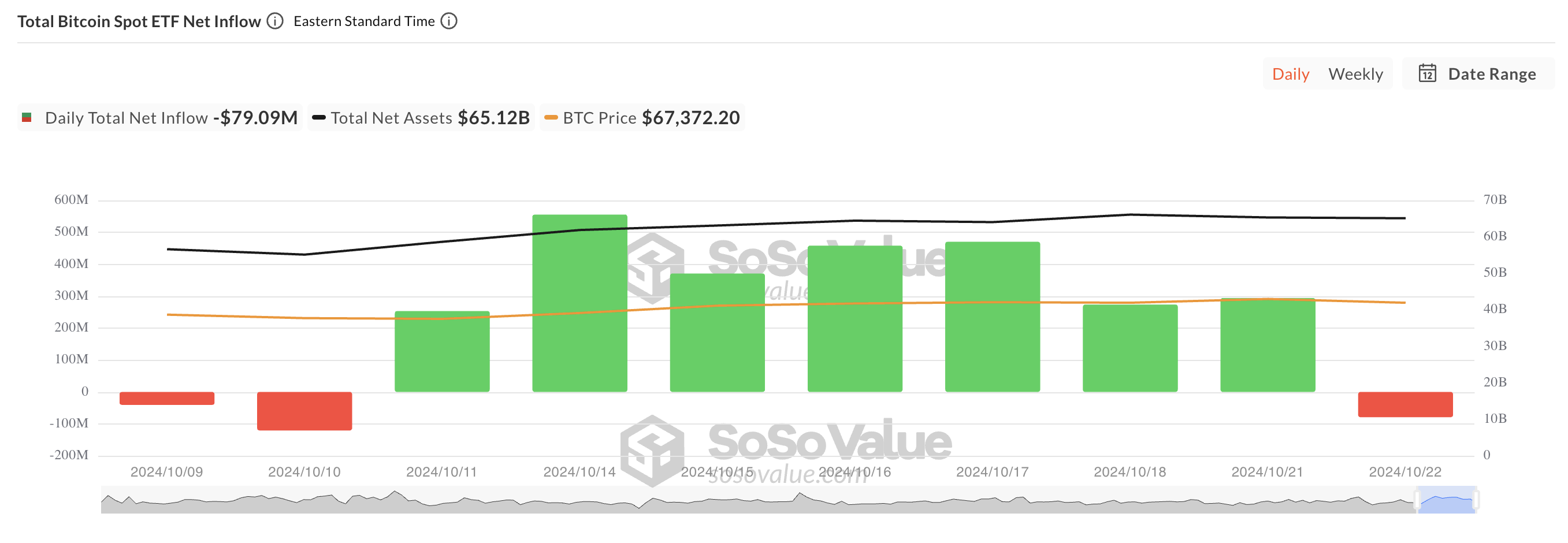

The Bitcoin (BTC) exchange-traded fund (ETF) recorded net outflows on the 22nd (local time). This is the first net outflow in the past week. This occurred as the prices of major coins fell to weekly lows amid a continuous decline in market activity.

Bitcoin is currently trading at $66,776, recording a 2% price decline over the past week. As the bearish sentiment on the coin gradually increases, holders need to prepare for additional losses.

Bitcoin ETF Records Net Outflow

According to SosoValue's data, the BTC spot ETF experienced a net outflow of $79.09 million on Tuesday. This broke a streak of 7 consecutive days of inflows exceeding $2 billion.

Read more: Top 7 Platforms Offering Bitcoin Bonus in 2024

The net outflow on Tuesday was mainly due to a $134 million outflow from the ARK 21Shares Bitcoin ETF, while other ETF products saw inflows or no activity. Additionally, the iShares Bitcoin ETF (IBIT) from BlackRock, the largest asset manager ETF provider, recorded a significant decrease from the previous day's $329 million inflow to just $43 million.

This decrease in institutional demand is primarily attributed to the recent decline in Bitcoin's value. Over the past week, the cryptocurrency has fallen 2%, reaching a 7-day low since issuance.

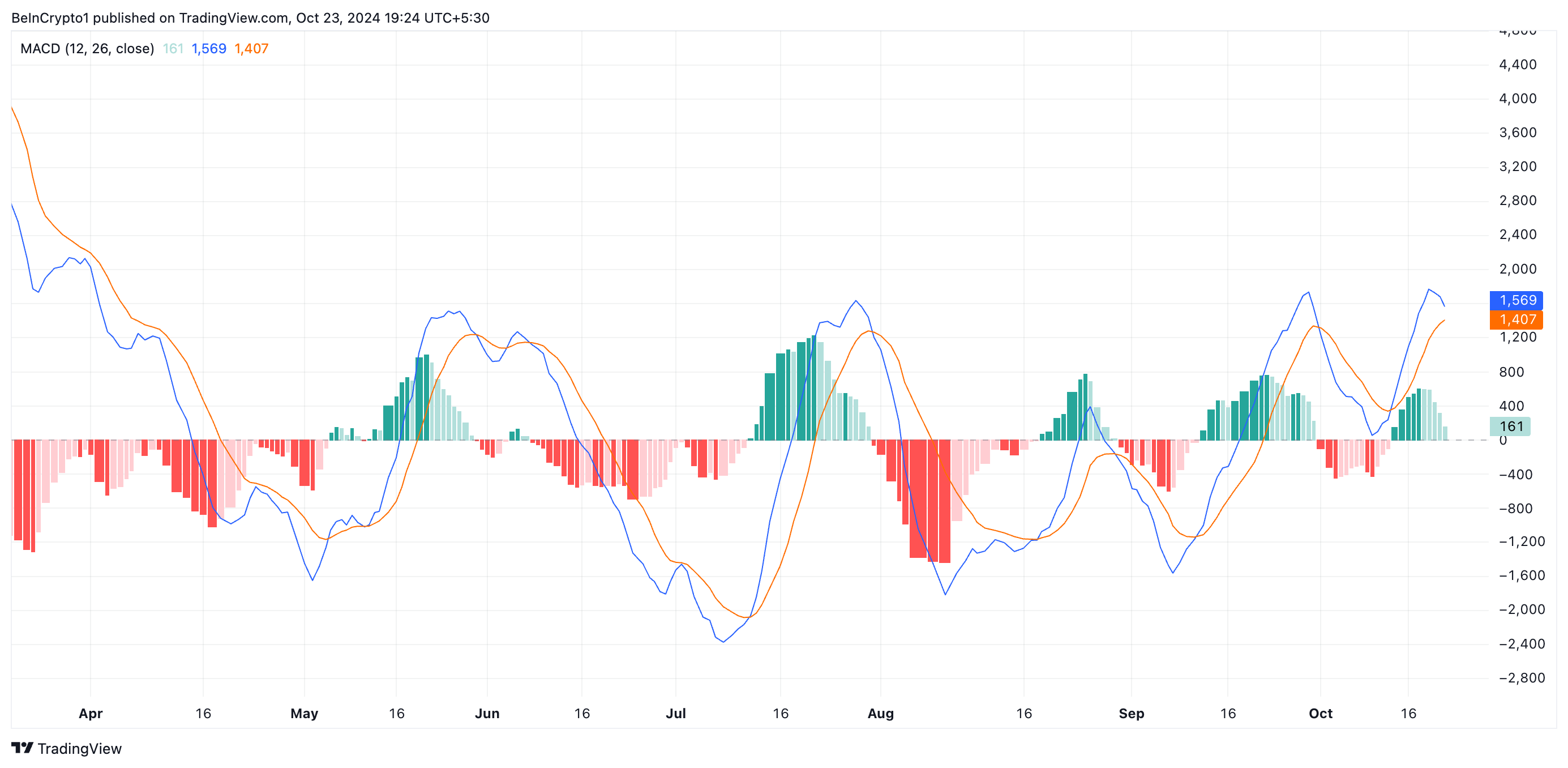

BeInCrypto's momentum indicator assessment has revealed a gradual increase in bearish sentiment on major coins. For example, the Moving Average Convergence/Divergence (MACD) reading is poised to cross the MACD line (blue) below the signal line (orange).

This indicator measures the asset's price trend and momentum, identifying potential buy or sell signals. When set up this way, it confirms an increase in selling pressure in the market. A potential crossover suggests that the asset's price momentum is weakening, and a downtrend or correction may follow.

BTC Price Forecast: Coins Have Only Two Choices

Bitcoin's price is declining towards the 20-day Exponential Moving Average (EMA), which measures the average price over the past 20 trading days.

When an asset's price declines towards this level, it suggests that the asset is experiencing a pullback but may find support around the 20-day EMA. If the price fails to maintain above the 20-day EMA and falls below it, the likelihood of a trend reversal significantly increases. This implies that the bearish sentiment is increasing, and further downside may follow.

At the time of writing, Bitcoin is trading at $66,776, just above the previous resistance level of $64,543, which has now turned into support.

If this support fails to hold during a retest due to the increasing bearish sentiment, Bitcoin's price could drop to the next major support level of $61,686. In a more pessimistic scenario, where a bearish mood takes over the Bitcoin market, the price could plummet to $58,828.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if the market sentiment improves and bullish momentum builds, Bitcoin could rally to $68,612. Breaking through this resistance could give BTC the potential to recover its all-time high of $73,794.