Author: BitpushNews

The financial markets saw a broad sell-off on Wednesday. On the macroeconomic front, driven by strong US economic indicators and concerns about the deficit, the 10-year US Treasury yield rose to 4.25%, the highest level since July, while the US dollar index rose to a year-to-date high, putting further pressure on risk assets, including cryptocurrencies.

At the close of the US stock market, the major indices fell across the board, with the S&P 500, Dow Jones, and Nasdaq declining 0.92%, 0.96%, and 1.60%, respectively.

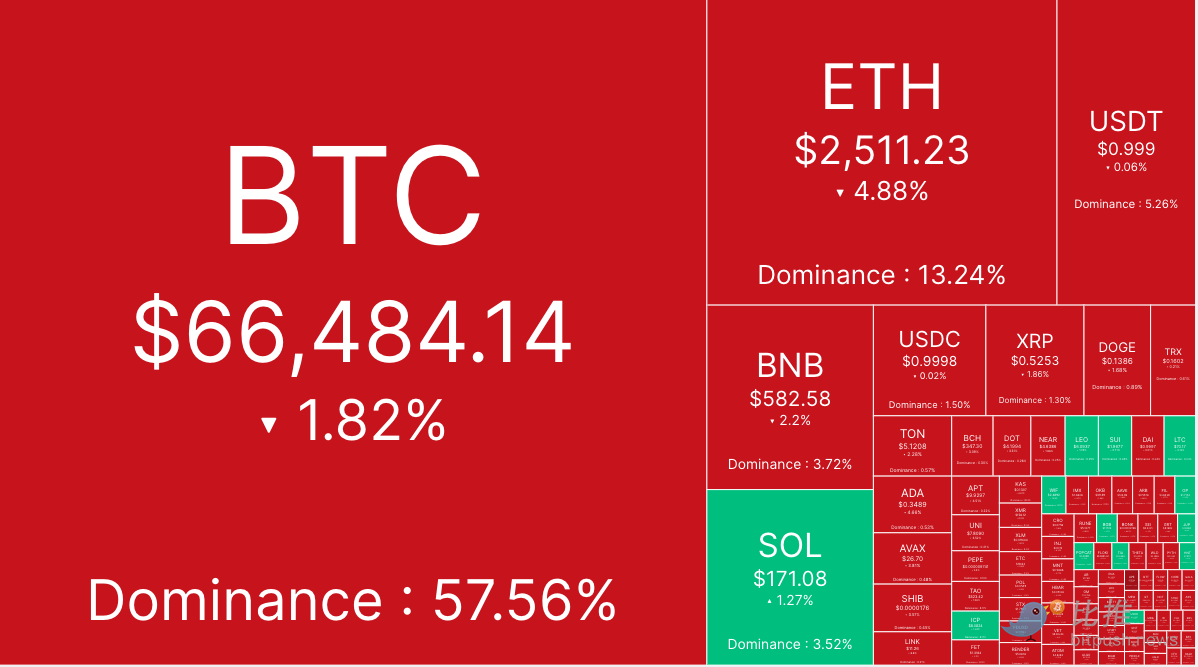

Bitpush data shows that in the early hours of Wednesday, Bitcoin broke below the $67,000 support level, briefly dropping to a low of $65,160, before the bulls successfully pushed it back above $66,000. As of the time of writing, Bitcoin is trading at $66,484, down 1.82% in the past 24 hours.

The Altcoin market was weak, with most of the top 200 tokens by market cap seeing more declines than gains.

The biggest gainer was Jupiter (JUP), up 5.5%, followed by ZetaChain (ZETA) and UMA (UMA), up 4.4% and 4%, respectively. First Neiro (NEIRO) saw the largest decline, dropping 15%, while Baby Doge Coin (BabyDoge) and Safe (SAFE) fell 10%.

The total cryptocurrency market capitalization currently stands at $2.28 trillion, with Bitcoin's market dominance at 57.5%.

Showing weakness in the short term, but poised to set new highs

Over the past few weeks, the price of Bitcoin has risen 18%, climbing from $58,845 on October 9th to a high of $69,495 on Monday. However, the recent uptrend has shown signs of slowing, accompanied by stagnant stablecoin trading volumes since the end of September. The Fear & Greed Index has spiked to 72, the highest greed level since July, and analysts believe Bitcoin is due for a correction and consolidation period.

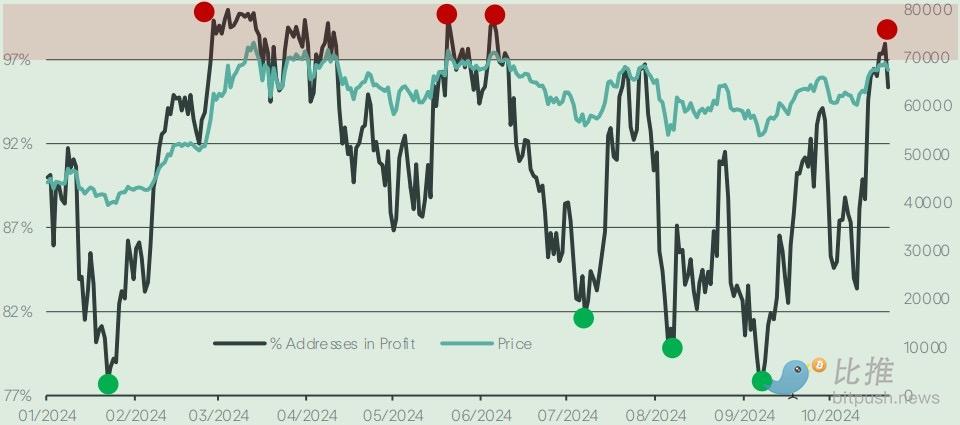

Copper Research analysts wrote: "As Bitcoin attempts to push towards $70,000, on-chain indicators may suggest the market is getting a bit overheated. While ETF inflows remain optimistic, a short-term top is currently more likely to occur."

They stated: "Bitcoin on-chain dynamics can provide insights into how many addresses are in profit based on the price movement and current price. The pattern that emerges is quite clear - when a large move occurs, and the profitability of addresses rises from around 75% to the current 98%, the market starts to face selling pressure as investors hold unrealized gains. This may signal a short-term top for BTC before the US elections."

The derivatives market sentiment has shown some recovery, but remains insufficient. Copper Research's data shows that the 3-month rolling basis trade, while rising, is still far below the highs seen earlier this year. This suggests the market's expectations for future prices are relatively stable, but overall trading activity is low.

In another report by Bernstein, their analysts forecast that Bitcoin's price could reach as high as $200,000 by the end of 2025 as cryptocurrencies enter a "new institutional era".

The report stated: "Currently, the top 10 global asset managers hold around $60 billion in regulated [ETFs], up from $12 billion in September 2022. By the end of 2024, we expect Wall Street to replace Satoshi as the largest BTC wallet."

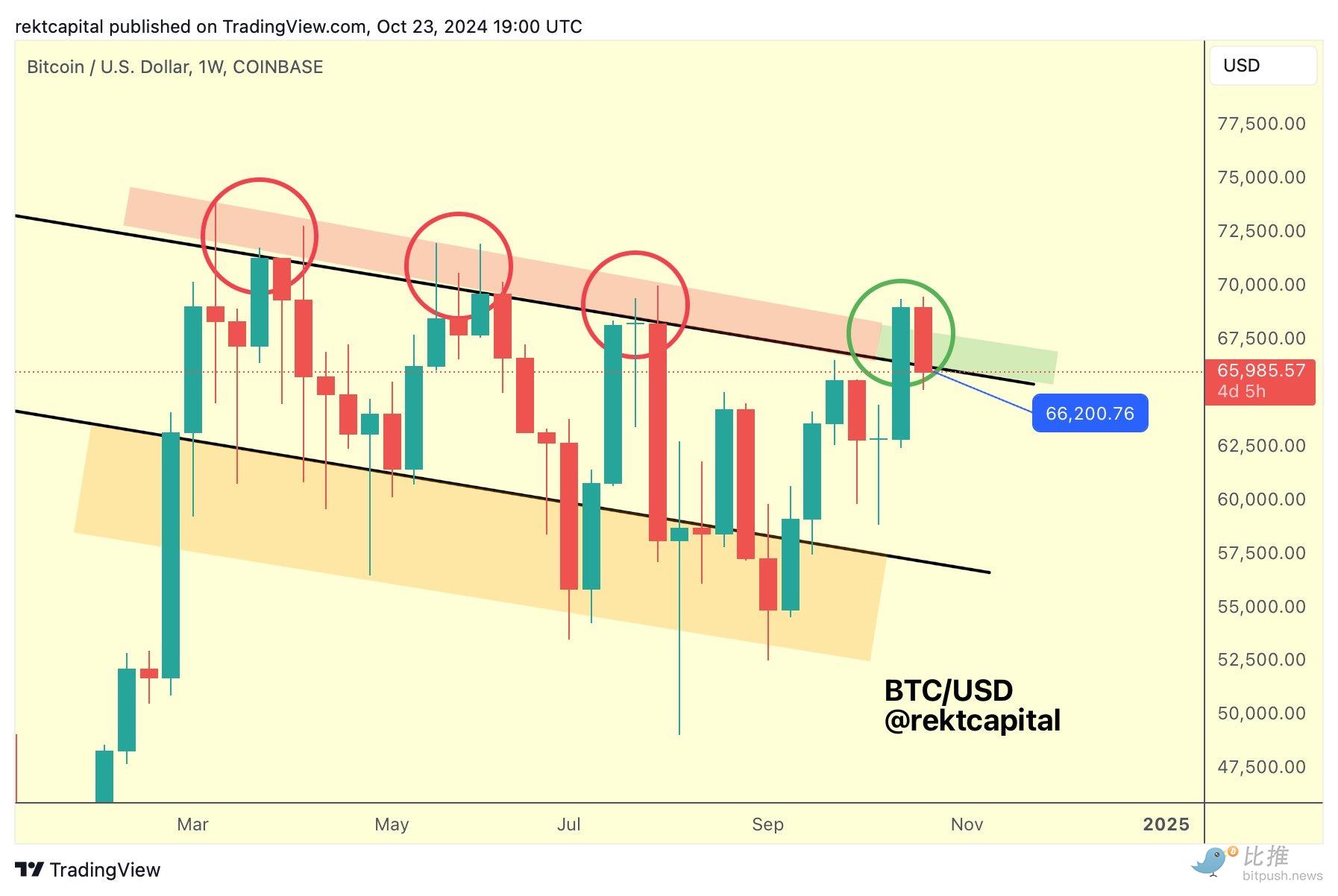

As for BTC's short-term price, market analyst Rekt Capital pointed out that "Bitcoin is currently in the process of retesting the top of its channel (black line in the chart below) as support."

Specifically, the top of the channel represents a price level of around $66,200, and BTC has been testing the September highs in the recent downtrend, so it needs to close the weekly candle above around $66,200 to confirm the upward momentum.

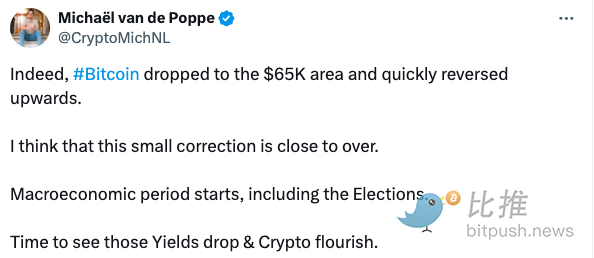

Michaël van de Poppe, founder of MN Consultancy, expressed an optimistic view, stating that the pullback to $65,000 on Wednesday could mark the low point of this adjustment, and he wrote on his platform: "Indeed, Bitcoin dipped to the $65,000 area and swiftly reversed back up. I believe this minor correction is about to conclude. The macroeconomic narrative is kicking in, including the elections, and it's time to see those bond yields come down and the crypto markets flourish."

However, US market research firm Fairlead Strategies took a more cautious stance. In a report, the firm stated that Bitcoin triggered a bearish reversal signal over the weekend, which could lead to Bitcoin consolidating around current price levels for several weeks. Fairlead said: "Bitcoin is in a testing zone, testing trend line resistance around $67,700. Support remains near $59,800, with resistance at $67,700 and $73,800."