Author: Ignas Source: X, @DefiIgnas Translation: Shan Eoba, Jinse Finance

The prevailing view is that the addition of each new L2 will further exacerbate the user experience (UX) deterioration and liquidity fragmentation problem, which is therefore bad news for ETH.

However, we have embarked on the "point of no return" of L2 expansion, and there is no turning back.

It's time to redefine this narrative and view the launch of new L2s as good news for the Ethereum ecosystem.

Am I being too naive in saying this?

In fact, the launch of L2s by Kraken and Uniswap is indeed good news for the Ethereum ecosystem.

You see, Kraken's Ink and Unichain have joined the L2 race, but they are not independent L2s, but have joined as members of the OP Superchain.

The first benefit of the OP Superchain alliance is the (eventual) achievement of frictionless user experience between all member L2s.

The Superchain is a unified, interoperable chain network that connects teams traditionally viewed as competitors.

Additionally, this also brings economic benefits to the OP Collective.

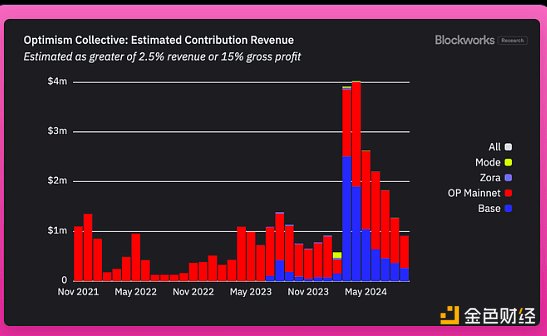

When new L2s join the OP Superchain, they commit to contribute the higher of the following two:

15% of their net profits (total sequencer revenue minus fees paid to L1), or

2.5% of their total revenue.

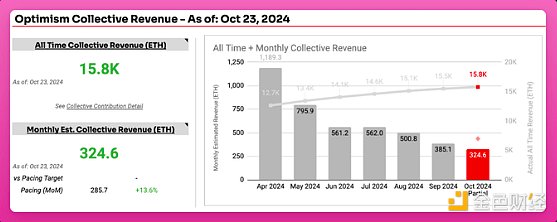

Currently, about 30 L2s in the OP Superchain have contributed 15,800 ETH (about $40 million) to the Optimism Collective.

Currently, Base and OP Mainnet are the largest contributors.

With the addition of Kraken and Uniswap's Unichain, revenue is expected to increase further.

These funds help drive the future development of Optimism and Ethereum:

Public goods: Provide funding support for projects in the Ethereum ecosystem, such as infrastructure and development tools.

Network growth: Support the development of the OP chain and drive the adoption of Ethereum.

Innovation: Provide funding support for technological advancements.

$40 million may not be a lot, but at least the Optimism Collective has a value accrual mechanism.

Ethereum L1 can draw lessons from Optimism and encourage L2s to reinvest value into ETH at least at the social level, even if they cannot do so technically.

This is a key factor in being bullish on ETH.

After reading Vitalik's four-part series "The Possible Futures of the Ethereum Protocol", I did not see any new, clear L2 profitability models.

He mentioned that Ethereum-based rollups can improve L1 efficiency through tighter integration and seamless interoperability, ensure higher security, and bring more value to the mainchain.

However, more and more major players are choosing to join the OP Stack instead of launching Ethereum-based rollups.

Perhaps L1 can advocate for more widespread adoption of Ethereum-based rollups.

Vitalik also discussed how to scale L1 to accommodate specific use cases that should remain on L1, in order to retain value.

As more L2s join the OP Superchain under a shared revenue model rather than launching independent L2s, the funding support for the Ethereum ecosystem has increased.

This also provides more incentives to solve the user experience and liquidity issues in each L2.

I can't wait to see "seamless capital flow within the Superchain" become a reality.