Whether Bitcoin can reach $70,000 depends on lower interest rates, the US election results, the growth of BTC miner profits, and strong spot ETF demand.

From October 23 to October 25, Bitcoin rose 3.8%, but the resistance level is at $68,700, but is the bullish momentum strong enough to push the price to break through the $70,000 range? Although the Fed's recent rate cuts have increased investors' risk appetite, four main drivers may determine whether Bitcoin can break through the $70,000 mark.

Limiting factors include global economic uncertainty, concerns about high mining sell-off pressure and low hash rate profitability, the potential impact of the US election results on regulation, and large Bitcoin reserves on exchanges.

Against the backdrop of global economic uncertainty, investors are taking a cautious stance. Although Bitcoin has become one of the top 10 assets globally by market capitalization, ranking alongside giants like TSMC, Berkshire Hathaway, Tesla, and Walmart, investors also have reason not to "go all in". The returns of traditional assets are stable, with fixed-income yields at 4.7%, so the incentive to shift to Bitcoin is still limited. Therefore, investors may choose to wait for more signals from the broader market before committing to a $70,000 target price.

The upcoming US presidential election is exacerbating this uncertain sentiment. Leading candidate Vice President Kamala Harris has indicated a tendency towards highly regulated markets, focusing on protecting individual investors. This stance contrasts sharply with former President Donald Trump's more constructive view on integrating digital assets into traditional finance, which could impact Bitcoin's adoption trajectory.

Bitcoin Miner Sell-off Pressure and On-chain Activity

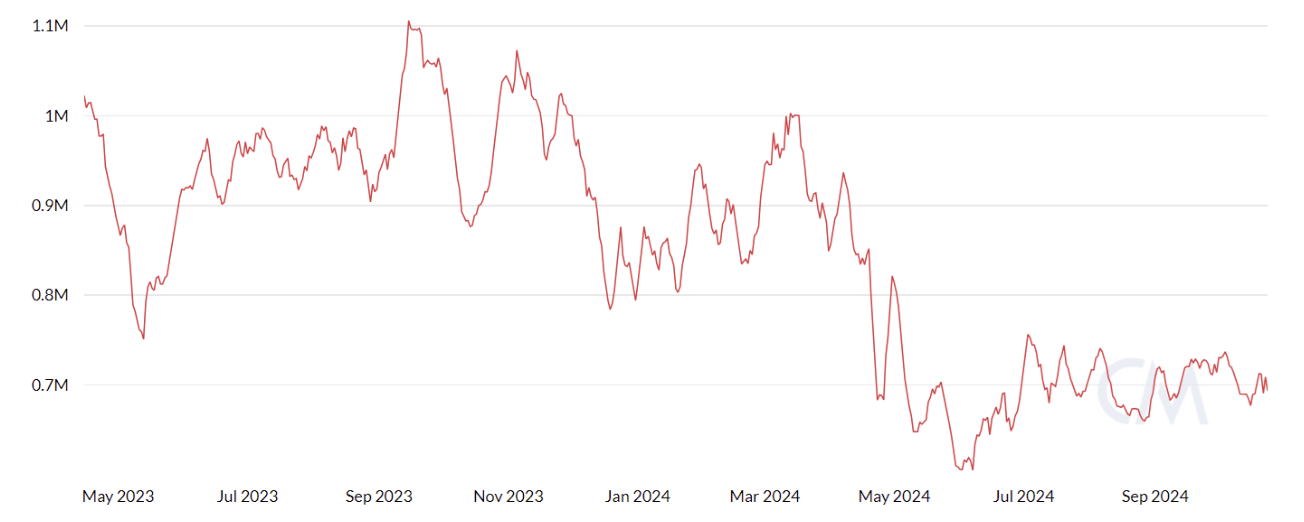

Concerns also stem from the Bitcoin mining industry, whose profitability is struggling against headwinds. The Hash Rate Index (a metric that measures the potential for mining revenue) has fallen to near historical lows, at $49 per exahash per second (EH/s) per day, down about 50% since the April halving. This decline highlights the financial pressures miners face, and as they adjust their operational strategies, their actions could impact Bitcoin's price dynamics.

Bitcoin mining Hash Rate Index, daily USD/EH/s. Source: Hashrateindex

Given that miners collectively hold over 1.8 million BTC (equivalent to around $12.24 billion), many traders are concerned that these entities may be forced to sell in large quantities.

In a recent interview with Bloomberg, Ethan Vera, Chief Operating Officer of Luxor Technology, stated, "You're going to continue to see negative profitability, and they're going to try to mask how bad the industry is and how bad their operations are by diluting shareholders."

On-chain data provides little comfort, as Bitcoin's 7-day average active addresses have remained essentially flat over the past six months. This trend reflects the stagnation in Bitcoin's Google search volume, indicating limited growth in public interest.

Bitcoin network active addresses, 7-day average. Source: Coin Metrics

Spot Bitcoin ETF Accumulation and Exchange Deposits

Some analysts expect that the substantial accumulation of spot Bitcoin exchange-traded funds (ETFs) could trigger a "supply shock". However, this prospect does not fully explain the large BTC deposits still held on exchanges, which remain high. The current estimates range from 1.9 million to 3 million BTC, varying based on the custody activities of companies like Coinbase.

Even if spot ETFs continue to ambitiously accumulate $2 billion per month, there is still at least $12.92 billion available in foreign exchange reserves. Predicting the exact price that would trigger a large-scale sell-off remains challenging. However, it can be imagined that more BTC will enter exchanges, and some ETF holders may choose to sell their positions after achieving significant gains.

Traders will need a combination of factors - including lower interest rates, improved mining profitability, and strong ETF accumulation - to have enough confidence to increase their Bitcoin positions and push the price to break through the $70,000 threshold.