Bit and other major cryptocurrencies have experienced sharp price fluctuations amid rising tensions in the Middle East, following a controversial report on Tether.

These events have resulted in significant losses for traders using high leverage, with the daily liquidation amount soaring to around $380 million.

Tether denial fails to mitigate Bitcoin and altcoin plunge

On October 25, the Wall Street Journal reported that the U.S. Department of Justice is investigating Tether. According to the report, the investigation is related to allegations of illegal activities facilitated through Tether's platform.

Tether strongly denied these allegations, calling the article "reckless" and based on "unfounded claims." It criticized the article for relying on unverified sources and emphasized that there is no official confirmation. Tether's USDT is the largest stablecoin in the industry, with a market capitalization of around $120 billion.

"Tether regularly collaborates directly with law enforcement agencies to prevent bad actors, terrorists, and criminals from abusing USDt. If we were under investigation as claimed in the article, we would know about it. As such, the claims in the article are clearly false," said Tether CEO Paolo Ardoino in a statement.

Read more: The Best Stablecoins Guide for 2024

This news led to a bearish market, halting Bitcoin's attempt to break through $70,000 - a level not seen in 3 months. According to BeInCrypto data, the Bit price plummeted sharply, reaching a daily low of $66,500, and has since rebounded slightly to around $66,932 at the time of reporting.

Other major digital assets also saw declines. Solana, Ethereum, Avalanche, and Binance's BNB each lost more than 4%.

Meanwhile, investor confidence has taken an additional hit due to the escalating tensions in the Middle East. Israel's recent announcement of direct airstrikes against Iran in response to missile attacks has raised concerns that the ongoing hostilities could escalate into a wider regional conflict.

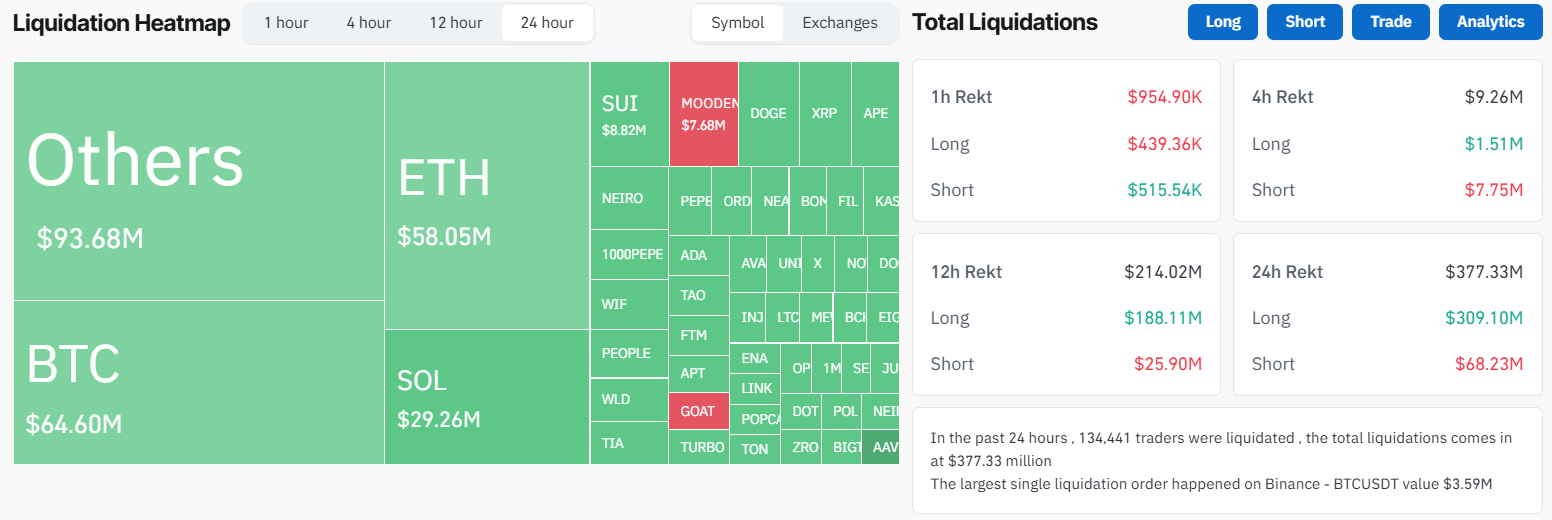

These factors combined have resulted in a daily liquidation amount of around $380 million, with the majority of the losses incurred by long traders who had bet on price increases. Long traders suffered $310 million in losses, while short traders lost $68.19 million.

Read more: Bit Price Prediction 2024/2025/2030

According to Coinglass data, altcoins suffered the biggest impact, with liquidations exceeding $90 million. Bit and Ethereum experienced $65 million and $58 million in liquidations, respectively.