Bitcoin has been engaged in a persistent struggle to surpass the $70,000 mark, but its recent attempts have ended in failure. These failures have dealt a blow to long traders, who have experienced significant liquidations.

Nevertheless, the overall market sentiment remains highly optimistic, and traders continue to maintain a positive outlook on the potential for further Bitcoin price increases.

Aggressive Bitcoin Investors... Defeated by Geopolitical Issues

Over the past 24 hours, Bitcoin has experienced a 2% price decline, leading to $50 million in long liquidations. This liquidation event has been the most significant loss for long traders over the past two weeks, reflecting the challenge of maintaining price support at the $70,000 level. The recent decline has impacted investor sentiment, and some traders have started to consider the possibility of further downside.

This wave of long liquidations underscores the volatility inherent in Bitcoin's price movements. Even a slight decline can trigger a significant market reaction. However, the persistent efforts of long traders are noteworthy.

Many are maintaining their positions, suggesting a belief that Bitcoin can overcome these challenges and continue its upward trajectory. This resilience indicates that market confidence is largely maintained despite the short-term adversity.

Read more: What Happened During the Last Bitcoin Halving? 2024 Predictions

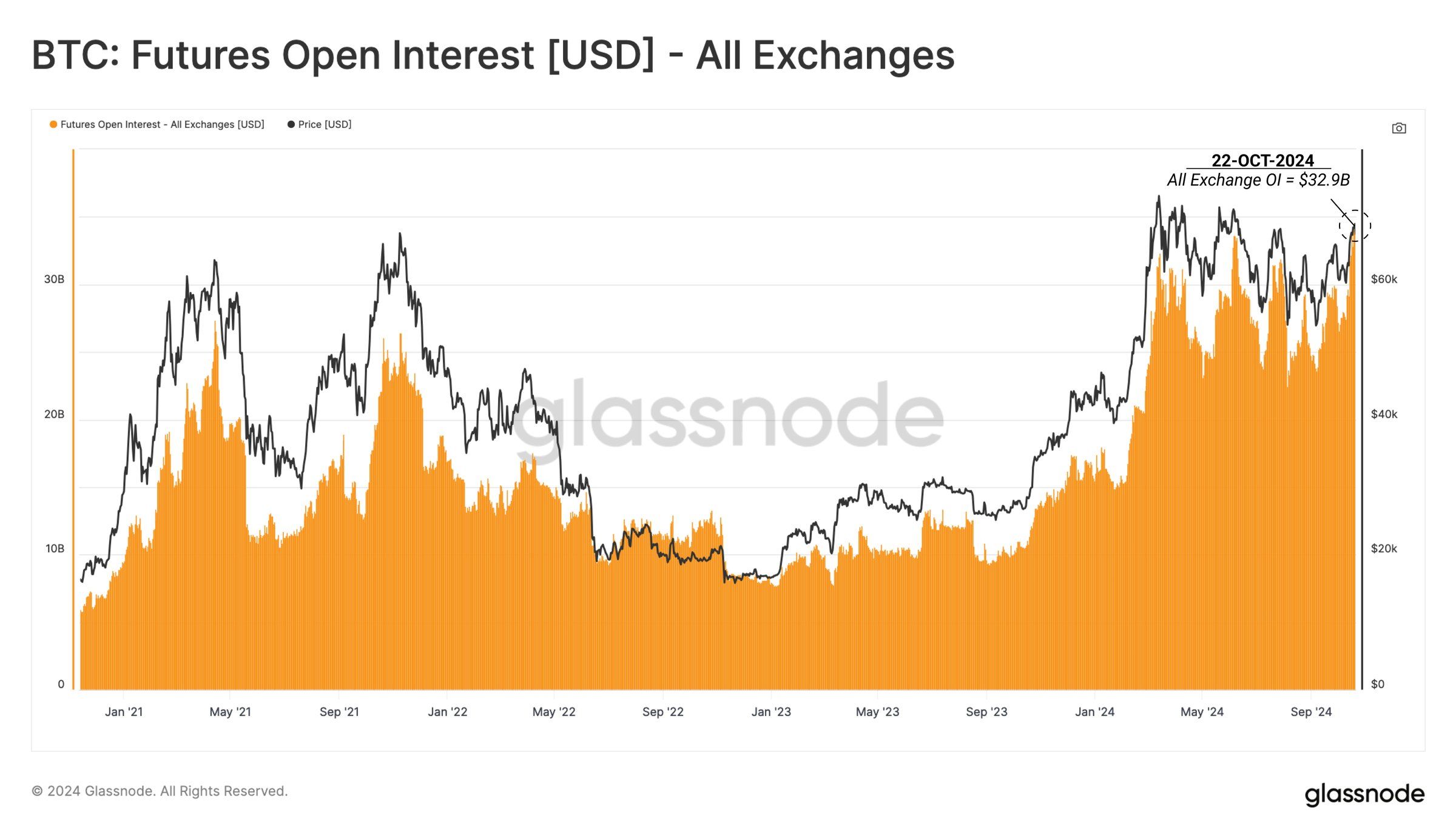

Bitcoin's macroeconomic momentum appears strong, with open interest reaching an all-time high of $32.9 billion. This record-high open interest reflects a high level of participation among traders, suggesting that more capital is flowing into Bitcoin despite the recent liquidations.

This elevated open interest indicates that Bitcoin's recent volatility has not undermined traders' confidence. Instead, both institutional and individual investors are committing substantial capital to support Bitcoin, reflecting a belief in the asset's long-term potential.

BTC Price Prediction: Increasing Upside Breakout Potential

Currently, Bitcoin is trading at $67,007, approximately 10% below its all-time high of $73,800. At this level, BTC is approaching a possible breakout from a descending wedge pattern, and this technical setup is poised for a major price movement. If it breaks out of this pattern, Bitcoin could initiate a strong rally towards $73,000.

The wedge pattern presents a potential 27% rally, setting a target price of $88,185 for Bitcoin. While this ambitious target is achievable, a more immediate goal is for BTC to establish its upward trajectory by breaking through the all-time high of $73,800.

Read more: Bitcoin Halving History: Everything You Need to Know

However, Bitcoin is still struggling to achieve a clear breakout, and $67,000 is a crucial support level. Failure to maintain this support could see BTC drop to $65,000, which could delay the accumulation of the upward momentum necessary for a breakout.