Bitcoin's price has been struggling to break above $70,000, which is an important level for it to leap to new all-time highs. Despite multiple attempts, BTC has failed to maintain a firm footing above this barrier, causing its upward momentum to slow down.

However, signs of large holders getting involved are emerging, which could create new impetus.

Bitcoin Whales Driving Optimism

According to recent data from the cryptocurrency online data platform Santiment, retail traders have been offloading their Bitcoin, while whales appear to be capitalizing on this decline. This shift in trading behavior is significant, as it suggests that while large players are accumulating BTC, retail traders are reducing their holdings. The number of wallets holding over 100 BTC has increased by 1.9% in the past two weeks, indicating that whale accumulation is underway.

The increase in large wallet addresses is a bullish signal. When whales accumulate, it typically reflects their confidence in the asset's future growth potential.

"As the key stakeholders in crypto continue to buy up the coins being sold by retail traders, this has historically led to upward results," Santiment noted.

Read more: What Happened During the Last Bitcoin Halving? 2024 Prediction

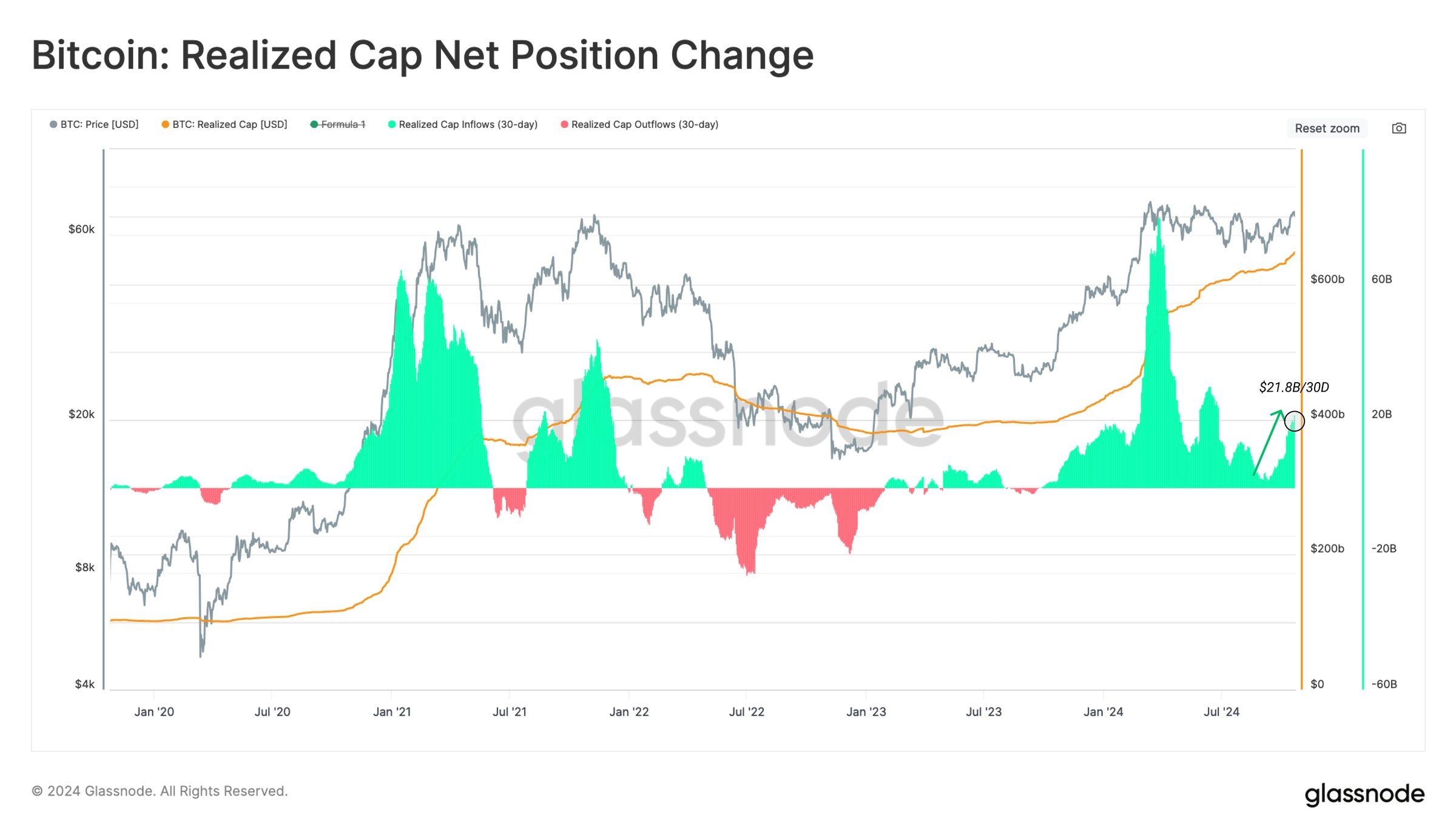

Bitcoin's macroeconomic tailwinds are also showing strong support signals, particularly in terms of capital inflows. Net inflows to Bitcoin have increased by 3.3%, or around $21.8 billion, over the past 30 days. This surge has pushed Bitcoin's realized market capitalization to a new all-time high of over $646 billion, indicating substantial capital is flowing into the market.

The rise in Bitcoin's realized market capitalization is expanding the liquidity base across the asset class. Meaningful capital inflows are supporting the rise in BTC prices, and large inflows suggest sustained interest from both institutional and retail investors. Increased liquidity acts as a buffer against volatility, reducing sharp sell-offs and supporting the asset's upward trajectory.

BTC Price Forecast, Setting Sights High

Bitcoin is currently trading at $67,553, with efforts to breach the $70,000 mark continuing over the past 10 days. Securing a support level at $68,248 is crucial for BTC to move towards the next resistance at $71,367, which could determine the path to a new all-time high.

The uptrend line is providing consistent support, suggesting a move to this resistance level could unfold within a few weeks. The pattern of whale accumulation reinforces this bullish outlook, indicating that BTC prices can rise regardless of the timeframe.

Read more: Bitcoin Halving History: Everything You Need to Know

However, if Bitcoin loses the support of the uptrend line and falls below $65,292 due to macroeconomic factors or profit-taking, the bullish outlook would be invalidated. Such a decline could send Bitcoin to $61,868, creating additional uncertainty about the price direction.