$CKB Profile

Token Name | $CKB |

Blockchain | Nervos |

Max Supply | ∞ |

Current Circulating Supply | 45 billion |

Current Market Cap | $580 million |

Market Cap Rank | 137 |

Token Price | $0.0128 |

Token Utility | Miner Rewards, On-Chain State Maintenance Fees, Transaction Gas, Governance Participation, Nervos DAO |

Major Trading Platforms (CEX) | Binance, Upbit, WhiteBIT (Ukraine) |

Team Background: The Group of People in China Who Understand Ethereum the Most

Nervos was co-founded in 2018 by Terry Tai, Kevin Wang, Cipher Wang, and Daniel Lv, with Jan Xie responsible for the overall blockchain architecture.

From right to left: Jan Xie, Cipher Wang, Terry Tai, Daniel Lv, Kevin Wang

Terry serves as the team's CEO. He initially worked as a backend engineer at software optimization company Omniquest and advertising agency Intridea, specializing in Ruby language. He later founded multiple blockchain software companies and is the founder and host of the well-known Chinese blockchain podcast Teahour.

One of the co-founders, Cipher Wang, is also the founder of RGB++ and RGB++ Layer, and has developed the Passkey wallet project JoyID, which is currently the most widely used wallet in the Nervos ecosystem and has accumulated 700,000 users, making a significant contribution to the promotion of Nervos and the expansion of Bitcoin.

Kevin Wang, in addition to being a co-founder of Nervos, has also founded the developer training platform Launch School and the decentralized solver coordination platform Khalani Labs. Prior to this, Kevin worked as a software engineer at IBM for 9 years and is highly skilled in technical development.

The core architecture of Nervos is led by Jan Xie, who was a core developer of Ethereum and co-developed one of Ethereum's core protocols, Casper, with Vitalik. He later founded the non-profit organization EthFans to assist in the adoption of blockchain technology in China.

Daniel Lv serves as the Chief Operating Officer of the Nervos team. He was a co-founder and CFO of the well-known Ethereum wallet project imToken, as well as the former CTO of the crypto exchange Yunbi. Daniel also organized and founded the Ruby China community ruby-china.org, and is an important driver of the blockchain industry in China.

This group of top developers has built Nervos together, as Daniel said: "The core developers of Nervos are the ones in China who understand Ethereum the most deeply."

Further Reading: Burying Nervos CKB Ecosystem! The Evolving Ultimate BTC Expansion Solution RGB++ | Project Introduction

Financing Situation

Nervos has raised a total of $100 million in two rounds of financing so far.

In August 2018, Nervos raised $28 million in a seed round led by Polychain Capital, with participation from Sequoia China, Wanxiang Blockchain, Blockchain Capital, Polychain, and Multicoin.

In October 2019, Nervos completed a $72 million public fundraising on the Coinlist platform.

Currently, Nervos has used these funds to build a fairly complete ecosystem, and this year it has become an important expansion solution for the Bitcoin mainnet (RGB++).

Technical and Architectural Summary

In this section, we will clarify Nervos' architecture and quickly introduce you to RGB++ and the core technical architecture, Cell.

Not adopting POS, following and optimizing BTC's POW mechanism

The Nervos team believes that the POW mechanism is more capable of ensuring blockchain security than the POS mechanism, as it is almost impossible to replicate the same computation results and occupy 51% of the computing power. Therefore, Nervos adopts a permissionless POW mechanism, using the optimized NC-MAX algorithm. Anyone can participate in block verification by purchasing mining machines, similar to Bitcoin mining.

However, the POW mechanism inevitably involves mining and miners, and the economic model needs to ensure an incentive system, otherwise the lack of miner rewards may lead to the entire chain being stalled. We will explore Nervos' economic model in the next section.

Understanding the Evolution of RGB++

The technical evolution of RGB++ has transformed Nervos from a simple POW public chain into a powerful expansion solution for the Bitcoin Layer2.

RGB Protocol

The RGB protocol is a Turing-complete distributed computing protocol developed by the LNP/BP Standards Association, serving as a smart contract solution for the Bitcoin mainnet and Lightning Network. Its key features are that it keeps all transaction verification data on the client-side and uses the one-time sealing principle of Bitcoin's UTXO to ensure transaction uniqueness. Although it has high privacy and security, due to low data availability and difficulty in multi-party interaction, it has not been widely adopted in the market.

RGB++

To address the limitations of the RGB protocol, Nervos co-founder Cipher proposed the RGB++ solution, which binds the UTXO and Nervos Cell in a homomorphic way and moves the client-side verification to the Nervos blockchain. This allows RGB++ to maintain security while improving data availability, with transactions appearing simultaneously on both the Bitcoin and Nervos chains. Nervos thus becomes a shadow chain of Bitcoin and, through its Turing-completeness, expands the capabilities of the Bitcoin mainnet.

RGB++ Layer

-

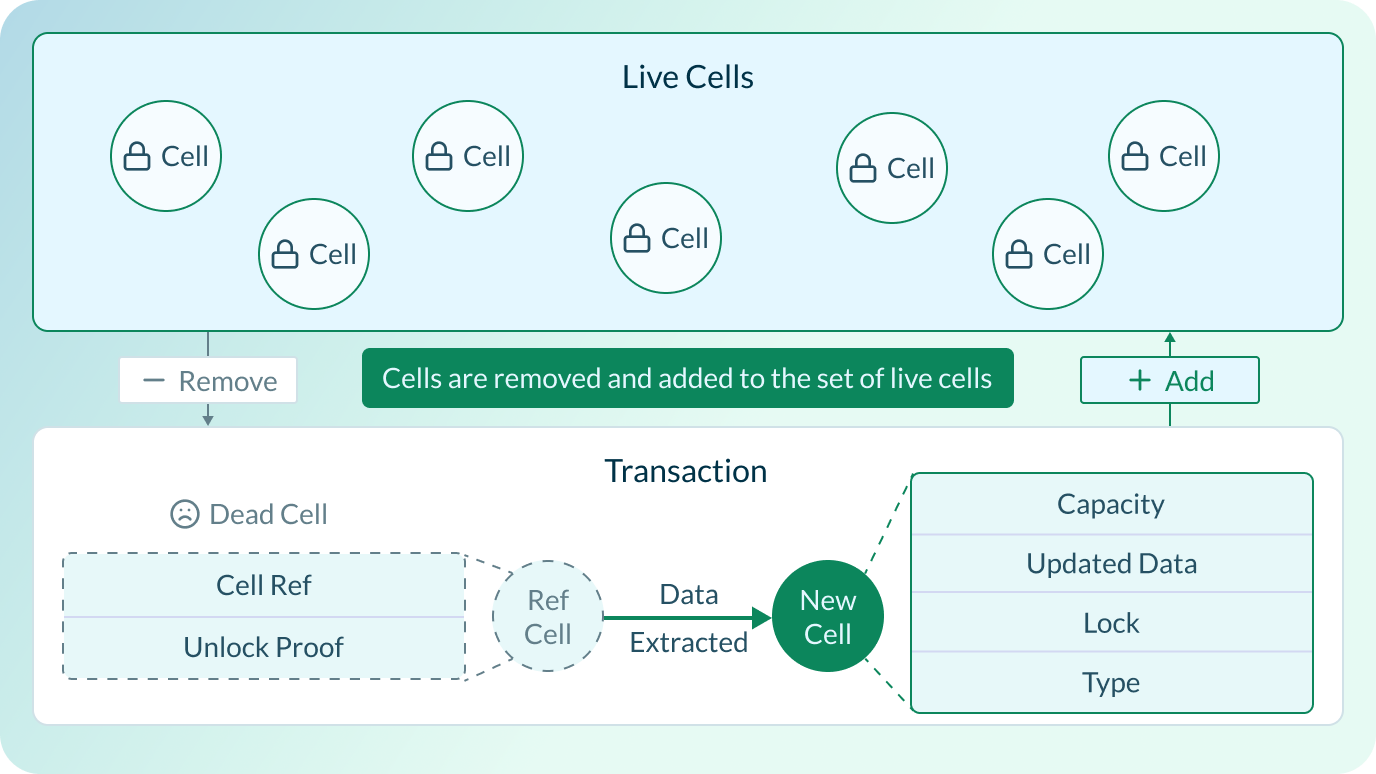

The Key to Nervos' Transformation: Cell Architecture

Cell is an optimized version of the UTXO model developed by the Nervos Network, inspired by the Bitcoin UTXO model, with additional expanded functionalities. Each Cell carries the following key information:

-

Capacity: Represents the on-chain space occupied by this Cell, 1 CKB = 1 byte

-

Data: Stores data of any form and historical transaction states, which can be read and modified

-

Type: Serves as the rules for changes to the Cell in a transaction, preventing malicious acts

-

Lock: The ownership verification program for the Cell (= the lock of UTXO)

This architecture allows Cells to be more than just simple value storage units, but complete solutions that can execute transactions, smart contracts, and store historical data. Particularly, the design of the Data field solves the data availability issue in the original RGB protocol, enabling Nervos to successfully integrate the RGB++ protocol and significantly expand the application scope of the UTXO model.

$CKB Economic Model

Initial Issuance

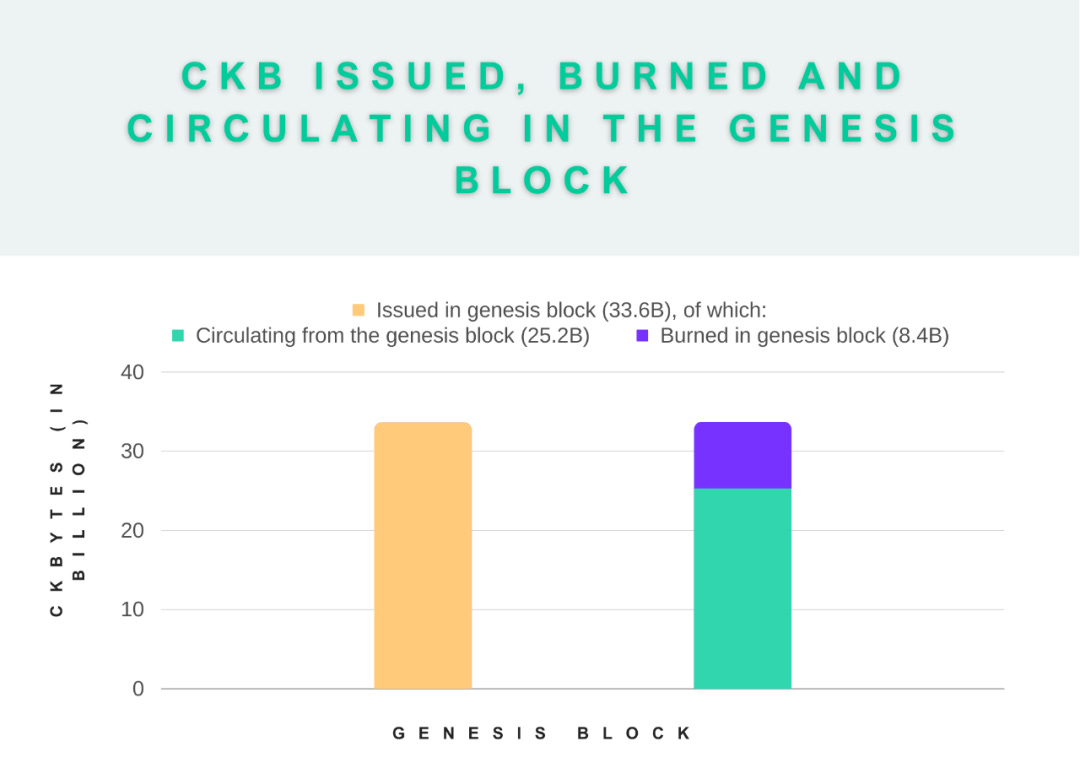

At the time of Genesis Block creation (November 2019), a total of 33.6 billion $CKB tokens were issued, of which 8.4 billion (25%) were burned, leaving 25.2 billion (75%) in circulation.

However, the tokens burned during the initial issuance were not destroyed, but rather forcibly encoded as 5.04 billion (15%) of occupied capacity and 3.36 billion (10%) of liquid state. This was done to ensure that even if no $CKB tokens were used to store state, or if all circulating tokens entered the Nervos DAO, the miners and the treasury would still receive revenue, serving as the last layer of protection.

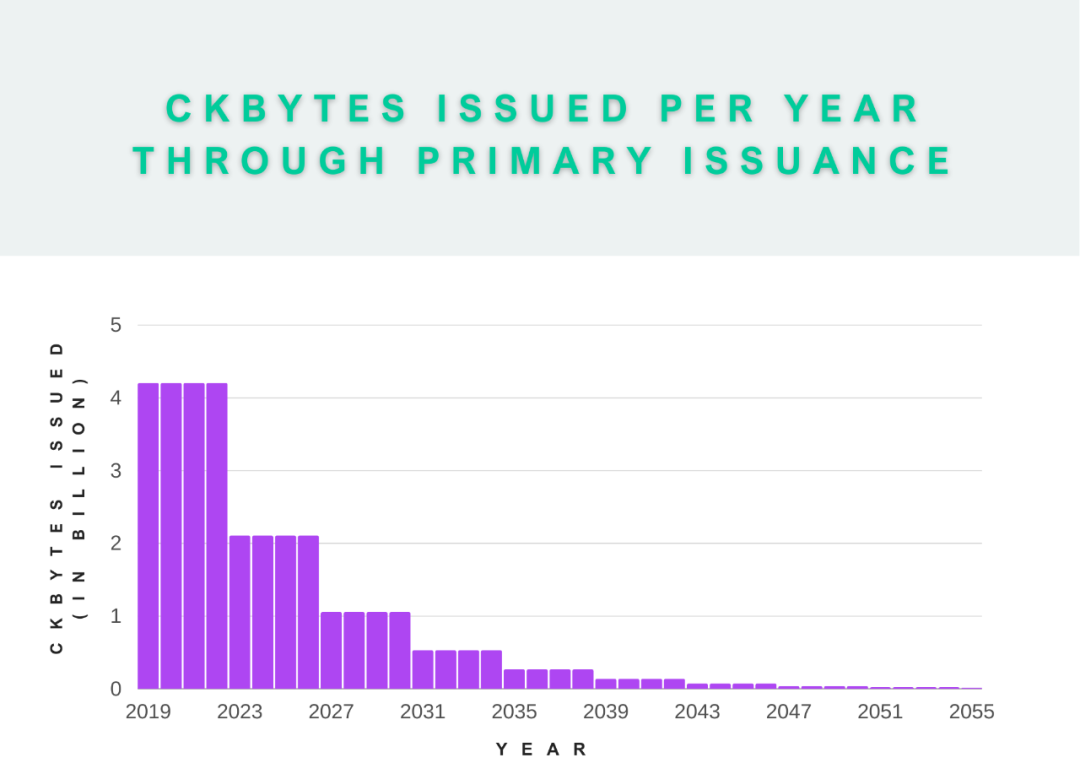

Primary Issuance

The total primary issuance is also 33.6 billion, and similar to Bitcoin, it is halved every 4 years. The first halving was completed in November 2023, reducing the annual issuance from 4.2 billion to 2.1 billion. In terms of proportions, the first 4 years saw 50% of the issuance, the next 4 years saw 25%, then 12.5%, and so on.

The tokens from the primary issuance need to be mined, and they serve as an incentive for miners to maintain the Nervos network, especially in the early stages when the rewards are high, which encourages miners to join the ecosystem.

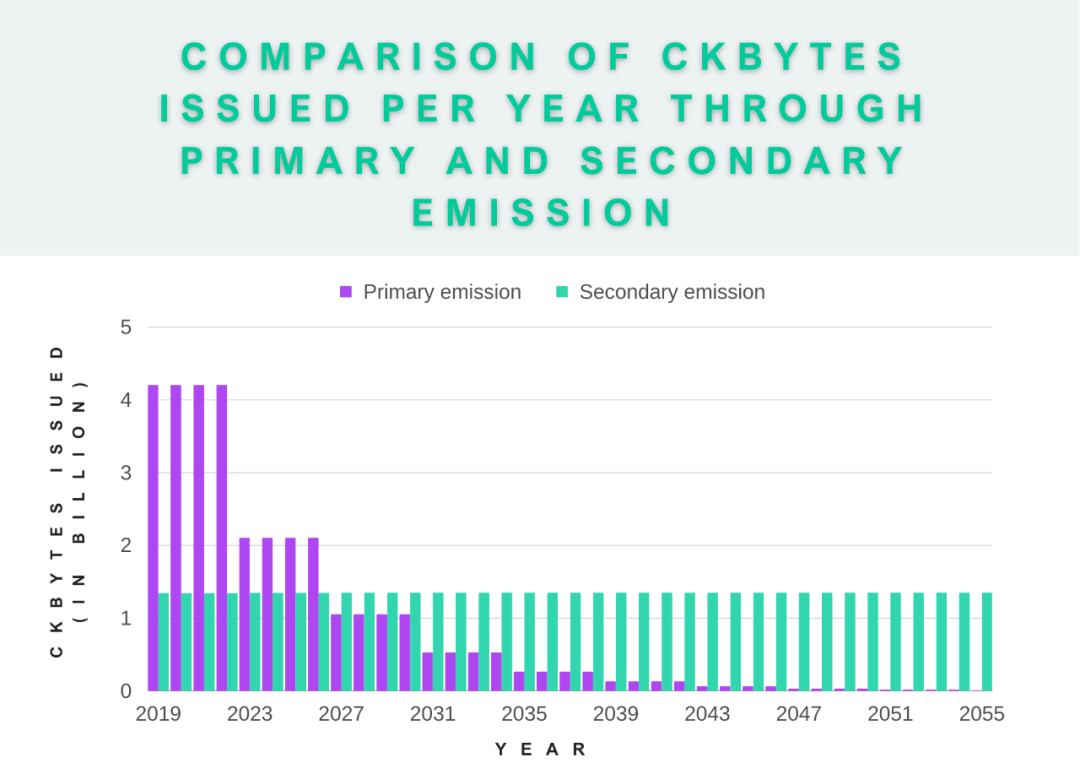

Secondary Issuance

In the secondary issuance, 1.344 billion $CKB will enter the market each year, and due to this mechanism, the total $CKB supply has no upper limit.

From the image, we can see that after the second halving (November 2027), the secondary issuance amount will exceed the primary mining rewards, so the secondary issuance will become the main source of rewards, replacing the primary issuance in the medium term.

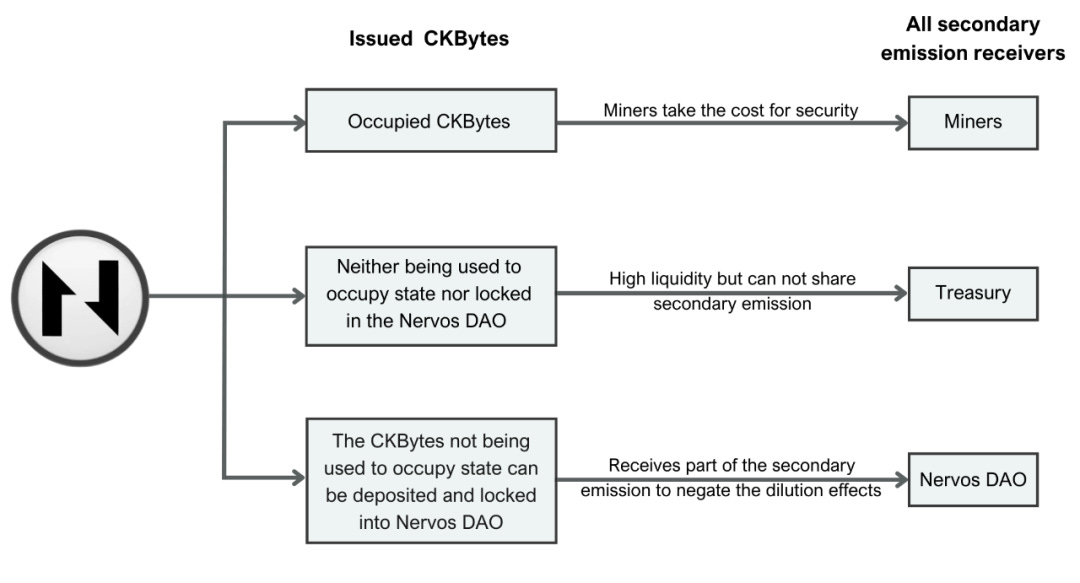

The distribution is based on the current state of $CKB tokens:

-

Distributed to miners: Proportional to the on-chain state occupied (each Cell will occupy $CKB)

-

Distributed to Nervos DAO stakers: Proportional to the amount locked in the Nervos DAO

-

Distributed to the treasury: Proportional to the circulating supply

For example, if currently 40% of $CKB is occupied on-chain, 35% is staked in the Nervos DAO, and 25% is in circulation, the secondary issuance will be distributed 40%, 35%, and 25% to miners, Nervos DAO stakers, and the treasury, respectively. The portion distributed to the treasury will be decided by community governance, and if no hard fork is executed, these tokens will be burned.

Nervos DAO

Some may wonder, with the secondary issuance, won't $CKB be continuously diluted? How can I ensure the value of my tokens? This has different interpretations for different roles in the ecosystem:

-

Asset holders occupying on-chain state: Compared to paying a state rental fee to miners, paying a fee to ensure on-chain state (it feels a bit like depositing money in a bank, except the bank is the Nervos blockchain)

-

Miners: Maintaining and verifying the network, they are the ones receiving the rental fees

-

Holders of $CKB not occupying on-chain state: Can participate in the Nervos DAO to receive the secondary issuance to offset token dilution, which is also the main function of the Nervos DAO.