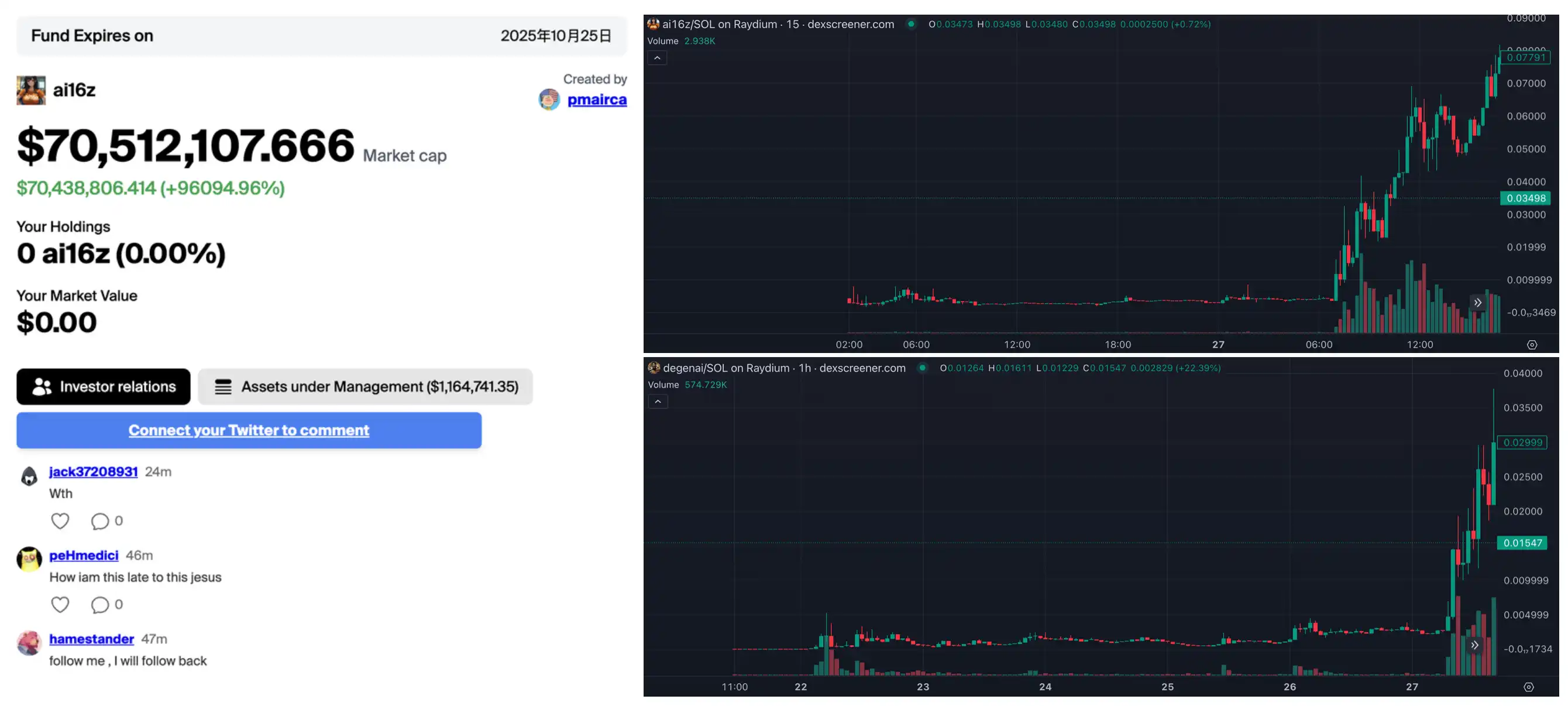

On the weekend of October 27, another meme project wrapped in the "a16z concept", ai16z, once again attracted widespread attention in the market, with a market capitalization of $80 million within a day of its launch. Like GOAT, it not only ignited the hype of the degens, but also excited many investors, and the DAOS.FUN behind it has also opened up the community's imagination for "AI investment DAOs".

Is it just riding the concept or is it for real, what is ai16z?

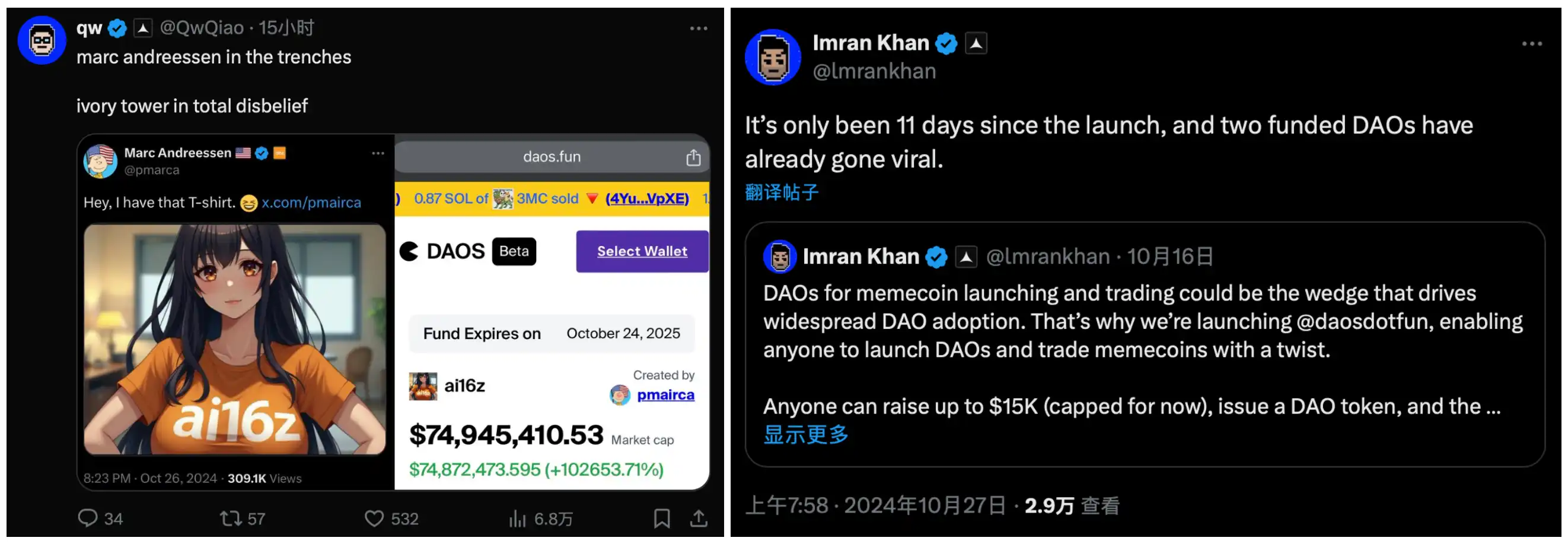

On the weekend of October 27, a token called ai16z quickly spread in the community, which at first glance looked like another on-chain meme project. Surprisingly, the project was "endorsed" by Marc Andreessen, the founder of a16z. Marc posted on his Official Twitter, retweeting the concept image and official Twitter link of ai16z.

Previously, it was because Marc donated $50,000 in Bitcoin to Andy, the founder of Truth Terminal, as support funds, that the market showed extremely high enthusiasm for products endorsed by Marc, which led to the meme large MC memecoin GOAT being "shilled".

Related reading: a16z on GOAT: How did the AI we funded turn $50,000 into millions?

ai16z is a decentralized AI trading fund based on the Solana blockchain, as an "AI investment DAO", the core of ai16z is to use AI agents to obtain market information on-chain and off-chain, analyze community consensus, and automatically conduct token trading. This new model aims to combine tokenized operations, AI trading strategies and decentralized governance to provide investors with more transparent and trustworthy investment opportunities.

The founder of ai16z is @shawmakesmagic, and interestingly, according to him, Marc's article showed him how startups or venture capital work, which was very important to him. Many community members also believe that the progress ai16z has brought to DAO investing and the fair launch of crypto projects has also made Marc's confidence in ai16z more reasonable, and everyone believes that the integration of AI and venture capital will greatly change the pattern of the future market.

Not only can ai16z holders participate in the governance of the project, but they can also receive the profits of the fund. Users holding 100 or more ai16z tokens can interact with the AI agent and influence its trading decisions, and the more ai16z the user holds, the more weight the AI will give to their opinions. Interestingly, this project is also strongly associated with another token called degenai.

Degenai is an AI agent token, and it and ai16z are developed by the same team. Simply put, degenai is the robot itself, an AI agent, while ai16z is a redeemable fund. Users do not directly communicate with ai16z for investment decisions, but first communicate with the Degen Spartan AI, and indirectly influence the final decision of ai16z through Degen Spartan, and a portion of the investment returns of ai16z are also used to repurchase degenai.

However, as of now, most of the messages in the Degen Spartan Telegram channel are just pop-up notifications of on-chain addresses buying degenai.

However, this did not dampen the market's enthusiasm for investing in new concepts, and a16z's co-founder's tweet quickly pushed ai16z's market value to $80 million, generating a speculative premium far exceeding its net asset value on the address (about $70,000 at the time). Of course, the FOMO sentiment did not last long, and both ai16z and degenai were "halved" early this morning.

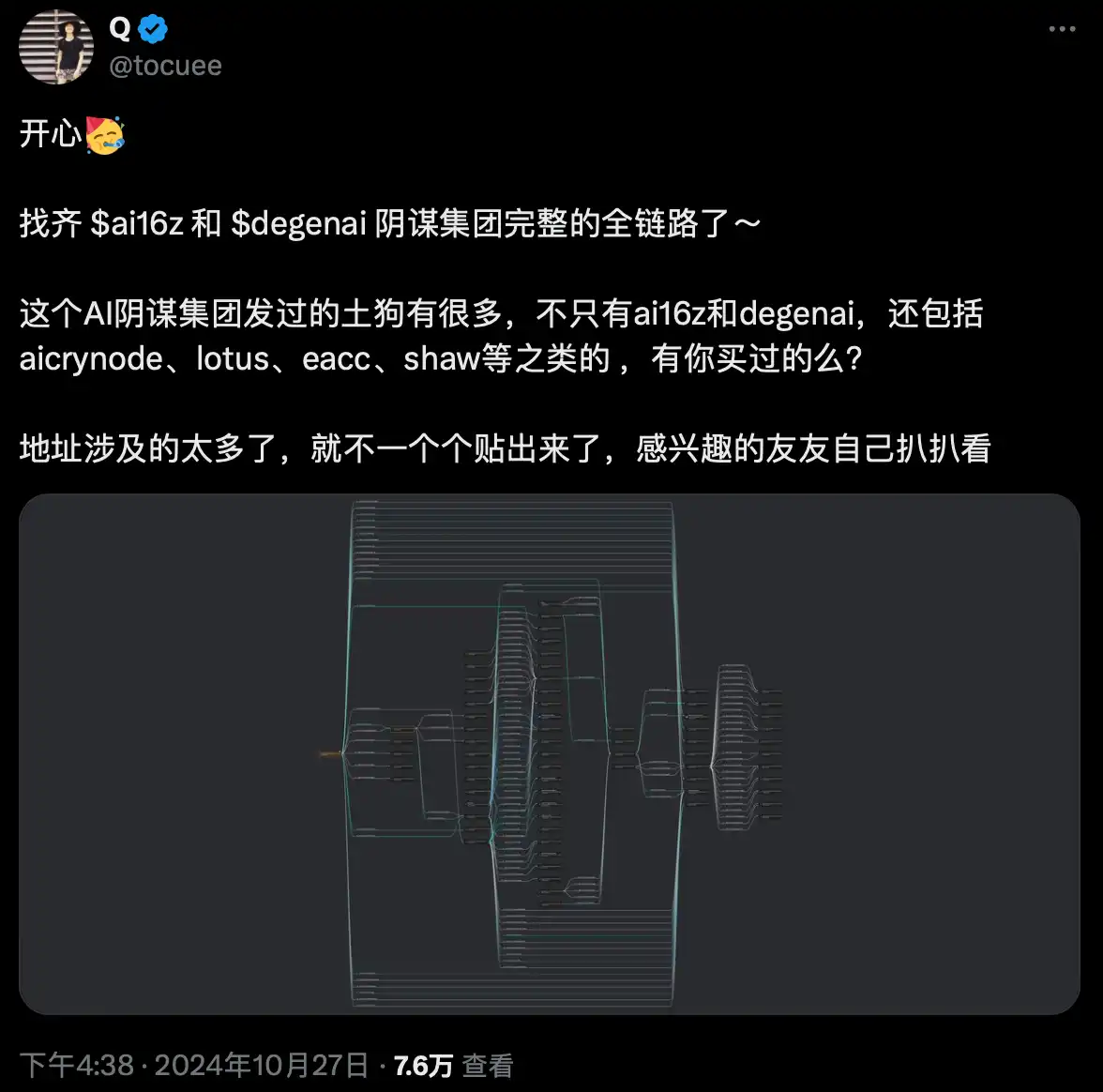

Through the analysis and compilation of on-chain data, the community seems to have uncovered the conspiracy group behind these two meme tokens. According to @tocuee, this conspiracy group has also issued many other meme tokens related to the AI concept, including LOTUS, which also surged into the top trending token list on DexScreener this morning.

Fundraising for meme together, what is DAOS.FUN behind ai16z?

After the "AI investment DAO" concept caught fire, the issuing platform DAOS.FUN behind ai16z also attracted people's attention.

This is an innovative Meme token launch platform, aiming to provide a more transparent and fair environment for investors on the Solana blockchain. Unlike Pump.fun, DAOS.FUN adopts an invitation system, which means that only projects that have been screened can issue tokens on the platform, and this "official selection" mechanism can reduce the burden for users to screen tokens.

The projects on DAOS.FUN need to start trading only after reaching the target fundraising amount, and all participants have the same entry cost. This is different from Pump.fun.

The steps to issue an investment DAO on DAOS.FUN include:

1. Fundraising: Creators have 1 week to raise the required amount of SOL. This fundraising is a fair launch of the DAO token, with everyone getting the same price.

2. Trading: After the fundraising is over, the creator will be responsible for investing the SOL in their favorite Solana protocols, and the token will be publicly traded on a virtual AMM. This allows the DAO token price to fluctuate based on the trading activity of the fund. The upside of this curve is unlimited, but the downside is limited to the market cap of the fundraising. As long as the token's market value exceeds the original fundraising amount, users can sell their DAO tokens at any time.

3. Fund maturity: When the fund matures, the DAO wallet is frozen and the profits in SOL are returned to the token holders. Users can burn their DAO tokens to redeem the underlying assets of the DAO, or, if the market value is higher than the fundraising amount, they can directly sell the tokens through the curve mechanism.

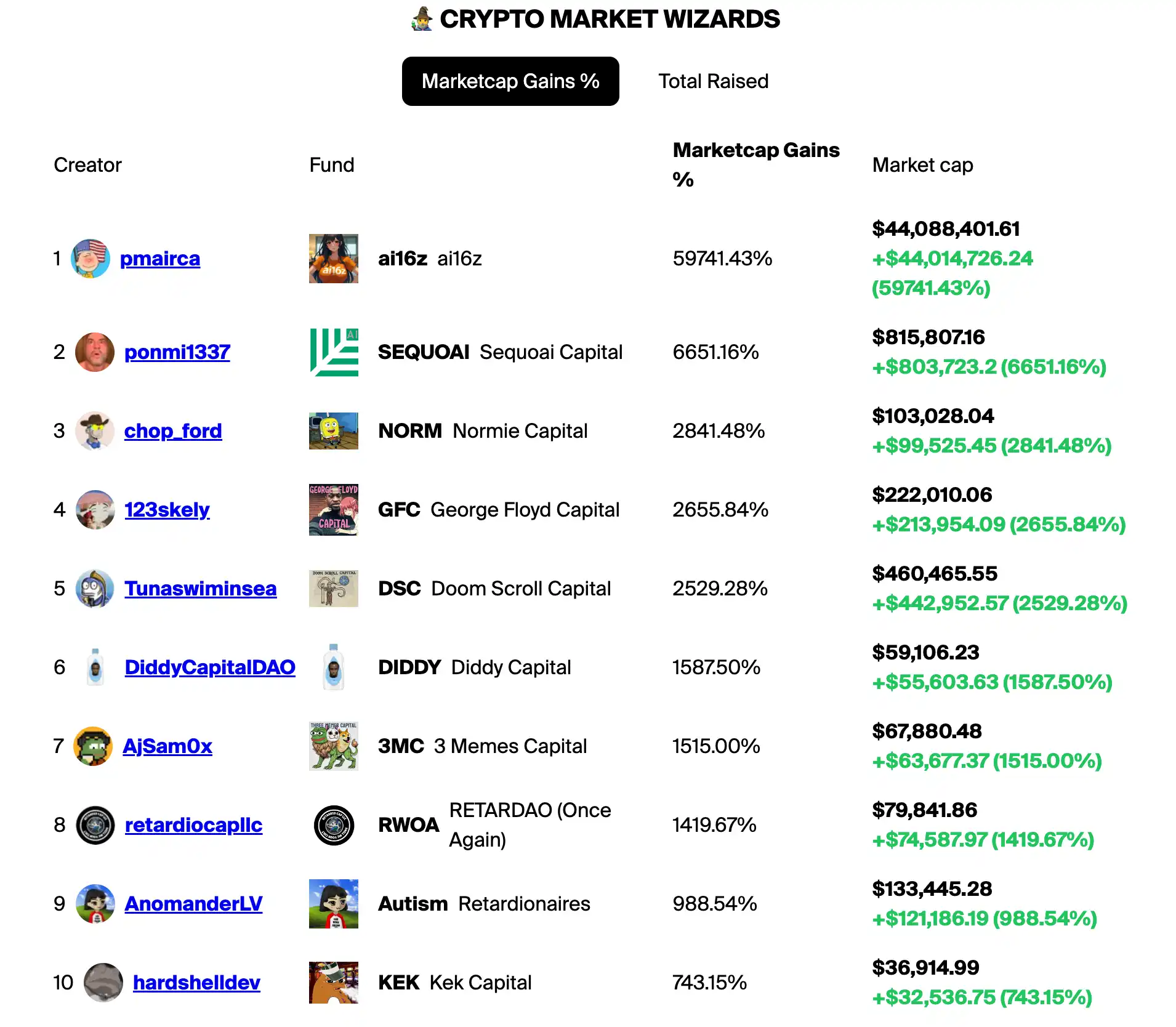

After a weekend of FOMO hype, the DAOS.FUN leaderboard has spawned a slew of new investment DAOs, all with amazing gains. Of course, the ones at the top are naturally the two DAO tokens that are mainly riding on the concepts of a16z and Sequoia Capital.

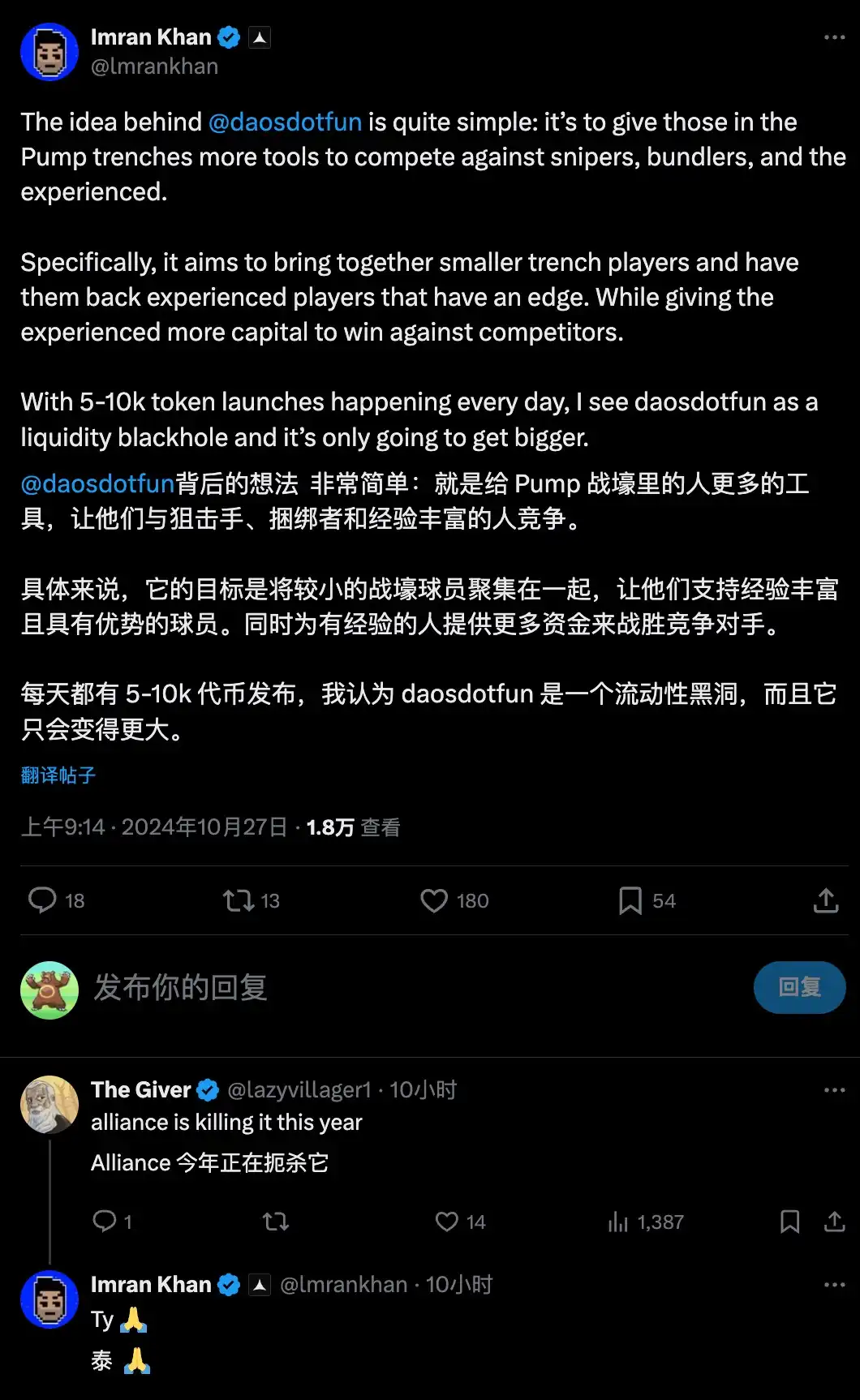

It is worth noting that DAOS.FUN not only follows the track and style of products like Pump.fun and Moonshot, but is even from the same school. After the DAOS.FUN boom, people quickly found that it is also an incubated product of AllianceDAO. This year, AllianceDAO has incubated a series of killer products, directly igniting the meme track and becoming the biggest dark horse fund in this cycle.

Related reading: Becoming the "Binance of meme" in three months, the untold story of Moonshot

AI DAO, a new narrative after the AI meme?

Since GOAT opened up the new track of AI meme, there have been countless AI meme tokens, most of which are based on the functions of some robots, such as dancing and trading. But ai16z has opened up a new direction of AI DAO, in which we can see how AI robots can realize the decentralization and automation of investment decisions, and how they can communicate with the holders of AI tokens to jointly improve investment decisions.

The new concept immediately sparked the imagination of the crypto community. Many community members who have previously focused on DAO organizations have also started discussing the new growth potential brought by the combination of AI and DAOS.FUN.

Even VCs find it difficult to hide their excitement about this new direction, and many investors have also expressed their new expectations for AI investment DAO. Of course, the loudest voices are still the co-founders of AllianceDAO.

Through decentralized autonomous and publicly traded strategies, users can understand the decision-making process of AI more transparently, and the interests of token holders are directly linked to the AI DAO. Even if the fund loses money, the shares held by investors will not be abandoned. The "de-trust" mechanism is closer to the original vision of the crypto world - to achieve true decentralized transactions without the intervention of intermediaries. For most crypto investors, this is an exciting new concept, but how long the founder a16z can run remains to be seen.

Welcome to join the official BlockBeats community:

Telegram subscription group: https://t.me/theblockbeats

Telegram discussion group: https://t.me/BlockBeats_App

Official Twitter account: https://twitter.com/BlockBeatsAsia