Yesterday, BTC consolidated around the $67,000 level for a day. It started to rise after 9 pm and broke through to $68,300 by early this morning, but has since seen some pullback.

Since October 21, BTC has seen two effective bottom supports, with the support price around $65,000. After the FUD from Tether and negative news from the Middle East this past weekend, the market has quickly digested and recovered, with the overall market recouping its losses by 4 am.

Whether looking at the weekly or daily charts, the trend is upward, just with varying degrees. Short-term volatility is inevitable, so everyone should hold spot positions for the long term.

Currently, the BTC daily chart is still attempting to break through the $70,000 resistance level, but has not yet done so effectively. The market can only establish a new trend if it can break out of the $65,000-$70,000 range.

Looking at the 4-hour level, it is still in a consolidation adjustment, and there are no clear breakout signals yet. As I mentioned before, if a breakout were to occur, it would happen quickly, not in a drawn-out manner.

The FUD around ETH has been growing louder recently.

Indeed, from the beginning of this cycle until now, capital's attention to ETH has been lukewarm. It's not that there is none, but it is far less than the previous cycle. Even with the approval of an ETH ETF, which is an epic positive, it has not been able to generate much more interest from capital.

If Ethereum maintains its current state (both internally and externally), even with an ETF, it will be difficult to regain a trading volume share of over 50% compared to BTC. The market has already rehearsed this scenario after the FOMO in March this year.

Under what circumstances can ETH catch up?

Whether ETH can catch up after BTC takes off depends on the degree of capital preference, coupled with on-chain comprehensive activity data to confirm. When can it catch up:

1. ETH's exchange trading volume share reaches 50% or more of BTC's (currently 35%)

2. The number of active addresses on the chain reflects the prosperity of the ETH ecosystem, and it needs to form a sustained upward trend

3. The number of transactions and transaction volume need to expand synchronously, especially the transaction volume, which is an important indicator of whether large capital is participating

Current market

The financial markets will face a series of closely watched data and events, any of which could shake up the market landscape. First, on November 1, the US non-farm payroll data and unemployment rate will be released, which, as a barometer of economic health, will directly affect market sentiment and expectations for future trends. Immediately after, on November 5, the results of the US presidential election will have a profound impact on policy direction and market confidence, and any uncertainty in the election results could exacerbate market volatility.

Subsequently, on November 8, Federal Reserve Chairman Powell will chair a monetary policy press conference and announce the Fed's latest rate cut decision. This step not only concerns the direct economic effects of interest rate changes, but also how the market interprets the Fed's stance on the future economy and monetary policy.

Caught in the crossfire of this series of "super events", whether the market will enter a bull market feast or encounter an unpredictable "black swan" event has become the focus of market attention.

The current market structure is:

1. Ethereum trend suppressed: Altcoin capital is diverging, and the major altcoins dare not make any moves!

2. Bitcoin institutional capital concentrated trading: Sucking up the existing supply, the data shows that Bitcoin capital is the most active and concentrated!

3. Lack of sustained capital effect: Secondary capital is flowing out of the chain! The meme market has ignited a localized short-term heat! (Stay away from domestic startup plates, small-cap PVP is serious)

The essence of the secondary market

The market does not reject "narratives". If the technology cannot be put into practice, the application cannot be implemented, and the business cannot be closed, and investors' investment expectations cannot be "delivered", then the "narrative" will be dominated by scams and rejected.

It is gratifying to see that narratives are constantly emerging, evolving, iterating and reshuffling, and this endless vitality of Crypto innovation is the best proof of the market's maturity.

Finally

Today I found that group friends have already been worn down by the market and lost confidence. To put it bluntly, it's just constantly losing money, constantly being beaten by the bear market, and constantly being slaughtered.

The longer the market grinds on, the more retail investors will be shaken off.

When the retail investors have given up and started to do short-term trading, the start of the next rally is not far away.

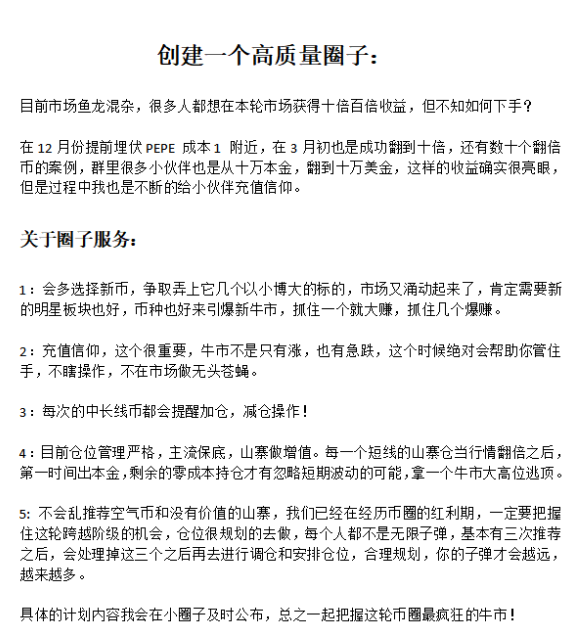

The new discussion group has already been set up! Now we are preparing to reorganize the discussion group, and as long as the overall market returns to an uptrend, there will be many opportunities for altcoins to explode. If you want to join the group, please feel free to message me, and I will add you to the group!

Group size: Temporarily limited to 50 people, mainly spot trading

That's it for the article, if you like it, please give a follow and a like~Also, we have a VIP paid group (spot trading) if you want to join the VIP group, feel free to contact me to learn more!

Scan the code to join the community!