Author: Mu Mu

Since this round of the market, BTC has been singing high, making ETH and some old "value projects" increasingly powerless, with the ETH/BTC once hitting the bottom, which has become the strongest "disappointment" of a large number of veteran crypto enthusiasts, without a doubt. Both the bull and bear markets have gone through, but they have never been able to get over the sluggish ETH, and the dissatisfaction of the crypto community with ETH seems to have reached its peak.

The crypto community has started to circulate a large number of mocking pictures targeting Ethereum

Has the original intention of Ethereum changed?

Although ETH and BTC have different paths and there is not much direct conflict, but since the bear market began, most of the people who have long-term ETH have hoped that ETH can outperform BTC, that is, ETH/BTC can have a good return. According to the experience of the previous two bull markets (2018 and 2021), ETH is mostly able to outperform BTC.

Similar to the mentality of the Ethereum community holding coins to outperform BTC, the original intention or differentiation development strategy of Ethereum is to take a path that the Bitcoin community has not taken and believes is not good to take: a blockchain-based smart contract application platform, and plans to explore blockchain expansion to bring scalability and performance, and develop decentralized applications beyond digital gold.

Similar to some "altcoin" projects that appeared at the time, they all wanted to improve on Bitcoin, with a differentiation strategy or to become a more successful Bitcoin.

Previous screenshot of the Ethereum Foundation's official website

If early crypto users have been paying attention, they must have seen the background image of the Ethereum Foundation's official website above, which looks "very ambitious", with a clear slogan written on it: Blockchain Application Platform, which was the most accurate positioning of Ethereum by the Ethereum community at the time, and the background image seems to be a high-rise building springing up, or foreshadowing the expansion and construction of the blockchain.

Now, some people believe that the original intention of Ethereum has changed, since the Ethereum consensus mechanism has undergone the POS merger, perhaps due to the inability to rise in price, they attribute the decline of Ethereum to the POS formula mechanism, believing that the huge shift from POW to POS is a huge mistake. But in fact, the transition of Ethereum to POS has been in the early roadmap, and is not a last-minute change, it is a choice and plan made under the demand for account model blockchain expansion and extension of the smart contract public chain platform.

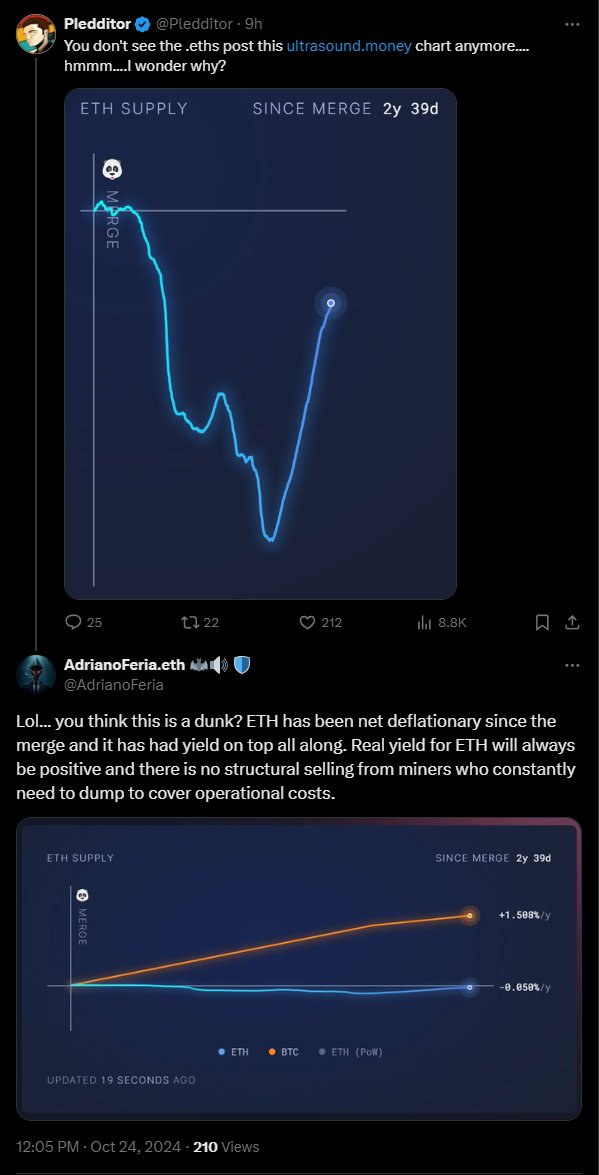

Recently, a major Bitcoin holder on social media has released a chart of the inflation rate trend of Ethereum after the merger, showing that Ethereum's inflation rate has risen rapidly in the past half year, trying to prove the wrong path of Ethereum's merger. But the counterattack came quickly, Ethereum community users released the full picture of the statistical trend of this chart, and compared with the annual inflation rate of Bitcoin (the ratio of new issuance to circulating supply), it became even clearer.

Initially, many people looked down on Ethereum's unlimited issuance, believing that Ethereum would issue an unlimited amount, but the real situation now is that Ethereum has not only not affected the security through the POS merger and EIP1559, but also controlled the inflation, far lower than the current inflation rate of Bitcoin, and has pulled away from other well-known POS public chains.

Ethereum has firmly taken the second throne in Crypto, and has also become the "differentiation object" of many new public chain projects, with many projects also aiming to become a better "Ethereum". It can be said that the Ethereum roadmap has not undergone major changes except for adjustments in the implementation details, and the original vision has also been gradually realized.

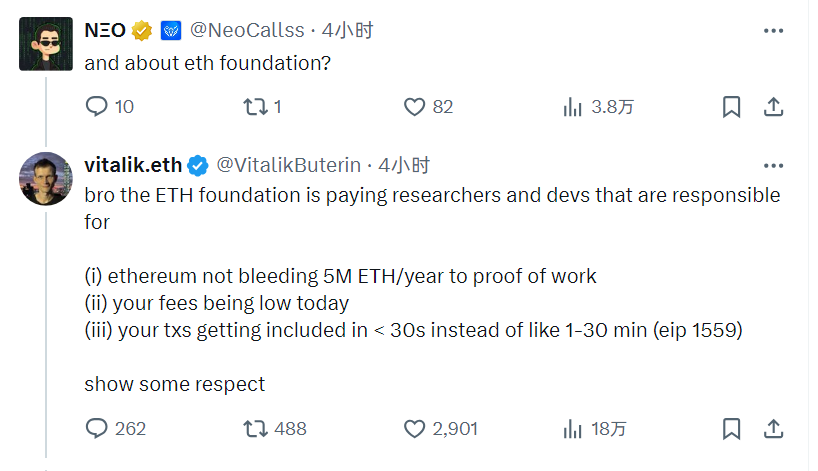

Recently, Vitalik responded on social media to the criticism of the Foundation's outflow, accompanied by 9 pieces of information related to the ETH fundamentals.

Vitalik:

The Ethereum Foundation is paying researchers and developers to work on

(1) No longer losing 5 million ETH per year to the Proof-of-Work (POW) mechanism

(2) Your current fees are very low

(3) Your transactions will be packed in < 30 seconds, not 1-30 minutes (eip-1559)

(4) zk technology allows people to maintain privacy while using ETH

(5) Account abstraction technology will allow ordinary people to use ETH safely without seed phrases or SBF-style centralized failure points

(6) Local ETH activities around the world, many of which hardly mention the Foundation's name

(7) ETH has never gone offline due to DoS attacks and consensus failures since 2016

(8) Various security work (internal development and grants) has prevented many fund losses

(9) The libraries used in the various codes (wallets, DeFi applications, etc.)

From another perspective, the reason why Ethereum exists and is endowed with a market value of over $300 billion may not just be due to the amount of Gas fees it captures, but more to its expansion and innovation in the crypto field, thus constantly absorbing the value spillover of Bitcoin. So in the previous two bull markets (2018 and 2021), the ETH/BTC ratio rose relatively high, which is also one of the main underlying logics for Ethereum to outperform in the long run.

However, in this round of the big market, although the fundamentals of Ethereum are good, the author finds that many people only mention the problems of on-chain liquidity fragmentation in the Ethereum ecosystem and the competition from new public chains, while ignoring the most important thing, which is Ethereum's absorption of Bitcoin's value spillover.

Are the troubles that Bitcoin itself needs to solve an opportunity for Ethereum?

In design, Bitcoin is undoubtedly a "god-level" work, but such a system does not mean "perfect in every way", after all, many project designs want everything and want to take care of everything, which seems perfect but is actually complex and full of loopholes, and difficult to break through quickly.

Satoshi Nakamoto has left some unsolved problems or regrets for Bitcoin for later generations to optimize. For example, the contradiction between the decreasing issuance and the development of the ecosystem threatens the sustainability of the Bitcoin system.

Simply put, the ever-decreasing inflation rate in the process of Bitcoin's continuous halving until the cap will drive the scarcity of Bitcoin to become a favorable factor for price increase, but this may not be the case for the Bitcoin system, because the halving is inevitable to lead to a decrease in the income of POW miners, which may also reduce the enthusiasm of miners, and in turn may affect the security and stability of the system.

Of course, the Bitcoin community has also proposed a solution, which is to develop the Bitcoin ecosystem, so that when the future halving leads to insufficient miner income, the prosperity of the Bitcoin ecosystem can make up for the reduction of system rewards, and continue to motivate miners to provide strong system protection. This is also the experience learned from the blockchain expansion route of the Ethereum community. But the high price and transaction fees, and the low efficiency of the mainnet, have posed a considerable challenge to the sustainable development of the Bitcoin ecosystem.

The problems of Bitcoin have always been on the "table", and the only solution is to keep Bitcoin rising, then there will be no problem, but obviously this is unlikely, so when capital pushes Bitcoin to the vicinity of the bottleneck, the value will spill out to other blockchains. At present, the only large-scale project that can bear most of the value spillover of Bitcoin is Ethereum, and there is no other.

Bitcoin L2 and Ethereum L2 are already in the same boat

The development of the Bitcoin ecosystem is now in full swing, with many teams bringing a lot of expansion solutions, especially borrowing from Ethereum's Layer2 solution, it can be said that the leading exploration of Ethereum Layer2 is guiding the expansion solutions of Bitcoin Layer2. Bitcoin Layer2 and Ethereum Layer2 are heading in the same direction, and some even say that Ethereum is the largest testnet for Bitcoin.

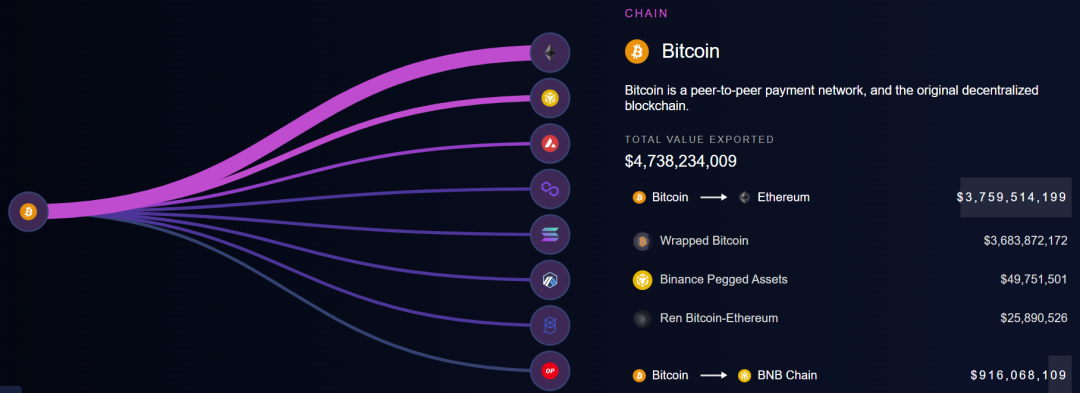

Of course, there are still some challenges facing the Bitcoin Layer2 at the moment, such as the difficulty in inheriting Bitcoin's security, and the slow block generation speed of Bitcoin itself, which affects the settlement efficiency of Layer2 transactions, etc. Therefore, if the idle BTC is to participate in DeFi, it will still choose to cross to the Ethereum chain to obtain reliability and security.

Source: CryptoFlows

According to CryptoFlows data, Bitcoin has exported about $3.8 billion in assets to Ethereum mainly through stablecoin bridges, not including Layer2, and the inflow to the Ethereum mainnet accounts for the vast majority of Bitcoin's cross-chain output, indicating the recognition of on-chain funds for Ethereum, and in the future, with the continuous development of BitcoinFi, the Ethereum ecosystem will inevitably receive more inflows.

In fact, if we look at it from a different angle, in the era of multi-chain interconnection and chain abstraction of large-scale Web3 applications, the interconnection and seamless interoperability between the major crypto ecosystems, isn't Ethereum already on its way to becoming the largest sidechain or the generalized Layer2 of Bitcoin? The best DeFi protocols in the Ethereum ecosystem are helping to activate the dormant Bitcoin funds.

Whether it is an expansion solution on the same boat or the cross-chain flow of funds, the future of Bitcoin and Ethereum seems to be increasingly intertwined.

Summary

From the current perspective, Ethereum's original intention has not changed, and what it was supposed to achieve has been achieved, the only change is due to the "fickle" holders who cannot resist the temptation. Against the backdrop of tightening global liquidity, the crypto narrative is shrinking, and chasing MEME is understandable (the economy is bad, so people gather at the village entrance to try their luck), but the upcoming global rate cut cycle that will gradually release liquidity may bring about a change, don't forget that the adoption of crypto assets and the landing value of Web3 applications will eventually return.

As the No. 1 and No. 2 crypto assets, the future intertwined Bitcoin and Ethereum are not in an antagonistic relationship, nor are they black and white. The crypto community, regardless of which camp they stand in, should stop internal consumption and "eating and breaking the pot" behavior, and march together towards the next generation of the Internet with large-scale adoption. Hopefully the other ETHs will not disappoint going forward.