The cryptocurrency market is preparing for volatility as it monitors key US economic events this week. Meanwhile, Bitcoin (BTC) is maintaining above $67,000 and continuing its small range-bound movement, awaiting a strong catalyst for further upside.

Meanwhile, the countdown to the US election continues. Volatility inspired by selected macroeconomic data is combining with US election anticipation, which could impact traders' and investors' portfolios. Heightened vigilance and customized trading strategies are necessary in this situation.

4 US Economic Data Points, Crypto Impact

As US economic events and data continue to influence cryptocurrencies, traders and investors should closely monitor these reports this week.

Q3 GDP

The US Census Bureau is scheduled to release the Q3 Gross Domestic Product (GDP) report on Wednesday, October 30th. The median forecast is 3.2% following 3.0% in Q2. However, according to the generally reliable model of the Atlanta Fed, the economy likely expanded at a 3.3% annual pace.

If this materializes, it would be nearly double the initial median forecast for the quarter. Meanwhile, a slowdown in GDP growth could signal a potential economic cooling, which could affect investor sentiment. This shift in sentiment could increase interest in Bitcoin and cryptocurrencies in general.

Read more: How to Protect Yourself from Inflation Using Cryptocurrency

Nonfarm Payrolls

Nonfarm Payrolls (NFP) are released on the first Friday of each month, and this week's US economic calendar highlights this as a key event. It represents the change in the number of employed people, excluding farm employees, government employees, private household employees, and nonprofit employees.

The US Department of Labor is scheduled to release the October report on Friday, November 1st, which has the potential to trigger significant market movements. First, the labor market is expected to have lost up to 40,000 jobs in October due to the impact of Hurricanes Ian and Fiona.

Against this backdrop, Reuters reports that economists estimate nonfarm payrolls increased by 125,000 this month, compared to 254,000 in September. The unemployment rate is also expected to remain unchanged at 4.1%.

A weaker-than-expected report could raise concerns about economic stability, potentially driving investors to seek alternative investment opportunities like cryptocurrencies. Conversely, a strong job growth report could boost consumer spending, promote economic expansion, and increase demand for digital assets.

Major Corporate Earnings

This week's US economic calendar also includes key earnings reports from large companies that could impact cryptocurrencies. Specifically, the following reports are scheduled to be released after market close:

- October 29th, Tuesday: Alphabet (GOOGL)

- October 30th, Wednesday: Microsoft (MSFT), Meta (META)

- October 31st, Thursday: Amazon (AMZN), Apple (AAPL)

Additionally, other companies such as Visa (V), Starbucks (SBUX), Merck (MRK), AMD, and Intel (INTC) are also scheduled to report. However, the five companies listed above are the ones currently garnering the most attention from large growth stocks.

US Election-Related Polls

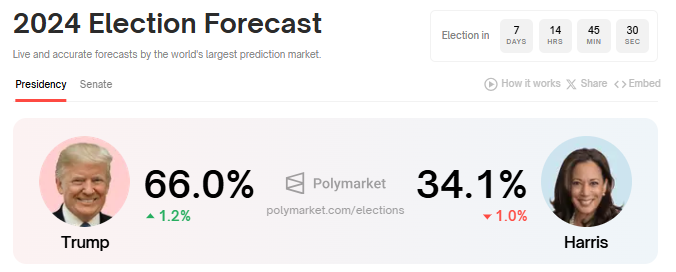

These events are taking place just days before the US election, which is expected to increase volatility. According to the US election countdown, Americans have just over a week left to elect the 47th president.

According to Polymarket data, Republican candidate Donald Trump is leading the popular betting indicator at 66%, while Democratic ticket holder Kamala Harris is at 34.1%. Polymarket has recently clarified that its prediction market is non-partisan.

Read more: How Can Blockchain Be Used for Voting in 2024?

As cryptocurrencies become increasingly a political topic in the US, with the expanding digital asset voter base, traders and investors can expect volatility as this countdown continues.