Last week, the inflow of cryptocurrency investment was $901 million, showing a significant decrease compared to the previous week. However, as political tensions are escalating ahead of the US election, the inflow trend is continuing.

Among digital assets, Bitcoin attracted almost all the attention, recording an inflow of $902 million. Notably, this change did not extend to Bitcoin short positions, which experienced a slight outflow of $1.3 million. This indicates that investors are confident in Bitcoin's upward trajectory.

Political Momentum, Increased Cryptocurrency Investment Inflows

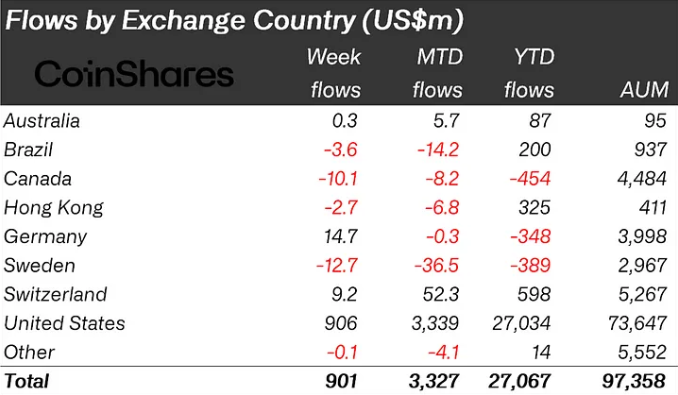

As expectations for political changes in the US are rising, digital asset investment products have continued to see positive inflows. According to a recent CoinShares report, $901 million flowed into these assets.

With these figures, October has become the fourth-largest month in terms of inflows, and the year-to-date inflows have reached $27 billion. It is noteworthy that this figure is nearly triple the $10.5 billion recorded in 2021.

This interest indicates that the passion for cryptocurrency investment is increasing as the US election cycle heats up. Notably, $906 million, which accounts for most of this month's inflows, originated in the US, showing a clear difference from other regions.

Read more: How to Buy Bitcoin (BTC) and Everything You Need to Know

CoinShares researcher James Butterfill mentions the impact of US domestic political developments on the cryptocurrency market. The researcher particularly emphasizes that the current surge is driven by politically-centered factors, especially with the 2024 presidential election on the horizon.

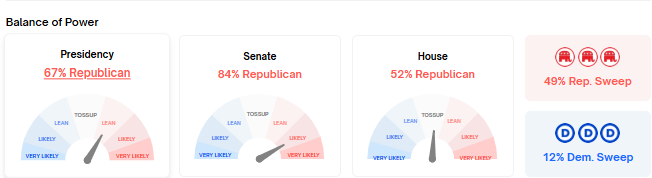

"The current Bitcoin price and inflows are heavily influenced by US politics, and the recent surge in inflows is likely associated with the Republican party's polling performance," the report states.

The general view is that the Republican party could make changes to regulations and tax policies that could benefit the digital asset space. This correlation has been clearly evident in the past two weeks, with $2.2 billion in cryptocurrency investment inflows in the week ending October 18, and $460 million in the week ending October 11, according to BeInCrypto.

The interest in cryptocurrencies is related to the recent shift in opinion polls favoring the Republican party. Historically, swing states that have played a crucial role in determining election outcomes have also influenced investor sentiment. According to Polymarket prediction market data, the Republican party is showing strength in several key states, and if this trend continues, it could further amplify cryptocurrency investment inflows.

Similarly, Donald Trump is currently leading the prediction market against Democratic presidential candidate Kamala Harris with 66.2% support, while Harris is at 33.7%. Meanwhile, the countdown to the US election is just over a week away.

As political changes loom, the cryptocurrency market is expected to continue attracting attention. Investors are closely monitoring US election opinion polls.

Read more: How Can Blockchain Be Used for Voting in 2024?

The continuous inflow of funds into cryptocurrency-related products suggests that not only is Bitcoin making a comeback, but there is also a political climate that could lead to more money flowing into the cryptocurrency market in the future. As the potential for political gains increases, investors are increasingly seeing Bitcoin as a viable option to hedge against economic uncertainty.