It has been confirmed that Emory University invested $15.8 million in Grayscale's Bitcoin Mini Trust on the 28th (local time). According to ETF analysts, all types of institutional investors who can now purchase Bitcoin ETFs have done so.

Grayscale's Mini Trust is gaining more and more attention, and the company is still looking for new revenue sources.

Emory's ETF Purchase

According to Bloomberg ETF analyst Eric Balchunas, Emory University purchased $15.8 million in Grayscale Bitcoin Mini Trust (BTC). He mentioned that this is the first case of a university endowment purchasing a Bitcoin ETF, and therefore the entire asset class has reached an important milestone.

"Now [ETFs] include every type of institution: (funds, banks, hedge funds, insurance companies, advisors, pensions, private equity, holding companies, venture capital, trusts, family offices, brokerages). An incredible performance in under a year, like winning all the tennis Grand Slams before your 16th birthday," Balchunas said.

Read more: What is a Bitcoin ETF?

In other words, Bitcoin ETFs have dramatically transformed traditional finance since their approval in January. This new ETF market is already showing clear benefits, such as billions of dollars in inflows and ongoing regulatory approvals. However, this broad-based adoption by institutions is a sign of independent trust. The appeal of ETFs extends beyond the cryptocurrency space.

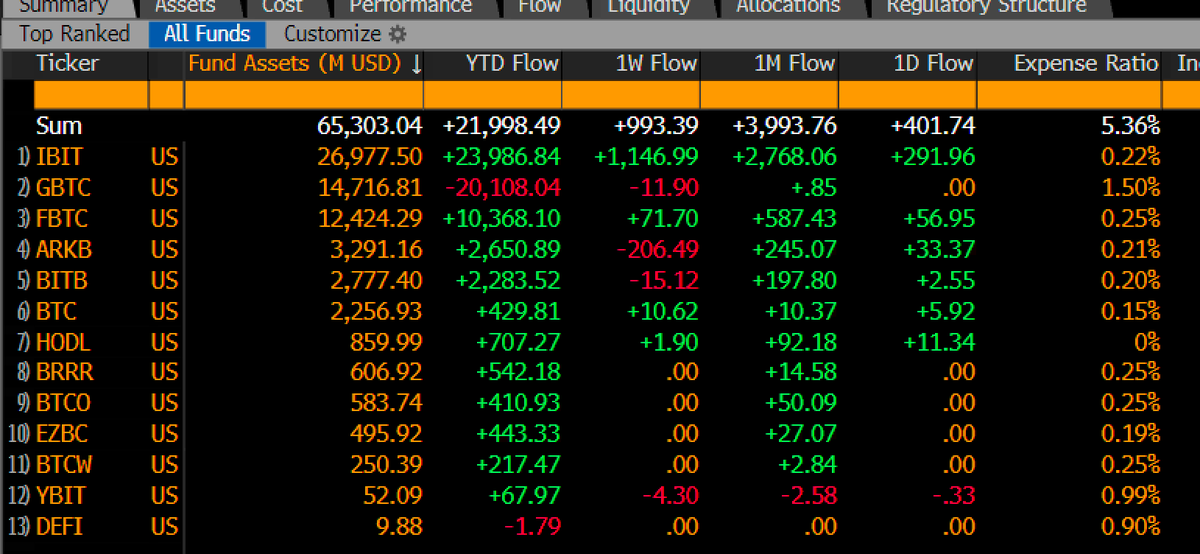

Grayscale launched the Mini Trust in July. It boasts the lowest fees among the various Bitcoin ETF products. This move came after BlackRock officially surpassed Grayscale's GBTC in May, establishing a dominance that continues to this day. Nevertheless, BTC is gaining new appeal, and Emory is just one of these investors.

"$BTC has been quietly climbing the charts and is now 6th, hot on the heels of [Bitwise ETF]. All together, Grayscale has seen net inflows in this category in recent months... There is a long history of this 'mini-me' low-cost strategy working in ETFs. And it has succeeded again," Balchunas added.

In addition to these recent successes, the two ETF issuers are exploring new investment products. Grayscale launched an AAVE-based investment fund in early October and has revealed it is considering 35 other cryptocurrencies for similar products. Meanwhile, BitWise has filed for a new XRP-based ETF.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

The issuers are not resting on their laurels. Emory's investment marks a milestone in the ETF market, but it is a small part of the overall fund. Grayscale manages the two largest ETFs and continues to seek new opportunities, while industry leader BlackRock has made substantial new investments recently. Innovation remains a top priority for ETFs.