Earlier today, as the price of Bitcoin (BTC) broke through $71,000 for the first time since June, the price of Ethereum (ETH) also saw impressive growth in the past 24 hours.

If you want to learn more about the crypto world and get the latest news, follow Weibo Dolphin Dolphin1 for more great articles ~

This large-cap Altcoin has a fully diluted valuation of around $315 billion, with an average daily trading volume of around $23 billion, surging over 5% in the past 24 hours, trading at around $2,618 during the European morning session on Tuesday, October 29.

As volatility has increased, the Ethereum leveraged market has seen nearly $40 million in liquidations, with 81% involving short traders.

Ethereum Bulls Remain Strong

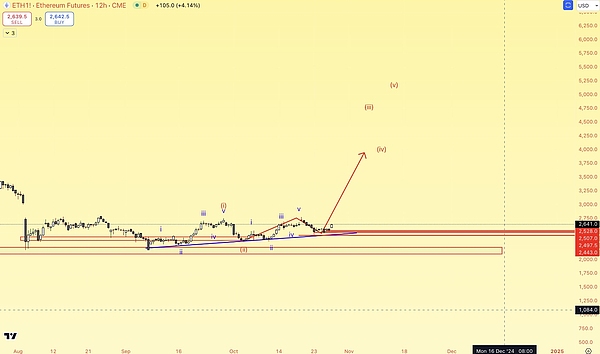

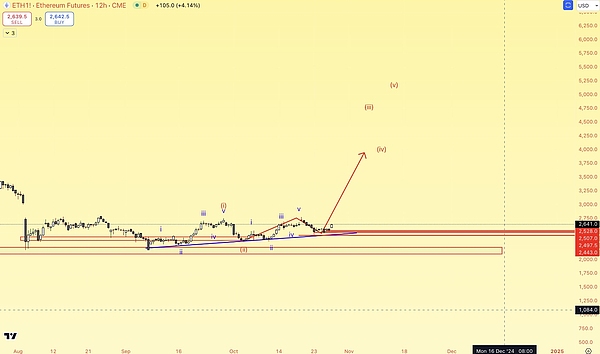

From a technical analysis perspective, Ethereum's price is consolidating at the apex of a weekly triangle pattern, suggesting an imminent breakout. Additionally, the price of Ethereum has rebounded from a key logarithmic uptrend that began at the start of last year.

In the short term, the price of Ethereum must continue to close above the resistance around $2,829 to confirm the potential to reach new all-time highs. Once the ETH/BTC pair reverses its current (since early 2022) downtrend, the Ethereum bull market will ultimately be realized.

On the Other Hand

The Ethereum network is facing fierce competition from Solana (SOL) in terms of on-chain activity and DeFi growth. Strong retail and institutional demand for SOL has boosted the SOL/ETH pair, which is now in the price discovery phase.

Last week, Solana investment products attracted over $10 million in inflows, while Ethereum saw outflows. Over the past two weeks, US spot Ethereum ETFs have seen outflows of over $25 million, led by Grayscale's ETHE.

Nevertheless, the Ethereum network is a major web3 ecosystem with a Total Value Locked (TVL) of over $49 billion and a stablecoin market cap of over $84 billion.

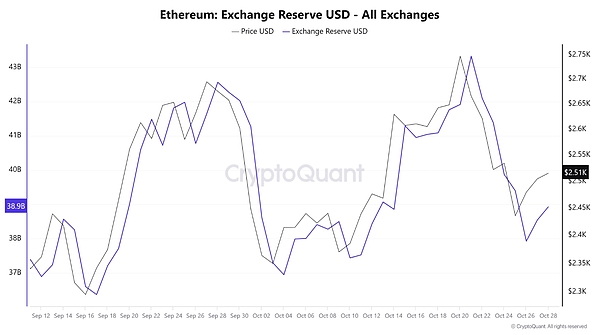

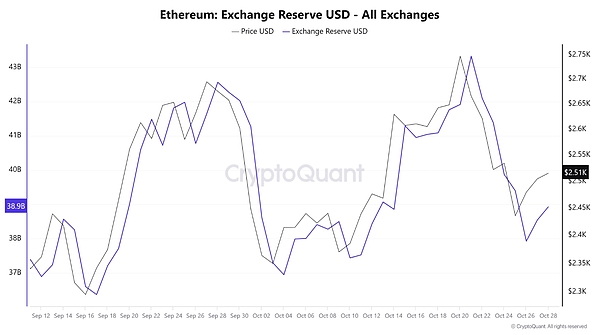

Ethereum Exchange Reserves Declining

Ethereum's exchange reserves have declined from $42 billion to around $38.5 billion, a drop of around $3.5 billion. The significant decline in exchange reserves may be a sign of whales or investors accumulating or acquiring.

Additionally, the decline in reserves has occurred near the strong support area where ETH is currently trading.

Ethereum Technical Analysis and Upcoming Levels

ETH is exhibiting a bullish trend and is within a bullish channel, forming higher highs and higher lows. Currently, ETH is at the lower boundary of the pattern, forming a higher low.

Based on historical data and price adjustments, the asset is likely to rise by 12% in the coming days, reaching the $2,800 resistance level. In fact, this level not only represents resistance but also coincides with the 200-day Exponential Moving Average (EMA) and the upper boundary of the bullish pattern.

The bullish case will only hold if ETH remains above $2,400, otherwise, it may fail.

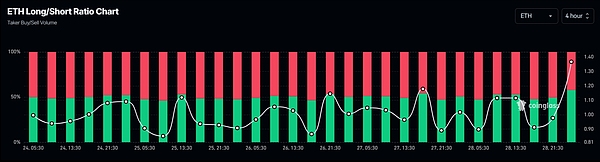

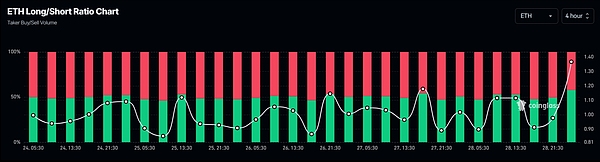

Bullish On-Chain Indicators

On-chain indicators further support the positive outlook for ETH. According to data from on-chain analytics firm Coinglass, the ETH long/short ratio is currently at 1.36 over the past four hours, indicating strong bullish sentiment among traders. During the same period, 57.76% of top traders have opened long positions, while 42.24% have opened short positions.

ETH's open interest has increased by 4.9% in the past 24 hours and 3.1% in the past 4 hours. The rise in open interest indicates growing trader interest in the asset, leading to the formation of new positions.

When examining the bullish on-chain indicators using technical analysis, it appears that the bulls currently dominate the asset and may continue to support it in the upcoming rebound.

That's the end of the article. Follow Weibo Dolphin Dolphin1 for more great articles. If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have a professional exchange community that publishes daily market analysis and high-potential altcoin recommendations. There is no threshold to join the group, welcome everyone to join and discuss! In the short term, the price of Ethereum must continue to close above the resistance around $2,829 to confirm the potential to reach new all-time highs. Once the ETH/BTC pair reverses its current (since early 2022) downtrend, the Ethereum bull market will ultimately be realized.

In the short term, the price of Ethereum must continue to close above the resistance around $2,829 to confirm the potential to reach new all-time highs. Once the ETH/BTC pair reverses its current (since early 2022) downtrend, the Ethereum bull market will ultimately be realized.

Additionally, the decline in reserves has occurred near the strong support area where ETH is currently trading.

Additionally, the decline in reserves has occurred near the strong support area where ETH is currently trading.

Based on historical data and price adjustments, the asset is likely to rise by 12% in the coming days, reaching the $2,800 resistance level. In fact, this level not only represents resistance but also coincides with the 200-day Exponential Moving Average (EMA) and the upper boundary of the bullish pattern.

The bullish case will only hold if ETH remains above $2,400, otherwise, it may fail.

Based on historical data and price adjustments, the asset is likely to rise by 12% in the coming days, reaching the $2,800 resistance level. In fact, this level not only represents resistance but also coincides with the 200-day Exponential Moving Average (EMA) and the upper boundary of the bullish pattern.

The bullish case will only hold if ETH remains above $2,400, otherwise, it may fail.

ETH's open interest has increased by 4.9% in the past 24 hours and 3.1% in the past 4 hours. The rise in open interest indicates growing trader interest in the asset, leading to the formation of new positions.

When examining the bullish on-chain indicators using technical analysis, it appears that the bulls currently dominate the asset and may continue to support it in the upcoming rebound.

That's the end of the article. Follow Weibo Dolphin Dolphin1 for more great articles. If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have a professional exchange community that publishes daily market analysis and high-potential altcoin recommendations. There is no threshold to join the group, welcome everyone to join and discuss!

ETH's open interest has increased by 4.9% in the past 24 hours and 3.1% in the past 4 hours. The rise in open interest indicates growing trader interest in the asset, leading to the formation of new positions.

When examining the bullish on-chain indicators using technical analysis, it appears that the bulls currently dominate the asset and may continue to support it in the upcoming rebound.

That's the end of the article. Follow Weibo Dolphin Dolphin1 for more great articles. If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have a professional exchange community that publishes daily market analysis and high-potential altcoin recommendations. There is no threshold to join the group, welcome everyone to join and discuss!