After stumbling for 3 months, Bitcoin finally stood above $70,000 again. $70,000 seems to be a key psychological level, being both the peak of the 2021 bull market and the level many people use to judge whether to get in. Bitcoin's all-time high was $73,777 in March this year, just 5% away. This latest rally is truly a bull market comeback, so is it time to get in? What about Altcoins?

VX: TTZS6308

Stimulus from Election Expectations

The cycle of the US election and the cycle of Bitcoin have been so closely intertwined, only realized by the crypto community this year. Trump surprisingly proved to be friendly towards Crypto and Bitcoin, exciting half the industry and worrying the other half. From attending Bitcoin conferences to launching his own DeFi products, his declaration to "make Bitcoin the US strategic reserve" has led the overall market to believe a Trump victory would be extremely positive for crypto.

Although Polymarket's big players have bet heavily on Trump's lead, current public polls still show Trump and Harris at around 50:50. The final showdown starts next week, and smart money's instincts are extremely sharp - it's unclear if this latest $70,000 Bitcoin has any new winds behind it.

ETF Inflows

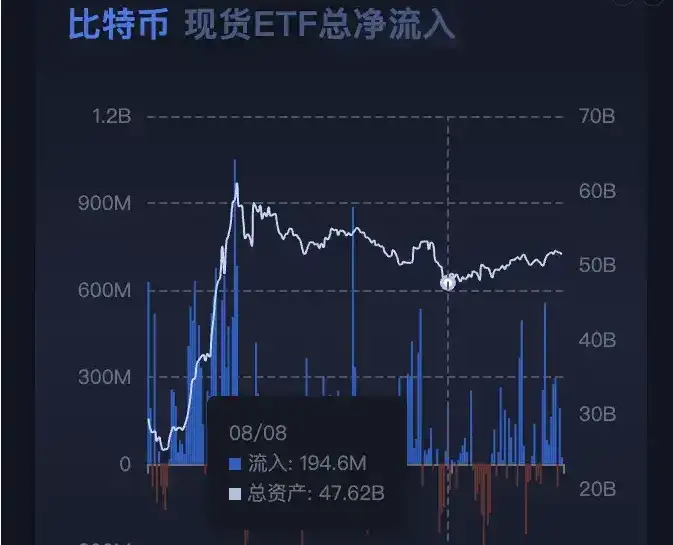

ETFs were closely watched when launched, mainly due to large inflows of new capital, which also set new Bitcoin price records. However, the total ETF assets soon started to see net outflows, and market sentiment also began to decline.

The inflow situation of ETFs can be seen directly from the data charts - August 8th was the lowest point of this phase, and funds have been steadily flowing in over the past few months.

Rate Cuts

The Fed's 50 basis point rate cut in September exceeded expectations, and Bitcoin also rallied in response. The expectation now is for a 25 basis point cut in November, which the market generally sees as a positive factor, after all, the starting point of the last bull run was the March 2020 rate cut.

Looking back at October as a whole, although Bitcoin (BTC) outperformed the Altcoin market for most of the time, we can see that the market's expectations for Altcoins have not diminished.

November Approaches, Which Altcoins to Watch?

APE

APE was one of the standout Altcoins in October, with its price soaring by 27% over the past 30 days on the back of the launch of the ApeChain (a new Layer 3 blockchain).

From the daily chart, after the ApeChain launch news, $APE price briefly surged to $1.58, followed by a 33% correction, and is now hovering around the $1 mark.

The 20-day Exponential Moving Average (EMA) shows $APE's support at around $0.87, and if this level holds, $APE could challenge $1.19 again in November; but if the bulls fail to defend $0.87, ApeCoin could fall to $0.71.

DOGE

DOGE has already risen nearly 30% this month, and a tweet from Musk yesterday further pushed Dogecoin up 14%.

The $DOGE price chart has formed a so-called "bullish pennant", where the price consolidates in a parallel channel after a strong rally, gradually forming a flag-like pattern, and once the upper boundary of the pennant is broken, it could lead to a larger upside move.

If $DOGE can maintain above $0.15 in November, it could challenge $0.18; but if the price falls below $0.13, it may enter a correction phase.

SOL

Finally, Ethereum's biggest competitor - Solana ($SOL), has surged 16% since October 18th, showing strong performance.

Looking at the $SOL/$BTC technical chart, the 20-day Exponential Moving Average (EMA) has already broken above the 50 EMA, forming a bullish "golden cross" pattern, which usually signals the start of a long-term uptrend.

Currently, the $SOL/$BTC ratio is 0.0026, and if the trend continues, it could rise to 0.0028 in November; however, if the golden cross fails, Solana's performance may lag behind Bitcoin.

Although Bitcoin remains the core of the market, some Altcoins have the potential to be the most bullish in November under favorable price trends. However, the Altcoin market is highly volatile, so caution is still needed, and market news and technical indicators should be closely monitored to effectively mitigate risks.

Considering Bitcoin's strong fundamental demand, barring major policy headwinds, Bitcoin still has a good chance of breaking through by the end of the year.

But everyone still needs to be cautious, and whether the target is reached will depend on whether the market can successfully overcome obstacles such as regulation, policy changes, and geopolitical risks. Facing volatility, more patience and strategic positioning are needed. Whether it's institutional demand, ETF inflows, geopolitical tensions, or the upcoming US election, various factors could bring uncertainty to Bitcoin's year-end price. So be sure to have your own strategy, with proper take-profit and stop-loss.