The price of Bit coin (BTC) has risen 5% in the last 24 hours, reaching $71,000. This is the highest level since March and is less than 4% below the all-time high.

Despite the upward trend, concerns about market correction are growing. This could lead to a large-scale liquidation of leveraged positions. This analysis explains the relevant factors and highlights important points that BTC holders should closely monitor.

Overheating of the Bit coin market begins

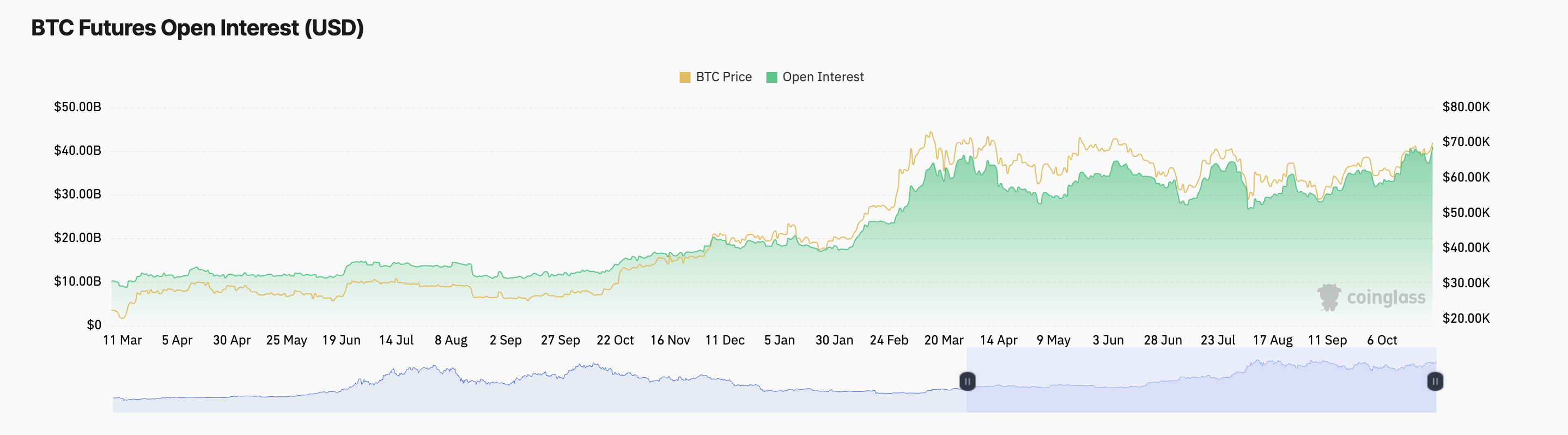

The rise in Bit coin prices was accompanied by an increase in open interest. It currently stands at $4.44 billion, a record high, up 10% in the last 24 hours.

Open interest represents the total number of outstanding contracts in the futures market. An increase in the open interest of an asset is a bullish signal indicating high interest among market participants, but it also carries great risk.

High open interest means that more leveraged positions are active. When prices fluctuate sharply, these positions become more vulnerable to forced liquidation. This can lead to abrupt price movements. High open interest can trigger large liquidations or margin calls even with small price changes.

Read more: What happened during the last Bit coin halving? Predictions for 2024

Additionally, when many traders take similar positions, imbalances can arise. If the market moves in the opposite direction, liquidations can occur, leading to a sharp price drop and a sudden reversal.

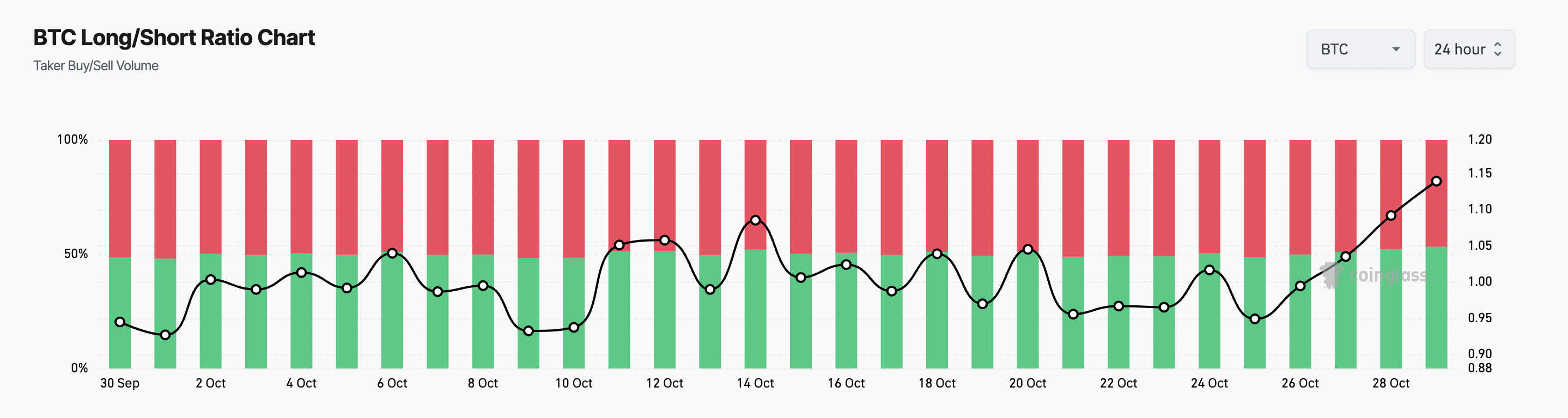

In the case of Bit coin, more than half of the positions opened in the futures market are expecting a price increase. According to Coinglass, the BTC Longing/Short ratio has reached a monthly high, with over 50% currently dominated by Longing positions.

This high ratio generally indicates a strong bullish sentiment among traders. However, the imbalance between Longing and Short positions carries significant risk.

If the price of Bit coin declines, these Longing positions may face rapid liquidation. This can trigger forced selling, further driving down the price.

BTC price forecast, focus on this price range

BeInCrypto's BTC/USD daily chart analysis confirms that the Bit coin market is gradually overheating. The current price is poised to break through the upper Bollinger Band, an indicator that measures market volatility.

Trading above the upper band of this indicator suggests the asset has entered an overbought state. This increases the likelihood that traders will start to realize their profits.

If the price of Bit coin fails to maintain the upper band and retreats, it may signal a potential reversal or momentum weakening. Such a reversal could lead to a sharp drop in price to $68,474.

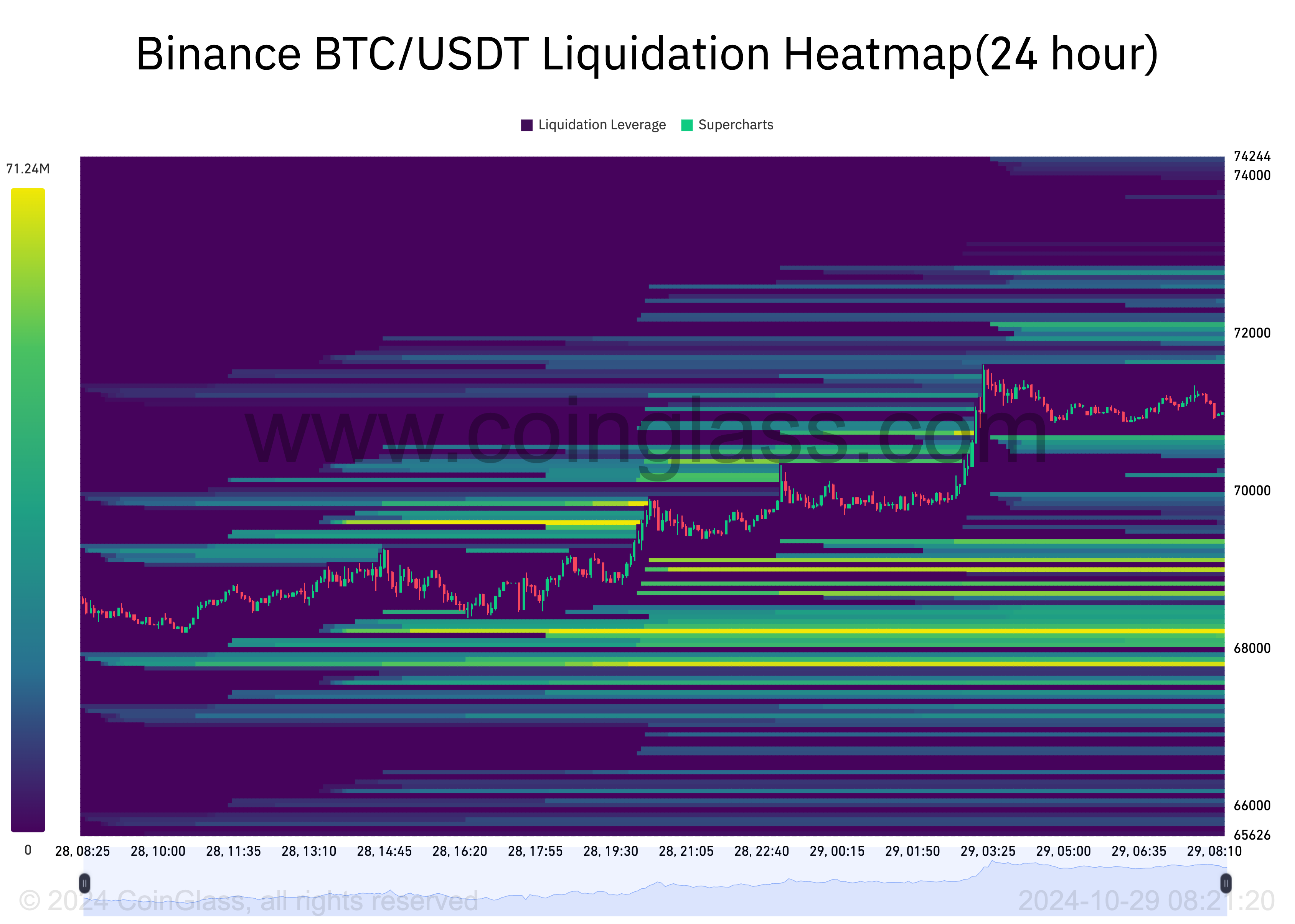

Additionally, the price range of $67,000 to $68,000 is an area that deserves attention. The Bit coin liquidation heatmap shows concentrated liquidity in this price range. Many traders are likely to have set up leveraged Longing positions at these levels. If the price of Bit coin declines to reach this level, these leveraged positions may be liquidated.

Read more: Bit coin Halving History: Everything You Need to Know

On the other hand, a retreat to this price range could also trigger a buying frenzy. If the buying pressure is strong enough, the price of Bit coin could continue its upward trend, breaking through the recent high of $71,726 and targeting the all-time high of $73,777.