Author: Revc, Jinse Finance

Preface

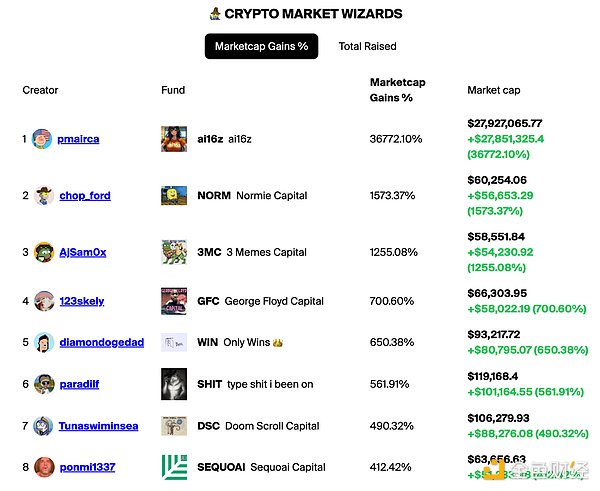

The AI16Z project, with a market capitalization close to $100 million, has been labeled as a MEME, as it has brought hundreds of times returns to early investors. However, we can further explore its implications for on-chain collective asset management activities.

The asset valuation system is usually divided into two types: one is based on the discounted cash flow of the asset, with the discount rate determined by the risk characteristics of the asset or cash flow, mainly used for operating entities; while the valuation of MEME assets focuses on the efficiency of network dissemination and the consensus on influence, and their sustainability is often placed in a secondary position. This different valuation approach has greatly influenced the positioning and design of Web3 projects.

Take Friendtech as an example, when the author first heard about Friendtech, he was thinking about a question: why can't the same group of Key holders be an investment collective? That way, at least there would be a visualized investment cash flow to support the value of the group's equity token, but they chose to speculate on the trading of dialogue opportunities. It may be that the Bonding Curve designed around the Key is more suitable for speculation, and the eventual liquidity flight cannot be avoided. The economic models designed by most Web3 projects like to artificially steepen the supply-demand matching, triggering FOMO emotions, and putting latecomers in a weak position, which is not conducive to attracting a wider audience, but mature DeFi protocols are excluded, although early liquidity incentives are more.

Returning to AI16Z, it is the largest project on the Soalna hedge fund protocol Daos.fun, and Daos.fun aims to lower the threshold for hedge funds and democratize them.

How Daos.fun Works

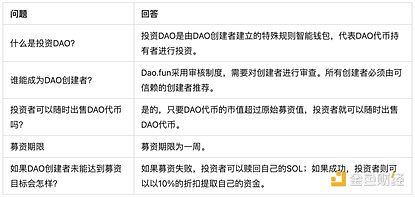

Daos.fun is an investment DAO, mainly involving fundraising, trading, fund liquidation, and fund term.

Fundraising: The DAO creator has one week to raise the required amount of SOL. The DAO tokens are issued fairly, and all participants can purchase tokens at the same price.

Trading: After the fundraising is completed, the creator will invest the raised SOL in the Solana tokens they choose and trade them on a virtual automated market maker (AMM). This causes the price of the DAO tokens to fluctuate based on the fund's trading activity. Although there is no cap on the DAO token price, the downside risk is limited by the fundraising market cap. As long as the DAO token market cap exceeds the original fundraising amount, investors can sell their DAO tokens at any time.

Fund Liquidation: At the end of the fund term, the DAO wallet will be frozen, and the SOL profits will be returned to the token holders. Investors can choose to burn their DAO tokens to redeem the DAO's underlying assets, or directly sell the DAO tokens.

Fund Term: The fund term is set by the DAO creator. For example, the fund term of AI16Z is 1 year, and it will be liquidated on October 25, 2025; the liquidation date of Kotopia is October 27, 2025; DCG (Degen Capital Guild) will be liquidated on April 25, 2025.

The fund creators are currently reviewed by the official, and their investment capabilities are basically evaluated in a qualitative way, and it cannot be guaranteed that they are not driven by other interests, especially in the constantly changing market, the information asymmetry between the creators and investors may lead to investor losses. Daos.fun may require the creators to hold a certain proportion of the fund assets, but it still cannot dispel the concerns about their operational capabilities, so the introduction of a pre-investment voting system is necessary. As Daos.fun opens up the invitation system, there will be more room for optimization.

Can the Democratization of Hedge Funds Change the Industry's Current Situation of VC Token Proliferation?

First, the reason for the VC token phenomenon may be the growing pains of the early wild development of Web3, the territorial war of VC immersion, and this group's awareness that the Web3 field will give birth to "Android and iOS" underlying decentralized operating systems, financial infrastructure, and the third-generation Internet (search, data communication, social networks). Compared to the mature securities issuance system in Web2, VC's almost unconstrained expansion in the Web3 field, combined with the competitive growth model of CEX, and the extreme desire for new asset categories, have led to the proliferation of air tokens in the entire industry.

While VC is expanding frantically, it is inevitable that they will have a negative impact on the industry. Due to the mature regulatory system in Web2, VC has a highly specialized process to evaluate the potential of projects, growth curves, and exit links in the investment process, but in Web3, the industry has not yet developed a self-disciplinary awareness until it evolves into a more positive balancing force to promote the healthy development of the industry.

How to understand VC's destruction of innovation, although Web2 is also an aggressive mode of operation, fund managers need to be accountable to investors, but VC (as well as CEX) in Web3 has more harmful monopolistic control over industry development, Suppose a new species is born in the early biological community of the Amazon rainforest, this new track is slowly developing, with its own micro-ecosystem, and in the perception of market demand and user experience, it is enriching its own wings. At this time, the other elements within the micro-ecosystem also provide positive feedback to each other, and in the process of continuous growth, they refine the core and forge the vitality of the organization through interaction with the environment. Note that this vitality is crucial for the long-term development and iteration of the project.

But if VC intrudes into this primitive forest in a barbaric way, what kind of scene would it be? They will bring in steel and concrete, modern construction projects into the Amazon rainforest, seize the head species of the micro-ecosystem, and change their objective development rules, pouring nutrients to accelerate their development, in most cases, this new species will lose its perception of products and markets, and develop towards the direction of "infantilization and air", and the entire small ecosystem is destroyed, breaking the positive feedback loop, replaced by a monopolized way, suppressing the possibility of competition and evolution in the Amazon rainforest, this is the cost that the entire industry and society have to bear.

The current primary market is depressed, financing is difficult, and the deterioration of the ecology has a backlash on VC itself. For VC, they need to let go of the monopoly illusion and focus on decentralized projects with business potential, and avoid becoming the promoters of "infantile" projects. But VC itself also faces the pressure of capital returns, and the contradiction between operations and capital returns needs to be balanced.

Since 2021, the entire crypto industry has faced the pressure of distorted regulation, with unprecedented density of US legal proceedings on crypto, leading crypto companies like Coinbase are fighting on the front line, and it is difficult to find who is the original sin of industry development in the entire chain of SEC-CEX-VC-Project, especially against the backdrop of prior interest rate hikes, the industry lacks liquidity, and waves of FUD condemnation, and what we can do is to establish self-disciplined organizations with a sense of decentralization after the barbaric development, and the emerging crypto giants avoid using traffic and user advantages to control the industry.

However, as a commercial organization, obtaining capital flow and users means extremely high costs. The balance between commercialization and public interest is a long-term challenge facing large crypto companies.

The Promoting Role of On-chain Asset Management for the Industry

The concept of on-chain asset management or investment DAO has been proposed since 2021 and is constantly evolving and being implemented. In a more abstract sense, the holders of the MEME community are also a kind of investment DAO. On-chain asset management can promote the healthy development of the industry in two aspects.

1. Actively managed funds that focus on truly decentralized projects with clear business models can help bridge the gap between the community and professional investors, which may be a way to solve the proliferation of VC-backed tokens and promote "good coins" as the market mainstream. Leverage the more transparent and open operation of DaosFun.

2. Short funds can target pseudo-Web3 projects where VC entities account for more than 20% of the token supply, with a single VC entity accounting for more than 3%, depending on the project's attributes. If a project attracts VC funding that exceeds its development and promotion needs, the Web3 industry should examine its decentralization attributes. Similar to the previous Gamestop short squeeze and Occupy Wall Street movement, there may be a touch of irrational enthusiasm, but for retail investors, the movement itself is just a matter of some corrective propositions. When the industry has problems, it needs to face them and use some methods that were not easily understood at the time but can be verified in the long run. Everyone has the right to take action against the unhealthy development of the industry, but it does not want to rise to the level of an ideology.

Whether the overly corrective propositions will affect the industry's competitiveness, the answer is yes, but looking at the generally existing monopoly phenomenon in the development of Web2 to the present, the industry also needs the "scalpel" of "Muddy Waters or Bonitas Research" level micro-operations.

Summary

Quoting Littlefinger's words in "Game of Thrones" - "Chaos is a ladder", freedom is a ladder, but it is often accompanied by chaos and monopoly. It's time for the Web3 industry to enter the next stage of development, and traditional regulation may not be suitable for the Web3 industry, although it is constantly exerting its influence.

Coming back to Daosfun itself, in the short term, we should not expect the democratization of funds to have a significant impact on the industry's self-discipline, but the free development opportunities brought by Web3 need each of us to maintain.