Bitcoin is approaching a critical moment, with the price just 2% away from its all-time high of $73,800. This upward trend suggests a breakout from the bearish wedge pattern, which traditionally predicts a powerful rally.

Investors are optimistic, and expect significant price appreciation if Bitcoin breaks this all-time high. However, the threat of a market top also looms over Bitcoin.

Bitcoin Profits at Peak

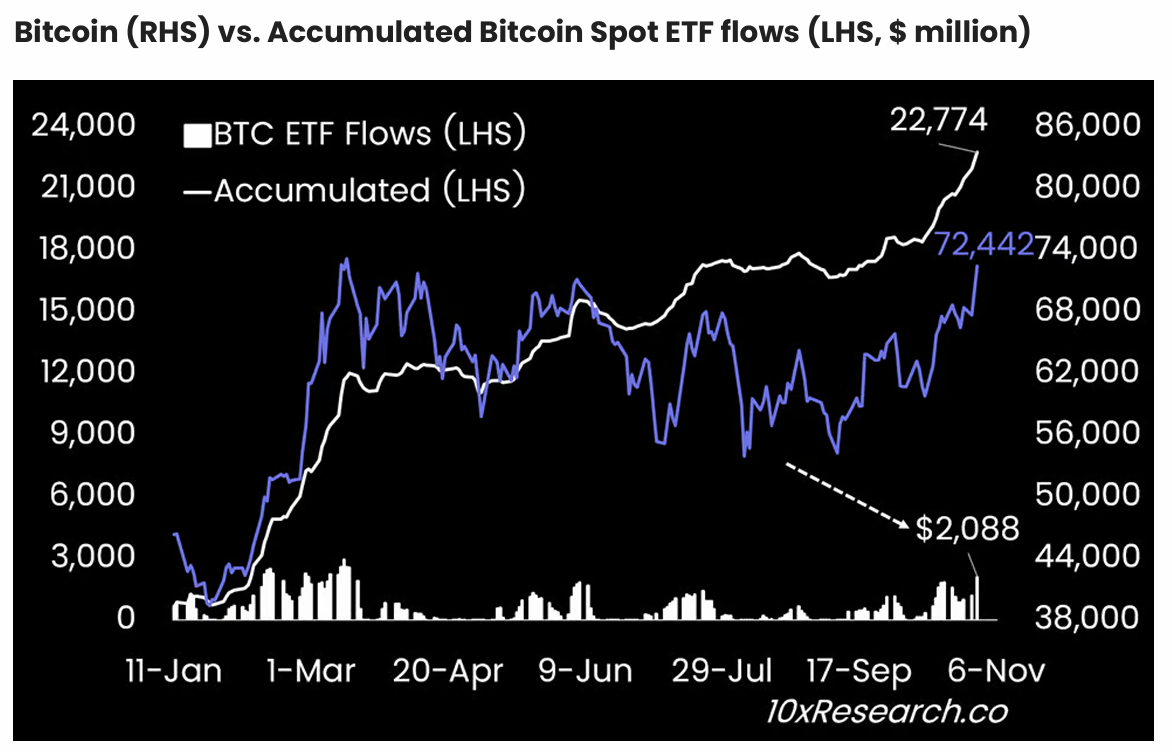

Bitcoin's recent rally has been largely driven by inflows into spot ETFs, which has established a strong institutional base. This influx is encouraging a continued rally as more institutions view Bitcoin as a valuable investment. This new level of interest is establishing a solid foundation and increasing Bitcoin's strong upside potential.

According to a report by 10x Research, $4.1 billion in ETF inflows were registered in October alone, the highest single-month trading volume since March.

"As ETF demand surges, Bitcoin will follow suit. If this trend continues, our quantitative signals predict a potential to reach $100,000 by the end of January 2025," 10x stated.

Read more: What Happened in the Last Bitcoin Halving? 2024 Predictions

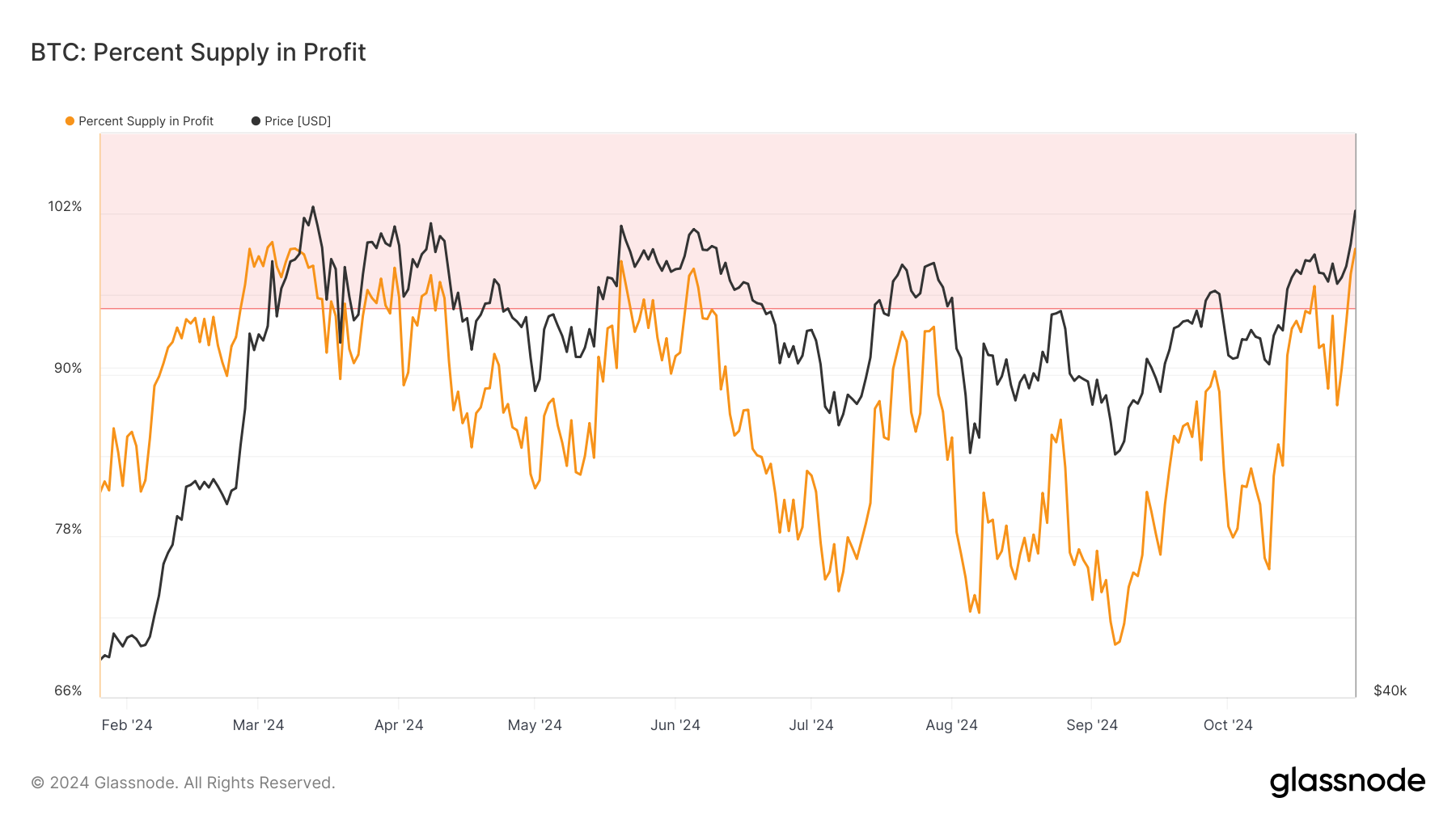

However, Bitcoin's macroeconomic momentum suggests caution, as the percentage of the total supply in profit indicates the potential for a market top. Historically, market tops have formed when over 95% of the Bitcoin supply is profitable, suggesting an overbought state. Currently, around 99.4% of the Bitcoin supply is in profit, reflecting the potential for a market top. This scenario suggests that Bitcoin's rally may face resistance, and these high profitability levels often increase selling pressure.

The current percentage of the supply in profit could lead to temporary pullbacks as investors lock in gains, potentially putting pressure on Bitcoin's upward momentum. This profit-taking pattern is common during long rallies, especially as all-time highs are approached. Increased selling could weaken Bitcoin's momentum and hinder a sustained rally above the all-time high.

BTC Price Prediction: Eyeing New Highs

Bitcoin's breakout from the bearish wedge pattern suggests a potential 27% rally, with a target of $88,185. For this rally to gain momentum, Bitcoin needs to firmly establish $73,800 as support. Confirming this support would act as a strong signal for continued upside and validate the breakout.

However, the threat of a market top could delay this move, and potential selling pressure could push Bitcoin below $70,000. Short-term profit-taking could extend the time before new highs are reached, especially if market sentiment cautiously shifts to an overbought state.

Read more: Bitcoin Halving History: Everything You Need to Know

On the other hand, if Bitcoin can establish $73,800 as support, it could push prices up to $75,000 and achieve a new all-time high. This successful breakout would signal a new phase in Bitcoin's rally, confirming its resilience and opening the door for further upside.