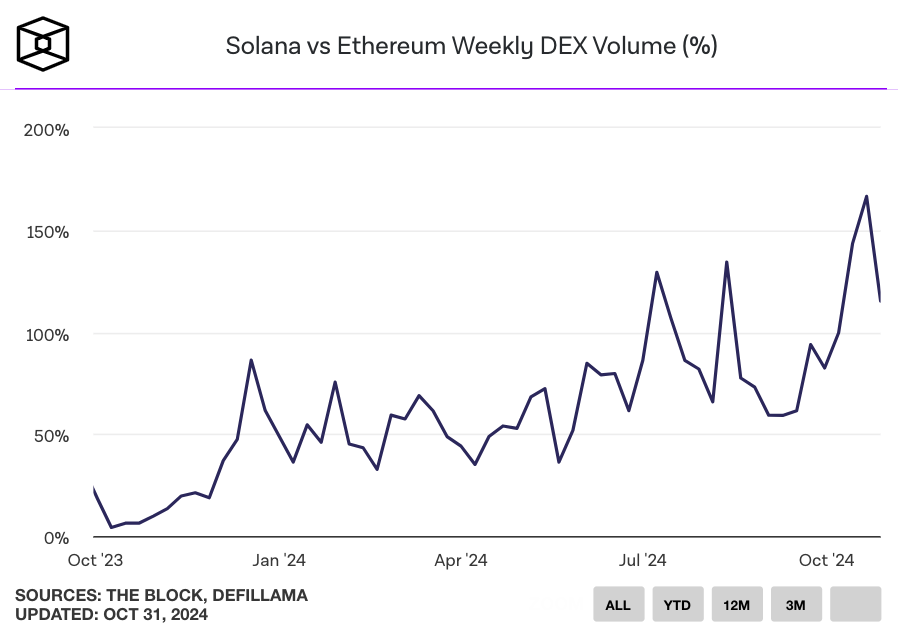

The DEX ecosystem of Solana has reached a notable milestone as its weekly trading volume surpassed 168% of the DEX volume on the Ethereum mainnet, an impressive record for this metric.

This increase marks a strong shift from the beginning of the year, when Solana's DEX volume was only 48.85% of Ethereum's. This metric is calculated by dividing Solana's weekly DEX volume by Ethereum's weekly DEX volume, providing deep insights into the relative trading activity between the two chains.

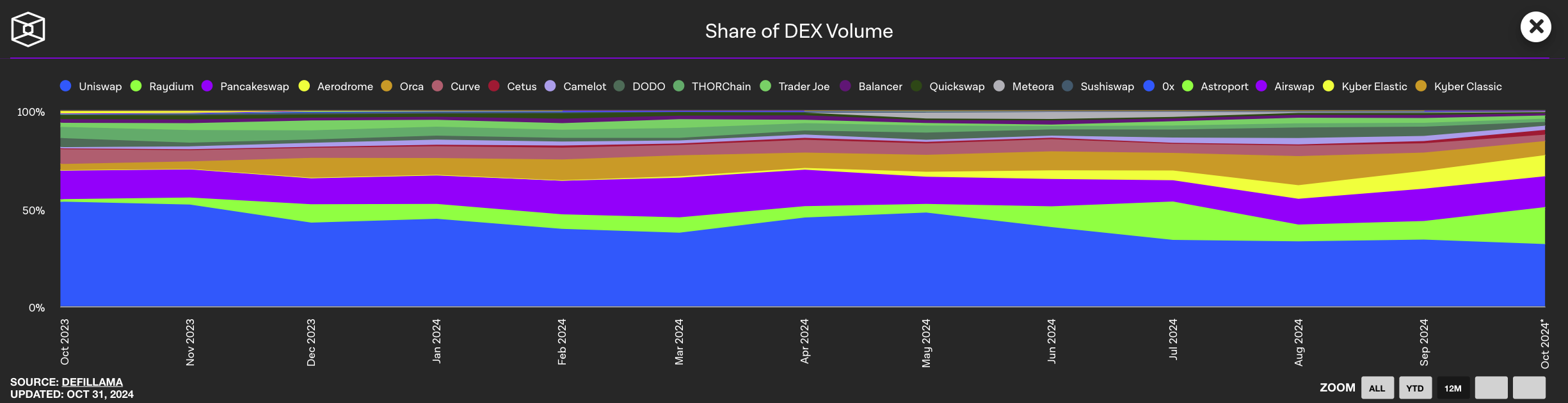

DEX Volume Market Share | Source: The Block

In October, Raydium, the largest DEX on Solana, recorded a trading volume of up to $22.3 billion, while Uniswap on Ethereum processed $38 billion. Raydium's market share has increased significantly, from 7.6% in January to 18.4% in October, while Uniswap continues to maintain its position as the leading DEX in the Ethereum ecosystem.

On Solana, the surge of the pump.fun token has been a key driver of DEX volume, with this platform facilitating high-frequency trading of new tokens.

Solana vs Ethereum Weekly DEX Volume Ratio (%) | Source: The Block, defillama

Recently, an AI agent has attracted attention in the cryptocurrency industry. Truth Terminal, an AI bot, has issued several tokens on Solana, generating strong interest on social media and within the trading community.

Solana's DEX volume has surpassed the volume on the Ethereum Primary Network, however, it is important to note that the entire Ethereum DEX ecosystem extends beyond the mainnet, including Layer 2 solutions. As Layer 2 solutions become more prevalent, they may significantly impact the DEX volume market share of SOL compared to ETH.

The trading dynamics between the chains also differ. Raydium's top trading pools are often related to new tokens, while Uniswap tends to have more established token pairs.

While the volume ratio is an impressive milestone for Solana, it is important to note that raw volume data does not necessarily reflect the overall health of the ecosystem or long-term sustainability. The varying trading patterns and user behaviors across chains suggest that they may serve distinct market needs rather than directly competing with each other.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to The Block