The price of Ethereum (ETH) has risen by more than 7% over the past 7 days. Despite the gains, whale activity remains cautious, reflecting hesitation among large holders.

From a technical perspective, the EMA lines indicate an upward trend, suggesting that momentum can continue to build. If the uptrend persists, ETH could see additional gains, but if the trend weakens, key support levels may come into play.

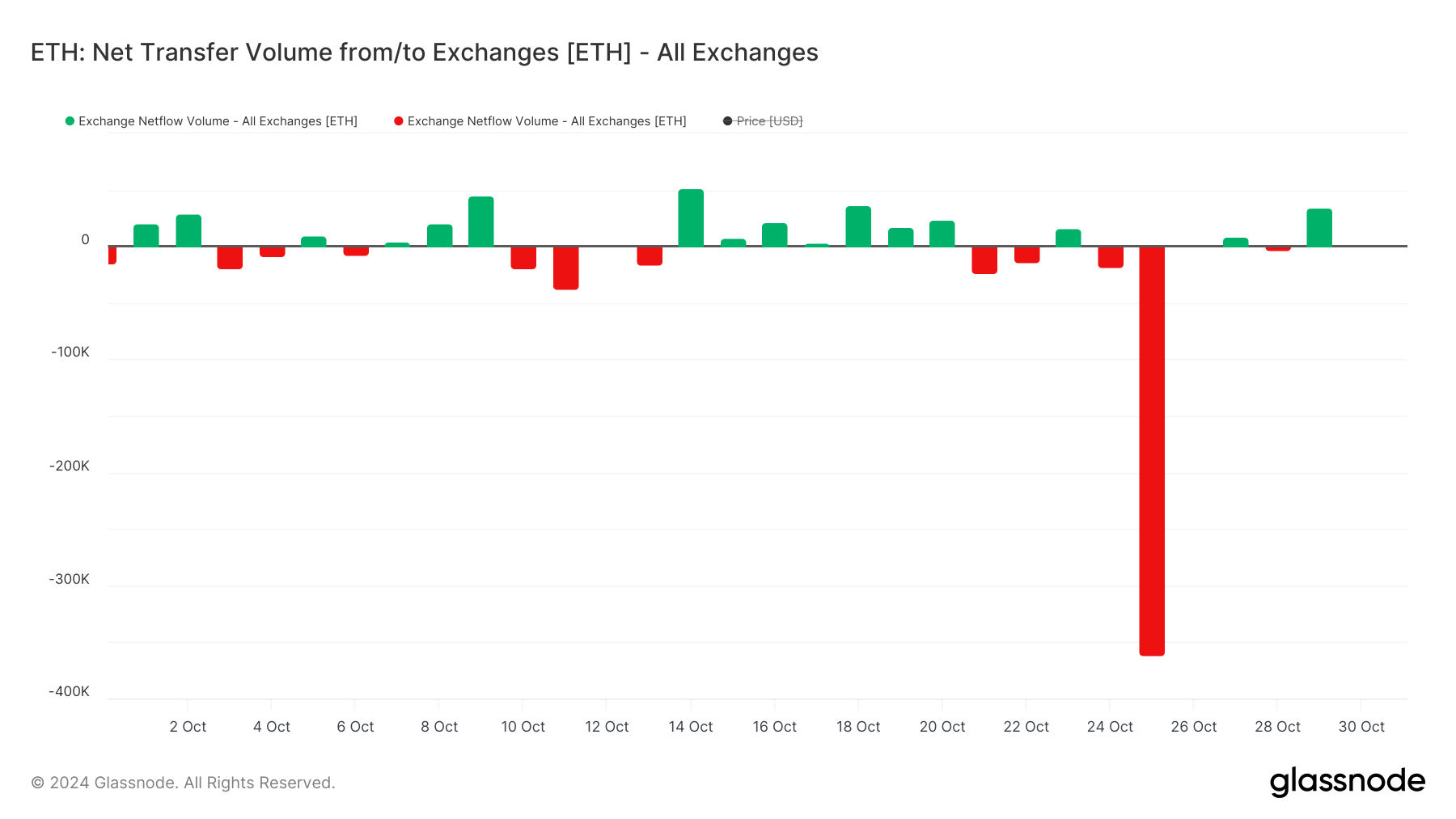

ETH Net Transfer Volume Reaches Highest Level Since May

On October 29, the net transfer of ETH to exchanges turned positive, with 35,000 ETH moving to exchanges. This generally indicates a bearish sentiment, as holders may be preparing to sell by moving assets to exchanges.

An increase in exchange supply is often associated with potential selling pressure and can impact prices in the short term.

Read more: How to Invest in an Ethereum ETF

However, a broader context tells a different story. On October 25, 361,000 ETH were withdrawn from exchanges, the largest outflow since May 30.

This significant outflow suggests that many holders are choosing to hold their assets long-term, reflecting a bullish outlook.

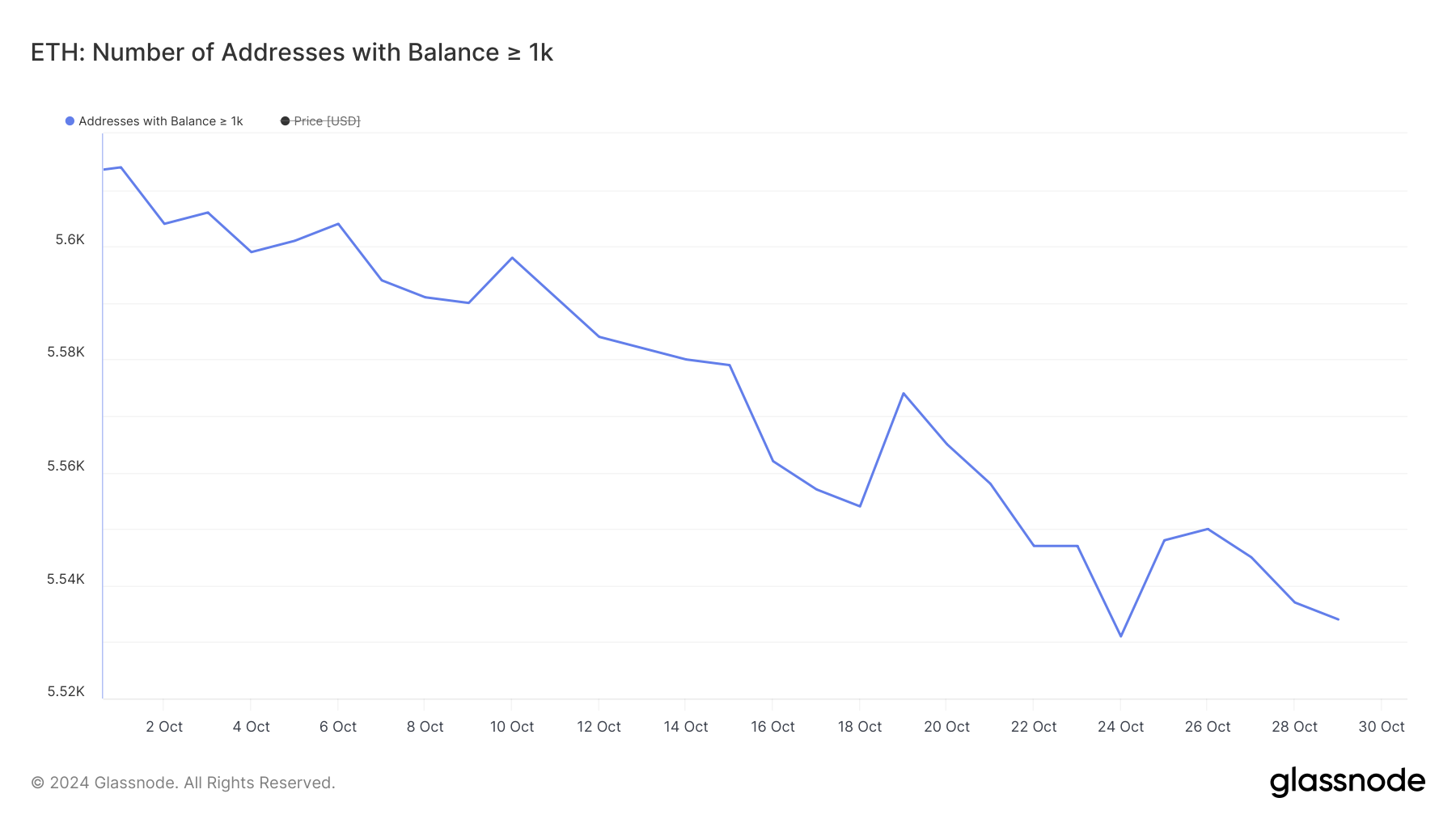

Ethereum Whales Still Hesitant

Despite the 7.54% rise in ETH last week, whale activity suggests that large holders remain uncertain. The number of addresses holding at least 1,000 ETH decreased from 5,614 on October 1 to 5,534 on October 30.

While the number of whales briefly increased on October 25, along with the major ETH withdrawals from exchanges, it has since started to decline again.

Tracking whale activity is important because these large holders can significantly impact the market through their trades. A decrease in the number of wallets holding at least 1,000 ETH suggests a lack of confidence among major investors, which could lead to a reduction in buying support.

This trend indicates that the potential for large-scale accumulation needed to drive or maintain higher prices may diminish as the number of whales decreases, potentially signaling a bearish outlook for ETH.

ETH Price Prediction: Will It Recover to $3,000 Soon?

While whales appear cautious, the EMA lines are showing an upward trend for ETH prices. The recent crossover of the short-term EMA above the long-term EMA, known as a "golden cross," is often a technical signal that suggests the potential for a strong upward price movement.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

If the uptrend strengthens, ETH could face resistance at the $2,820 level. However, if this resistance is breached, it could lead to an additional rise to the $3,400 level, representing a 25% price increase.

On the other hand, if the uptrend weakens and a downtrend forms, ETH may test support around $2,308 or $2,150, which would represent a 20% price correction.