The US Bureau of Economic Analysis reported on Thursday (31st) that the US September PCE price index rose 2.1% year-on-year, hitting a new low since early 2021, in line with market expectations; the previous value was revised slightly upward from 2.2% to 2.3%.

Additionally, the September core PCE, the Fed's preferred inflation indicator that excludes energy and food prices, rose 2.7% year-on-year, slightly higher than the market expectation of 2.6%, but unchanged from the previous value.

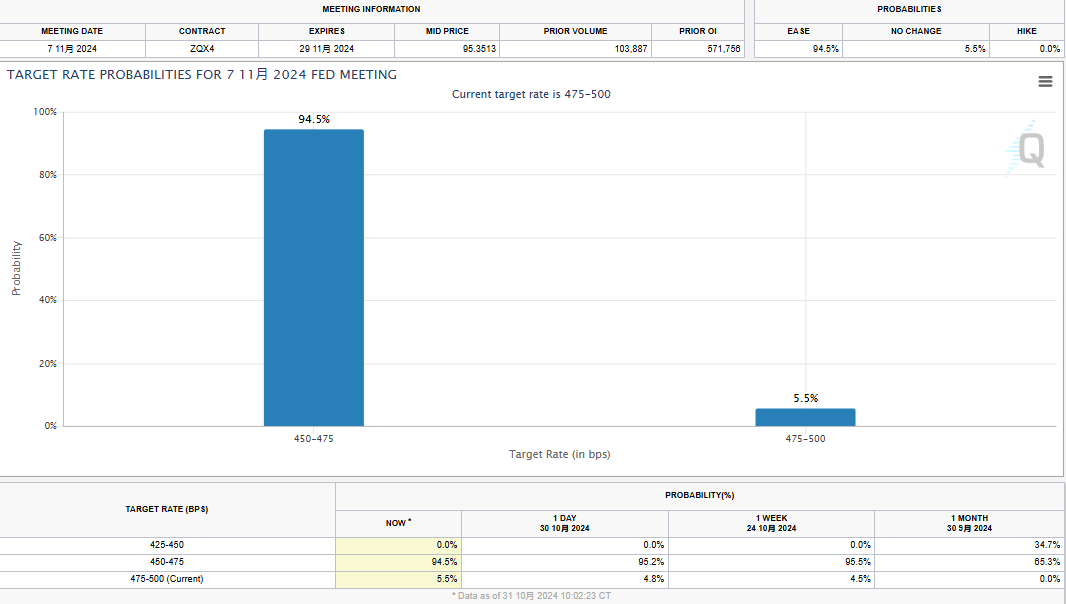

The Fed is Likely to Cut Rates by 1 Basis Point in November with a 94.5% Probability

After the release of the PCE data, the lack of deterioration in inflation provides support for the Fed to cut rates in November. As of the time of writing, according to the CME Group's Fed Watch tool, the market currently believes the probability of the Fed cutting rates by 1 basis point in November is 94.5%, the probability of keeping rates unchanged is 5.5%, and the probability of a 2 basis point cut is zero.

Major US Stock Indices Plummet

Although economic data shows that US inflation remains under control, perhaps due to the inability of Meta and Microsoft, members of the "Seven Giants" of the US stock market, to impress investors with their Q3 earnings reports released after the market close on the 30th, dragging down the performance of US stocks, the four major indices all fell:

- The Dow Jones Industrial Average fell 378.08 points, or 0.90%, to 41,763.46 points

- The S&P 500 index fell 108.22 points, or 1.86%, to 5,705.45 points

- The Nasdaq index fell 512.78 points, or 2.76%, to close at 18,095.15 points

- The Philadelphia Semiconductor Index plunged 206.75 points, or 4.01%, to 4,946.75 points

Although Meta and Microsoft's earnings and revenue both exceeded market expectations, Meta's user growth rate did not meet expectations, and it also warned that AI costs will rise sharply next year, and Microsoft forecast that its Azure business will slow growth and increase costs, causing investors' risk aversion to deepen.

Bitcoin Briefly Dips Below $70,000

Perhaps affected by the decline in US stocks, Bitcoin began to fall after 7:00 PM last night, reaching a low of $69,688 at 4:45 AM this morning, and has since rebounded to above $70,000 as of the time of writing, a drop of 3.12% in the past 24 hours.

Whether Bitcoin can stabilize and continue to rise in the short term may still be affected by the performance of US stocks.

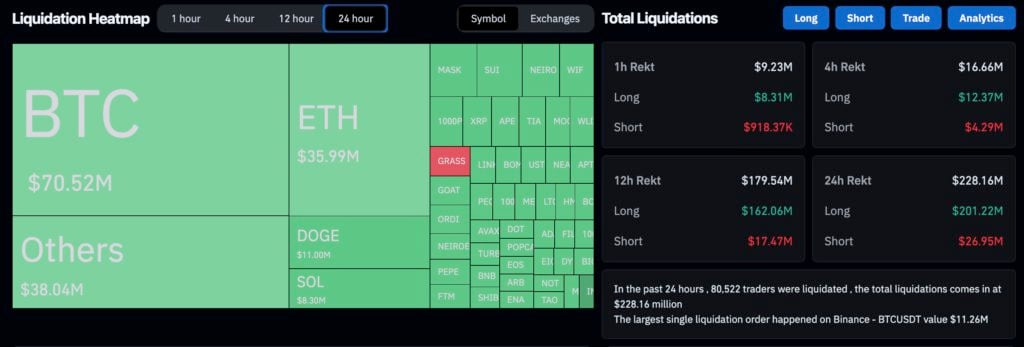

The decline in Bitcoin has also triggered a general sell-off in the cryptocurrency market, with major cryptocurrencies such as Ethereum, SOL, and ADA all seeing declines of 3-4%, resulting in nearly $228 million in liquidations across the network in the past 24 hours, with over 80,000 people being liquidated.