On November 1 (local time), Bitcoin and Ethereum option contracts worth $2.29 billion will mature. This massive maturity can affect short-term price movements, especially as the prices of the two assets have recently declined.

Bitcoin (BTC) options are valued at $1.94 billion, and Ethereum at $344.92 million. Option traders are preparing for potential volatility.

Cryptocurrency options expiring today

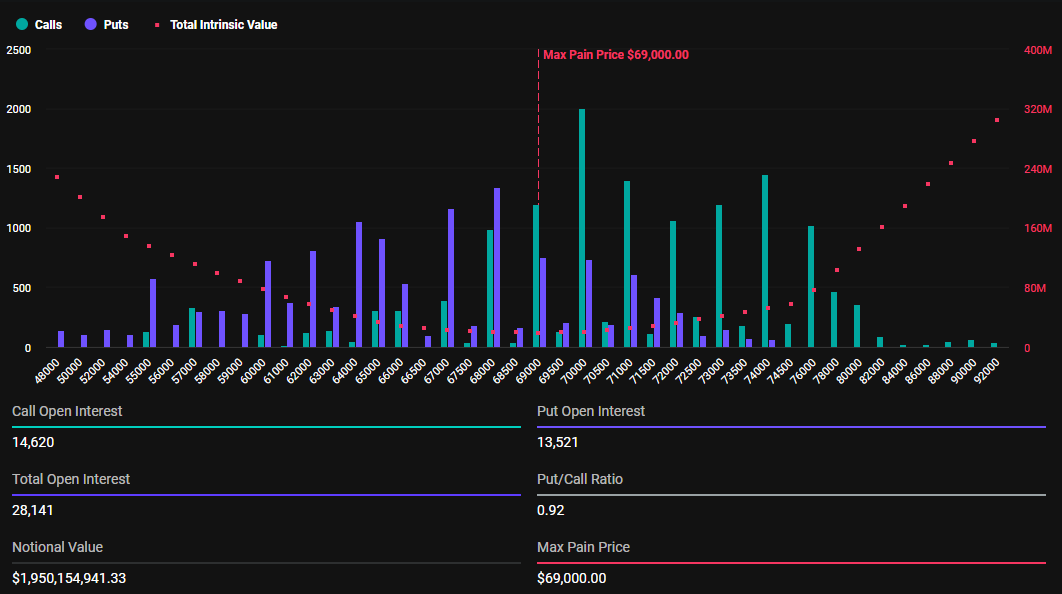

According to data from the cryptocurrency derivatives exchange Deribit, the Bitcoin option maturity this Friday includes 28,125 contracts. For Ethereum, the total number of option contracts maturing is 137,866.

The maturity Bitcoin options have a max pain price of $69,000 and a put-to-call ratio of 0.92. Max pain refers to the price range where the most option holders suffer the greatest losses.

Since the put-to-call ratio is less than 1, this generally indicates a bullish sentiment despite a 4% decline in BTC. For Ethereum, the max pain price is $2,550, and the put-to-call ratio is 0.69, reflecting a similar market outlook.

Read more: Introduction to Cryptocurrency Options Trading.

According to analysts at Greek.live, the implied volatility (IV) has increased slightly due to the recent price decline and external factors such as the US election. However, the maximum pain point for BTC has reached its highest level this year, and the market currently offers very good trading opportunities.

"Bitcoin reached $73,500 this week, just $150 shy of its all-time high, before plummeting below $70,000. The max pain point hit its highest level this year this week, and Ethereum struggled near its yearly lows, with its maximum pain point also declining this week. The key market event this week is the US election, and on November 8, with BTC ATM IV approaching 70% and BTC fluctuating near new highs, there are very good trading opportunities from all perspectives," the analysts said.

According to BeInCrypto data, Bitcoin is currently trading at $69,268, and Ethereum at $2,503. This indicates that BTC is above the max pain point, while ETH is below it. The max pain price is the strike price where the most option contracts expire worthless, and the market price tends to gravitate towards this level.

If the Bitcoin price moves towards the max pain point of $69,000, it would signify a price decline and could trigger short-term market volatility. Option maturities often cause temporary price fluctuations, but the market generally stabilizes soon after.

Due to today's massive maturity, traders should expect similar volatility that could shape the short-term cryptocurrency trends. The contracts will be settled by Deribit at 08:00 UTC on Friday, relieving price pressure on BTC and ETH.

Read more: Top 9 Cryptocurrency Options Trading Platforms.

This Friday is the first Friday of November, and the market should be prepared for volatility due to the Non-Farm Payroll (NFP) data. This US macroeconomic data could also set the next trend, along with the US election on Tuesday.

"Don't force trades until after tomorrow's NFP and next week's US election. Observe the market and only take clear A+ setups. Anything less is not worth it," a trader on X wrote.