As the 2024 US presidential election approaches, the tension in the capital market has reached a critical point, and the cryptocurrency market is even more nerve-wracking. This year, the high-profile campaign of Trump, who has gone through life-and-death crises, has instantly ignited the enthusiasm of the cryptocurrency circle with the slogan "Making America the Crypto Capital". However, history repeatedly reminds us that subtle changes in policies often become the watershed of the market.

VX: TTZS6308

After Roosevelt took office in 1933, the "New Deal" overnight completely reshaped the economic rules of the United States, forcing a large number of enterprises to adapt to the new policy direction and reorganizing the market pattern. This time, the cryptocurrency industry may be facing the same fate. With Harris' steady progress in the campaign, her and Biden's highly consistent policy positions mean that the current government's anti-cryptocurrency regulation may continue to be intensified. For a cryptocurrency market that advocates freedom and decentralization, this policy direction may be a real life-and-death test.

If Harris is elected, what will the future of cryptocurrencies be like?

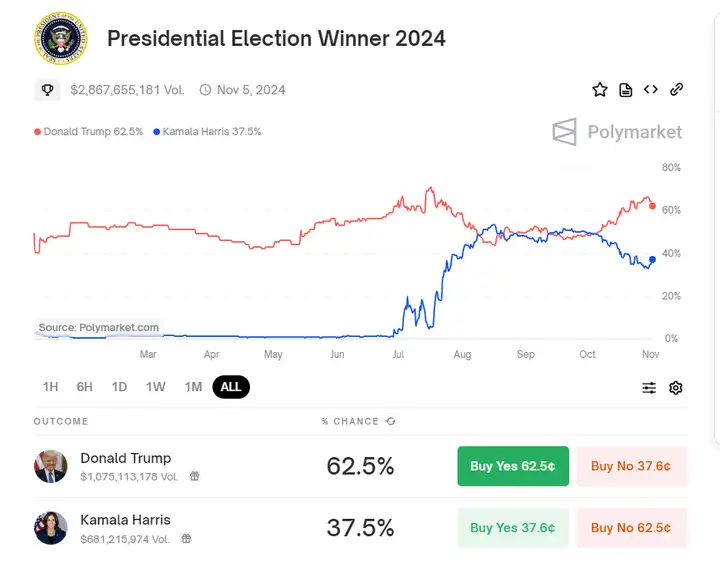

According to data from the prediction website Polymarket, the probability of Trump's victory is currently 62.5%, while Harris' chances of winning are only 37.5%. Although the prediction market believes that Trump's victory rate is higher, polls show that Harris is leading Trump nationwide by a slim margin of 1%, and 10% of voters may change their stance before the election.

In the seven key swing states that will decide the election, Harris' support rate is 49%, slightly ahead of Trump's 48%. Just a week ago, Trump was leading Harris 50% to 46% in these states.

Therefore, although many cryptocurrency supporters are more optimistic about Trump's election, Harris still has the possibility of succeeding.

First, we have to admit that if Harris is elected, there is a high probability that she will continue the policy tone of the Biden era. At this moment, the hearts of cryptocurrency investors are a bit like riding a roller coaster.

If Harris wins, the price of Bitcoin may see a significant decline by the end of the year, possibly even dropping by 10%.

Although in the long run, regardless of who takes office, the overall direction of the cryptocurrency market will not change, and the bull market will eventually come, the road may be a bit bumpy. But the short-term impact on the market cannot be ignored, especially for those who like to operate in the short term.

So, there are two key points here: first, Biden-style policies are not friendly to cryptocurrencies, and second, the market is guessing whether Harris will intensify regulation, thereby causing greater uncertainty.

Even so, Bitcoin may rebound and bottom out in 2025, driving the entire market towards a new round of bull market. These predictions are not unfounded, because both Bitcoin and Altcoins, the ups and downs of the cryptocurrency market have already become the norm. And for some staunch supporters, this is just short-term volatility, not a reversal of the overall trend.

Will loose monetary policy become the driving force for the bull market?

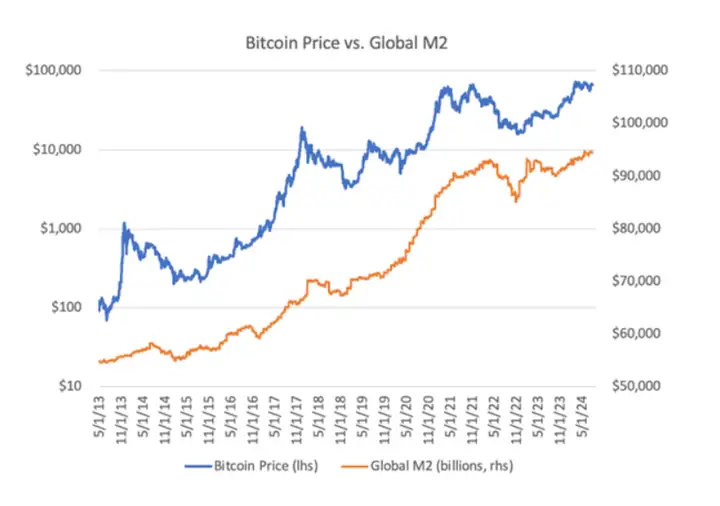

If Harris is elected, the global economic liquidity should be paid special attention to.

The key point here is: will the so-called "hot money" flow into the cryptocurrency market again, becoming a catalyst for a new round of bull market? The more loose the monetary policy, the greater the possibility of capital flowing into the cryptocurrency market. Considering the current uncertainty in the global economy and the generally loose policies adopted by central banks around the world, the influx of hot money may indeed bring more market opportunities.

If the Federal Reserve takes a more accommodative stance under Harris' leadership, then even if regulatory challenges exist, the increase in market liquidity will still provide support for prices. In other words, the further Harris' policies go down the path of "loose monetary policy", the greater the bull market potential of the cryptocurrency market.

However, the premise is whether the United States can withstand greater inflationary pressure. It can be foreseen that if Harris tries to continue to implement a loose policy, it will inevitably face considerable fiscal pressure and market resistance. In this case, companies and investors must be vigilant about the volatility risks in the cryptocurrency market and not easily ignore the chain reactions brought about by monetary policy.

With only four days left until the US election day, regardless of who takes office, the volatility of the cryptocurrency market is likely to be inevitable. In the short term, the strict control of policies or the favorable news of monetary easing will only be a peak or trough in the market waves; in the long run, the forward direction of the cryptocurrency market will not change due to this, but the road will be more winding and unpredictable.