The US presidential election is set to take place on November 5th local time, and with many market investors betting on a Trump victory, related concept stocks and BTC have been on the rise. However, Citi analysts recently believe that the Trump trade may have reached a point of profit-taking.

Citi points out: The Trump trade performed very strongly in October, but they now see potential gains have diminished and risk-reward has deteriorated, so they are starting to gradually take profits. On the other hand, US stocks also generally performed poorly last week, in addition to the big tech companies' earnings failing to gain investor support, the market may also be pulling back to avoid potential volatility before the election.

However, looking ahead, Citi believes that the market momentum after the election can be expected to drive the market higher, the bank's research shows: chasing price trends after elections is often effective, especially for the S&P 500 index and the US dollar index.

BTC Breaks Below 69K Again

In the BTC market, after hitting a low of $68,800 in the early morning of the 2nd, BTC has continued to challenge to get back above $70,000, but is not currently strong, and has once again fallen below $69,000 as of the time of writing, hitting a new low of $68,631 yesterday.

With the election approaching, will BTC set new highs, has the market already priced it in, or will it continue to fluctuate under a risk-off sentiment? BlockTempo will continue to track the developments.

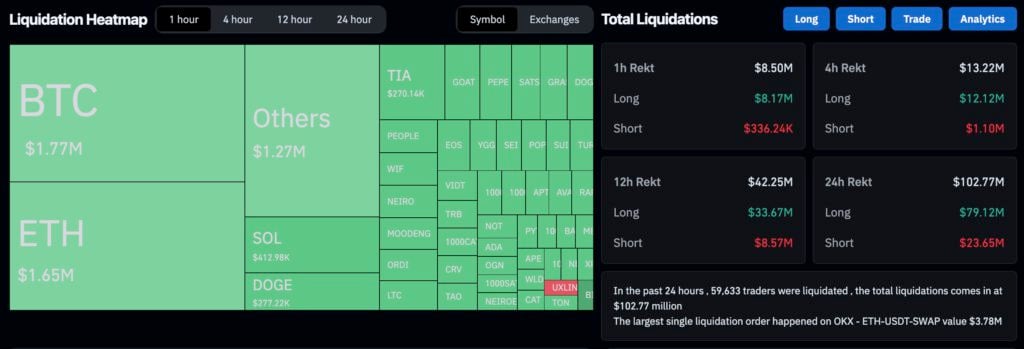

Over $102 Million in Crypto Liquidations in the Past 24 Hours

In the volatile BTC market, according to data from Coinglass, in the past 24 hours, the total amount of crypto liquidations across the network exceeded $100 million (long positions accounted for $79.12 million), with nearly 60,000 people being liquidated.

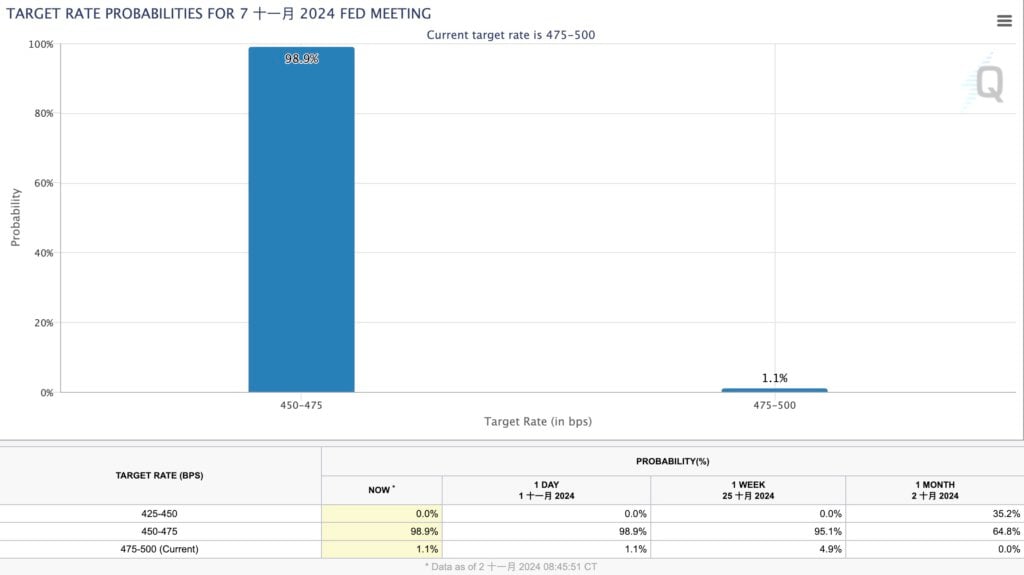

Fed Hike Probability Reaches 99%

Additionally, there is another important news next week, the Fed will hold its November interest rate decision meeting, which is expected to be announced on the 8th Eastern Time, which may also bring great volatility to the global market.

According to the CME Group Fed Watch tool, the market currently believes that the probability of a 1-point rate cut this month has risen to 98.9%, with only 1.1% believing that the Fed will keep rates unchanged.