On November 1, the BNB Chain completed its 29th quarterly burn, effectively reducing the total supply of the cryptocurrency. Following this event, the BNB bulls are looking to leverage the supply reduction to drive up the token price.

Will they succeed? This analysis examines the possibility using a few on-chain and technical indicators.

Token Burn, Driving Bullish Sentiment on BNB

In a recent blog post, the BNB Chain announced that it had burned 1.77 million BNB. This total includes 1.71 million BNB for auto-burn and an additional 62,569 BNB for BTokens. The BNB Chain has been burning tokens since migrating from Ethereum to its own blockchain, aiming to reduce the supply to 100 million.

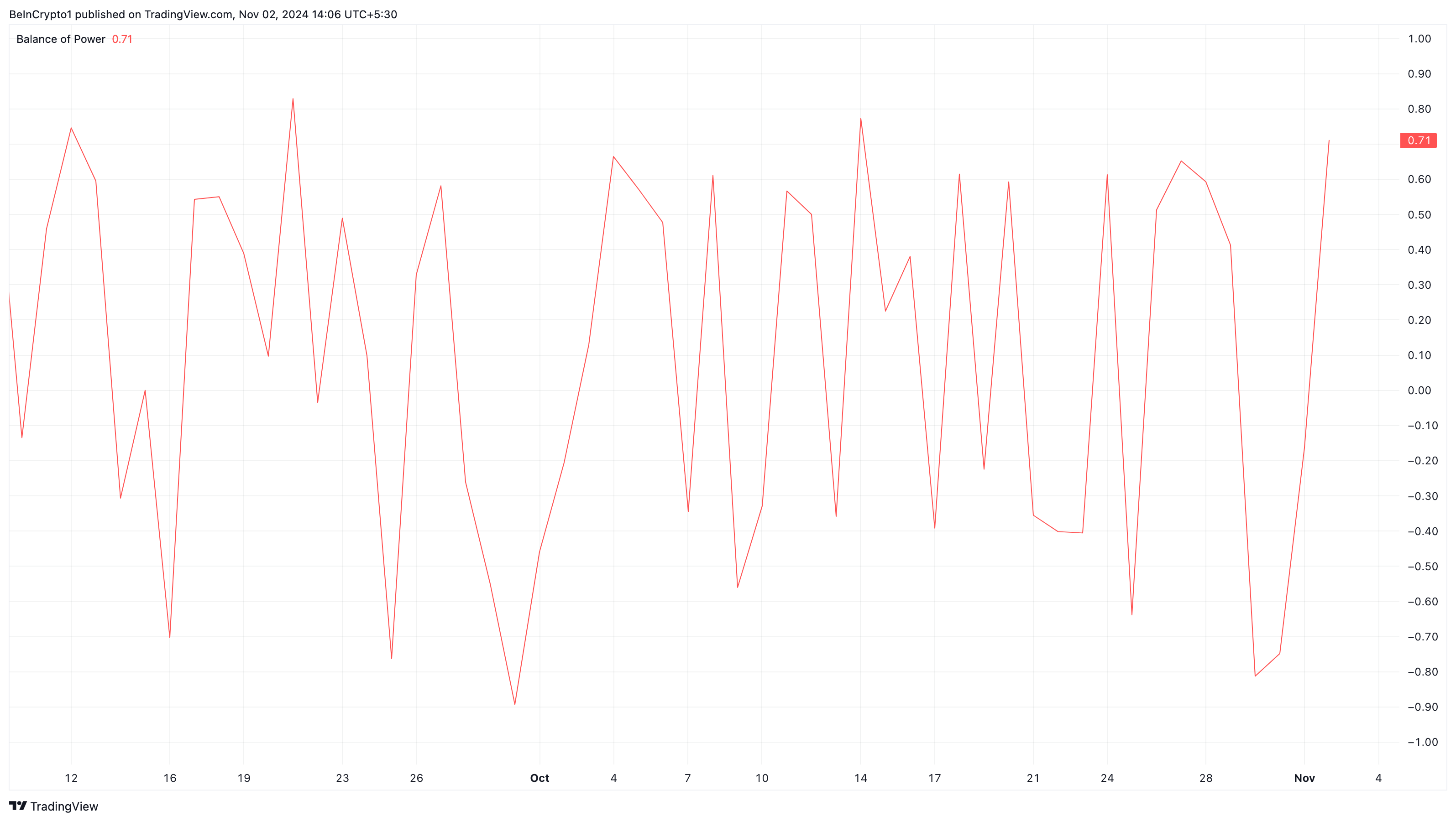

This 29th quarterly burn, worth over $100 million, can stir up positive sentiment among BNB holders who are expecting price appreciation as it contributes to reducing the overall supply. Notably, the Balance of Power (BoP) index on the daily chart has risen post-burn, suggesting increased bullish momentum. Generally, a declining BoP indicates bearish control and often precedes price declines.

Read more: How to Buy BNB and Everything You Need to Know

However, the current situation suggests that the BNB bulls are in control. The cryptocurrency is maintaining a price of $576, indicating potential for further upside.

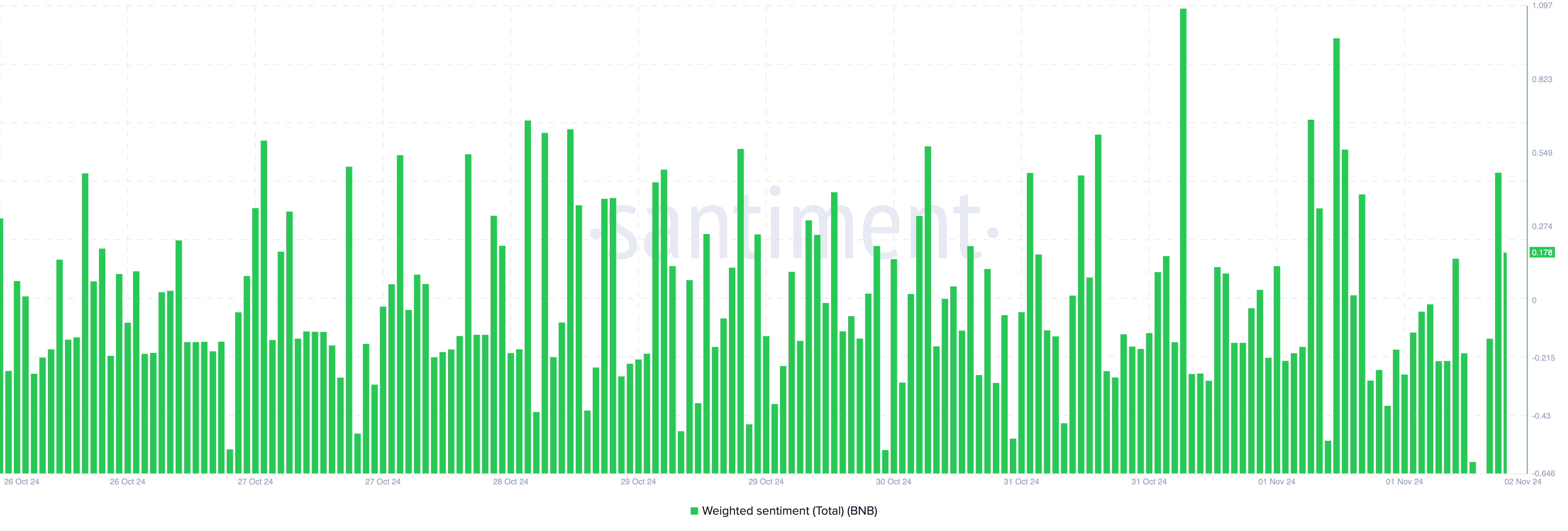

From an on-chain perspective, sentiment data shows a noticeable increase in the weighted sentiment index. This metric measures the market's perception of the cryptocurrency.

When the index is negative, the average discourse tracked through social media is bearish. In this case, the positive reading suggests that most investors are optimistic about BNB's price potential, which could lead to increased demand.

BNB Price Prediction: $573 Support, $606 Upside Target

On the daily chart, BNB has seen a slight rebound. The bulls have successfully defended the $573 support level. Had this support not held, the cryptocurrency could have dropped to the next crucial support at $563.

Additionally, BNB's price has formed an inverse head and shoulders pattern, suggesting a potential shift from bearish to bullish momentum. Considering this technical structure, BNB's price could rise above the $596 resistance and target $606.

Read more: BNB (Binance Coin) Price Prediction 2024/2025/2030

However, if bearishness were to overwhelm the bullishness this time, the predictions could be invalidated. In that scenario, BNB could drop below the $573 support and potentially reach $543.