The US presidential election will officially arrive on November 5th local time, with the earliest polling stations closing in Indiana and parts of Kentucky at 7am Taiwan time on November 6th, and the latest being Alaska at 2pm Taiwan time. This article will speculate on three possible scenarios for this US presidential election.

Three Possible Scenarios for the US Presidential Election

1. The Winner is Announced on Election Night

The first scenario is a landslide victory, with the winner being quickly determined within a single day. If this happens, stock market investors will likely be able to celebrate in the short term. Analysts point out that typically, the stock market has a higher probability of good returns in the month following a US presidential election, as uncertainty dissipates.

2. The Swing State Races Remain Tight

The second scenario is that the vote counting in key swing states is prolonged, and the result may not be known for several days. For example, in 2020, the media did not announce Biden's victory over Trump until four days later.

Analysts believe that unless there is a decisive victory, given the extremely narrow margins in many states, and the possibility of some states requesting recounts, it may take even longer to announce the results this year.

3. A Protracted Legal Battle Ensues

The third scenario is that a winner is declared, but the loser challenges the result, initiating a time-consuming legal process. For example, the 2000 election between George W. Bush and Al Gore dragged on for over a month before the final outcome was determined, during which time the US stock market generally declined due to the uncertainty.

4. Trump Declares Victory Early, Potentially Sparking Unrest

The fourth scenario could be more extreme, with Trump once again emulating his actions in 2020 by prematurely declaring victory. Even if he ultimately loses to Biden, he may refuse to accept the election results and publicly criticize the vote counting process as a "baseless fraud"... resulting in several more weeks of court battles before the final outcome is settled.

This could even reignite the tensions that led to the "Capitol Hill Riot" in 2021, which resulted in the deaths of 2 non-violent protesters and 2 police officers due to violence.

In light of this, Kamala Harris stated in a late October interview that if Trump attempts to "prematurely declare victory" again, they are prepared to respond swiftly, calling on the public to remain calm and patient during the vote counting process.

Additionally, Washington state Governor Jay Inslee has decided to activate the National Guard, keeping them on standby to address potential "unrest".

In summary, the first scenario would likely be the best outcome for the stock market, while the second scenario is the most probable. The third and fourth scenarios are ones that are hoped to be avoided, as they could put pressure on global risk asset markets, including cryptocurrencies.

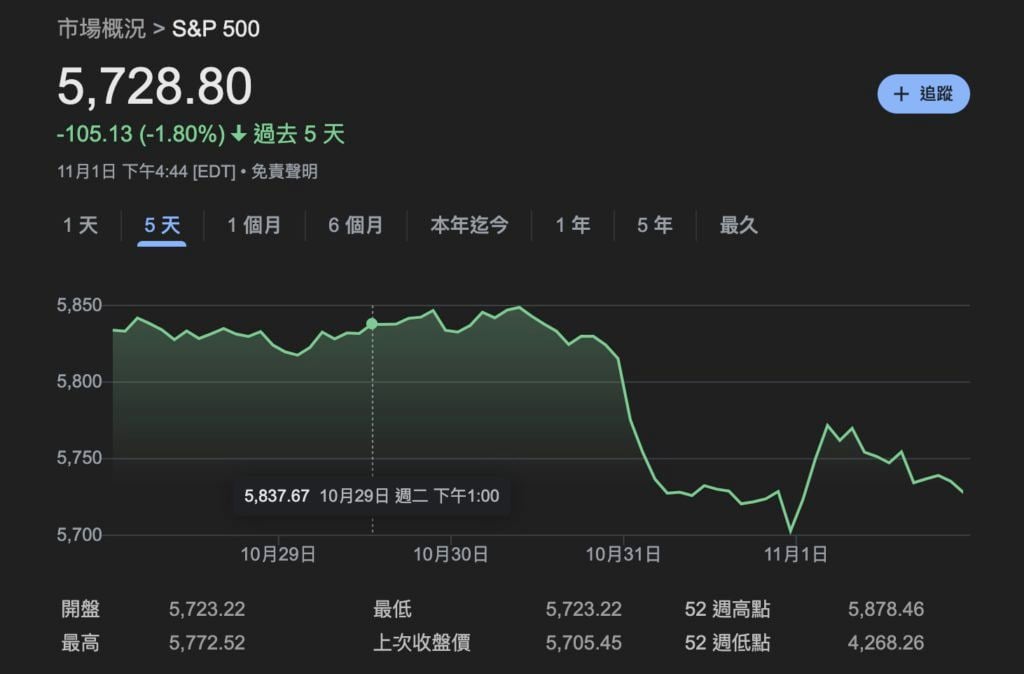

Did US Stocks Lock in Gains Last Week?

For investors, US stocks generally performed poorly last week, with the earnings reports of the Big Tech companies failing to gain investor support. Choosing to exit the market before the election to avoid potential volatility may also have been a factor in the market decline.

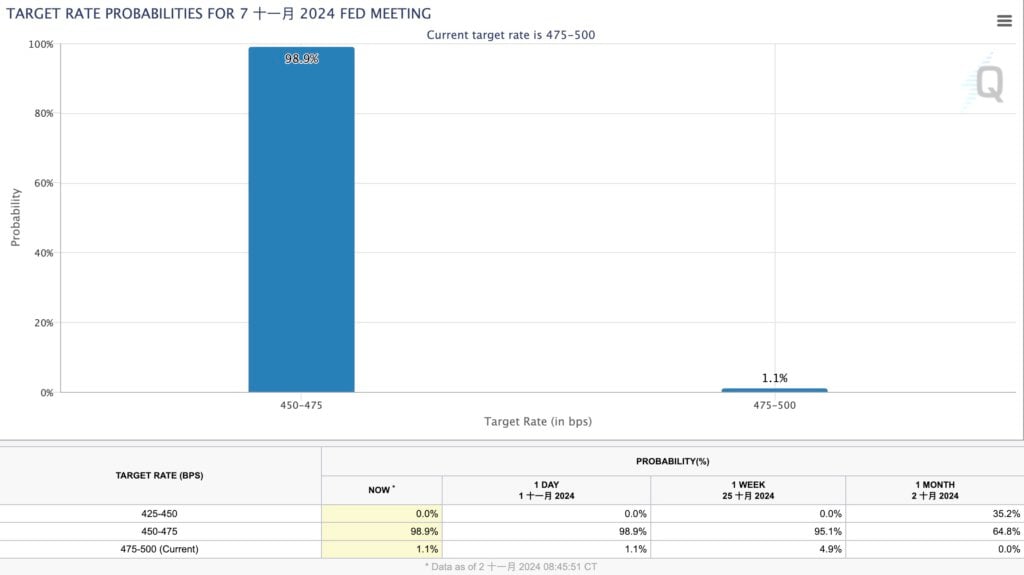

The Probability of a 1-Basis Point Rate Cut by the Fed Reaches 99%

Additionally, next week the Federal Reserve will hold its November policy meeting, with the announcement expected on November 8th Eastern Time, which could also bring significant volatility to global markets.

According to the CME Group's Fed Watch tool, the market currently believes the probability of a 1-basis point rate cut this month has risen to 98.9%, with only 1.1% expecting the Fed to keep rates unchanged.