Author:arndxt

Compiled by: TechFlow

Some notable hot trends include Memes, AI, BRC-20, and RWA.

In a bull market, my strategy is to double down on projects that have already succeeded and closely follow these trends.

Trends to watch in November.

Weekly Updates

Market Momentum from the Elections

Bitcoin is nearing its all-time high, but the calmness in the market shows a sense of anticipation. With the US elections approaching, there could be significant market volatility.

Although Trump is leading in Polymarket's predictions, the election results are still very close. The candidates can no longer ignore an industry worth $2 billion and millions of holders. A victory for crypto-friendly candidates could be a catalyst for a market breakthrough.

Post-Election Bitcoin: Preparing for a Rebound

Trump's stance is clear - he supports the leading role of cryptocurrencies, Bitcoin reserves, and a new SEC leadership. Harris, although supportive, has a more ambiguous stance. Nonetheless, the clarity after the election will usually drive a rebound in Bitcoin. Some volatility is expected, but patience will ultimately be rewarded.

Why This Positioning Is Crucial

Although the all-time high is within reach, retail capital has not yet flooded in.

The supply of Bitcoin on exchanges is rapidly decreasing.

Gold and the S&P 500 index are reaching new highs.

Rate cuts may be imminent.

All the conditions are in place. There may be short-term volatility, but the overall outlook remains optimistic.

Hot Trends for 2024

What are the hot trends? Memes, AI, BRC-20, and RWA.

Future strategy: Double down on successful projects. As the market cycle heats up, stick to these trends to gain a competitive edge.

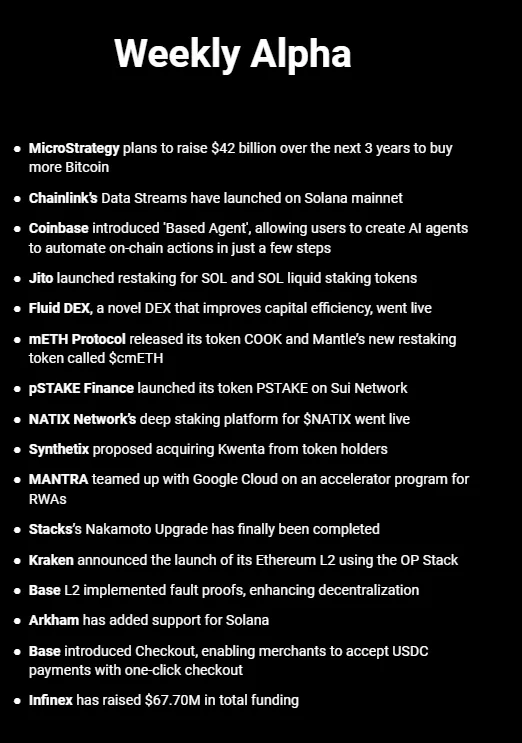

Weekly Alpha Source @TheDeFinvestor

Weekly Alpha

MicroStrategy plans to raise $42 billion over the next three years to buy more BTC

Chainlink's data streaming functionality has gone live on the Solana mainnet

Coinbase has launched "Based Agent", allowing users to create AI agents to automate on-chain operations in just a few steps

Jito has introduced re-staking functionality for SOL and SOL liquid staking tokens

Fluid DEX, an innovative decentralized exchange aimed at improving capital efficiency, has gone live

mETH Protocol has released its token COOK and a new re-staking token $cmETH for Mantle

pSTAKE Finance has launched its token PSTAKE on the Sui network

NATIX Network's deep staking platform $NATIX is now live

Synthetix has proposed to acquire Kwenta from token holders

MANTRA has partnered with Google Cloud to launch an accelerator program for RWA

The Nakamoto upgrade on Stacks has been successfully completed

Kraken has announced the launch of an Ethereum L2 based on the OP Stack

Base L2 has implemented fraud proofs, further enhancing decentralization

Arkham has added support for Solana

Base has launched a one-click checkout feature for merchants to accept USDC payments

Infinex has raised a cumulative $67.7 million in funding

Narrative Overview

The real strategy is to avoid chasing the hype of newly launched meme coins.

The real investment opportunities lie in the established meme coins that have weathered market turmoil.

Why Buying New Coins Is a Trap for Most Traders

Murad recently spoke at the Token2049 conference, and the $SPX he recommended immediately spiked. But the core of his argument is about finding the survivors in the market.

In on-chain investing, to maximize expected value (EV), the "old" meme coins with historical volatility - especially those that have dropped at least 80% from their all-time highs - are the true goldmines.

Let's dive deeper into this goldmine strategy.

The Problem with Chasing New Coins

In fact, for every coin that 50x or 100x in price, there are hundreds that go to zero. Only the top-tier traders, with advanced tools and relentless effort, can consistently generate positive expected value in this environment.

A Better Strategy: Target Crypto Assets with Massive Upside Potential

Most newly launched coins disappear within just hours or days. However, when a coin can survive for months and still not collapse after experiencing major drawdowns, it demonstrates resilience. These coins may not immediately deliver 100x returns, but this investment strategy has significant advantages.

Launched several months ago

Down 80% or more from their all-time highs

Charts show a stable or upward trend (higher lows)

Have an active and loyal community, not just bots or hype

Possess unique meme and "mania" potential

Have relatively high market awareness compared to their market cap

Have a low market cap

Other Updates

The Runes Explosion

Runes activity is growing rapidly, with a 3-fold increase in trading volume and a 4-fold surge in the number of transactions since August. This has also driven a 32% increase in BTC on-chain fees, demonstrating Bitcoin's adaptability and resilience.

The Role of Magic Eden

Magic Eden has dominated the Runes trading, capturing 90% of user activity in the Bitcoin ecosystem. As Runes bring true fungibility to Bitcoin, it has become not just a digital gold, but a platform for memes and collectibles. High fees and slow speeds? These issues are now a thing of the past, thanks to the innovations of Runes and OP_CAT, which could trigger a "meme coin supercycle" on Bitcoin.

The Key Drivers

$DOG is currently leading, but emerging tokens like $PUPS, $GIZMO, and $BDC (especially with the upcoming OP_CAT) are shifting the focus towards cat-themed tokens.

Growth Potential

The market cap of BTC meme coins is $2 billion, which is only 0.11% of Bitcoin's $19 trillion market cap. In comparison, the market cap of ETH meme coins is $20 billion, and for SOL it's $12 billion. The BTC meme coin market has significant room for growth, and early listings on CEXs could bring substantial returns for current investors.

Token Unlocking Dynamics

This week saw significant volatility in token unlocks:

$PORTAL: Typical crypto volatility, with price swings of up to 10%

$TIA: Dropped 21% ahead of an upcoming major unlock

Focusing on $TIA

With the upcoming addition of 9.23 million TIA, this unlocking has become one of the biggest events of the year. Open interest is nearing historical highs, and the market is cautiously responding - this month's strategy appears more thoughtful than the frenzied 30% surge in September.

Despite the recent price decline, early $TIA investors have still reaped substantial returns: seed investors have profited 526x, Series A investors 50x, and Series B investors 5x.

BlackRock's Bitcoin ETF is Setting Records

BlackRock's Bitcoin ETF is making history, reaching $30 billion in assets under management in less than a year, becoming the fastest-growing ETF to date. This is not just a trickle of institutional interest, but a flood.

A Broader Perspective

Inflows have continued to grow, with over $1 billion per day in March alone. This strong interest indicates we are at the forefront of a new wave of institutional adoption. Keep an eye on daily inflows - they signal the impending tidal wave of mass adoption.

BTC Price Trend: Consolidation with Bullish Bias

BTC is in a consolidation phase, but the long-term trend remains bullish. The price is currently above the 50-day moving average, nearing previous all-time highs, and poised for a potential breakout.

The current breakout could trigger the next major rally, or BTC may see a slight pullback to set the stage for a new accumulation wave before rising again. A distributed collapse would be concerning, but there are no signs of this happening yet.