After the dawn, history will come.

The fate of Bitcoin and the US presidential election seem to have never been so closely intertwined. Since the end of October, Trump's winning rate on major prediction platforms has been declining, and Bitcoin has also been fluctuating up and down. As the "hero" and "Bitcoin president" of the crypto circle, if Trump wins the election, what kind of explosion will Bitcoin's price usher in? If he loses, what will the crypto circle and Bitcoin look like?

Soldiers will be blocked, and water will be covered by earth.

On the eve of the election day, let's take a look at the predictions of top traders and prepare a comprehensive trading strategy.

How do traders view the future of Bitcoin?

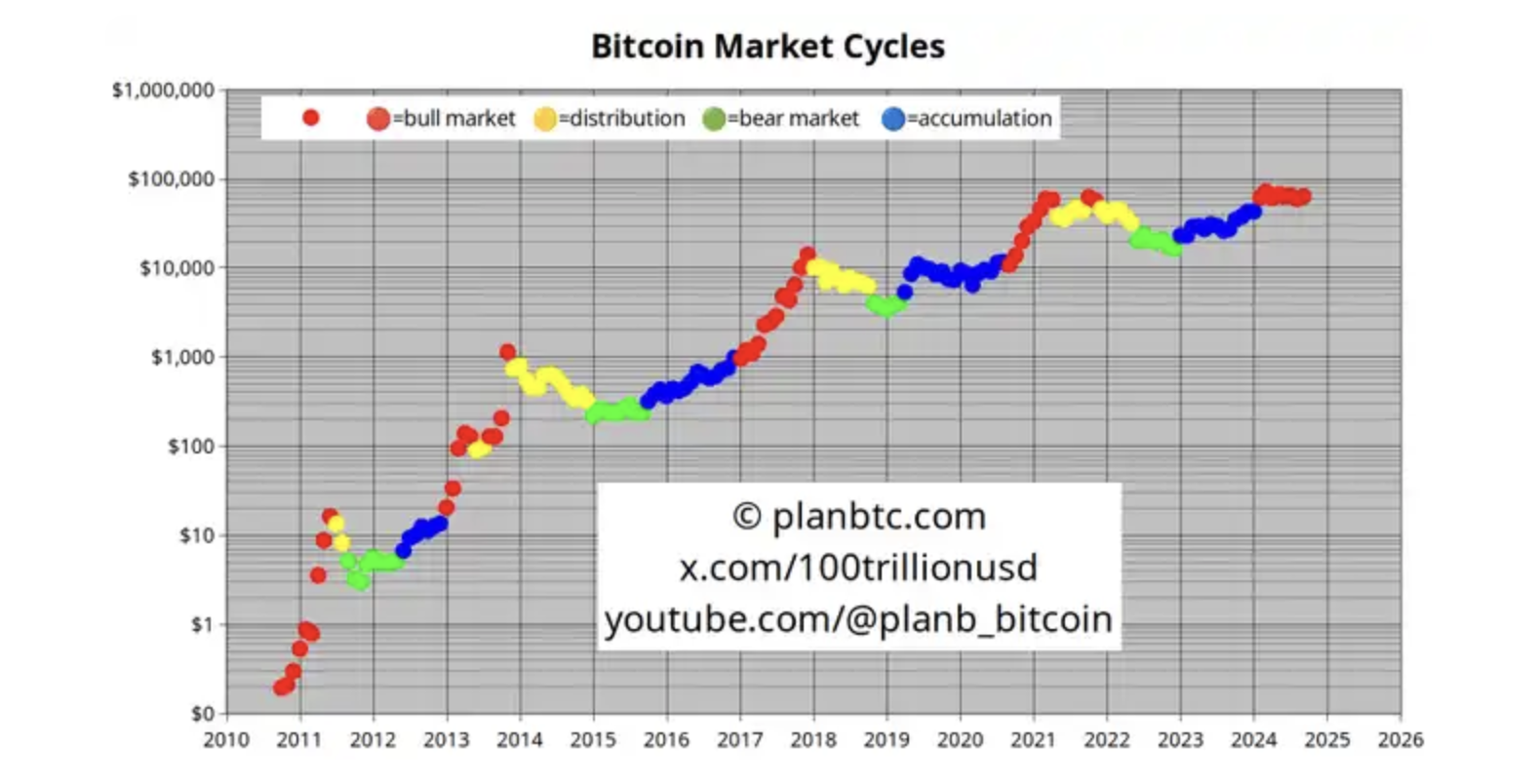

PlanB: BTC is expected to reach $1 million by the end of 2025

PlanB is the creator of the Bitcoin Stock-to-Flow (S2F) model, and enjoys a high reputation in the crypto industry for his unique asset scarcity and price relationship model. His analysis focuses on the growth potential of Bitcoin's long-term value, especially the price fluctuations after the halving event. His latest forecast points out that if Trump wins the upcoming presidential election, the Bitcoin market may usher in an unprecedented price surge.

In his forecast a few months ago, PlanB gave specific figures based on his S2F model:

October: A classic bull run month, BTC reaches $70,000. PlanB predicts that Bitcoin price will see a strong surge in October. He believes that the surge in Bitcoin may be driven by increased global market volatility and the recovery of investor confidence, which is also the time when Bitcoin has often shown price surges in history.

November: Trump wins the election, Bitcoin price reaches $100,000. If Trump wins the election, PlanB believes that Bitcoin will reach a major turning point. He points out that Trump's inauguration may bring friendly policies towards cryptocurrencies, thereby ending the "war" against cryptocurrencies by the Biden/Harris administration, especially the policy constraints on regulatory officials such as Gary Gensler and Elizabeth Warren, which will directly push the Bitcoin price to $100,000.

December: Massive inflow of ETF funds, Bitcoin soars to $150,000. PlanB believes that Trump's victory will clear the way for the approval of Bitcoin ETFs, and a large amount of funds are expected to flow into the market. The inflow of ETFs represents the acceptance and recognition of the mainstream financial market and the trust of investors, further pushing the Bitcoin price to $150,000.

January 2025: The crypto industry returns to the US, Bitcoin rises to $200,000. With the open crypto policy of the Trump administration, a large number of crypto companies and investors may bring their businesses back to the US. PlanB expects this to have a significant market demand effect, pushing the Bitcoin price to $200,000.

February 2025: The "Power Law" team takes profits, the price falls back to $150,000. The correction in February is a prediction of the adjustment in the Bitcoin market. PlanB believes that the profit-taking of investors will lead to a short-term pullback of Bitcoin to $150,000 after reaching a high. However, this adjustment will be temporary and necessary, laying a more stable foundation for the next stage of the rise.

March to May 2025: Bitcoin globalization trend, price breaks through $500,000. Starting from March, PlanB expects Bhutan, Argentina, Dubai and other countries will successively adopt Bitcoin as legal tender, and from April, the US will also launch a Bitcoin strategic reserve under Trump's promotion. Subsequently, in May, he believes that other countries, especially non-EU countries, will join this wave, further pushing Bitcoin to rise to $500,000.

June 2025: AI boosts, price reaches $600,000. In June, PlanB proposed the hypothesis that artificial intelligence will start to autonomously participate in Bitcoin market arbitrage. He expects that with the participation of AI in the Bitcoin market, this high-frequency trading will further drive the price increase, pushing Bitcoin to break through $600,000.

July to December 2025: FOMO subsides, price reaches $1 million. In the following months, PlanB believes that the market's FOMO sentiment will begin to subside, and Bitcoin is expected to reach a new high of $1 million by the end of the year. By then, Bitcoin has not only become a mainstream asset reserve, but also a must-have allocation for global investors.

2026-2027: Market adjustment and bear market. In 2026, PlanB expects Bitcoin's price to pull back from $1 million to $500,000, entering the distribution phase, and by 2027, the market will enter a bear market, with Bitcoin's price expected to drop to $200,000.

PlanB summarizes that the key to this forecast lies in the scarcity value of Bitcoin. He points out that scarcity will become the core factor driving asset prices, just like scarce assets such as real estate and gold. PlanB believes that in the next 18 months, Bitcoin's price is expected to jump in growth driven by the halving effect and market demand, further consolidating its position as "digital gold" among global investors.

The key to PlanB's forecast lies in the scarcity value of Bitcoin. He points out that investors like scarcity, and now there are basically 3 choices for scarcity: real estate (S2F 100, market cap $10 trillion), gold (S2F 60, market cap $20 trillion) or Bitcoin (S2F 120, market cap $1 trillion). Therefore, the scarcity of Bitcoin will become the core factor driving asset prices, just like scarce assets such as real estate and gold.

PlanB proposed the opposite scenario, that is, if Harris wins, he believes this will represent the "end of Western civilization" and continue to exacerbate the decline of the American empire. He expects that the crypto industry will be further suppressed under the regulation of Gensler and Warren, with more stifling actions, and may even face harsher tax policies, such as the introduction of unrealized capital gains tax. However, he also emphasizes that Bitcoin is not dependent on a specific regulatory environment, and its value drive will still come from the global demand for scarcity.

Alex Krüger: Focus on spot BTC on election night

Argentine economist, trader and consultant Alex Krüger believes that the election result will directly affect the direction of Bitcoin prices:

Trump wins: Bitcoin's year-end target price is $90,000. Krüger estimates that if Trump wins, Bitcoin's price will quickly surge to $90,000 by the end of the year, giving a 55% probability of realization. In this scenario, he predicts that Bitcoin prices will "surge rapidly", as the market has already partially expected the positive impact of Trump's victory on cryptocurrencies. But there is still a certain degree of price underestimation, and the market's rapid response will be reflected shortly after the confirmation of the news.

Harris wins: Bitcoin's year-end target price is $65,000. If Harris wins the election, Bitcoin is expected to first drop slightly and then rise, eventually closing at $65,000. Krüger's probability judgment for this scenario is 45%, and he points out that Harris' inauguration may mean a continuation of existing policies. In this scenario, market volatility is more uncertain, but Krüger believes Bitcoin prices still have support and may continue to rise after fluctuations, although the magnitude will not be as strong as expected if Trump is elected.

Krüger emphasized the importance of timing, especially for leveraged investors. He pointed out that if the market confirms Trump's victory, the price of Bitcoin will rise rapidly, while in the case of Harris' victory, the price trend may experience a longer period of volatility. Krüger's personal operation is an unleveraged position (mainly in Bitcoin and some tech stocks like Nvidia), and he believes that spot holdings should be the main focus, avoiding the volatility risk brought by high leverage.

At the same time, Krüger said that regardless of the election result, he remains optimistic about the US stock market, but the premise is that there will be no "blue sweep" - that is, the Democratic Party wins both the presidency and both houses of Congress. He pointed out that the rise and fall of the stock market will directly affect Bitcoin, as the Bitcoin price is highly correlated with the US stock index. Especially in the scenario of Trump's victory, he expects a more crypto-friendly policy and growth-oriented economic measures to drive the stock market higher, which in turn will benefit Bitcoin.

Currently, Krüger pointed out that the market has partially priced in Trump's victory, but based on various betting data and election models, Trump's probability of winning is still between 50% and 63%. This setting of electoral suspense means that the market has not fully digested the possibility of a victory, which will bring greater "surprise" impact on the election results. For the election night strategy, Krüger said he will mainly hold Bitcoin spot, and adopt a long-term operation when Trump wins, such as increasing his holdings of Solana (SOL).

The Giver: Post-election mid-term will decline

The Giver is an anonymous veteran investor with rich experience in buy-side and sell-side financial institutions. He is currently engaged in private equity investment in special situations, providing a different perspective. Compared to Krüger and PlanB, The Giver's strategy is more conservative and focused on the short-term, as he believes that the Bitcoin rally driven by the election is more of a temporary phenomenon rather than a long-term trend. This view particularly emphasizes the driving effect of market liquidity and short-term events, and points out that Bitcoin may face a downward adjustment after the election. His specific analysis is as follows:

The driving force behind this Bitcoin rally is the "non-sticky" buyers driven by event-driven, that is, some short-term speculators seeking to hedge election risks, rather than due to the overall trend. These buyers will not hold Bitcoin for the long-term, and once the election dust settles, they may quickly withdraw from the market. Therefore, these funds lack "stickiness", and Bitcoin prices may face selling pressure after the election.

The lackluster performance of Altcoins is related to the concentration of Bitcoin. In his view, the inflow of funds is mainly concentrated on Bitcoin, and has not widely flowed into Altcoins, leading to the poor performance of Altcoins. This indicates that the current capital flow is more based on Bitcoin as a hedging tool, rather than the overall positive news for the crypto market.

The Giver expects that in the coming week, the open interest and positions of Bitcoin futures contracts will continue to be crowded, even reaching new highs. He pointed out that this "right-side effect" may lead to a short-term surge in Bitcoin prices, but due to the limited market capacity in the fourth quarter of 2024, it is unlikely to continue into the next year. This short-term effect increases the possibility that Bitcoin prices will peak before the election, but the speculative liquidity behind it is not sufficient to support a long-term bull market.

Based on this judgment, The Giver has proposed a relatively aggressive investment strategy: based on the current market environment, he suggests going long on Bitcoin and short on other major coins and Altcoins. Bitcoin will test $70,000 before the election day, but after the results are announced, regardless of who wins, there will be a mid-term decline.

Markus: Hedging strategy of going long BTC and short SOL

Markus Thielen is a well-known analyst at Matrixport and 10X Research, who gained a high reputation in the investment community a few months ago due to the high accuracy of his prediction of Bitcoin's $1 trillion market cap.

Markus' latest analysis is based on the latest signal model of 10X Research, which has a hit rate of 73% to 87%, usually realized within 2 weeks to 9 months. He predicts that if Bitcoin's price continues to develop along the historical trend, it may increase by 8% in the next two weeks, 13% in one month, 26% in two months, and 40% in three months. Based on this calculation, Bitcoin's price may break through $100,000 by January 27, 2025, and reach the target of around $140,000 by April 29, 2025.

Regarding the election results, Markus analyzed the impact of different election results on Bitcoin and other crypto assets. If Trump wins, Markus predicts that Bitcoin may rise by 5%, and Solana and Ethereum may also see similar gains. He believes that Trump's victory will lead to a more crypto-friendly policy environment, which is expected to drive the market upward.

If Harris wins, Bitcoin may decline by about 9%. At the same time, the tightening of the Democratic Party's regulatory policies may affect the approval process of other crypto ETFs. For example, the Solana ETF submitted by 3iQ Digital may face delays or even rejections due to the incoming Harris administration. The increased difficulty in approving the Solana ETF will further impact the market demand and price performance of Solana. Therefore, Markus predicts the decline of Solana may be greater than Bitcoin, reaching around 15%.

In this scenario, Markus recommends a strategy of "going long on Bitcoin and short on Solana" to hedge the uncertainty brought by the election. However, Markus also pointed out that if the election results are delayed or disputed, this will increase the uncertainty in the market, which may lead to increased volatility in Bitcoin.

In the case of disputed election results or a Harris victory leading to a short-term decline in Bitcoin, Markus emphasizes that Bitcoin may still show strong resilience, and therefore recommends that investors seize the buying window after the short-term decline in Bitcoin.

From the perspective of the derivatives market and on-chain data, the total amount of Bitcoin held by short-term holders has increased in October, while the amount held by long-term holders has decreased, which usually occurs at important price levels before a breakthrough. The total open interest of Bitcoin options contracts has soared to $22.5 billion within 2024, indicating a strong bullish sentiment in the market for Bitcoin. The 25 Delta skew of Bitcoin is at the low end of the annual range (-8% to -10%), indicating a strong bullish sentiment.

Thielen also pays special attention to the impact of MicroStrategy's stock performance on Bitcoin prices. He pointed out that MicroStrategy's stock price has risen by 33% since October, and the surge in its stock price has had a "coattail effect" on Bitcoin prices. The covering of a large number of short positions has further boosted the bullish sentiment in the market for Bitcoin.

Standard Chartered Analyst: If Trump Wins, BTC to Reach $125,000 by Year-End

According to an October 25 Cointelegraph report, Standard Chartered bank analyst Geoff Kendrick predicted that if Trump wins the November election, Bitcoin's price could climb to $125,000 before the end of the year.

Kendrick's model shows that on election day (November 5), Bitcoin may stabilize around $73,000. In the case of Trump's victory, Kendrick expects Bitcoin to rise immediately by about 4%, and then another 10% in the following days, with the rise in market confidence and the relaxation of the regulatory environment being the main driving forces.

If Harris is elected president, Kendrick's expectations are relatively conservative, predicting that Bitcoin may face selling pressure in the short term, but is expected to stabilize around $75,000 by the end of the year.

Meanwhile, a research report from another broker, Bernstein, pointed out that if Trump wins the US election in November, Bitcoin is expected to reach a new high later this year, and its price may reach $90,000 in the fourth quarter. In contrast, if Harris wins, the market may expect increased regulation, and BTC prices may fluctuate in the range of $30,000 to $40,000.

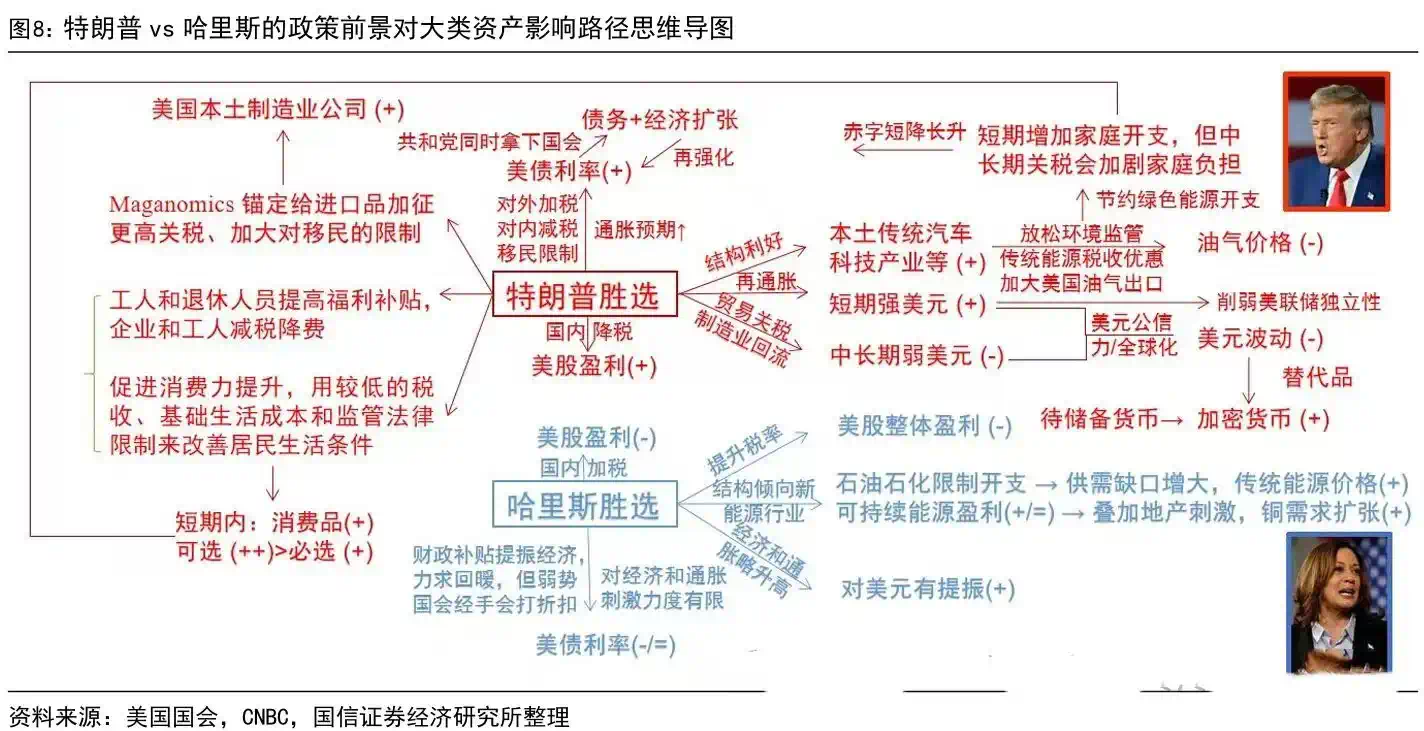

Who becomes the president, and how does it affect other assets?

Overall, if Harris wins, bullish assets include gold, crude oil, copper, and the US dollar; stocks (including A-shares and US stocks) and BTC may face short-term pressure, while US bonds may show a short-short and long-long trend. At the same time, cryptocurrencies like Solana (SOL) may also face downward pressure under the expectation of stricter regulation.

If Trump wins, the trading mechanism will be more complex. Bullish asset classes include gold and cryptocurrencies like BTC, while US stocks and the US dollar may see a short-term rise but a medium-term pullback. A-shares show a short-short and long-long trend, while assets like crude oil, US bonds, and copper may face certain negative impacts. Assets like Solana, which are more closely associated with traditional crypto regulation, are expected to benefit from policy support, but the degree of benefit may be slightly less than BTC.

US Stocks

If Trump wins, small-cap stocks and certain industries are expected to benefit, especially traditional energy, firearms manufacturing, private prison operators, and small retailers. Due to Trump's tendency towards low taxes and reduced regulation, especially beneficial to domestic manufacturing, corporate tax cuts and his support for the energy and extraction industries may drive small-cap stocks higher, with the current Russell 2000 index (small-cap benchmark) already reflecting this expectation, rising about 4% since early October.

If Harris is elected, the market tends to focus on her policies to expand healthcare and Medicaid. Healthcare stocks may see a boost, but the overall US stock market may face pressure. Additionally, the US dollar and US bonds may strengthen in the short term, and the market remains cautious about potential regulatory and corporate tax policies, which may suppress overall market confidence.

US Dollar and Foreign Exchange Market

The expectation of a Trump victory has already manifested in the exchange rate of the US dollar against the Mexican peso, with the Mexican peso seen as one of the currencies most affected by Trump's immigration policy. Market volatility also increased significantly when Trump's election prospects rose, with the MSCI Latin American Currency Index falling more than 3%, and the US dollar clearly strengthening after Trump's statement on Mexican goods import tariffs.

If Harris wins, the US dollar may remain relatively strong in the short term, especially as the market expects the Federal Reserve to maintain a steady approach to interest rate decisions. If economic policies drive long-term fiscal stimulus, the US dollar's medium-term volatility may remain moderate, and the pressure on emerging market currencies like Latin America may ease.

Oil and Copper

If Trump wins, the traditional energy industry (such as oil and fossil fuels) may rise due to Trump's supportive policies. Trump's energy policy tends to reduce regulation, support domestic extraction and fossil fuel use, which will have a positive impact on the relevant markets.

Harris, on the other hand, tends to adopt stricter policies on environmental and climate issues, which may put certain medium- and long-term pressure on oil. Metals like copper may benefit from the expected demand growth from green infrastructure construction, but the market needs to be alert to the potential supply chain pressure from tax policies and environmental policies.

US Bonds

A Trump victory is a short-term positive for US bonds, and in the interest rate and bond market, market analysts say smart money has already started to focus on the bond market. The yield on US bonds may rise due to the expectation of a Trump victory, but in the long run, under the influence of fiscal expansion and inflation risks, US bonds may face greater selling pressure.

However, if Harris wins, the US bond market may perform "short-short and long-long" in the short term, with short-term selling pressure perhaps exacerbated by interest rate expectations or capital shifting to risky assets, but in the long run, as expected inflation declines, it may support bond demand.

Gold

As the most traditional inflation hedge tool, gold seems to continue to rise regardless of who wins. Analysts generally believe that the US government's debt problem will continue to expand, and it will use inflation to dilute the debt, making gold and BTC the main choices for investors to hedge against inflation. Gold, due to its safe-haven properties, will attract investors to cope with the potential depreciation of the US dollar and economic uncertainty.

However, Standard Chartered Bank analysts point out that gold is more likely to rise if Trump wins, as the market generally expects more fiscal spending after a Trump victory, which will drive inflation in the short term and further increase the demand for gold.

The "Hero" in the Crypto Circle, What Has Trump Done in the Crypto Circle?

At one point, Trump was a staunch opponent of cryptocurrencies. In early 2019, during his presidency, Trump publicly criticized BTC and other cryptocurrencies, calling them "worthless" and believing that crypto assets could be used as tools for illegal activities. He stated that BTC "is not money" and is highly volatile.

After leaving the White House, Trump continued to hold a reserved attitude in interviews, calling BTC a "scam" and insisting that the US dollar should be the world's only reserve currency. During this period, Trump's attitude towards cryptocurrencies was basically negative. But the 2021 NFT craze quickly began to influence Trump's views.

The story starts in 2022. At that time, the cryptocurrency market was in a "winter," with many crypto projects on the verge of bankruptcy and market confidence low. It was then that Trump's long-time advisor Bill Zang appeared in his life, bringing a suggestion that could change Trump's mind: issuing Trump-themed Non-Fungible Tokens (NFTs).

Trump expressed unexpected interest in this - although he didn't like the term "NFT," preferring to call them "digital trading cards." Despite the seeming oddity, these cards were very popular, with each one selling for $99 and being snapped up almost immediately after release. Trump's NFTs not only brought him tens of millions of dollars in revenue, but also made him stand "in front of the crypto community" for the first time, discovering a new and powerful support group.

Therefore, Trump's attitude towards crypto has undergone a complete reversal over the past few years.

On November 1, 2024, the 16th anniversary of the Bitcoin whitepaper release, Trump tweeted to express his blessings for BTC, and stated that if elected, he would end the Harris administration's crackdown on cryptocurrencies, and even called on his supporters to help him realize the vision of "Bitcoin Made in America." At this point, he is no longer an opponent, or even just an observer, but a "presidential candidate" who is a crypto advocate.

The most iconic event was his attendance at the Bitcoin 2024 conference in Nashville, where Trump announced that he would become a staunch supporter of cryptocurrencies, and was even very clear about the biggest pain point in the crypto circle, promising to fire the current SEC chairman Gary Gensler and replace him with a "crypto-savvy regulator."

He bluntly stated that "opposing crypto is the wrong policy," and that he will make America a "BTC superpower," hoping to lead the global crypto industry's development through a more friendly regulatory environment. He even praised BTC as the core of the modern economy, saying that if BTC wants to "go to the moon" in the future, he hopes America can be its leader.

Trump attends the Bitcoin 2024 conference, source: WSJ

Trump forcefully positioned himself against the Democratic Party's harsh stance on encryption in his speech, particularly contrasting himself with Elizabeth Warren, who is known for her encryption regulation. He also stated that if elected, he would create a "Presidential Crypto Advisory Council," which immediately sparked enthusiastic applause and cheers from the audience. Even more shocking was his assertion that the market capitalization of Bitcoin could one day surpass that of gold, as he openly criticized the Biden-Harris administration's anti-crypto policies.

During the conference, Trump underwent a sort of "public awakening," transforming from a former president who was skeptical of cryptocurrencies to a spirited defender of Bitcoin and the free market. The audience was captivated by his change in attitude, viewing him as a "hero" in the crypto community.

Another detail behind this transformation reveals the subtle connection between Trump and cryptocurrencies. At the conference, he noted that Bitcoin had surged by 3900% during his previous presidential term, skyrocketing from less than $1,000 to over $30,000. His remarks not only ignited the crowd but also garnered the support of crypto industry heavyweights, such as Elon Musk, the Winklevoss twins, and a16z founder Marc Andreessen, who all voiced their support for his crypto policies.

Beyond Bitcoin itself, Trump has gradually recognized the important role of Bitcoin mining in US energy security and economic sovereignty. In June 2024, he met with executives from several major Bitcoin mining companies in the US and promised to provide strong policy support for crypto mining activities. He even posted on the Truth Social platform that Bitcoin mining is the "last line of defense" against central bank digital currencies (CBDCs), expressing his hope that "all remaining Bitcoins are made in America." In Trump's view, Bitcoin mining is not just an economic activity but also a symbol of America's will to resist central banks.

In September, Trump purchased a cheeseburger at the Bitcoin-themed bar PubKey in New York using Bitcoin, a move that could help to reposition Bitcoin from a financial investment to a daily transaction currency, becoming a symbol of his crypto stance.

Trump has also made larger promises to the crypto community, not only publicly stating his intention to maintain a strategic Bitcoin reserve but also planning to pardon Ross Ulbricht, who was sentenced to life in prison for operating a Dark Web platform. Through these radical measures, Trump has successfully positioned himself as the "savior" of the crypto community, pledging to protect Bitcoin from excessive government regulation and to make the US the global center of cryptocurrencies.

Amid the uncertainty of whether Trump will return to the White House, the future of Bitcoin and the entire crypto market seems to be at a crossroads. Over the past few years, political turmoil, policy changes, and global economic uncertainty have all contributed to Bitcoin's steady rise to new heights. If Trump regains power, his support for cryptocurrencies could trigger a new market frenzy, propelling Bitcoin to new highs and potentially reshaping the US financial landscape.