Author: JW, Four Pillars Researcher; Translation: Jinse Finance xiaozou

Abstract:

There are three basic components of a modern crypto wallet: key management for handling cryptographic keys, accounts for user authentication and interaction, and an interface for user engagement. Each part has different challenges and innovations that together shape the overall wallet experience.

Key management has evolved from simple private key management to more complex solutions: Shamir's Secret Sharing scheme splits the key into multiple fragments, Threshold Signature Schemes supports multi-party computation without rebuilding the key, and Trusted Execution Environment uses hardware-level isolation. Projects such as Privy, Particle Network, and Turnkey have adopted these methods in practice.

Account abstraction makes blockchain interactions more user-friendly by converting complex accounts into programmable interfaces. This enables features such as gas-free transactions, social recovery, and customized security settings, making blockchain technology more accessible to mainstream users, as demonstrated by projects such as Abstract's Global Wallet.

Chain abstraction makes the various blockchains invisible to end users, thereby solving the complexity of cross-chain interactions. Users can manage balances across chains, use any token for payments, and interact seamlessly with multiple blockchains while maintaining decentralization and security. One Balance's Credible Accounts system shows us a way to achieve these features.

The crypto industry is rapidly moving from a desktop-first to a mobile-first development model, and platforms like Zora are leading the transition by providing sophisticated mobile experiences while maintaining the complexity of blockchain under the hood.

The future of wallet development lies in simplifying the user experience without compromising security. The path to wider adoption requires moving from private keys to social logins, while having a seamless experience comparable to Web2 applications and retaining the core benefits of blockchain.

1. Introduction to wallet stack

For end-user crypto applications, wallets are much more than digital containers for assets - they are the gateway to the entire blockchain experience. Every interaction with a crypto application, from initial setup to daily transactions, flows through the user's wallet. This makes the wallet not just a function, but the most basic infrastructure that determines the user's blockchain experience.

Creating a new wallet and depositing funds into it requires a lot of time, effort, and risk tolerance from the user. While this high barrier to entry drives up the user acquisition cost of the application, it also creates a strong retention mechanism - once a user uses a wallet, he is likely to continue using it and will not choose to switch to another wallet and go through the process again.

Yet, despite the critical role they play, crypto wallets have earned a reputation for having the most technically challenging user experience. First-time crypto wallet users often find themselves lost in a maze of technical concepts — private keys, public keys, seed phrase— leaving little room for error. This complexity has led many to question whether such a steep learning curve is really necessary to fully utilize blockchain technology.

However, this is finally changing. After years of stagnation, wallet technology is experiencing a major renaissance due to an increasing focus on user experience. Modern wallets are building a bridge between the convenience of Web2 and the security of Web3 through innovations such as social login authentication, biometric verification, and gas fee abstraction. These developments are finally bringing crypto wallets closer to the user-friendly experience people expect from modern applications.

The technical infrastructure of a blockchain wallet consists of three basic layers:

Key Management: This foundational layer orchestrates the generation, storage, and recovery of cryptographic keys. It encompasses key technical decisions about encryption methods, security protocols, and access control. Modern solutions go beyond basic key storage and include methods such as multi-party computation (MPC), Shamir Secret Sharing (SSS), social login integration, and mobile-friendly Passkey.

Accounts: This layer defines how users are identified and how they interact with the blockchain network. It ranges from basic concepts like external accounts (EOA) to complex concepts like smart contract accounts (SCA). Each type of account can be enhanced with different features - from gas fee sponsorship and multi-signature requirements to customized transaction controls - which ultimately determines the functionality and versatility of the wallet.

Interface: This is where users interact directly with the blockchain. Whether through a browser extension, mobile app, or web interface, this layer provides key points for user actions such as signing transactions, managing assets, and connecting to dApps.

Each layer has its own set of design considerations and trade-offs. How they are implemented and integrated determines the overall wallet experience. In this article, we will look at the components and latest innovations of each layer, exploring how various methods can help create more user-friendly crypto applications.

2. Key management: where and how to store your keys

The key management layer contains three key decision points:

Key generation: The core of the key generation method is to define how to create keys and use them to sign transactions. Although the single private key method is still the traditional method, the industry is increasingly adopting complex solutions such as multi-party computation (MPC) and Shamir Secret Sharing (SSS). These new methods distribute the key generation and signing process to multiple parties, thus achieving a better balance between security and usability.

Storage: This component determines where the generated keys or key fragments are stored. The final choice depends on various factors: security needs, accessibility needs, operating costs, and the degree of decentralization required. Available options include centralized cloud servers (such as AWS), decentralized storage solutions, personal storage devices, and hardware wallets, each of which has unique advantages and trade-offs.

Authentication: Users prove their identity through various authentication methods to access their keys. Traditional password systems are giving way to more user-friendly methods such as social login and Passkey, reflecting the industry's shift towards better user experience, especially on mobile devices.

When deploying a key management system, the components can be configured differently depending on specific needs, whether it is the purpose of the application, technical constraints or business requirements. In current market solutions, the key differentiator is often the choice of key generation method and authentication method combination, as these choices fundamentally determine the balance between security and user experience.

The earliest key management methods were simple but demanding: users retained full control of their private keys through an external account (EOA). While this direct ownership model continues to be widely used, its limitations are becoming increasingly apparent. New users are often overwhelmed by the technical complexity of key management, and even experienced users face significant security risks - whether it is a potential hack or permanent loss of funds due to improper key storage.

To address these challenges, the industry has developed three different modern key management approaches: Shamir Secret Sharing (SSS), which distributes key fragments to multiple locations; Multi-party Computation (MPC), which supports transaction signing; Trusted Execution Environment (TEE), which provides a secure enclave for key operations. Each of these solutions addresses the limitations of traditional wallets in a unique way, providing a different balance between security, usability, and decentralization, which we will explore in depth below.

2.1 Shamir Secret Sharing (SSS)

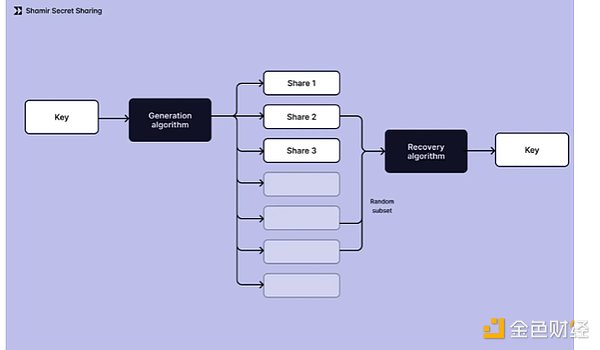

Developed in the 1970s, SSS is an encryption algorithm that improves security by breaking a key into multiple fragments. This approach serves two main purposes: it eliminates the single point of failure inherent in single-key management, while ensuring that the key remains recoverable when needed. The key feature of the system is its threshold mechanism - a certain minimum number of key fragments must be combined to reconstruct the original key, and any smaller collection of fragments cannot reveal the key content.

In practice, SSS works by generating a private key locally on the user's device, splitting it into multiple fragments, and distributing these fragments to different stakeholders (usually including users and service providers). For transaction signing, the system temporarily reunifies the required number of key fragments to reconstruct the key. This approach enhances security while seamlessly integrating with existing blockchain infrastructure.

advantage:

- Proven stability: The algorithm has been extensively validated over decades, resulting in multiple open source implementations that have been battle-tested.

-Flexible key distribution: Administrators can precisely customize the total number of key fragments and the threshold required to reconstruct a key.

- Modularity: Individual fragments of the storage solution can be updated independently, enabling targeted system improvements without a comprehensive overhaul.

- Scalability: The client-side computing model ensures consistent performance regardless of the size of the user base.

shortcoming:

-Key reconstruction vulnerability: A temporary security vulnerability is generated when re-keying is performed during transaction signing.

- Verification limitations: SSS lacks cryptographic methods to verify that fragment deletion was successful or that the initial key generation was accurate.

- Complex implementation: Solutions often require complex development expertise, especially in ensuring client operations are secure.

Case Study: Privy

Privy demonstrates an advanced SSS implementation in a modern wallet architecture. Their embedded wallet solution uses a secure isolated iframe environment where CSPRNG is used to generate wallet credentials. The system then generates a seed phrase to obtain the wallet's public address and private key.

After initial generation, the system uses SSS to split the private key into three different fragments:

-Device Share : Stored locally on the user's device, in the browser's local storage when using a web application.

- Authentication Share: Stored in encrypted form on Privy servers and accessed during the authentication process.

-Recovery Share: Can be flexibly stored in Privy's key management infrastructure or directly by the user.

A key security feature is that the full private key is only temporarily stored in memory during operation and is never saved anywhere permanently. The system's architecture requires any two fragments to reconstruct the key, creating three strong recovery paths:

-Device Share + Authentication Share: This is the standard user flow. The user authenticates through social login or similar methods, triggering the decryption of the user's authentication Share, which is combined with the user's local device Share.

-Device Share + Recovery Share: This path provides a fallback mechanism when the Privy server is unreachable or the user cannot access their primary authentication method.

- Authentication Share + Restore Share: Create a new device Share on other devices to achieve seamless device migration.

Privy's advanced recovery system allows secure access to wallets in a variety of situations without compromising security. The deployment successfully achieves a delicate balance between reliable security measures and user accessibility in digital asset management.

2.2 Threshold Signature Scheme (TSS)

TSS is a form of multi-party computation (MPC) where multiple participants jointly generate and combine signed shares to perform cryptographic operations on a shared key. Unlike SSS, a key feature of TSS is that participants can combine their signed shares to perform operations without having to reconstruct the key.

TSS can be implemented in a variety of ways, from large-scale networks involving multiple computing nodes to simple two-party signature schemes between users and service providers. Participants can contribute to signature generation without directly knowing the key, achieving a flexible signing process while maintaining high security.

advantage:

- Enhanced security: Eliminates the single point of failure present in SSS by eliminating the need for key reconstruction

-Flexible architecture: allows custom configuration of the number of participants and required signatures, supporting various trust models.

shortcoming:

-Technology maturity: As a relatively new commercial technology, there are few proven deployment and large-scale deployment cases.

- Scaling limitations: TSS-based systems require communication between participants, resulting in slower processing speeds, especially when deploying ECDSA on Ethereum.

-Deployment complexity: It requires coordination and communication among multiple parties, resulting in complex deployment and high operating costs.

In summary, although TSS has attracted attention as a powerful alternative to solve the single point of failure problem of SSS, its current deployment faces some limitations in terms of performance and complexity. These limitations restrict its scalability in practical applications to a certain extent.

Case Study: Particle Network

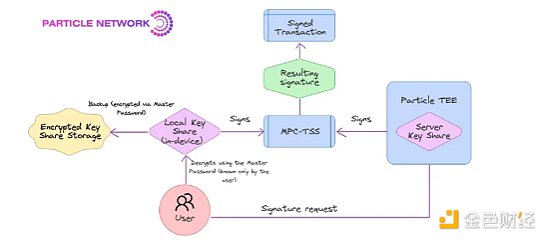

The Particle network is a prime example of a user-friendly wallet solution provided through MPC-TSS deployment. They specifically adopted a 2/2 TSS approach, ensuring that private keys are never centralized in one place throughout their lifecycle (from generation to storage and use).

In the TSS deployment of the Particle network, two independent key shares are generated and stored in different locations. One share is stored in the user's local environment, while the other is saved in the Particle's trusted execution environment (TEE). Importantly, the individual shares do not disclose any information about the complete key, and operations are performed by combining the shares without reconstructing the complete key.

As an extra layer of security, users can set a master password to encrypt the locally stored keyshare. This provides additional security beyond social login authentication while still supporting secure wallet recovery across different devices.

Currently, the Particle network provides MPC signature support for Solana and EVM chains. With this approach, the Particle network provides a secure, non-custodial key management system that remains user-friendly and chain-agnostic.

2.3 Trusted Execution Environment (TEE)

TEE takes a completely different approach from SSS and MPC. It performs all private key related operations in a secure isolated execution environment (enclave). This security is guaranteed at both the hardware and software level through platforms such as Intel SGX or AWS Nitro Enclaves.

In a TEE-based system, authorized code runs in a remote enclave with isolated CPU and memory resources, free from external monitoring or interference. The enclave can generate certificates that prove that operations are performed correctly, allowing users to verify that their private keys are handled securely. This provides a simple and powerful platform for key management. Unlike SSS or TSS, which require complex key splitting or multi-party computation, TEE achieves secure key management through hardware-level guarantees.

advantage:

- Strong Security: Provides advanced security through hardware-level isolation.

- Verifiability: It can be cryptographically proven that all operations were performed as expected.

- Efficient performance: Requires less network communication than TSS, resulting in relatively faster processing.

shortcoming:

-Hardware Dependency: High reliance on specific hardware or vendors can lead to centralization or censorship risks.

- Security vulnerabilities: If the enclave itself is attacked, the entire system may be at risk.

TEE provides a practical solution to the key management problem through hardware-based security. Although its deployment is simpler than SSS and its operation is more efficient than TSS, its dependence on the hardware platform is still an issue that needs to be seriously considered.

Case Study: Turnkey

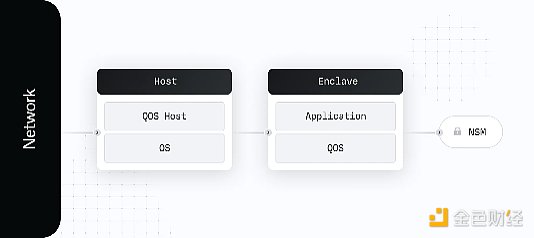

Turnkey's core security strategy revolves around handling all critical security operations within the TEE. In the Turnkey system, all security-sensitive services - including key generation, signing, and policy engines - are executed within the secure enclave.

The Turnkey architecture consists of two main parts:

-Host: This is a standard AWS virtual machine that runs basic applications for receiving network traffic and making enclave calls. It acts as a buffer between the enclave and external systems, collecting metrics and other operational information related to enclave operations.

-Enclave: This is an environment that is completely isolated from external connections, with only a virtual serial connection to the host and its own security coprocessor, called the Nitro Security Module (NSM) in AWS. This environment runs QuorumOS (QOS), Turnkey's enclave operating system, and the security applications that run on it.

Through this structure, Turnkey can prove to itself and its users that all critical safety systems are operating exactly as expected. Enclave runs in a highly restricted computing environment with no permanent storage, interactive access, or external networking, thus providing the highest level of security.

3. Accounts: Invisible Accounts and Chains

As blockchain technology continues to grow and gain mainstream adoption, there is a growing need to abstract its technical complexity. Wallets are the primary touchpoint between users and blockchain networks, but they often have a high barrier to entry. New users must work hard to grasp unfamiliar concepts such as private key management, gas fee payments, and transaction signing, and these technical aspects can be daunting and too complex for the average user.

This need for abstraction also mirrors the development of other technologies we use every day. Think about how we interact with the Internet: users don’t need to understand the TCP/IP protocol or the DNS system to browse a website. Similarly, making a phone call doesn’t require understanding GSM or LTE technology. This pattern is consistent among mature technologies – as they evolve, technical complexity is increasingly hidden behind user-friendly interfaces.

In this article, we will explore two fundamental abstractions that reshape the wallet user experience. The first is Account Abstraction, which transforms complex blockchain accounts into a programmable, user-friendly interface. The second is Chain Abstraction, which eliminates the complexity of cross-chain interactions and gives users the ability to seamlessly operate across different blockchain networks without understanding the underlying mechanisms.

3.1 Account Abstraction

Initial EOAs provided only a few basic functions: storing addresses and signing transactions. The lack of programmability at the account level meant that any advanced functionality or customization was impossible. The introduction of account abstraction changed this by enhancing functionality directly at the account level. While account abstraction initially showed promise in addressing blockchain user experience challenges, there were several barriers that delayed its widespread adoption. Complex deployment requirements, high gas costs, and poor compatibility with existing EOAs all contributed to slower adoption than we had expected. The technology has matured, overcoming early challenges, and is now moving toward real-world applications. Several recently launched consumer applications have successfully integrated account abstraction, allowing end users to interact seamlessly with blockchain applications, often without realizing that they are using a wallet or blockchain. This development signals the potential for broader crypto adoption beyond the existing crypto user base. The impact of account abstraction continues to expand across the crypto ecosystem. L2 rollups are now integrating it at the protocol level to enhance the user experience, while wallet-as-a-service (WaaS) providers have deployed more advanced embedded wallet solutions. The importance of this technology is further highlighted by the upcoming Ethereum Pectra upgrade, which includes EIP-7702, which allows EOAs to leverage the temporary programmability of SCA on the mainnet.

Case Study: Abstract

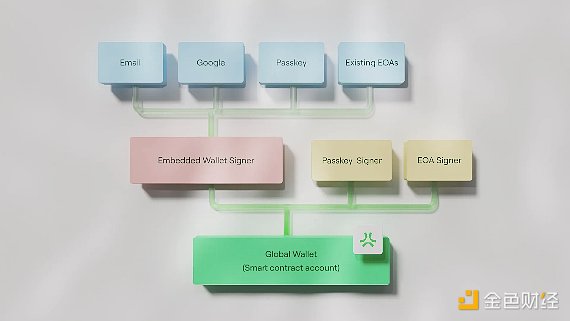

Abstract has developed Abstract Global Wallet (AGW), a universal embedded wallet designed to power the applications on its platform. Unlike application-specific wallets, AGW acts as a comprehensive solution that allows users to access any application in the Abstract ecosystem. This wallet solves a real need: allowing users to manage their data and assets across multiple applications through a single access point.

Compared to traditional EOA, AGW implements Native Account Abstraction to create a smart contract wallet with higher security and flexibility. This approach treats all accounts as smart contracts, ensuring that they follow the same transaction lifecycle. While traditional Ethereum maintains separate processes for EOA and smart contract accounts, the Abstract deployment handles all accounts uniformly, providing consistent functionality for existing EOA users and users using the new AA wallet.

The wallet creation process follows a simple two-step approach for EOA and Smart Contract Account (SCA) integration. When a user logs in through common methods such as email, social login, or password, the system creates an EOA wallet in the background. This EOA address then becomes an authorized signer of the deployed smart contract wallet. This design eliminates the complexity of blockchain wallet creation while maintaining its security features.

Abstract’s local account abstraction follows the zkSync standard and includes the following key components:

- IAccount standard interface: defines the methods required for all smart contract accounts, standardizes account behavior, and ensures consistency.

- DefaultAccount Conversion: EOA wallets (such as MetaMask) are automatically converted to IAccount’s DefaultAccount deployment during transaction processing, giving them access to SCA advanced features.

- Paymaster support: All accounts can sponsor gas fees for other accounts, or use ERC-20 tokens instead of ETH to pay gas fees, which greatly reduces the entry barrier for new users.

Through this architecture, Abstract enables users to seamlessly access advanced features without understanding the underlying complexity. Users only need to log in through familiar methods such as email or social accounts, and the system will automatically handle EOA creation and smart contract wallet deployment in the background. After initialization, users can access features such as multi-signature settings, transaction limits, and account recovery mechanisms.

In addition to native account abstraction, AGW also integrates Privy's Cross App Wallet to support its consumer-centric approach. Traditional embedded wallets, while providing simple social login and key management, are limited by their application-specific nature, leading to fragmented asset management across platforms. The Cross-app Wallet concept deployed in AGW solves this problem by allowing users to access their assets and data across multiple applications with a single authentication.

The development of universal embedded wallets poses significant technical challenges, especially in terms of security architecture. Unlike application-specific wallets that contain security risks, cross-application wallets mean that security issues in one application may affect all associated applications. This requires a more robust security model. However, the benefits of this approach are huge:

- Simplified asset management : One deposit point for all integrated applications.

- Centrally track assets: Centrally track assets across multiple applications for users and developers.

-Seamless transfers: Funds can be transferred directly between different applications within the ecosystem.

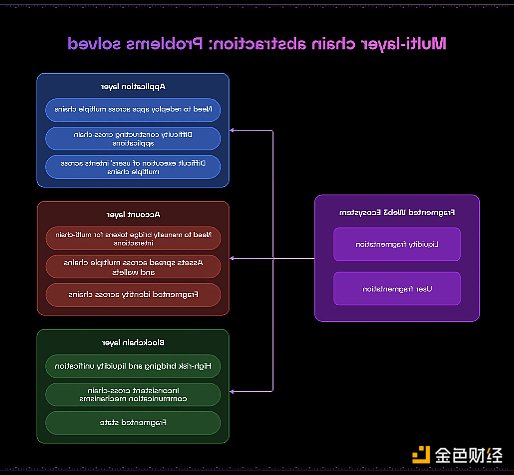

3.2 Chain Abstraction

In addition to account abstraction, chain abstraction has recently become an important concept in blockchain development. While account abstraction focuses on improving the user experience within a single blockchain, chain abstraction addresses a different challenge: enabling users to seamlessly interact with assets on multiple chains without involving bridging mechanisms. Chain abstraction, at its core, is about making the concept of different blockchains transparent to end users, a need that becomes increasingly important as more modular blockchains continue to create more complex on-chain ecosystems.

Unlike account abstraction, which is defined by a specific technical specification such as EIP-4337, chain abstraction is a broader approach that can be deployed across all layers of the blockchain stack — from applications and accounts all the way to protocols — with the goal of abstracting away the complexity of cross-chain interactions.

Chain abstraction can provide an enhanced blockchain user experience, including but not limited to:

- Unified balance management: Users can manage their assets through a single interface, regardless of which blockchain they are on. This unified management approach eliminates the requirement for users to track balances on different chains or understand the underlying blockchain architecture.

-Flexible payment system: Users can pay with any token on any chain. There are dedicated solutions to handle the complexity in the background - accepting various payment tokens, managing cross-chain bridges, and processing gas fees - while providing users with a simple payment experience.

-Seamless cross-chain interactions: While centralized applications can easily provide similar functionality, chain abstraction achieves these benefits while preserving the core principles of blockchain technology (decentralization, individual asset ownership, and security).

Case Study: One Balance

One Balance is a project initiated by the Frontier Research team, which is famous for proposing their CAKE (Chain Abstract Key Element) framework. The core of their solution is the "Credible Account" concept, which combines the advantages of EOA and SCA.

Trusted accounts extend the traditional blockchain account format to provide trusted assurances without cross-chain consensus requirements. These accounts run on secure machines selected by the user and make trusted commitments to message signing. They maintain the security guarantees of SCA while supporting key features of account abstraction, including gas abstraction, social recovery, permission policies, and modern authentication methods.

Trusted accounts can generate and manage any number of sub-accounts across multiple chains, fully controlling the status of each chain. They are designed to be universally compatible with various blockchain networks (Ethereum, Solana, Bitcoin) and various smart contracts and assets (including ERC20 tokens, NFTs, DAOs, and DeFi protocols).

One Balance’s chain abstraction system is based on the following two key components:

- Resource Locking: Users under this mechanism make a verifiable commitment to lock their assets until specific conditions are met or they expire. Unlike traditional smart contract deposits or ERC20 approvals, these are account-level locks that do not require on-chain finality. For example, when using Ethereum USDC to purchase a Solana NFT, the user will lock their USDC until a specific block height is reached to purchase the NFT. This design protects solvers from risks such as double spend attack and ensures transaction integrity during cross-chain operations.

-Trusted Commitment Machines: This is the secure infrastructure for executing cross-chain transactions. These machines run in a dedicated secure environment and perform two basic functions: they verify the validity of resource locks set by users and ensure accurate execution when the lock conditions are met. For example, when using Ethereum USDC to purchase a Solana NFT, the commitment machine verifies the user's USDC ownership and manages the secure transfer to the seller after the NFT purchase is completed. This automated process follows predefined rules to ensure reliable execution for all parties involved. Commitment Machines can be deployed through four methods: TEE, MPC, SCA, or Protocol Virtual Machine.

While One Balance is still in development, they have already released integration examples using Privy. Their approach stands out from other chain abstraction solutions by providing a framework for integrating existing blockchain infrastructure or applications without the need for a specialized chain or system, thereby minimizing barriers to adoption.

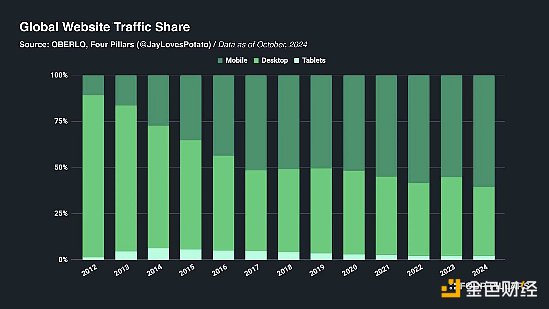

4. Interface: Mobile apps are the next frontier

High-quality mobile apps are rare in the crypto ecosystem. Most crypto apps are primarily developed around desktop platforms for two reasons.

The primary reason is the nature of crypto applications themselves. These platforms often handle complex financial transactions that require detailed information, comprehensive analysis, and multiple data points to be displayed simultaneously - all of which are better suited to desktop interfaces. While mobile platforms excel at providing a streamlined, user-friendly experience, they often do so at the expense of the depth and breadth of functionality required by serious crypto traders and users. This natural limitation makes desktop development a natural priority for most crypto applications.

This desktop-centric development has shaped how users interact with crypto applications: they typically maintain a main wallet and connect to various applications as needed. However, this model creates a huge friction when switching to a mobile environment. Users find themselves frequently switching between wallet apps and main apps, doing basic operations like logging in or signing transactions over and over again. This back-and-forth operation is in stark contrast to the seamless interaction that mobile users expect from traditional applications.

The second major reason is the restrictive policies of mobile app stores, with Apple’s App Store being particularly challenging. Their strict policies on crypto-related payments have forced many crypto apps to seek creative solutions. Early attempts to circumvent these restrictions through Progressive Web Apps (PWAs) showed initial promise but ultimately failed to gain traction, primarily due to users’ unfamiliarity with the installation and usage process and the cumbersome nature of the process. This distribution challenge is further highlighted by the success story of Telegram App Center, which has managed to garner a staggering 500 million MAUs across more than 1,000 small apps, demonstrating that the potential is enormous when crypto apps are given an effective distribution channel.

However, the landscape is slowly changing. As the crypto market expands from a pure financial services market to more consumer-friendly sectors like meme coins and AI applications, we’re seeing a resurgence in mobile-first development. This evolution is evident in the emergence of new players like social platforms (Farcaster, Interface) and meme coin exchanges (Moonshot, Sauce), all of which prioritize sophisticated mobile experiences. Even traditional DEXs like Jupiter and Uniswap are looking to mobile-optimized interfaces to attract more users. This trend is further supported by infrastructure providers, with WaaS platforms like Privy and Reown (formerly WalletConnect) expanding their SDK capabilities to provide better support for mobile-first development. These developments show that there is a clear industry-wide understanding that mobile optimization is no longer optional, but a must for mainstream crypto adoption.

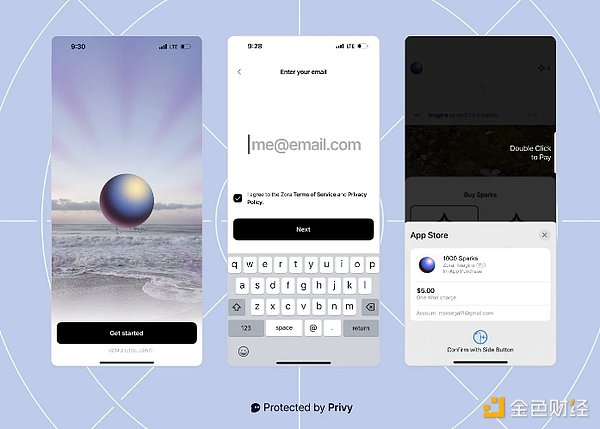

Case Study: Zora

Zora is a great example of how crypto apps can successfully adopt mobile-first design principles. As a digital creation social network, Zora enables users to seamlessly create, share, and trade all forms of digital content — whether it’s images or videos, or music or memes.

What makes Zora unique is its comprehensive mobile optimization, from initial account creation to NFT minting. The onboarding process is simple: users only need to enter an email address to sign up, and those who already have Farcaster or Instagram accounts can link these accounts to instantly receive personalized feed recommendations and find friends. Perhaps most importantly, Zora takes advantage of native mobile capabilities - users can take photos or videos directly through their phone's camera and immediately mint them into NFTs, creating a natural experience like posting on traditional social media.

Under the hood, Zora uses complex blockchain technology while maintaining simplicity for users. They have deployed a modern account abstraction stack that combines Privy's embedded wallet technology with Coinbase's smart wallet infrastructure. This technical architecture allows Zora to handle complex operations, such as gas fee management and transaction batching, completely in the background. Users do not need to understand or interact with these technical elements, so they can focus only on content creation and sharing.

A unique innovation of Zora is its in-app currency system called "Spark". Spark is denominated in one millionth of an ETH (equivalent to 1000 Gwei) and can be purchased directly with common payment methods such as credit or debit cards. The design of the system is very simple: with a sufficient Spark balance, users can mint NFTs with a simple double-click. Each NFT costs 111 Sparks to mint, including gas-free transactions. Importantly, the Sparks you purchase will never expire, and they will remain useful even if Zora's minting fees change in the future.

What’s particularly noteworthy about Zora is how they’ve managed to abstract away the complexity of blockchain. All of the technical elements that typically create friction in crypto apps — wallet creation, gas fee management, the NFT minting process — are all handled invisibly in the background. The result is an experience that’s indistinguishable from any popular social media, while retaining all the benefits of blockchain technology. This approach sets a new standard for what’s achievable with mobile-first crypto apps, demonstrating how blockchain technology can be seamlessly integrated into everyday mobile experiences.

5. Conclusion

The crypto industry has come a long way since applications exploded in the DeFi & NFT summer of 2021. The DeFi & NFT summer marked an era of explosive innovation in the field. In the following two years, infrastructure has made significant progress: modular blockchains have emerged, L1 networks have achieved significant performance improvements, and technologies such as Oracle and bridging have matured greatly. These developments have effectively overcome many bottlenecks that once hindered blockchain adoption, especially the persistent problems of slow transaction speeds and high fees.

However, while the technical foundation has been greatly strengthened, the user experience has not kept pace. Despite continuous experimentation and development at the application layer, few crypto platforms can match the seamless, intuitive experience that users get from Web2 applications. As our infrastructure becomes more reliable and ready to support the next generation of applications, this experience gap will become increasingly apparent. The most pressing challenge now is to create services that can bring a familiar web2-level user experience while retaining the unique advantages of blockchain technology.

At the heart of this challenge lies the crypto wallet - perhaps the most critical factor in determining the overall user experience. The wallet is the entry point for new users and the gateway to all important actions in the application, from simple login to transaction approval. So crypto wallets are positioned as the base layer for users to interact with the entire crypto ecosystem, and their design and functionality are crucial to mainstream adoption.

Innovation in wallet technology is not limited to a single layer, but spans multiple dimensions simultaneously - from key management and account structure to UI/UX. Each layer presents different design parameters that vary according to the characteristics and needs of the application. Innovation in wallet technology continues, with new narratives emerging around account abstraction and chain abstraction, and the introduction of new technologies such as WebAuthn and TEE.

Therefore, the success of an application may require a good understanding of the decision-making process at each layer of the wallet architecture. By analyzing successful deployment cases and understanding the trade-offs involved, teams can make informed choices based on their specific use cases while maintaining a balance between functionality and user experience.

The ability of cryptocurrencies to achieve widespread adoption ultimately depends on our ability to make complex blockchain technology accessible to everyday users without compromising the fundamental principles of decentralization and security. While recent case studies show promising progress in this direction, with innovative solutions emerging in the ecosystem, we are still in the early stages of this transformation. The challenge ahead lies in creating experiences that not only match but surpass traditional digital services, while preserving the unique value proposition of blockchain technology. As wallet technology continues to evolve, it will play an increasingly important role in shaping how the next generation of users interact with crypto applications.