Written by: Grayscale Research

Compiled by: Golem;

Edited by: Hao Fangzhou

Key Highlights:

As the market focuses more on the U.S. election, Bitcoin rose in October. Opinion polls show a tight race for the White House, but changes in financial assets and the implied odds in prediction markets suggest that investors now see a higher chance of a Trump victory.

There was a significant net inflow into Bitcoin exchange-traded products (ETPs) this month, although some of the new demand may reflect hedge fund de-risking trades (where they may be long Bitcoin ETPs and short Bitcoin futures).

The convergence of crypto and AI technologies continues to have far-reaching implications, including autonomous chatbots promoting their own MEME coins. While the novelty of these projects makes it easy to overlook their significance, they indicate that blockchain technology can be an effective tool for intermediating economic value between humans, AI agents, and networked physical devices.

October Market Expects Trump to Win the Election

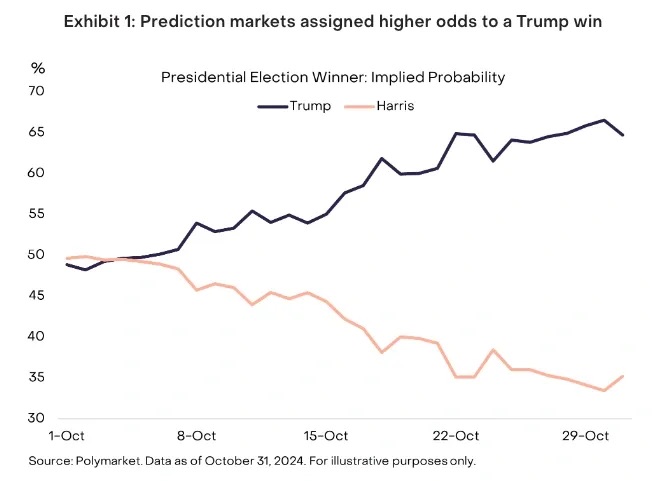

American voters will go to the polls on Tuesday, November 5th, and this election is expected to have a significant impact on the digital asset industry. Although opinion polls show a tight race for the White House, investor expectations seem to have shifted towards a victory for former President Trump last month. For example, at the end of September, the blockchain-based prediction market Polymarket (https://polymarket.com/) had odds slightly favoring Vice President Harris. However, by the end of October, Polymarket's presidential election market showed a 65% probability of a Trump win (Chart 1). Prediction markets are not infallible, and Harris could still win the election, but the shift in investor expectations towards a Trump victory appears to have driven asset market gains last month.

Chart 1: Prediction markets show higher odds of a Trump election victory

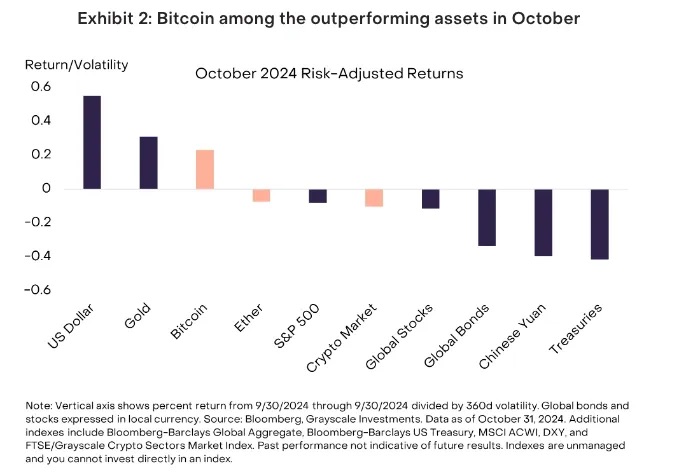

Whether financial markets are pricing in a higher likelihood of a Trump victory can only be inferred indirectly, but Grayscale Research believes that the cross-asset returns in October are consistent with a "Trump trade" (Chart 2). From a macro perspective, the U.S. dollar strengthening and the Chinese yuan weakening may reflect increased awareness of tariff risks. Similarly, rising bond yields (falling bond prices) and rising gold prices may reflect expectations of increased budget deficits (https://www.grayscale.com/research/reports/potential-implications-of-u.s.-election-outcomes-on-digital-asset-markets) and inflation during a Trump presidency. Bitcoin appreciated 9.6% this month, making it one of the better-performing risk-adjusted assets. Trump has been enthusiastic about Bitcoin and cryptocurrencies, so the Bitcoin price increase may reflect market expectations of a regulatory environment supportive of Bitcoin under a Trump administration. Additionally, like gold, Bitcoin may be responding to potential macro policy changes (https://www.grayscale.com/research/market-commentary/bitcoin-and-the-macro-policy-issues-of-biden-v-trump2) during a Trump presidency.

Chart 2: Bitcoin was one of the best-performing assets in October

The U.S. election outcome could have significant implications for the digital asset industry. The next president and Congress may enact legislation targeting cryptocurrencies and could change tax and spending policies that impact broader financial markets. Grayscale Research believes that changes in Senate control may be particularly relevant for cryptocurrencies, given the Senate's role in confirming presidential appointments to key regulatory bodies like the SEC and CFTC.

However, at the voter level, data suggests that cryptocurrencies are a bipartisan issue, with a slightly higher proportion of Democrats holding Bitcoin than Republicans. Additionally, the specific candidates from both parties have expressed support for crypto innovation. Regardless of which party is in power, Grayscale Research believes that comprehensive bipartisan legislation may be the best long-term solution for the U.S. digital asset industry.

Weakening Bitcoin Arbitrage Trades Reduce the Impact of Net Inflows into Physical Bitcoin ETPs on Price Appreciation

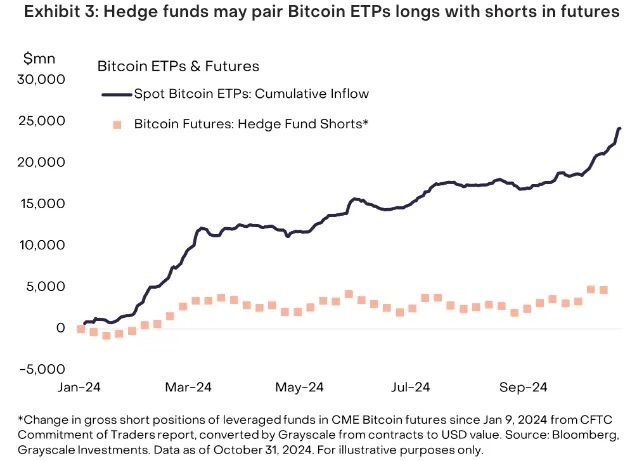

In October, demand for physically-backed Bitcoin exchange-traded products (ETPs) listed in the U.S. increased. As of October 31st, the total net inflow was $5.3 billion, up from $1.3 billion in September, the highest level since February. Since the launch of physical Bitcoin ETPs in January, the total net inflow has exceeded $24.2 billion, with U.S. ETPs now holding around 5% of the total Bitcoin supply.

The net inflows into physical ETPs this year may have exerted upward pressure on Bitcoin prices. However, this relationship may not be one-to-one, partly because hedge fund arbitrage trades have become more prevalent. Specifically, hedge funds (or other sophisticated and/or institutional investors) can go long Bitcoin ETPs while simultaneously shorting an equivalent amount of Bitcoin futures. This strategy aims to profit from the spread between spot and futures prices, sometimes referred to as a Bitcoin "basis trade" or "arbitrage trade". Since this strategy involves both buying Bitcoin (through the ETP) and selling Bitcoin (through futures), it should not have a significant impact on the market price of Bitcoin.

There is no precise measure yet, but a CFTC report indicates that some hedge funds have increased their Bitcoin futures net short positions by nearly $5 billion since the launch of physical Bitcoin ETPs in January. Based on this estimate, Grayscale Research believes that around $5 billion of the $24.2 billion net inflows into U.S.-listed physical Bitcoin ETPs this year may have been used to pair spot/futures positions, and thus may not have driven Bitcoin price appreciation (Chart 3).

Chart 3: Hedge funds may be pairing long Bitcoin ETP positions with short futures positions

Blockchain as a Value Intermediary for AI Agents

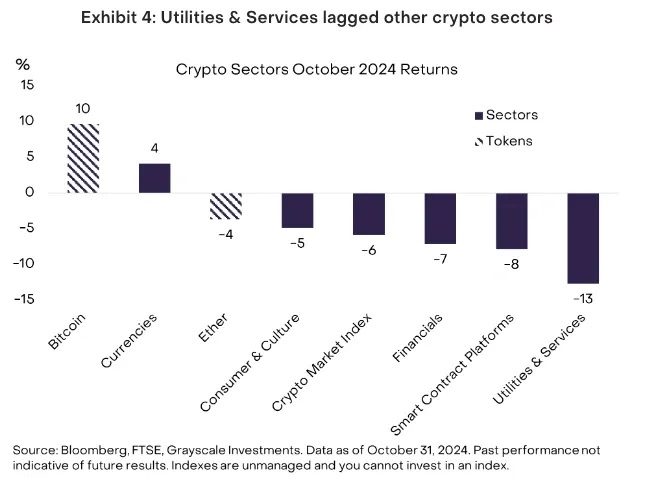

While Bitcoin prices rose significantly in October, returns in other crypto market segments were lackluster. For example, the Crypto Sector Market Index (CSMI) - a comprehensive index we developed with FTSE/Russell - declined by around 6% (Chart 4). The worst-performing segment was the Utilities and Services crypto sector (https://www.grayscale.com/crypto-products/grayscale-crypto-sectors/utilities-and-services). This diverse crypto sector includes many tokens related to decentralized AI technologies, some of which have pulled back this month after earlier gains, including FET, TAO, RENDER, and AR.

Chart 4: The Utilities and Services sector lagged other crypto market segments

Although some token valuations have pulled back, the decentralized AI theme remains a focus in the crypto market. We believe this is largely due to new applications demonstrating the use of "AI agents" on blockchains - software capable of understanding objectives and making autonomous decisions.

One key "character" is Truth Terminal, an AI chatbot created by researcher Andy Ayrey. The chatbot has an account on X (formerly Twitter) and interacts autonomously with other X users (i.e., without any input from Andy). The innovation is that Truth Terminal has expressed interest in creating a MEME coin called GOAT, and then deposited the new MEME coin into an associated blockchain address. With ownership of the MEME coin, Truth Terminal has taken steps to promote the token to its social media followers.

Due to strong interest in this narrative, the related MEME coin has appreciated by around 9x, leading many to dub Truth Terminal the "first AI agent millionaire". While the project seems humorous and lighthearted, it demonstrates that AI agents can understand economic incentives and use blockchains to send and receive value. Other innovative projects are making breakthroughs in co-owned AI agents, and there will likely be many use cases in the future.

These attempts are still in the early stages, but the latest wave of decentralized AI applications may realize one of the promises of blockchain technology in a tangible way: it can serve as a core financial infrastructure of the future, acting as a value intermediary between humans, AI agents, and potentially various physical devices. We believe that using permissionless blockchains can be a better way for AI agents to accumulate and transfer resources compared to traditional payment infrastructure.

Summary

The US election on November 5th may dominate the cryptocurrency and traditional financial markets in the short term. The digital asset industry faces some important issues, and the results of the White House and Congress may to some extent affect the development of the cryptocurrency business in the US. At the same time, we are encouraged by the bipartisan ownership of digital assets, the many macro trends driving Bitcoin adoption, and the recent technological breakthroughs, particularly at the intersection of cryptocurrencies and AI. Therefore, regardless of the election results next week, we are optimistic that cryptocurrencies will continue to thrive in the US.