Author: Alex O'Donnell, CoinTelegraph; Compiled by: Bai Shui, Jinse Finance

As voters flock to the polls on November 5, bettors are going all-in on the U.S. presidential election, with trading volume on major prediction markets approaching $4 billion.

The Web3 native Polymarket has emerged as the dominant political betting platform. According to the Polymarket website, despite being banned in the U.S., trading volume in the presidential race has exceeded $3.3 billion.

Emerging U.S. betting platforms - including Kalshi, Robinhood, and Interactive Brokers - have quickly gained attention since launching in October.

According to app websites, they have collectively attracted over $500 million in trading volume for the presidential election betting market.

Republican candidate Donald Trump is leading Harris on top prediction platforms.

As of the time of writing on November 5, Polymarket sees Trump's chances of winning at around 62%. According to the websites of these apps, Kalshi and Interactive Brokers put this proportion at around 58%.

Source: Polymarket

Election betting markets allow users to purchase contracts with a binary payout structure tied to the outcomes of political events.

They have discussed everything from the U.S. presidential race to Senate races, cabinet appointments, and even the potential resignation of New York City Mayor Eric Adams.

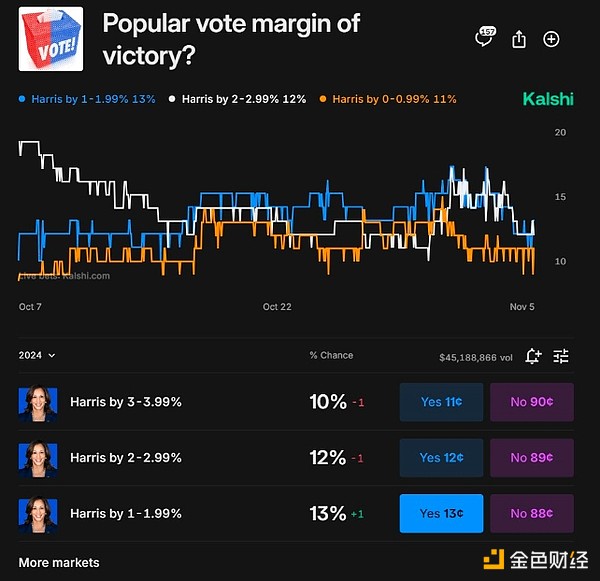

The most popular contracts involve betting on the popular vote and the probability of a winning candidate.

Based on an analysis of public data, these contracts have generated close to $1 billion in cross-platform trading activity.

Source: Kalshi

Fierce Competition

On October 7, Kalshi listed betting contracts on the U.S. election results after winning a landmark court battle in September last year.

This marked the first time election prediction markets were allowed to operate in the U.S., paving the way for other markets to enter the competition.

Since then, the competition has become very fierce.

On October 28, the cryptocurrency and stock trading platform Robinhood introduced contracts for certain users to bet on the presidential election outcome.

According to an article on the X platform on November 5, it has already traded around 200 million contracts in the presidential race.

Interactive Brokers also launched an election betting market in October. Its presidential election market has already attracted around $50 million in trading volume.

On October 28, Kalshi began accepting deposits in the USD Coin stablecoin. Kalshi stated on X that on November 5, it added USDC deposits on the Polygon blockchain network.

Polymarket rules govern the spending on the 2024 U.S. presidential election prediction market. Source: Polymarket

Manipulation Fears

In October, Polymarket faced criticism for multiple investigations that claimed around 30% of its U.S. presidential election bets came from wash trades, a form of market manipulation aimed at artificially inflating trading volume.

Meanwhile, according to anonymous political bettor Domer, five large Polymarket investors are said to have purchased more than half of the bets, betting on a Trump victory.

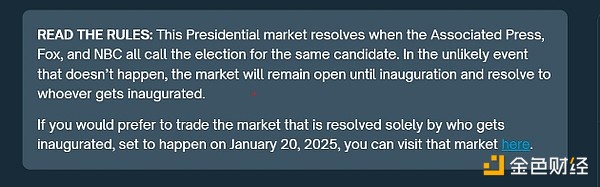

If the Associated Press, Fox, and NBC are all unsure of the winner, Polymarket's winning presidential bets may be delayed until January 20, 2025.

In September, Kalshi won a lawsuit against the U.S. Commodity Futures Trading Commission (CFTC), challenging the regulator's decision to prohibit Kalshi from listing political event contracts.

The CFTC argued that election prediction markets like Kalshi threaten the integrity of elections, but industry analysts say they often capture public sentiment more accurately than opinion polls.

Rutgers University statistics professor Harry Crane, in a comment letter submitted to the CFTC in August, stated: "Event contract markets are a valuable public good, and there is no evidence of the significant manipulation or widespread use for any nefarious purposes that the Commission alleges."

In August, financial data and news service Bloomberg LP added Polymarket's election odds data to its terminal.