The price of Bitcoin (BTC) rose to $70,000 today ahead of the US presidential election, and reached $75,000 as the vote counting began. Historically, political uncertainty and important elections have impacted the sentiment and volatility of the cryptocurrency market.

As the election gets underway, on-chain analysis provides insights into future price movements. Analysts are discussing the potential impact of the election results on Bitcoin, with differing opinions on whether cryptocurrencies will continue their upward trend or face downward pressure. The details are as follows.

Surging Bitcoin Demand, as in 2016 and 2020

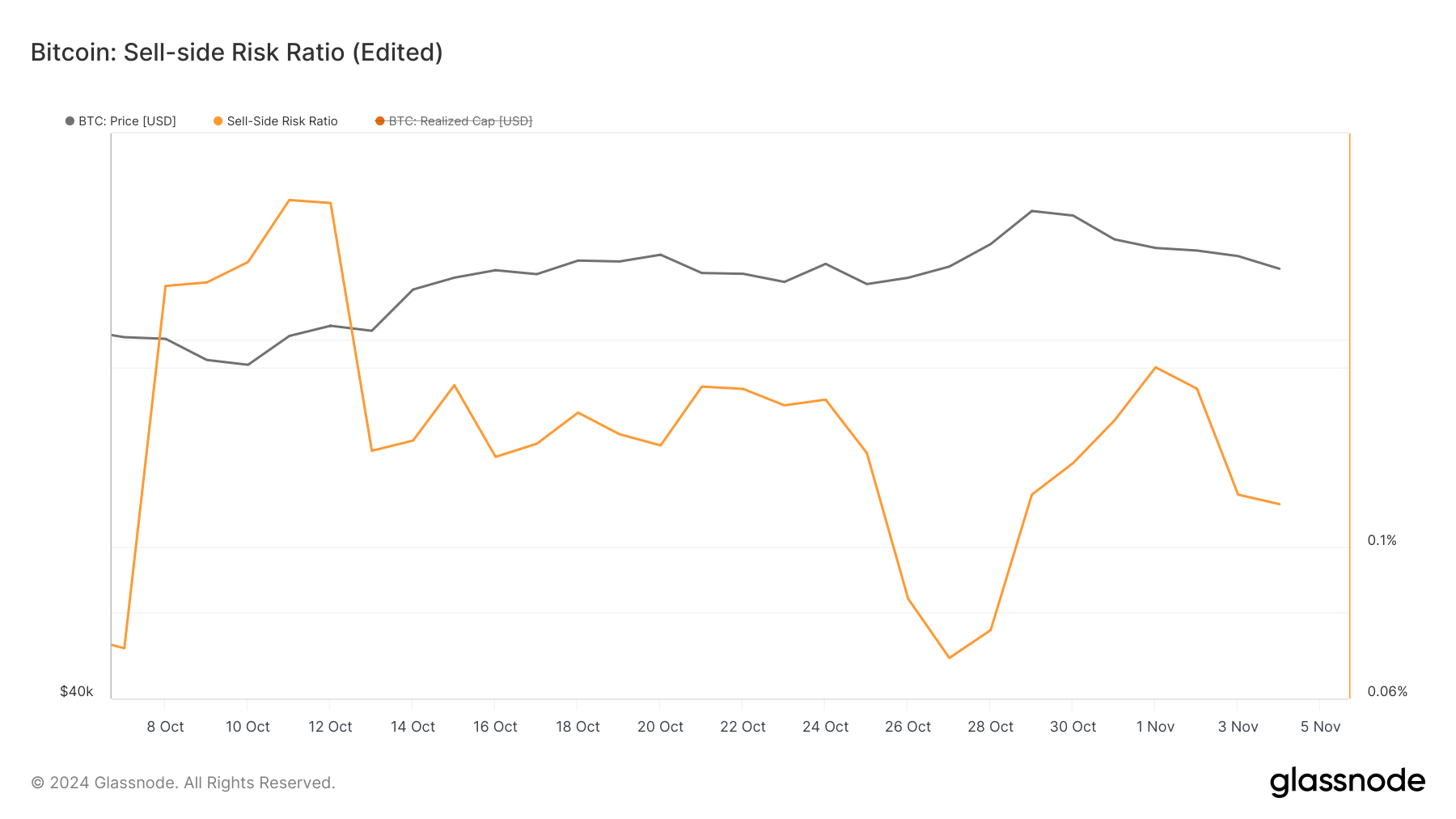

According to Glassnode, the Bitcoin price increase occurred as the sell-side risk ratio decreased. This metric indicates whether investors are confident in the bullish market or have low conviction.

High values of this metric signify substantial value realization and are often associated with increased market volatility, typically towards the later stages of a bull market.

Conversely, low values indicate minimal value realization and reduced market volatility, suggesting a macro market bottom, an accumulation phase, and an environment of low sell-side pressure and risk. This may also signal the start of a future uptrend.

Read more: The 7 Best Cryptocurrency Exchanges for Trading Bitcoin (BTC) in the USA

Therefore, the rise in Bitcoin price indicates low selling pressure and the potential for the US election to be a positive catalyst for cryptocurrencies.

In this regard, Juan Pellicer, senior researcher at IntoTheBlock, opined that a victory for Donald Trump would be good for BTC and the cryptocurrency market.

"The market is primed for additional upside moves, and the US election can act as a potential catalyst. The sentiment suggests that Trump's more crypto-friendly stance could provide the necessary momentum for a decisive breakout to new all-time highs," Pellicer told BeInCrypto.

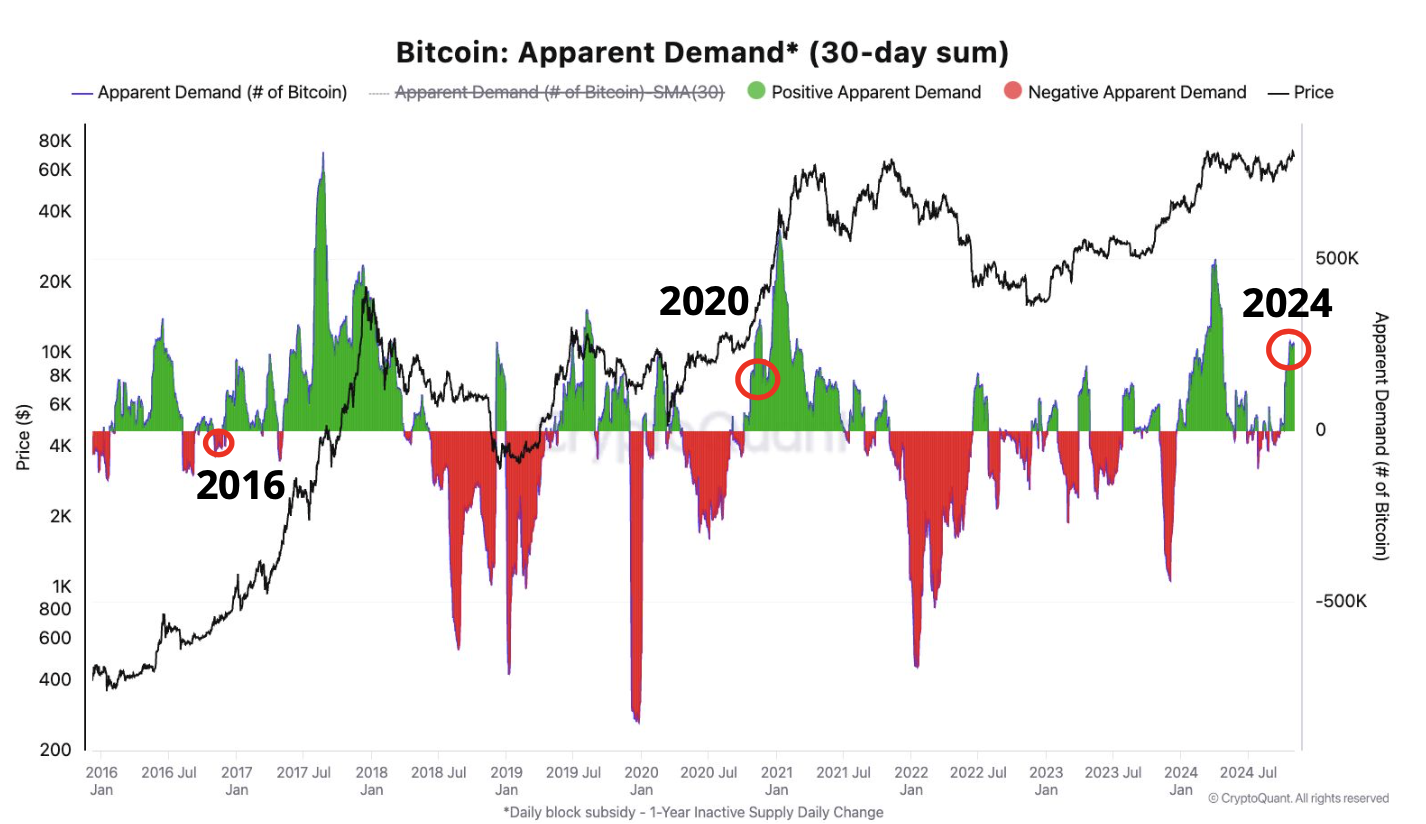

Meanwhile, according to CryptoQuant's weekly report, BTC is at a favorable price level ahead of the election. It was noted that the cryptocurrency is not currently overvalued. Therefore, if demand increases, Bitcoin prices could rise after the election.

For example, between the election day and December, BTC prices rose 22% in 2012, 37% in 2016, and 98% in 2020. On-chain data providers' data indicates that demand for Bitcoin has increased, similar to the trends in 2016 and 2020.

BTC Price Prediction: Over $75,000 if Trump Wins

On the 1-hour chart, Bitcoin has attempted to break out four times. However, it has been rejected each time since October 31st. But today, the trend has changed, with the bulls pushing the cryptocurrency above $68,336.

This breakout has allowed Bitcoin to rise to $70,288. Additionally, the Bull Bear Power (BBP) now shows that aggressive buyers are in control of the market. If this continues, Bitcoin's price could surge much higher in the coming days.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If the bullish momentum persists, Bitcoin is likely to reclaim the $75,000 level before the US election results are announced. However, if Trump's victory is thwarted and BTC is rejected at the resistance level, this prediction may be invalidated, and the cryptocurrency could drop to $67,405.