Author: Revc, Jinse Finance

Preface

After Donald Trump's re-election as President of the United States, the focus of the global financial market has gradually shifted from the election results to the direction of Federal Reserve Chairman Jerome Powell and his monetary policy. At the upcoming Federal Reserve interest rate decision meeting (Beijing time 3 am on the 7th), the market generally expects the Federal Reserve to further ease monetary policy, with an expected 25 basis point rate cut, in order to address the pressure of slowing US economic growth and a weak labor market. However, Trump's policy proposals have raised concerns among investors, especially about how his fiscal policy may affect the future policy path of the Federal Reserve.

Expectations of Trump's Policies and Challenges for the Federal Reserve

During the campaign, Trump proposed a series of economic policies, including imposing tariffs on trade partners, deporting illegal immigrants, and cutting corporate taxes. If these measures are implemented, they may increase inflationary pressure and raise the federal deficit, posing greater challenges to the Federal Reserve's inflation target and employment stability. Economists believe that the Federal Reserve may continue to cut rates to support the economy, but Powell may be cautious about the pace of rate cuts to avoid exacerbating economic uncertainty. In this context, the market expects Powell to avoid political issues in the upcoming press conference, focusing mainly on the economic situation, and cautiously analyzing the new government's economic policies while maintaining neutrality.

Adjustment of the Interest Rate Path and Controversy over the End Point of Rate Cuts

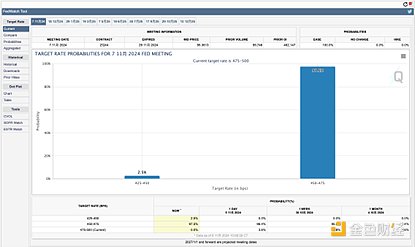

Trump's victory has changed market expectations for the future interest rate path. According to CME's "Fed Watch" data, investors expect the Federal Reserve to continue cutting rates in the coming months, with the federal funds rate potentially reaching 3.75%-4.0% by the end of 2025. Some analysts believe that Trump's fiscal policy will increase inflationary pressure, potentially forcing the Federal Reserve to accelerate rate cuts. However, some experts, such as Nomura Securities' economists, predict that the Federal Reserve may only cut rates once in 2025, with a terminal rate of 3.625%. Bill Inglehart, a professor at the Yale School of Management, believes that the Federal Reserve may pause rate cuts in the middle of the easing cycle to evaluate the response of economic data, providing a buffer for market uncertainty.

Market Impact and Global Attention on Powell's Speech

As the interest rate decision approaches, global investors are eagerly awaiting Powell's assessment of the economic situation and hints about the pace of rate cuts. Whether Powell will indicate that inflation is gradually under control and whether future rate cuts will slow down have become the focus of the market. CME data shows that some traders believe rate cuts may pause next year, and any statement by Powell could directly impact market expectations. In the political environment of Trump's victory, the Federal Reserve's future monetary policy is seen as an important factor in influencing economic recovery and global asset prices.

Trump's Policies and Potential Volatility in Global Capital Markets

Trump's economic policies, including tax cuts, increased government spending, and higher tariffs, if fully implemented, will affect the Federal Reserve's policy path. Economists believe that if inflation rises rapidly due to fiscal expansion, Powell may have to adjust the pace of the current monetary policy, adopting more cautious easing measures to stabilize market expectations. This will not only affect domestic US bank rates, mortgage rates, and savings rates, but also have a far-reaching impact on global capital markets through fluctuations in the US dollar and interest rates. The market expects Powell to gradually slow the pace of rate cuts to address this challenge, and global investors will closely monitor this.

Short-term Reaction and Outlook for the Cryptocurrency Market

Changes in Federal Reserve policy also indirectly affect the cryptocurrency market. Whenever the Federal Reserve announces rate cuts or easing policies, the relative decline in traditional asset returns may lead some funds to flow into cryptocurrencies like Bitcoin to hedge risks. If Trump's policies lead to higher inflation, cryptocurrencies may further attract safe-haven funds.

Summary

As the US election comes to an end, the Federal Reserve's monetary policy will become a global market barometer. In the current political and economic context, Powell and the Federal Reserve's policy decisions, especially their dynamic adjustments to inflation, interest rate paths, and the impact on global capital markets, will continue to lead the focus of investors.