Introduction

The latest developments in the US presidential election have attracted widespread global attention. With Trump's successful election as the 47th President of the United States, the cryptocurrency market has also experienced significant volatility. BTC (BTC) once reached $75,242, setting a new historical high, and then experienced a certain pullback due to the confirmation of the election results, falling below $73,000. At the same time, Doge (DOGE), which is supported by Trump's policies, has experienced a strong surge, with its price rising by more than 20% on election day and ultimately breaking through $0.21. The entire cryptocurrency market, especially the cryptocurrencies surrounding Trump's election, seems to be entering a new cycle and may experience more violent upswings in the short term.

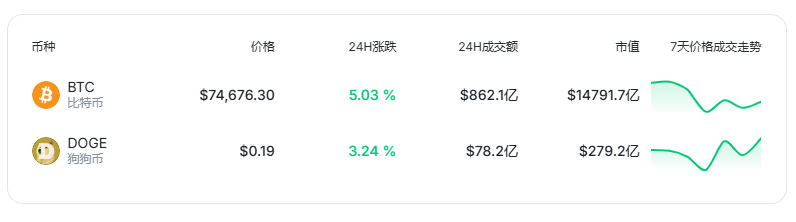

Latest price trends of BTC &Doge

Trump's Victory and Bitcoin Price Fluctuations

The price of BTC experienced intense volatility in the short term after the confirmation of Trump's election. As the election results became increasingly clear, the price of BTC rose to $75,242, setting a new historical high. Subsequently, due to the realization of market expectations for Trump's victory and some investors taking profits, the price began to fluctuate and at one point fell below $73,000 at 16:20. According to data from Coin World, the open interest of BTC contracts on exchanges is approaching a historical high, which is usually a signal that the price has reached a top, reminding investors to remain cautious.

This wave of volatility reflects the market's speculative psychology and the potential impact of Trump's election on cryptocurrencies. As the most well-known cryptocurrency globally, the price of BTC is usually sensitive to macroeconomic environments and political situations. In the context of Trump's election, the market's optimistic sentiment towards cryptocurrencies has been further stimulated. This is not only due to Trump's personal charisma and electoral victory, but more importantly, his friendly attitude towards the cryptocurrency market and the policies he may implement to promote the future development of cryptocurrencies.

Trump's Cryptocurrency Policy: Positive Impact on the Market

Trump's election platform has expressed clear support for the cryptocurrency market. He has promised that after being elected, he will take measures to relax the regulation of the cryptocurrency industry, making the US the global "capital of cryptocurrencies". Trump stated that he will reduce regulatory barriers to cryptocurrencies, encouraging innovation and technological development. This policy stance has undoubtedly instilled confidence in investors and also led the market to have more optimistic expectations for cryptocurrencies.

Furthermore, Trump has mentioned the possibility of using BTC as a strategic reserve asset for the US national debt, which is not only exciting but also allows cryptocurrency investors to see the potential for greater policy support. If this supportive policy is implemented, it is expected that a large amount of capital will flow into the cryptocurrency market, driving the prices of BTC and other cryptocurrencies to rise.

Trump's support for cryptocurrencies has particularly attracted institutional investors in the market. Many institutional investors have been waiting for a more explicit regulatory framework, and Trump may further develop the Financial Innovation Act (FIT21). This act aims to address the regulatory ambiguity of digital assets and clarify the regulatory functions of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). These measures will help provide stronger policy support and legal protection for the cryptocurrency industry.

From Trump's Victory to Musk's Influence

Compared to the price fluctuations of BTC, the performance of Doge has been more eye-catching. Doge's performance on election day was nothing short of shocking. Within a few hours of Trump's election, Doge's price saw a surge of over 20%, breaking through $0.21. Within 24 hours, Doge's gains exceeded 31%, making it the highest-performing asset among the top 100 cryptocurrencies by market capitalization. According to data from Coin World, Doge's market capitalization once exceeded $30 billion, surpassing XRP and TRON, becoming the seventh-largest cryptocurrency globally.

This surge is inseparable from Musk's support. The founder of Tesla and SpaceX, Elon Musk, has a deep connection with Doge, and he is not only one of Doge's biggest advocates but has also continuously created topics and hype around Doge through social media. After Trump's election, Musk has become an important driver in this interaction between politics and the cryptocurrency market.

Musk had previously publicly stated that if Trump were to be elected, he would assist in establishing an institution called the "Department of Government Efficiency" (D.O.G.E.) to streamline and improve the efficiency of federal government spending. The name of this plan is identical to Doge (DOGE), which has caused Doge's supporters to quickly gather after the election, driving up the price of Doge. The signal of Musk and Trump's supporters jointly promoting this policy seems to be a strong positive for the cryptocurrency market, especially the Doge market.

The Future Development of the Cryptocurrency Market

The surge in Doge and the overall optimistic sentiment in the cryptocurrency market are synchronized. While BTC has set a new high, Doge and other cryptocurrencies have also shown strong upward momentum. Analysts generally believe that the current cryptocurrency bull market momentum remains strong and may drive the prices of more assets to rise. Particularly, the increasing demand for BTC ETFs and the potentially more relaxed cryptocurrency policies that Trump may implement will provide more momentum for the cryptocurrency market.

However, the market's optimistic sentiment has also made some investors cautious. Although the current upward trend is strong, historical experience tells us that the volatility of the cryptocurrency market is extremely high, and investors need to maintain a flexible risk management strategy. For investors in mainstream cryptocurrencies like BTC, the current high point may be a sell signal, while for assets like Doge, the market's upward trend may only be a temporary frenzy. Therefore, when choosing whether to increase their positions, investors should carefully operate based on market sentiment and fundamental factors.

Conclusion

With Trump's election as President of the United States, the entire cryptocurrency market has entered a new cycle. From the price fluctuations of BTC to the surge in Doge, the market's optimistic expectations for cryptocurrency policies are reflected. The support from Trump and Musk, coupled with the potential for cryptocurrency-friendly policies in the US, have injected strong confidence into the entire market.

However, there are also hidden risks behind all of this. Although Trump's policies may have a positive short-term impact on the cryptocurrency market, the volatility and uncertainty in the market still exist. Investors need to take a rational view of the current upswing, maintain a flexible operating strategy, and closely monitor the implementation of future policies and the actual market performance.

Regardless, the policies and market enthusiasm for cryptocurrencies after Trump's election are likely to have a far-reaching impact on the market in the coming period, especially popular cryptocurrencies such as Bitcoin and Dogecoin, which are expected to continue to benefit from this trend.