Making the Avalanche C-Chain Cheap Again.

With stark competition for users and apps amongst L1s and L2s, the Avalanche community is proposing a significant reduction in the base fee.

This 96% fee cut could lead to a 39% - 80% increase in daily transactions.

What is ACP-125? 🧵

1/ ACP-125 aims to reduce base transaction fees from 25 nAVAX to 1 nAVAX on the C-Chain—a 96% reduction.

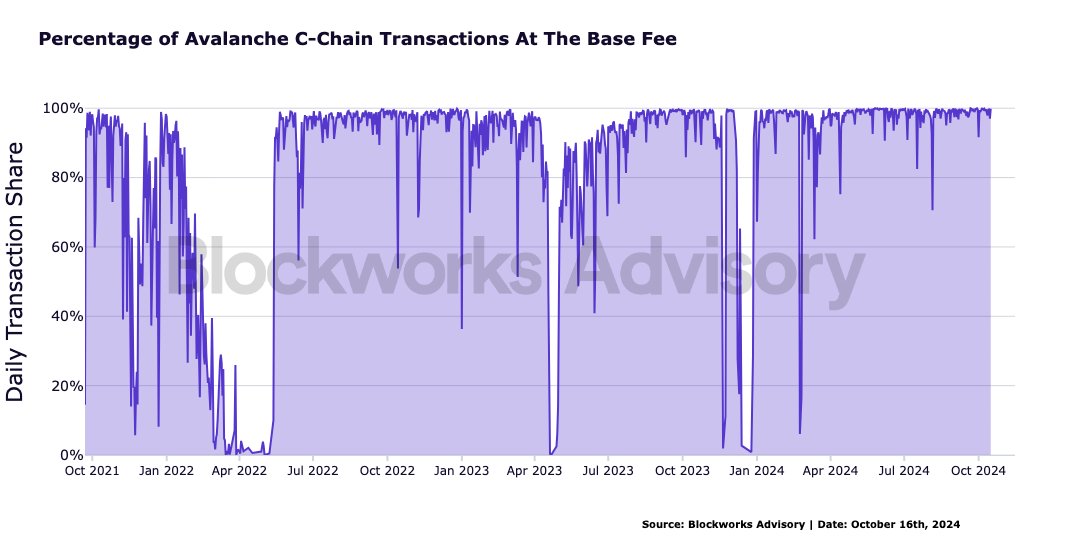

The significance of this proposal is that over 80% of transactions cluster at the base fee level implying an overproduction of blocks at a price not matched by wallet demand.

2/ We explore several fee reduction events across L1s and L2s to compete for apps and wallets, and their impact on respective ecosystems.

We then perform a fee sensitivity analysis to project the overall and sectoral impact of ACP-125 on Avalanche.

3/ Historical Impact Analysis of Fee Reductions:

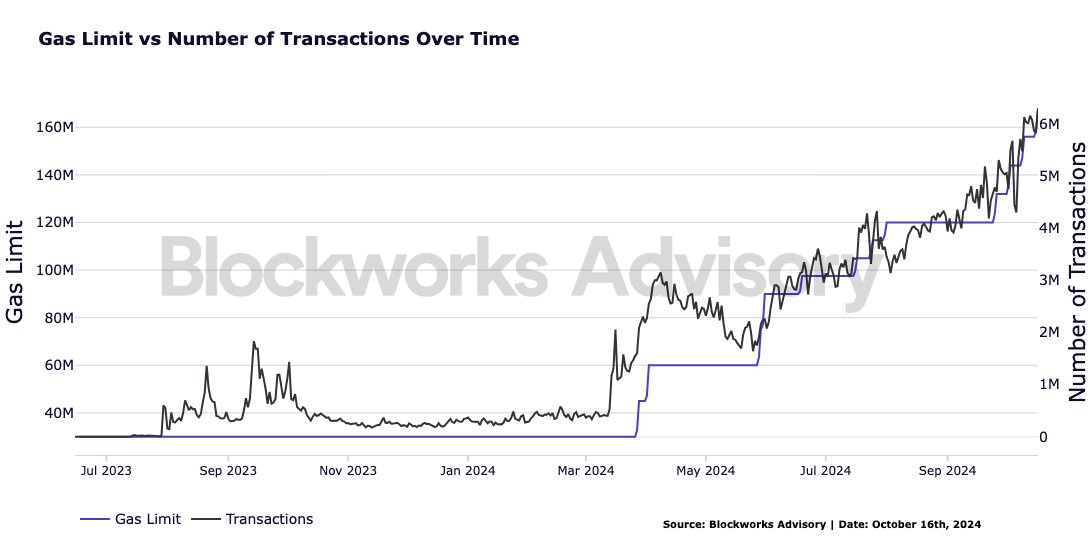

The relationship between transaction costs and network activity can be observed through two significant fee-reducing mechanisms on Base: the first is periodic gas limit increases.

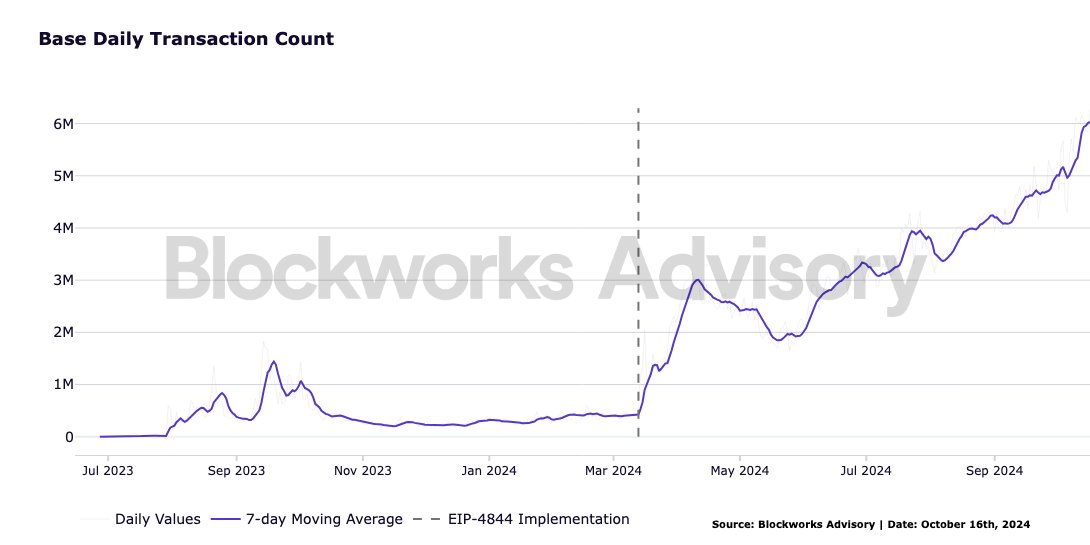

4/ The second fee-reducing mechanism on Base is the implementation of EIP-4844 which effectively reduced data availability costs by 99%. The network's response was substantial and immediate:

Daily transactions increased by 82% within the first week.

5/ These findings show significant network growth following major fee reductions, though the pattern and timing of responses vary across different metrics. However, which categories of wallets are the most price-sensitive and stand to benefit the most from fee reductions?

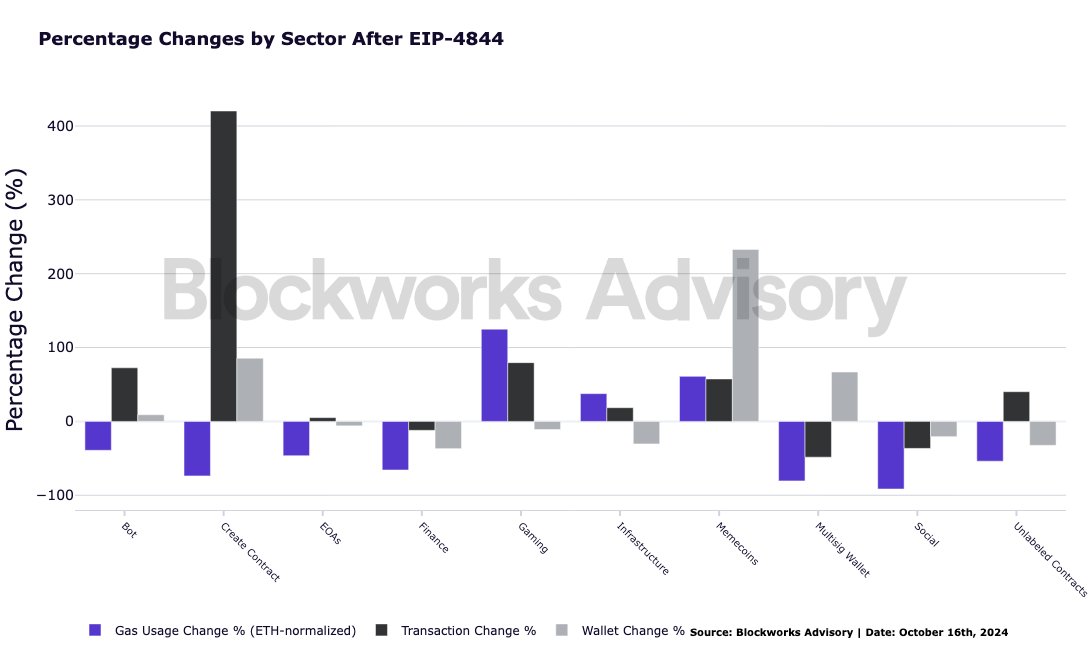

6/ Optimism’s Post-EIP-4844 Transformation:

The implementation of EIP-4844 provides a case study of how fee optimization affects different wallet segments within L1s and L2s. To isolate the true impact from broader market movements, we normalized metrics by the ETH price.

7/ Contract deployment saw the highest transaction growth at 420.3%, along with an 85.6% increase in wallets.

Gaming showed balanced growth across gas usage (125.0%) and transactions (79.6%), while memecoins exhibited modest gas growth (61.0%) but led wallet growth at 232.9%.

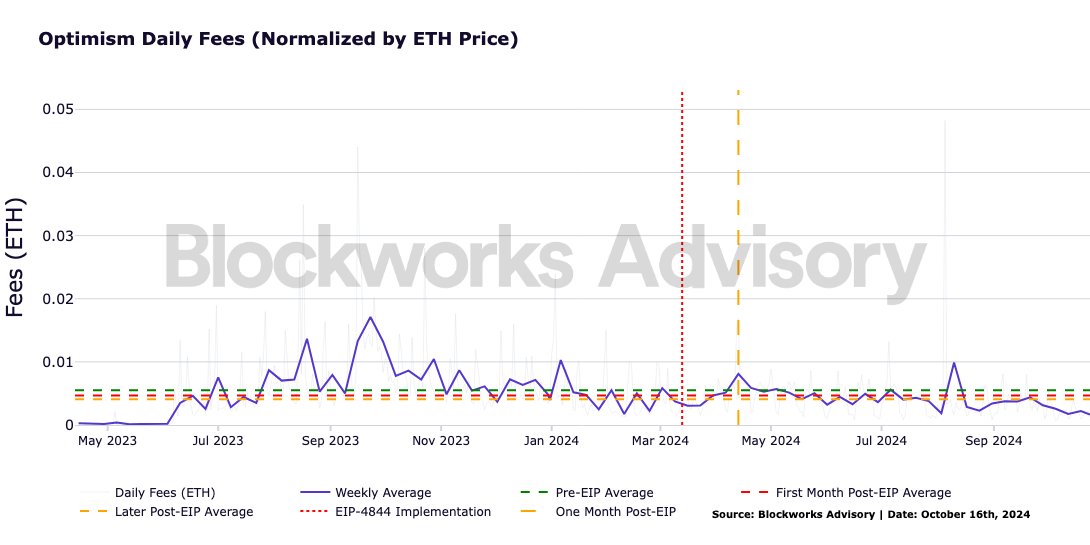

8/ Despite transaction volume increasing by 64.4% and active wallets growing by 22.6%, ETH-denominated revenue declined by 26.0% in the post-implementation period.

This indicates that a balance must be struck between growth incentives and sustainable revenue generation.

9/ ACP- 125 Fee Sensitivity:

Our analysis evaluates the potential impact of Avalanche Community Proposal 125 (ACP 125) on Avalanche C-Chains transaction volume, active address count, and fee/gas consumption across different network sectors.

10/ Our methodology:

We combine normalization techniques and sectoral weighting to provide robust projections across different scenarios, highlighting potential impacts on transaction growth, active addresses, and fee/gas consumption from ACP 125.

11/ Three sectoral weighting scenarios:

We use the impact of EIP-4844 on Optimism and the impact of a historical gas limit increase on Avalanche (70-30, 50-50, and 30-70 for Optimism and Avalanche, respectively).

These scenarios offer a spectrum of potential outcomes.

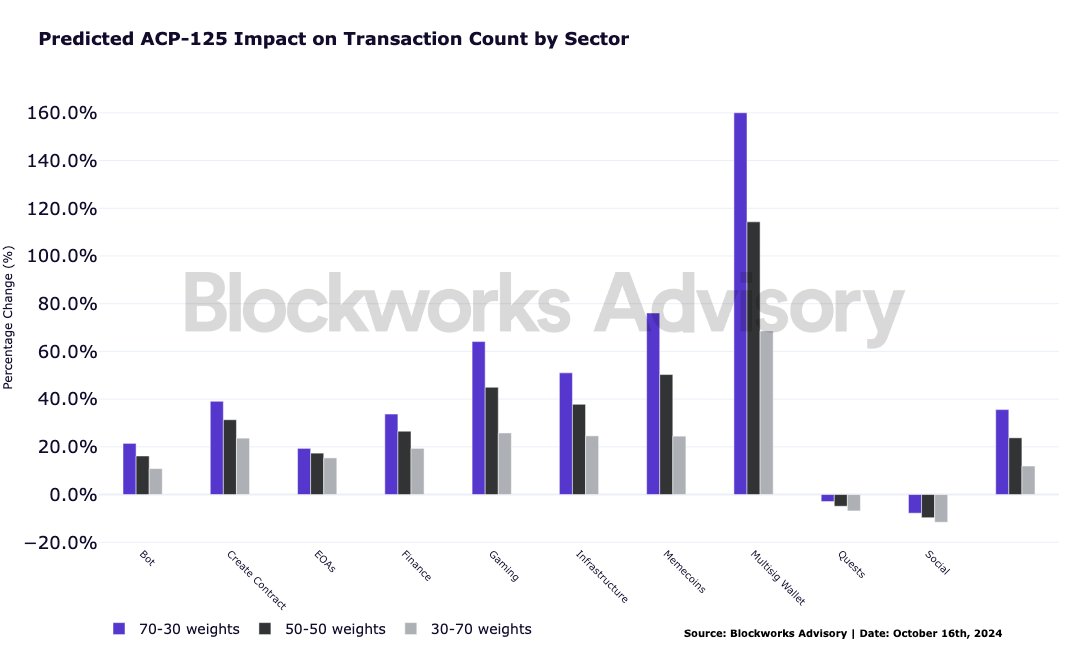

12/ ACP 125 could drive a significant increase in daily transactions

Projections range from a 39.3% to 80.9% boost depending on the scenario.

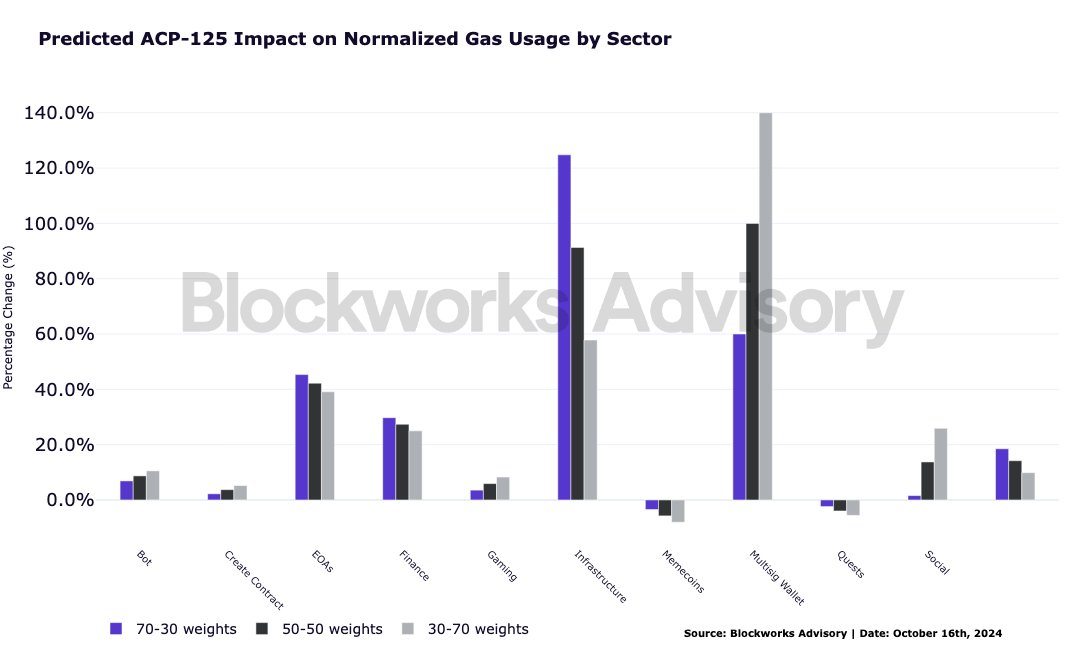

13/ Multisig wallets, Memecoins and Gaming Sectors stand to experience the largest increases.

Their estimated transaction growth ranges from 50% to 325% across scenarios.

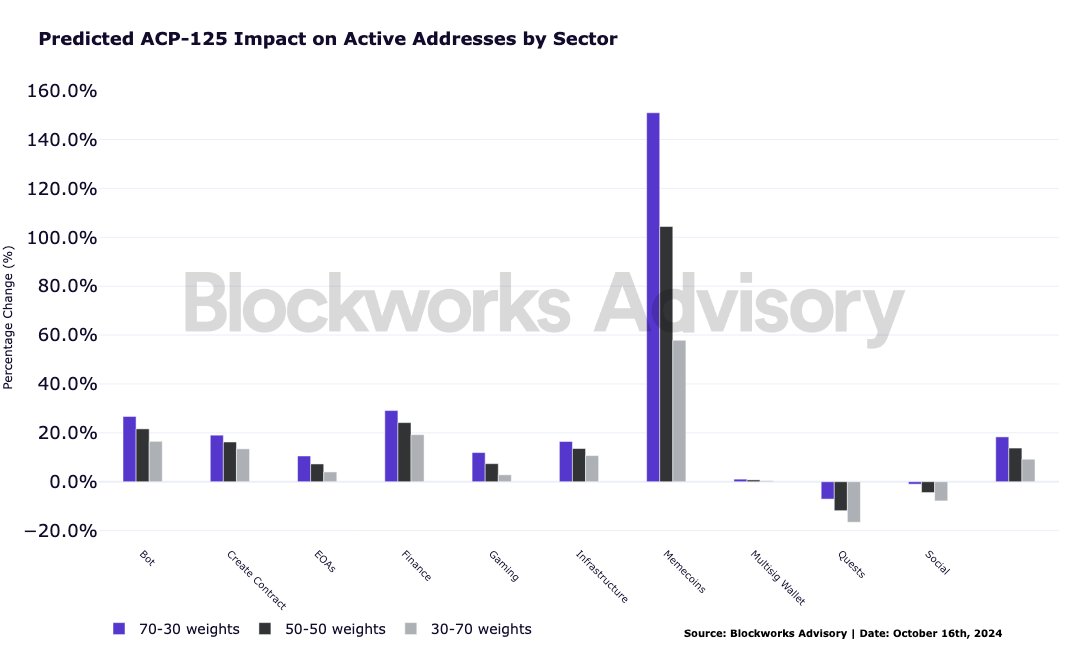

14/ ACP 125 is also projected to drive Active Address growth.

Memecoins and Finance Sectors show the most elastic response, with active address growth projections up to 200% in certain scenarios.

15/ Multisig Wallets and Infrastructure sectors are expected to see the most significant initial gas consumption increase.

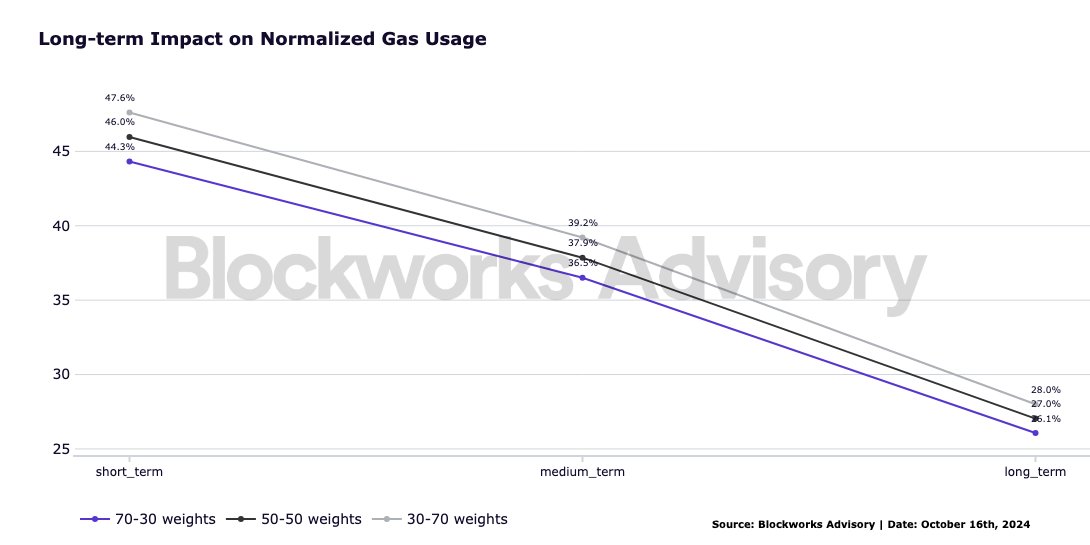

16/ However, gas consumption may have a more complex pattern.

Initially, gas consumption may rise due to increased activity but could decrease as the average fee per transaction falls.

This mirrors the EIP-4844 response on Optimism, where gas usage spiked before leveling out.

17/ When we adjust the increase in gas usage post ACP 125 by the 96% reduction in the Avalanche C-Chain base fee, we estimate a reduction in fees generated by ~94% (adjusted for the growth in transactions and gas usage)

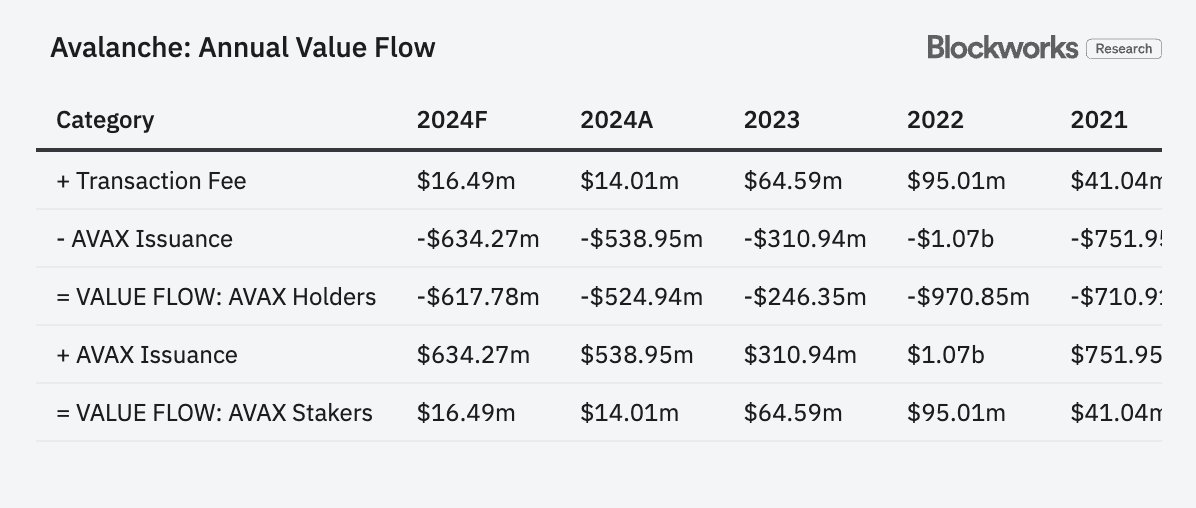

18/ Avalanche burns the fees generated on the C-Chain. Using 2021 and 2022 as a case study since these were time periods of significant consistent onchain activity on Avalanche, approximately $41M and $95M were generated in fees for the respective years.

19/ Assuming that Avalanche C-Chain onchain activity sees a return to comparable activity levels, post ACP-125 we could see annual fees being anywhere between ~$2.46M - $5.7M for the identical amount of onchain usage.

20/ ACP-125 represents a strategic opportunity to enhance Avalanche's competitive position in the Layer-1 blockchain ecosystem.

21/ Based on our previous ACP-77 analysis paired with an analysis of ACP-125, Avalanche is prioritizing kick-starting growth and network effects in its ecosystem while trading off short-term value accrual.

22/ While projected growth suggests the proposal could catalyze a new phase of network expansion in the long term, the stark decrease in fees generated suggests the need to explore other ecosystem growth programs paired with fee reductions to offset this phenomenon.

23/ To learn more about ACP-125 and our analysis, please read our free report below, unlocked by

@avax:

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content