Uniswap [UNI] has seen a significant increase in volatility in the past 24 hours, with the price fluctuating between $8.83 and $9.63. The increase in volatility is due to the rise in whale activity. More information Crypto Buns

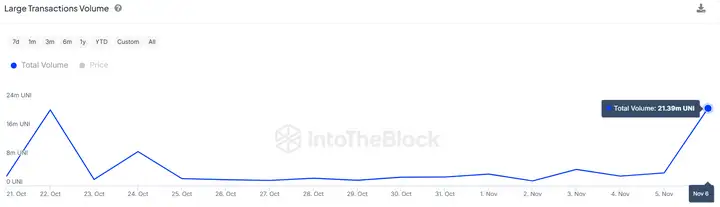

According to IntoTheBlock data, within 24 hours, the volume of transactions over $10,000 increased from 3.05 million to 21.39 million, an increase of over 500%.

If these large traders are buying, they have likely driven the recent surge. For outsiders, whales hold 51% of the circulating UNI supply, while retail investors hold only 16%.

Therefore, when whale trading volume increases, it inevitably affects volatility.

Is Uniswap ready for a 30% rally?

As of the time of writing, the UNI trading price is $8.91. After reaching a 4-month high of $9.63, the recent uptrend has stalled due to buyer fatigue.

The volume bar chart on the daily chart shows significant buying pressure. The Relative Strength Index (RSI) has also risen to 62, indicating that buyers are the driving force behind the bullish momentum.

Despite the price pullback, the Moving Average Convergence Divergence (MACD) shows that the bulls still dominate. The MACD line and histogram have turned positive.

For Uniswap to continue its uptrend, it needs more buyer support. This could trigger a 30% rebound up to the next resistance level at the 1.618 Fibonacci level ($11.60).

However, if buying activity fails to show new growth, the uptrend will weaken. Traders should watch the $7.34 support level, as a break below it could exacerbate the downward trend.

Profit-taking poses resistance

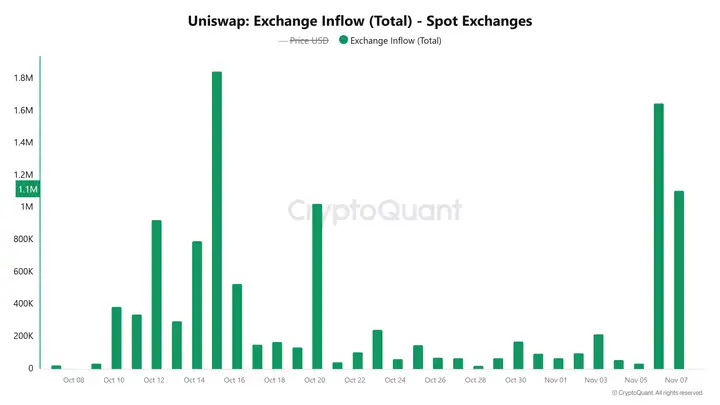

Sellers currently have the ability to trigger a bearish trend reversal. CryptoQuant's exchange inflow data shows that over the past two days, traders have sent over 9 million UNI tokens to exchanges.

When traders deposit their tokens into spot exchanges, it indicates they are preparing to sell, which could prevent further gains.

However, deposits on derivative exchanges have also seen a sharp increase. If traders increase their open positions in UNI, this could lead to a spike in volatility.

In the derivatives market, the phenomenon of short positions being forcibly liquidated has surged. Coinglass data shows that in less than 48 hours, over $2.8 million in UNI short positions were liquidated.

Short liquidations often drive buying activity, as short sellers are forced to cover their positions. If the bullish sentiment around UNI heats up again, leading to more forced liquidations, the Altcoin could see further gains.

The "Head and Shoulders" pattern and market reaction

Uniswap's price chart also displays a "Head and Shoulders" pattern, a technical formation commonly viewed as a bearish reversal pattern.

If the price maintains above the neckline (currently estimated to be between $8.00 and $8.50), the pattern will be completed and open the door for a breakout.

Breaking out of the "Head and Shoulders" pattern could push Uniswap's price towards $12, which is within the previous resistance area. However, traders may closely monitor this pattern, as a break below the neckline could undermine the bullish expectations.

UNI's price prediction and outlook

As of now, nearly half of Uniswap's holders are in profit, so the market sentiment remains relatively optimistic. Out of a total of 181,980 addresses holding UNI tokens, the average price is $9.06. IntoTheBlock estimates that around 60% of them are in a profitable position.

These holders are likely to support the price increase by holding their tokens.

However, some UNI holders are "out of the money," having purchased at prices higher than $9.06. If UNI reaches these levels, more selling could occur as these holders seek to exit at prices close to their entry points. This could lead to short-term defense at higher price levels.

As Uniswap seeks to break through the $10.06 trading price, all eyes are on the token's price trajectory. If it successfully breaks this level, UNI could see further gains, with the next milestone being $12.

In summary, Uniswap has seen a surge in whale activity, but the momentum of reaching a 4-month high has stalled after over 9 million UNI were deposited into exchanges, increasing selling pressure.